Opting new tax regime – Basic Conditions

Table of Contents

Opting new tax regime – Basic Conditions

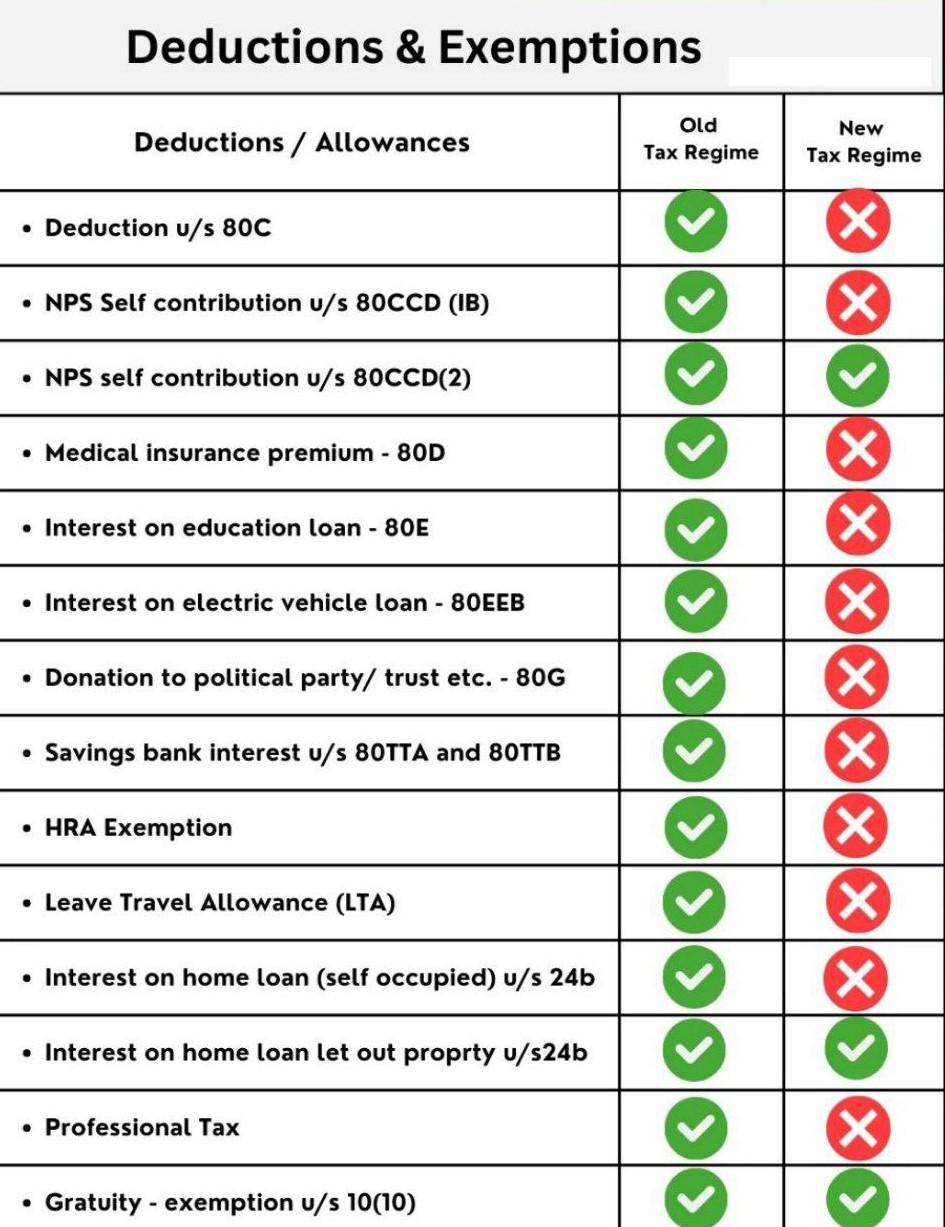

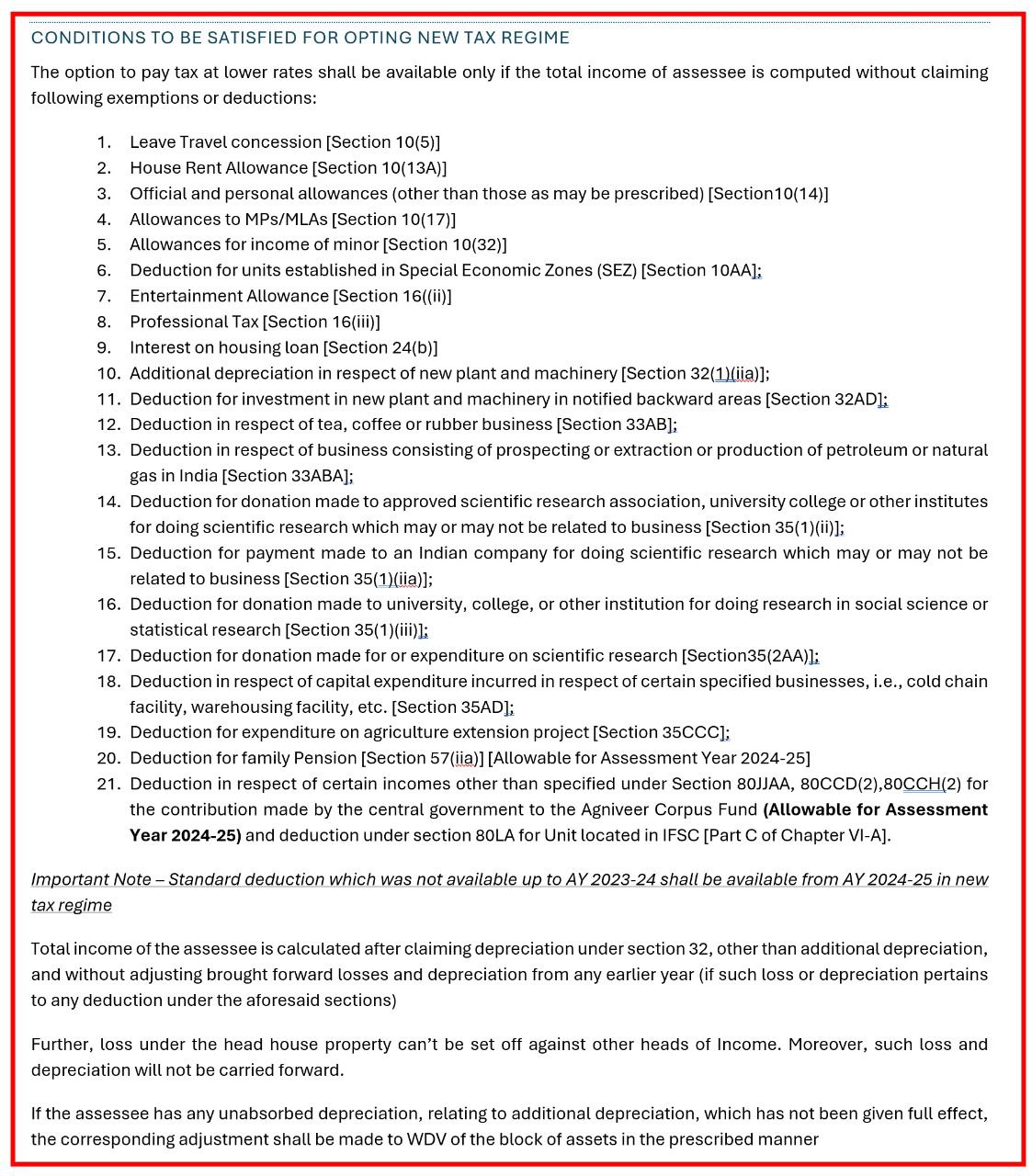

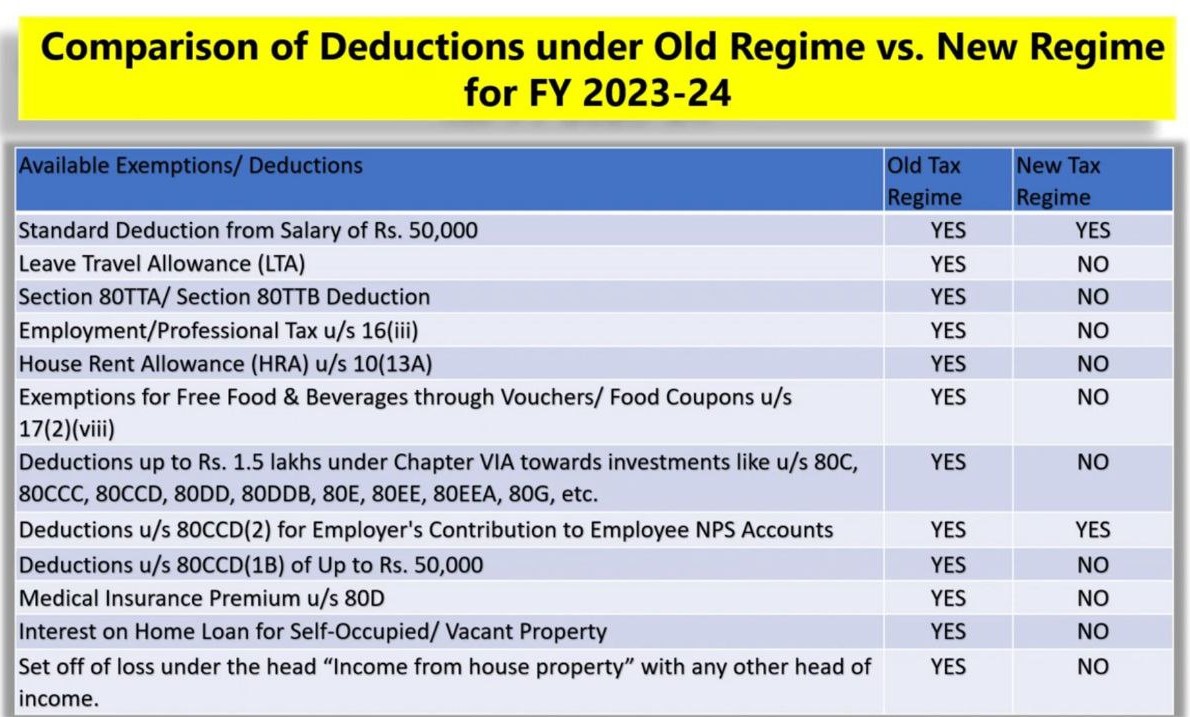

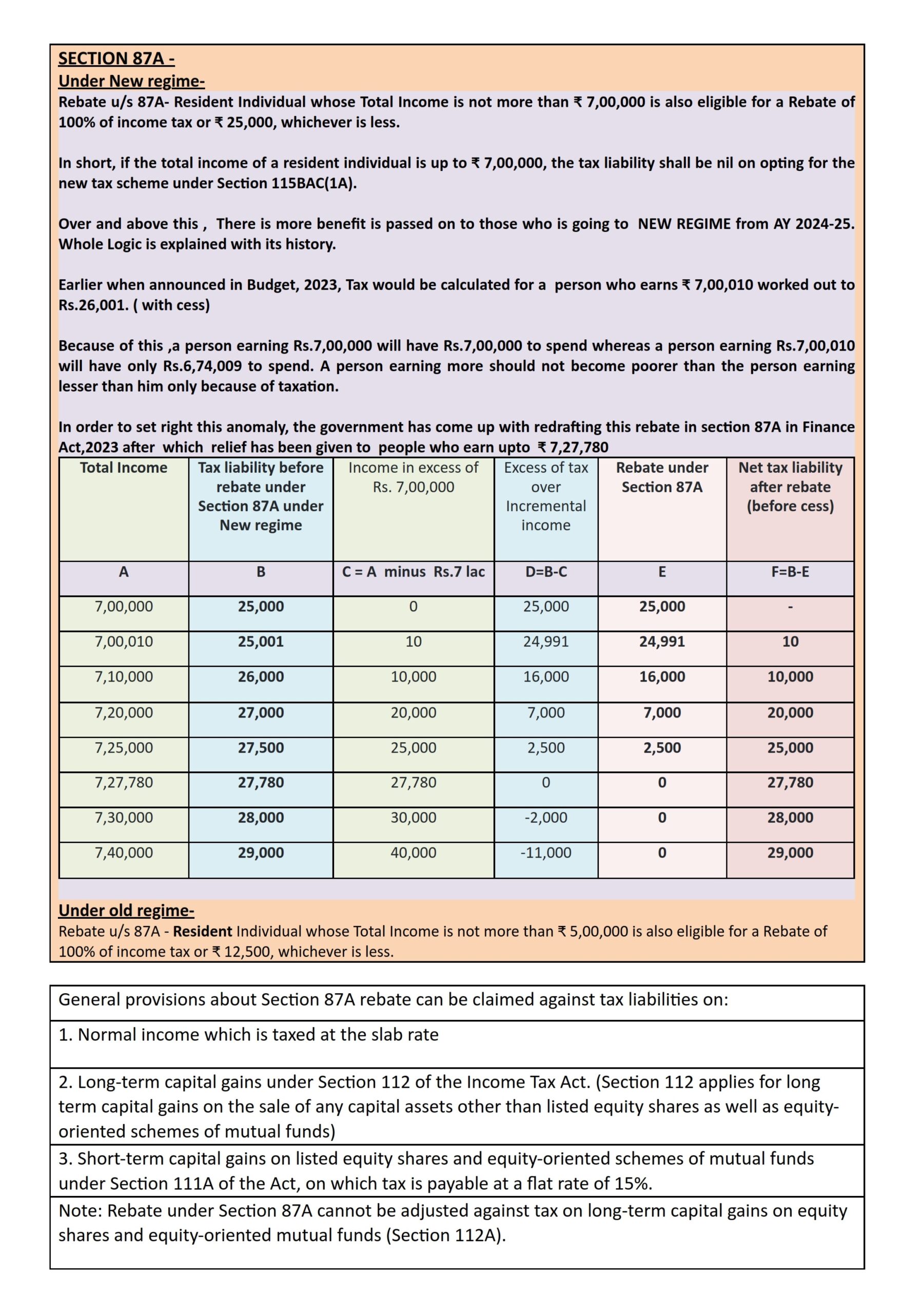

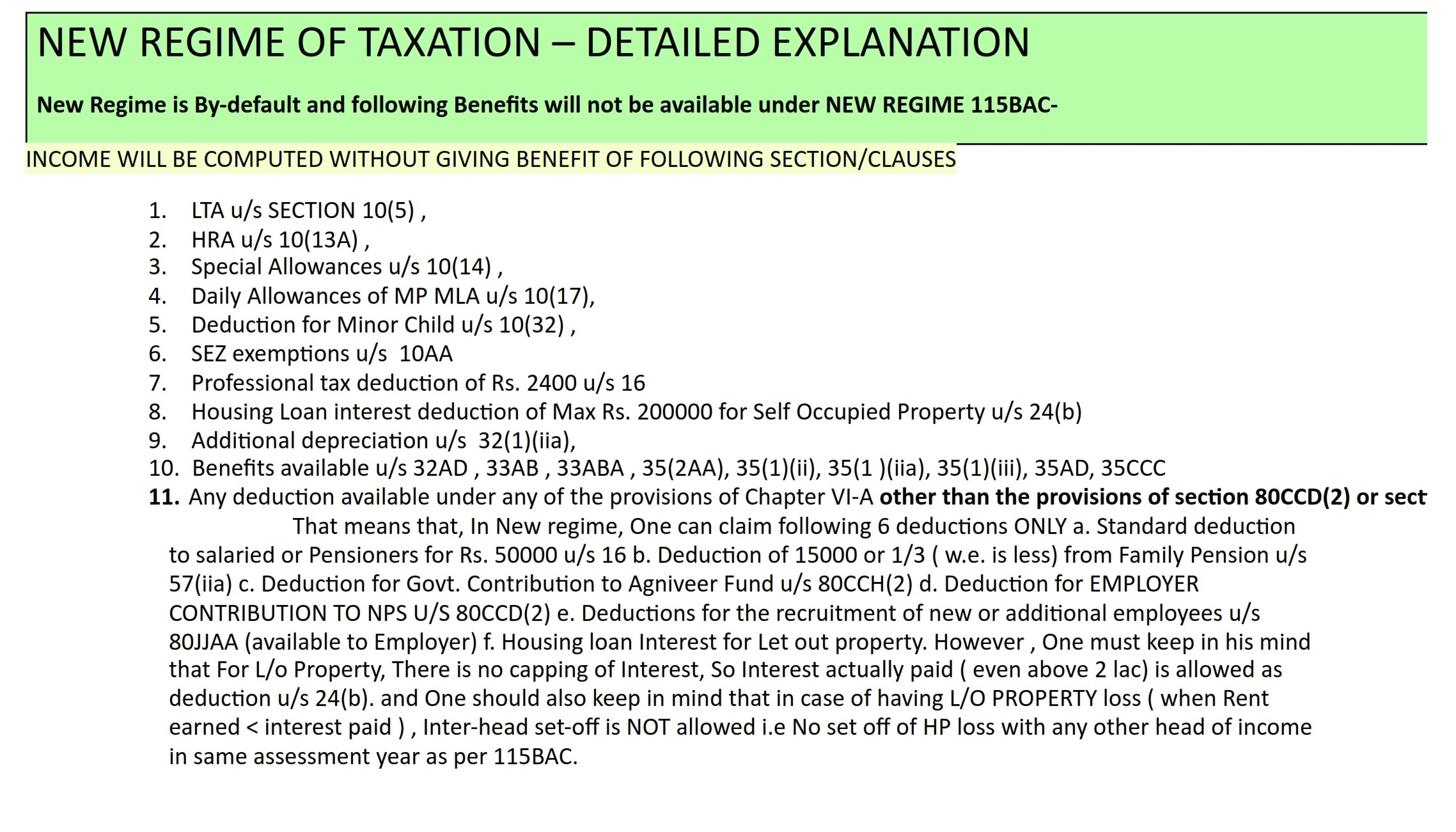

Income taxpayers who choose the New Tax regime’s concessional rates will have to give up some of the deductions and exemptions that were part of the previous tax system. There are a total of 70 deductions and exemptions that are prohibited, the most popular of which are stated below:

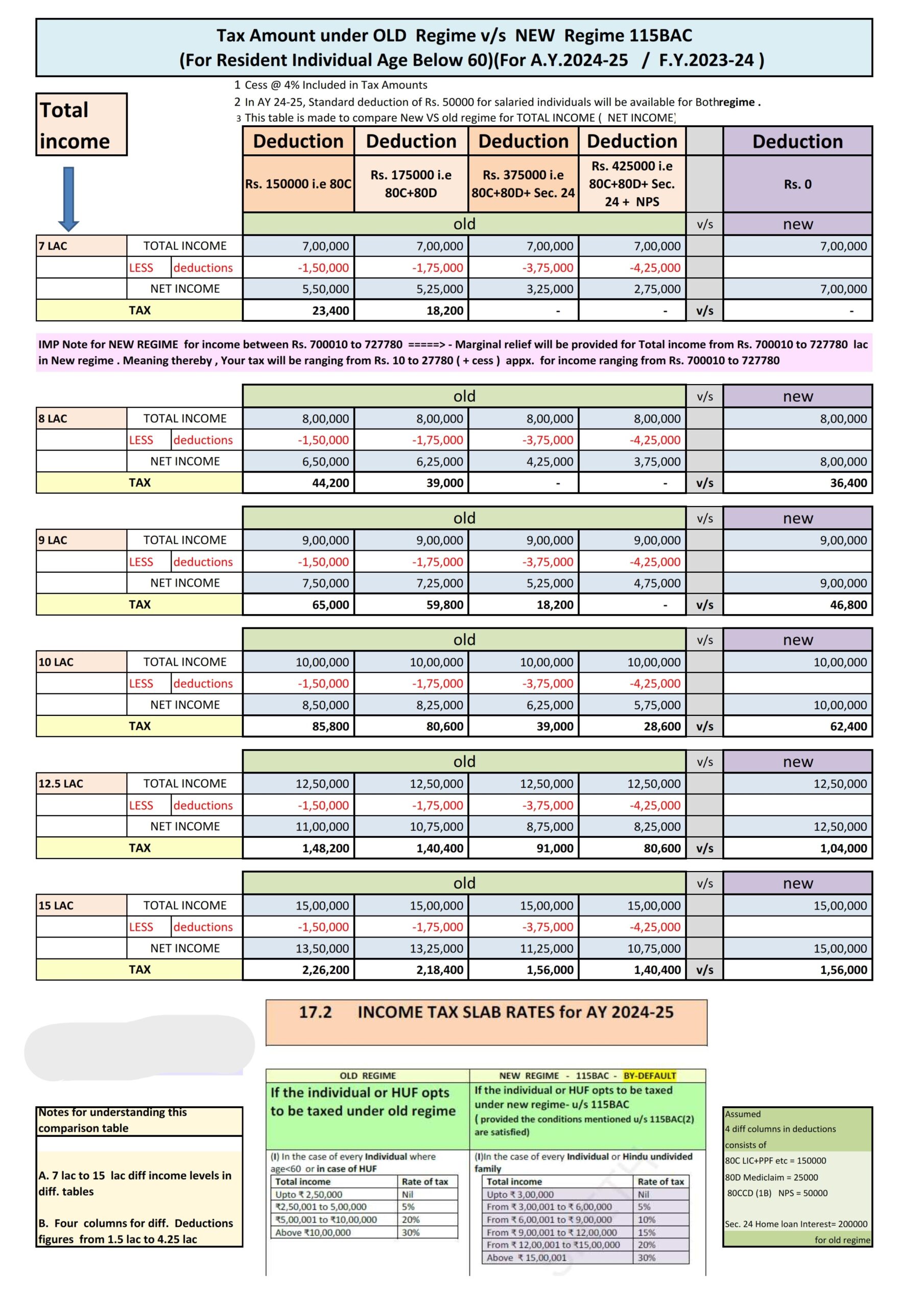

| Particulars | Old Tax Regime | New Tax Regime (From 1st April 2023) |

New Tax regime (until 31st March 2023) |

| Rebate eligibility under different Income level | ₹ 5 lakhs | ₹ 7 lakhs | ₹ 5 lakhs |

| Applicability of Standard Deduction | ₹ 50,000 | ₹ 50,000 | – |

| Effective Tax-Free Salary income | ₹ 5.5 lakhs | ₹ 7.5 lakhs | ₹ 5 lakhs |

| House Rent Allowance Exemption | ✓ | X | X |

| Leave Travel Allowance | ✓ | X | X |

| Standard Deduction (Rs 50,000) | ✓ | ✓ | X |

| Other allowances including food allowance of Rs 50/meal subject to 2 meals a day | ✓ | X | X |

| Interest on Home Loan Under Section 24b on slef-occupied or vacant property | ✓ | X | X |

| Interest on Home Loan Under Section 24b on let-out property | ✓ | ✓ | ✓ |

| Entertainment Allowance Deduction & Professional Tax | ✓ | X | X |

| Perquisites for official purposes | ✓ | ✓ | ✓ |

| Employer’s contribution to National Pension System | ✓ | ✓ | ✓ |

| Payment of Medical insurance premium – Section 80D | ✓ | X | X |

| Disabled Individual – Section 80U | ✓ | X | X |

| Payment of Interest on education loan – under section 80E | ✓ | X | X |

| Deduction under Section 80C (EPF|LIC|ELSS|PPF|FD|Children’s tuition fee etc) | ✓ | X | X |

| Employee’s contribution to NPS | ✓ | X | X |

| Savings Bank Interest Under Section 80TTA & 80TTB | ✓ | X | X |

| Other Income Tax deductions under Chapter VI-A | ✓ | X | X |

| All contributions to Agniveer Corpus Fund – Section 80CCH | ✓ | ✓ | Did not exist |

| Interest on Electric vehicle loan – Under Section 80EEB | ✓ | X | X |

| Donation to Political party/trust etc – Section 80G | ✓ | X | X |

| Exemption on voluntary retirement Section 10(10C) | ✓ | ✓ | ✓ |

| Income Tax Exemption on gratuity Under Section 10(10) | ✓ | ✓ | ✓ |

| Exemption on Leave encashment Under Section 10(10AA) | ✓ | ✓ | ✓ |

| Daily Allowance | ✓ | ✓ | ✓ |

| Transport Allowance for a specially-abled person | ✓ | ✓ | ✓ |

| Conveyance Allowance | ✓ | ✓ | ✓ |

| Deduction on Family Pension Income | ✓ | ✓ | ✓ |

| Gifts up to INR 50,000 | ✓ | ✓ | ✓ |

| Rebate Under Section 87A | 12,500 | 25,000 | 12,500 |

No changes in Tax Regime both in Income Tax and GST, have been proposed.

Income Tax Amendments related to Taxation provision :

- Time limit for tax incentives for International Financial Services Centre units (IFSC) under Sections 10(4D) & 10(4F), eligible startups, Pension Funds & Prescribed Sovereign Welfare, expiring in March 2024, have been extended for one more year till 31st March, 2025.

- Petty Income Tax Disputed Demands upto INR 25k upto Financial Year 2009-10 & upto INR 10,000 for Financial Year from 2010-11 to 2014-15, to be waived off by the Govt of India. This is expected to advantage around 1,00,00,000/- Income tax Taxpayers.

- The recent changes in Tax collected at source on Liberalized Remittance Scheme remittances & foreign tour packages announced in various press releases, have been incorporated in Legislative section 206C(1G), via Income Tax amendments in the existing language of this section. There is no reduction in Tax collected at source from 20% to 5%.

- The time limit for incorporation of Faceless Scheme for Income Tax Appellate Tribunals has been extended for one more year till 31st March, 2025.

- The threshold time limit for the advantage of reduced corporate tax rate applicable on Company under Section 115BAB of 15% plus surcharge, in case of a newly setup manufacturing Companies up to 31st March, 2025, has unfortunately not been extended further. So new manufacturing Co. which are incorporated on or after 1.4.2024 will be taxed at 22% and not 15%, if they opt for the new regime.

What is provision related to New tax regime in professional tax?

Ans : Professional tax will not show in form 16 if in your declaration if you have opted for new tax regime, but when filing if you opt for old tax regime you can claim. Taxpayer cannot claim if you opt for new regime when filing.

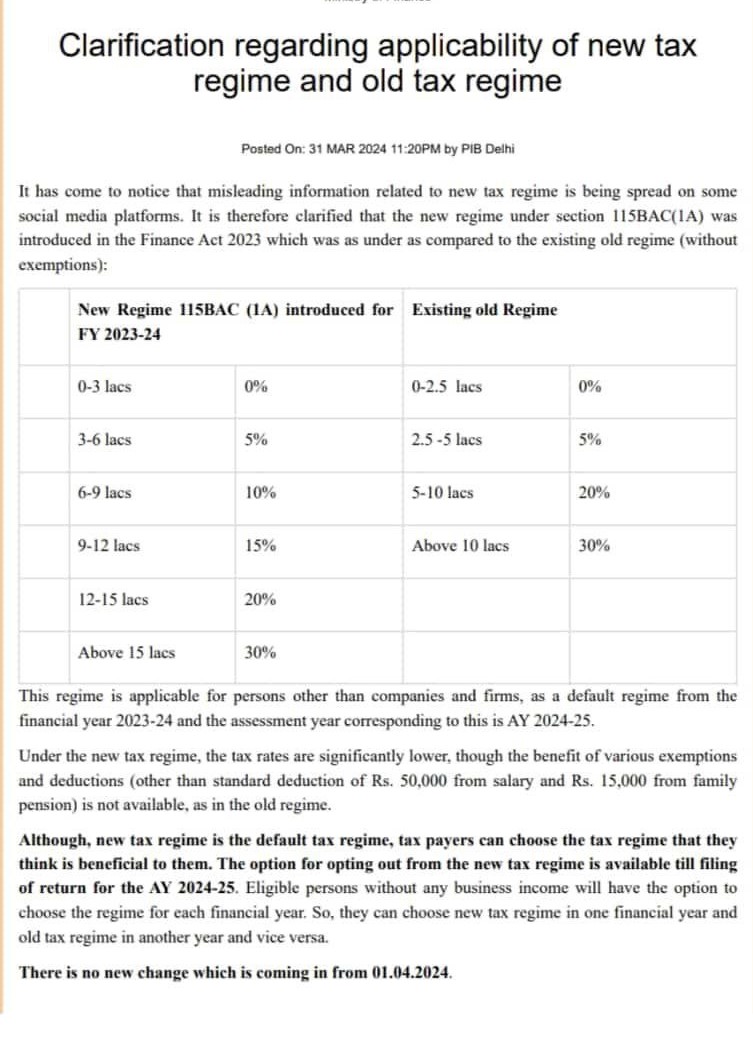

What are the time limit to switch between the old and new income tax regime?

Ans : The time limit to switch between the old and new income tax regime for filing income tax return for Assessment Year 2024-25 depends on your source of income:

1.If Taxpayer are a salaried individual, you can switch between the regimes every year. The new tax regime will be the default option from Financial Year 2023-24, but you can opt for the old regime while filing Taxpayer return before the due date, which is July 31, 2024 for non-audit cases.

2.If Taxpayer have income from business or profession, Taxpayer can switch between the regimes only once in your lifetime. Taxpayer will have to file Form 10IE before July 31, 2024 to opt for the new regime, and Taxpayer will not be able to switch back to the old regime in the future.

In case employee opted for old tax regime at their company, then at the time of filings it will new regime or have to select old regime. Because new regime is default for every one

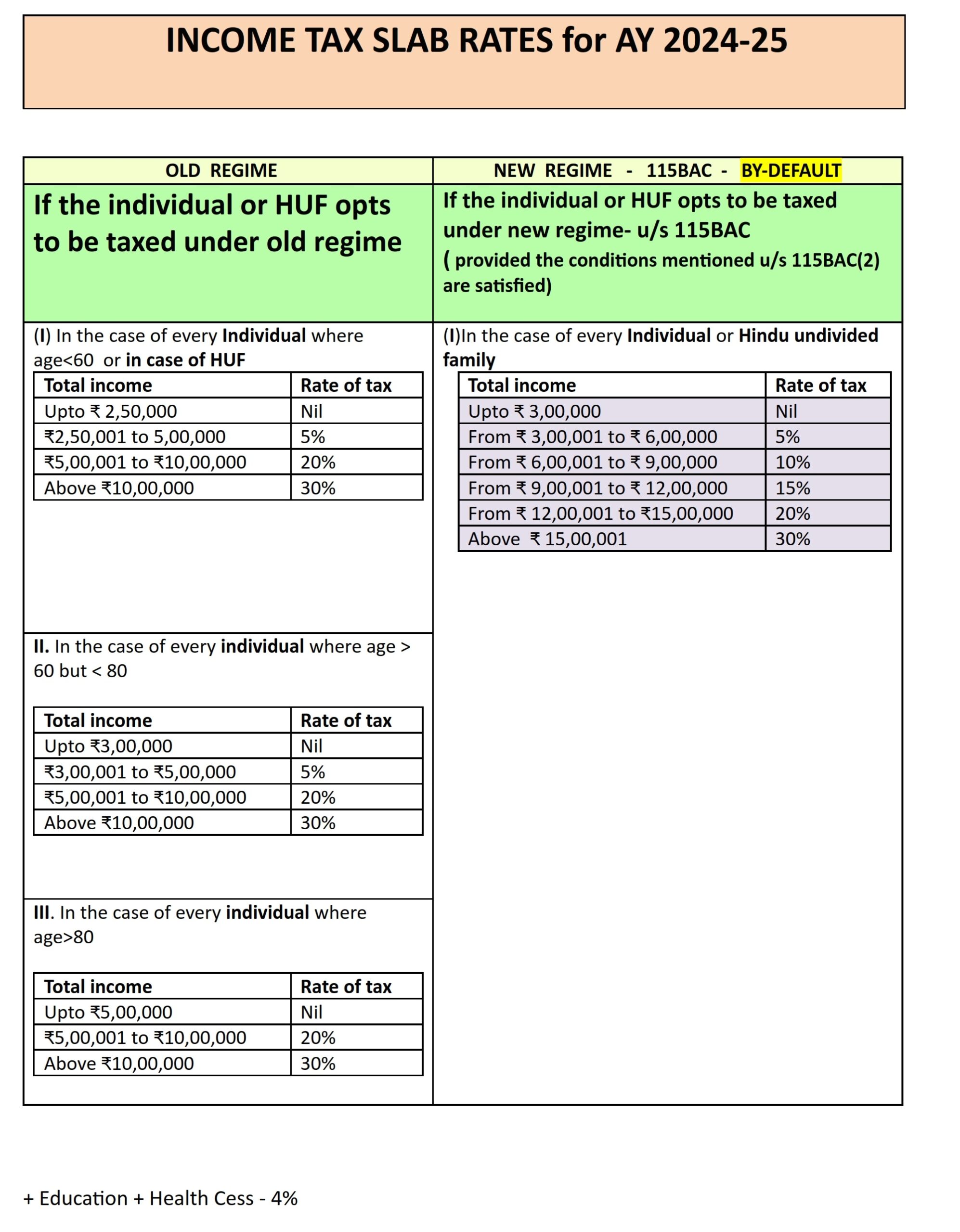

Income tax Slab Rate AY 2024-25:

Clarification related to Old Vs New tax regime – Recent Update

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.