Relief for Taxpayer on Govt waived off demands up to 1 lakh

Big Relief for Taxpayers on Govt waived off of Small tax demands up to INR 1 lakh

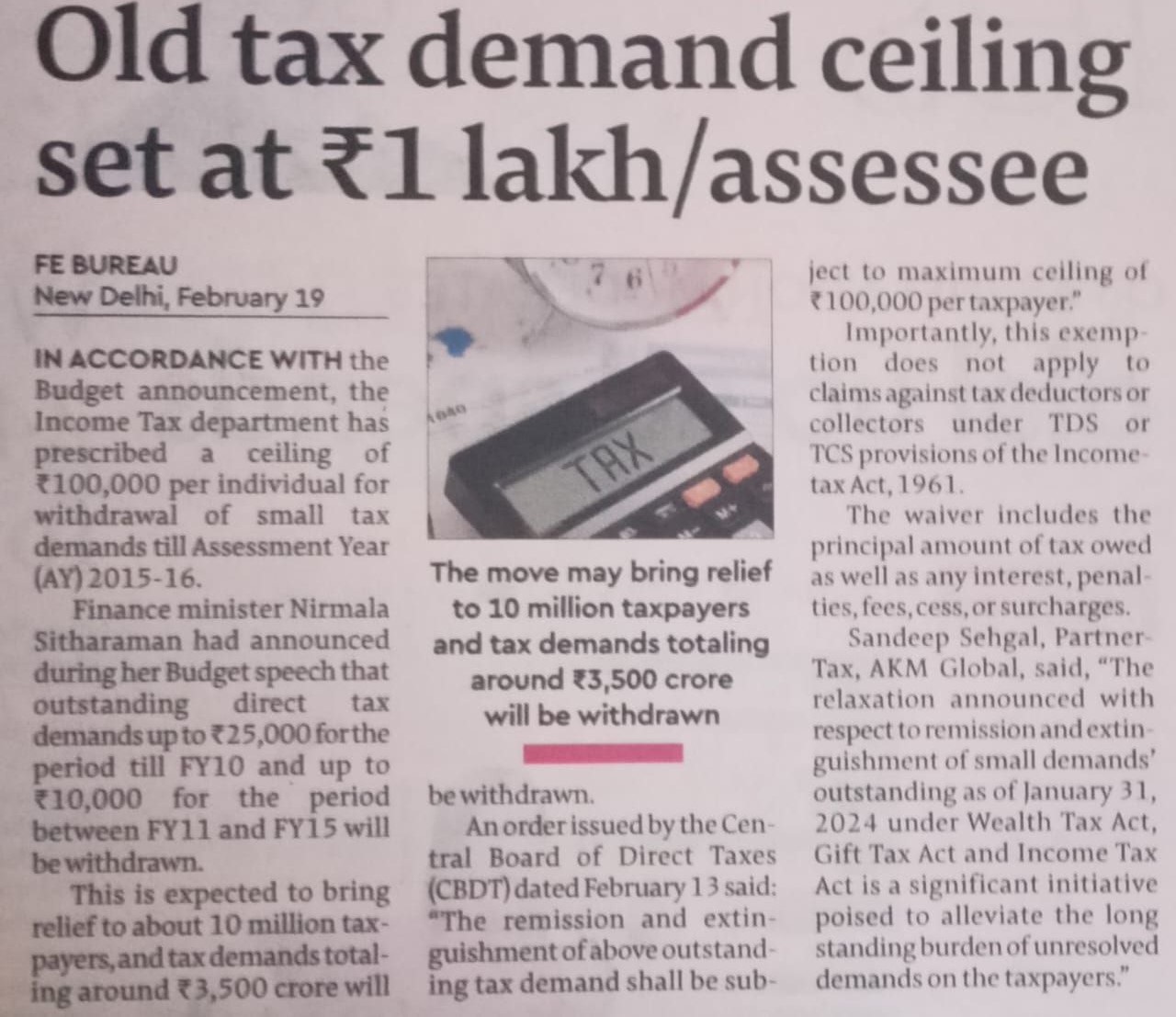

The Central Board of Direct Taxes (CBDT) issued an order to remit and waived off the tax payer requests under the Income-tax Act, Wealth Tax Act, or Gift Act following the Finance Minister’s Budget speech. Tax demand would be waived off, up to a maximum celling of INR 1,00,000/- for each individual taxpayer. Details are mention here under :

- Income Taxpayers, check Income tax portal Login now: Pending Small tax demands of up to INR 1,00,000/- individual is going to be waived by Government of India. Which is big relief to Income Taxpayers.

- CBDT through an income Tax order stated that the Income Tax Dept has started remitting & extinguishing eligible old income tax Small tax demands which were outstanding as of 31st January, 2024.

This waived off of small tax demands up to ₹1 lakh is an Automated process

- The Small tax demands waiver will be automatically applied by the Tax Dept’s CPC without any intervention needed by Income taxpayer. The Small tax demands waiver process is expected to be completed upto 2 months or as earliest. Income Taxpayers can conveniently check the status of their waived demands by logging into Permanent account number via Tax portal & Accessing “Pending Action > Response to Outstanding Demand” section.

- But each Income Tax taxpayer Permanent account number can only receive a maximum of INR 1 lakhs in total waiver. For a Income taxpayer or entity, the waiver will only apply to eligible demands totaling INR 1 Lakhs or less; if the total of all outstanding demands exceeds Rs. 1,00,000, the remaining demands would still be applicable. Refunds cannot be requested in exchange for the demands being waived.

- “Consequent to the Order of the Central Board of Direct Taxes in 375/02/2023-Income Tax Budget issued dated 13.2.2024 eligible outstanding direct tax Small tax demands have been remitted & extinguished. This is requested to you to go into your income tax portal login account & follow the path Pending Action Response to income tax Outstanding Demand to check status of ‘Extinguished Demands’ in your income tax case,” said Central Board of Direct Taxes in the order dated 13th February, 2024, which get published on 19th Feb 19, 2024.

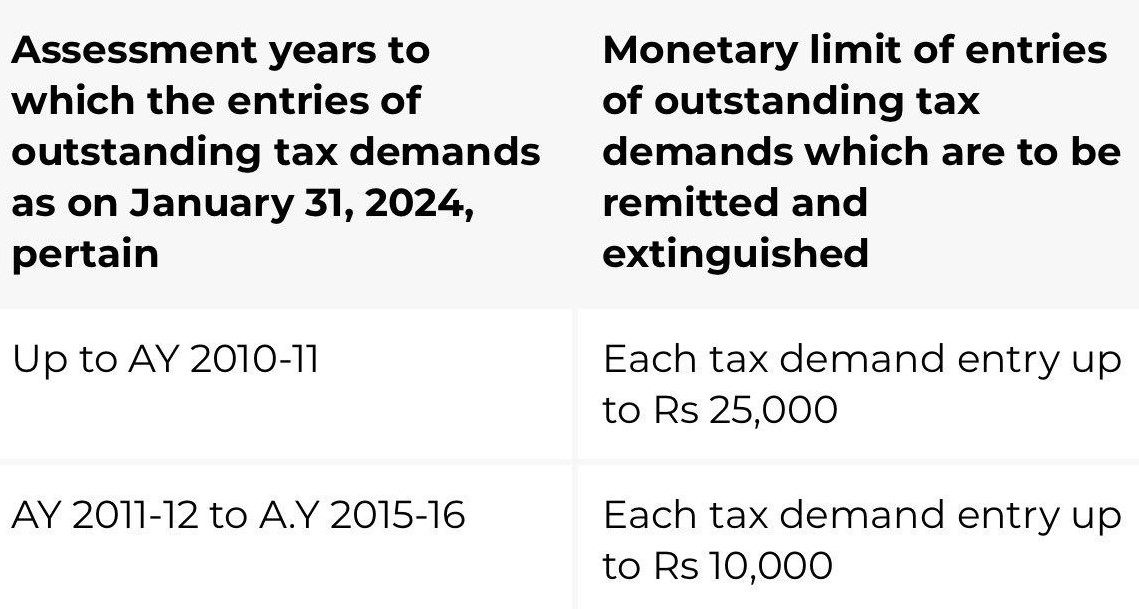

- The remission & extinguishment of Small tax demands shall be subject to ceiling of INR 1 Lakhs for any specific assessee for the below kind of Small tax demands Entries:

a) Principal component of Small tax demands up to ₹1 lakh under the Income-tax Act, 1961 or corresponding provisions of Gift-tax Act, 1958 or Wealth-tax Act, 1957 and

b) Interest, fee, Penalty, Cess, or surcharge under different provisions of the Income-tax law or respective provisions, if any, of Gift-tax Act, 1958 or the Wealth-tax Act, 1957.

Sum-Up

For the withdrawal of small tax demand, The Income Tax dept has imposed a maximum of ₹ 1 lakh per person. This decision direct tax demands were withdrawn comes after as announced in the interim budget. The Income Tax dept has specified the requirements for the withdrawal in an official order, emphasising obligations up until the assessment year 2015–16.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.