Officer not have Power to change date of cancellation

Table of Contents

GST officer is not right in taking a stand that they do not have powers to rectify effective date of cancellation of taxpayer’s GST registration: High Court

- The GST officer is erroneous in asserting that they do not have the powers/authority to change the effective date of the cancellation of a taxpayer’s registration: High Court Case – Does a GST officer have the powers/authority to change the effective date of cancellation of taxpayer’s registration?

Petitioner:

- Petitioner case is that while applying for cancellation, the effective date of cancellation in the drop-down menu was incorrectly entered as 30.06.2020 instead of 30.06.2021.

- The petitioner’s sole complaint is that a rectification should be carried out with regard to the date of cancellation of its registration as reflected in the portal concerning form GST REG-16.

Revenue:

- The replies appear to be contending that they have no powers to carry out the rectification.

Held:

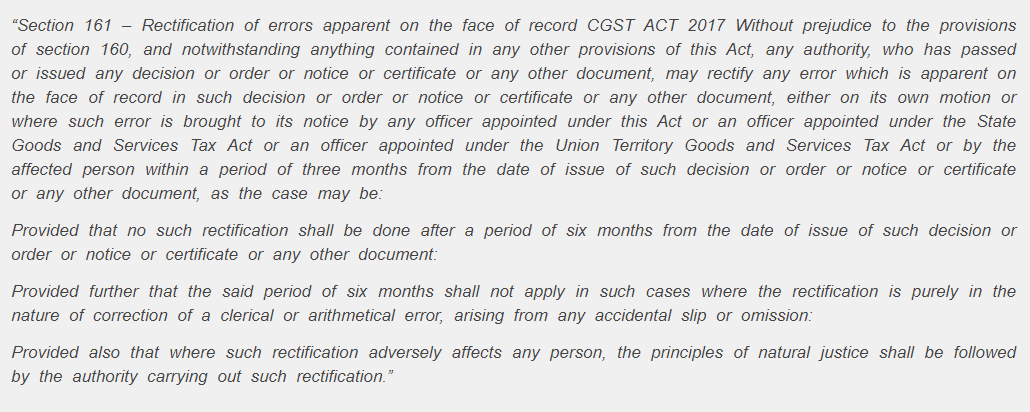

- Section 161 of the Central Goods and Services Tax (CGST) Act, 2017, has been brought to attention by counsel for the petitioner. The below is an extract of the said provision for your convenience:

- The aforementioned provision, in our opinion, authorises the petitioner’s requested correction.

- As a result, the order dated 18.07.2021 is set aside..

- The respondents are ordered to correct the above-mentioned date of cancellation of the petitioner’s registration.

- Rectification will be incorporated into the portal as well.

- The Respondents will take the appropriate actions in this regard within 2 weeks of receiving a copy of the order.

The show cause notice issued by the GST officer for cancellation of registration is utterly devoid of key particulars, including the date and time of the personal hearing: High Court

- As a result, the authority’s notice and cancellation order on that basis is set aside.

The cancellation of a GST registration should not be based solely on the fact that a taxpayer has failed to respond to a show cause notice.

- Petitioner’s GST registration to be reinstated on the condition that he pays all outstanding tax and interest in cash and that any additional ITC be used only after department scrutiny: The High Court

Post facto, Changes in GST Registration (after detention of goods by officer in transit) is allowed & relief is granted to taxpayer: The High Court

- In this case, a GST inspector detained items in transit that were being delivered by the supplier to a location not shown on the buyer’s GST Certificate. After the occurrence, the buyer made a change to his RC by including the specified address. The High Court has quashed the demand and penalty orders.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.