Professional loans for CA, CS, Doctors & Architects

Table of Contents

Professional loans for Chartered Accountants, Doctors & Architects

Operations of business can be established, grow and enlarge with IFCCL for professional loans. It is a kind of loan available for working professionals so that they can grow or even start their business. No collateral is required to buy machinery or update equipment, as it is unsecured loan. Processing fee is also low , and less documentation is required.

What is Interest rate & processing fees for professional loans by Top banks for Chartered Accountants, Doctors & Architects

| Bank name | Interest rate | Processing fee |

| Axis Bank | 14.25% | 2% |

| IDFC First Bank | 10.85% | 3.5% |

| HDFC Bank | 14.50% | 2.50% |

| IndusInd Bank | 13% | 2% |

List of eligibility for professional Loan

Business turnover , repayment history, salary turnover among others are various factors affecting professional loan

- Age limit should be between 25 to 65

- Income should be minimum 1 lakh

- Business must be profit making for last 2 years.

- Borrower should be indian resident.

- Chartered accountants , doctors as well as lawyers can apply for this Loan.

- Maximum of 50 lakh can be applied.

List of documents mandatory for obtaining a professional loan

- 2 Passport sized photographs

- Income Tax Return if the computation of income (if filed) for 3 years.

- 3 months’ salary slips and appointment letter.

- Bank statement of salary account for 1 year.

- Complete property documents with ATS + MAP and Chain.

- Aadhar card and Passport

- PAN Card

- A Cheque for the processing fee.

- Permanent address proof and also needed if rented.

- Aadhar Card and Passport

- Loan scheduled and Sanction letter.

- Appointment letter and salary slips of the previous 3 years

- Education proof such as Certificate of degree and registration

Advantages we get from taking a professional loan.

Professional loan is given to working professionals. Here’s the list of benefits of a professional loan

- Little to no paperwork– less paper work is required as compared to process of loan application.

- Loan limit is 50 lakh– 50 lakh is the amount up to which a professional loan is given ,however factors like professional profile , age criteria , repayment capacity also affects the limit.

- Online process– the applications and documents are uploaded online.

- Repayment is flexible– the repayment tenure is flexible up to 5 years, as provided by lendor.

- Speedy approval– the loan process is simple and straightforward because of speedy approval.

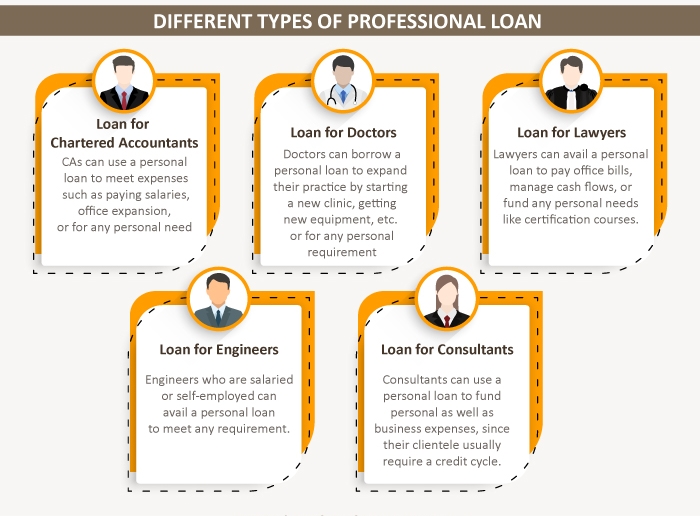

Different kind of professional loans

Different type of loans are based on different factors. Type of loan can be selected by borrower based on eligibility and requirement of the borrower.

- Loan for doctor: loan of 1 crore is provided for doctors. The loans are provided with smooth EMIs and a repayment tenure . It doesn’t require much documentation and is hassle free.

- Loan for Chartered Accountants: working capital , purchase of equipment , maintain business cash flow, etc needs are to be fulfilled by loan

- Loan for engineers: personal finance can also be availed with repayment tenure. The loan can be taken for the purpose of IT, computer science, electronic engineers among other things.

Who are eligibility for applying a professional Loan

- Doctors : with degree including of MBBS , BDS,BAMS,MDS,BHMS, physiotherapist, MD, Veterinary

- Chartered Accountant

- Architects: including degrees of B.Arch , M.Arch

Steps for applying a professional loan!

Following are the steps for a professional loan

- Application form needs to be filled first, either online or via visiting a branch. Application form require all the relevant information.

- Relevant documents need to be uploaded only after the lender confirms the eligibility and pre- assessment.

Elements that affects eligibility criteria for obtaining a loan

Loss In organization –

- every business shall have a profit for the previous 2 years. It is a primary criteria for obtaining loan.

Low CIBIL score –

- the CIBIL score shall be 650 or more to have a good credit. To improve this score the borrower shall repay the principle as well as interest on time to avoid having a bad CIBIL score.

Methods to enhance eligibility for Loan

EMIs shall be paid on time:

- the bank analyses the repayment behavior before giving out loan. Keeping credit score in line is absolutely necessary for improving reputation.

Multiple Loans shall be avoided:

- Multiple lenders can be avoided when the borrower takes into consideration loans from various banks and then opt the one with the lowest rate of interest.

Eligibility, Interest rate & Characteristics of Professional loan

Professional loan is given to working professionals like CA, CS, dentist. advocate, engineers etc. so that, these working professional can start, grow and develop their business easily. In India, many banks, financial institution or NBFCs provide professional loan. It is a collateral free unsecured loan.

ELIGIBILITY CRITERIA FOR A PROFESSIONAL LOAN

| Age criteria | Age should be between 25-65 |

| Eligible entities for professional loans | CA,CS, Doctors, engineers , advocate ,dentist, physiotherapist , architect , designer etc. |

| Income | Minimum of One lakhs. |

| Nationality | Indian |

| Financial Entities | Partnership firm , companies ( both public and private) , LLP , sole proprietorship |

| Business profit | Profit of previous Two years |

| Applicant | Self-employed |

| Work experience | Minimum four to Five years |

Rate of interest and processing fee for professional loans by Top banks

| Bank name | Interest rate | Processing fee |

| IDFC First Bank | 10.50% | 1% |

| ICICI Bank Ltd. | 10.25% | 1% |

| Kotak Mahindra Bank | 11% | 1% |

| Deutsche Bank | 15% | 2% |

| Neogrowth | 14% | 1% |

| Yes Bank Ltd. | 11% | 1% |

| URGO Capital | 14% | 2% |

| Standard Chartered Bank | 14% | 2% |

| Bajaj Finance Limited | 13% | 1% |

| Axis Bank Ltd. | 10.50% | 1% |

| Aditya Birla Housing Finance Ltd. | 12% | 1% |

| HDFC Bank Ltd. | 10.50% | 1% |

List of documents mandatory for obtaining a professional loan

- 2 Passport sized photographs

- Income Tax Return if the computation of income (if filed) for 3 years.

- 3 months’ salary slips and appointment letter.

- Bank statement of salary account for 1 year.

- Complete property documents with ATS + MAP and Chain.

- Aadhar card and Passport

- PAN Card

- A Cheque for the processing fee.

- Permanent address proof and also needed if rented.

- Aadhar Card and Passport

- Loan scheduled and Sanction letter.

- Appointment letter and salary slips of the previous 3 years

- Education proof such as Certificate of degree and registration

What are the charges applicable for professional Loans

Following is the list of charges:

- Foreclosure charges: – Foreclosure charges are the extra amount that the bank charges from the borrowers for closing the loan prior to the tenure is over.

- Processing fee: – It is the total cost charged for one time by the banks for processing the loan.

- Late payment fee: – It is a charge or a penalty that borrowers have to pay when they fail to pay EMI on time.

- Pre-payment charges: – A pre-payment charge or penalty is an additional fee charged by some banks if the borrower pays their loan early.

- Statement charges: – The statement charges include the cost of printing and sending hard copies across to you

- Stamp duty: – Stamp duty is paid on the legal documents.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.