Consolidated Financial Statement- A part of financial statement

Consolidated Financial Statement (a part of Financial Statement)

Financial Statement

A. The financial statement, including consolidated financial statement, if any, shall be approved by the Board of Directors before they are signed on behalf of the Board at least by the following:

- Chairmen of the company,or,

- By two directors out of which one shall be managing director and the Chief Executive Officer, if he is a director in the company,

- The Chief Financial Officer, if any and

- The company secretary of the company, wherever they are appointed.

- In the case of a One Person Company, only by one director.

B. “Financial Statement” in relation to a company, includes:

- A Balance sheet as at the end of the financial year,

- A profit and loss account, or in the case of a company carrying on any activity not for profit, an income and expenditure account for the financial year,

- Cash flow statement for the financial year,

- A statement of changes in equity, if applicable and

- Any explanatory note annexed to, or forming part of, any document referred to above.

Note: The financial statement, with respect to One Person Company, small company and dormant company, may not include the cash flow statement.

C. Where a company has one or more subsidiaries, it shall, in addition to financial statements provided under sub-section (2), prepare a consolidated financial statement of the company and of all the subsidiaries in the same form and manner as that of its own.

D. The company shall also attach along with its financial statement, a separate statement containing the salient features of the financial statement of its subsidiary or subsidiaries in form AOC-1

The statement containing features of documents referred to in first provison to sub-section (1) of section 136 shall be in Form AOC-3.

For the purposes of this sub-section, the word “subsidiary” shall include associate company and joint venture.

Meaning of Associate Company: In relation to another company, means a company in which that other company has a significant influence, but which is not a subsidiary company of the company having such influence and includes a joint venture company.

For the purposes of this clause, “significant influence” means control of at least twenty per cent. of total share capital, or of business decisions under an agreement.

Note: According to section 131 of the Companies Act, 2013 If it appears to the directors of a company that the financial statement of the company do not comply with the provisions of section 129 they may prepare REVISED FINANCIAL STATEMENT in respect of any of the three preceding financial years after obtaining approval of the Tribunal on an application made by the company. But no form has been notified by the Central Govt. till now.

Consolidated Financial Statement (a part of financial statement)

The consolidation of financial statements of the company shall be made in accordance with the provisions of Schedule III of the Act and the applicable accounting standards

In case of a company covered under sub-section (3) of section 129 which is not required to prepare consolidated financial statements under the Accounting Standards, it shall be sufficient if the company complies with provisions on consolidated financial statements provided in Schedule III of the Act.

A. As per Companies (Accounts) Amendment Rules, 2014 notified by MCA on 14th October, 2014:-

- The intermediate wholly-owned subsidiary Companies, other than a wholly-owned subsidiary whose immediate parent is a company incorporated outside India are exempted from consolidation of financial statements of their wholly-owned subsidiary company.

- A company which does not have a subsidiary or subsidiaries but has one or more associate companies or joint ventures or both are not required to consolidate financial statement in respect of associate companies or joint ventures or both, as the case may be for the financial year commencing from the 1st day of April, 2014 and ending on the 31st March, 2015. “

B. As per Companies (Accounts) Amendment Rules, 2014 notified by MCA on 16th January, 2015: A company having subsidiary or subsidiaries incorporated outside India are not required to consolidate financial statement for the financial year commencing on or after 1st April, 2014.

Cash Flow Statement:

The financial statement, with respect to One Person Company, small company and dormant company, may not include the cash flow statement

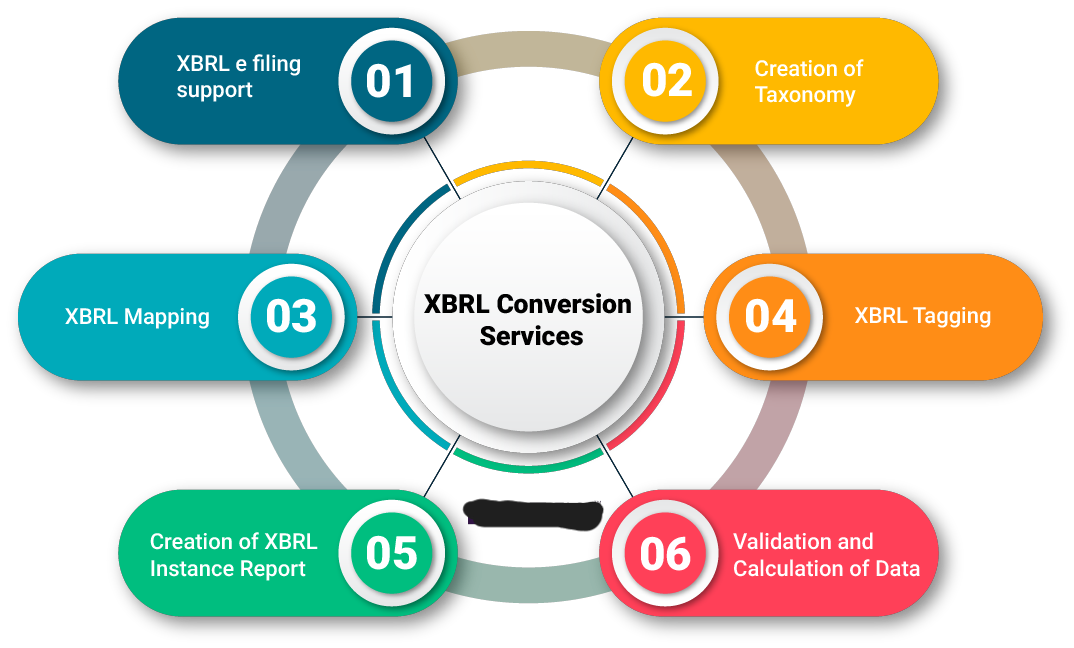

AOC-4 XBRL (Need to file within 30 days from of the Annual General Meeting)

The following class of companies shall have to file their Balance Sheet and Profit & Loss Account in XBRL mode in form AOC-4 XBRL.

- All companies listed with any Stock Exchange(s) in India and their Indian subsidiaries;

- All companies having paid up capital of Rupees five crore and above;

- All companies having turnover of Rupees one hundred crore and above

However, banking companies, insurance companies, power companies and Non-Banking Financial Companies (NBFCs) are exempted from XBRL filing.

4. FORM MGT-7: (Need to file within 60 days from of the Annual General Meeting)

Every company shall prepare a return in Form No. MGT-7 containing the particulars as they stood on the Closing day of the financial Year.

Following are the Contents and Annexure of Annual Return under Companies Act, 2013:

- Principal business activities and %age to Total Turnover of the Company,

- Particulars of its holding, subsidiary, Joint Ventures and associate companies and %age of Shares held,

- Share Capital Structure: (Including Individual/Body Corporate whether Indian or Foreign)

- Details of Transfer of Shares since 01.04.2014 till 31.03.2015 or in case of 1st Return, since date of Incorporation till 31.03.2015:

- Its indebtedness

- Its members and debenture-holders along with changes therein since the close of the previous financial year

- Its promoters, directors, key managerial personnel along with changes therein since the close of the previous financial year

- Date of meetings of members or a class thereof, Board and its various committees along with attendance details

- Remuneration paid to Directors, if any (for each Director)

- Penalty or punishment imposed on the company, its directors or officers (For eg.- – Condonation of Delay) and details of compounding of offences and appeals made against such penalty or punishment (Copy of Order from Concerned Authority) matters relating to certification of compliances, disclosures as may be prescribed;

Authentication of Annual Return:

| TYPE OF COMPANIES | AUTHENTICATION |

| PRIVATE COMPANY (SMALL COMPANY OR OPC)(WHERE SMALL COMPANY MEANS A COMPANY HAVING A PAID UP SHARE CAPITAL LESS THAN RS. 50 LAKH OR TURNOVER LESS THAN RS. 2 CRORE) |

|

| PRIVATE COMPANY (OTHER THAN SMALL COMPANY AND OPC) |

|

| PUBLIC COMPANY |

|

| LISTED COMPANY |

|

CERTIFICATION

| TYPE OF COMPANIES | CERTIFICATION |

| PRIVATE COMPANY (OTHER THAN SMALL COMPANY AND OPC) |

CERTIFICATION BY PRACTISING COMPANY SECRETARY IN FORM MGT-8 IS REQUIRED. |

| LISTED COMPANY | CERTIFICATION BY PRACTISING COMPANY SECRETARY IN FORM MGT-8 IS REQUIRED. |

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.