Which Is Best? Business Loan Vs Personal Loan

Table of Contents

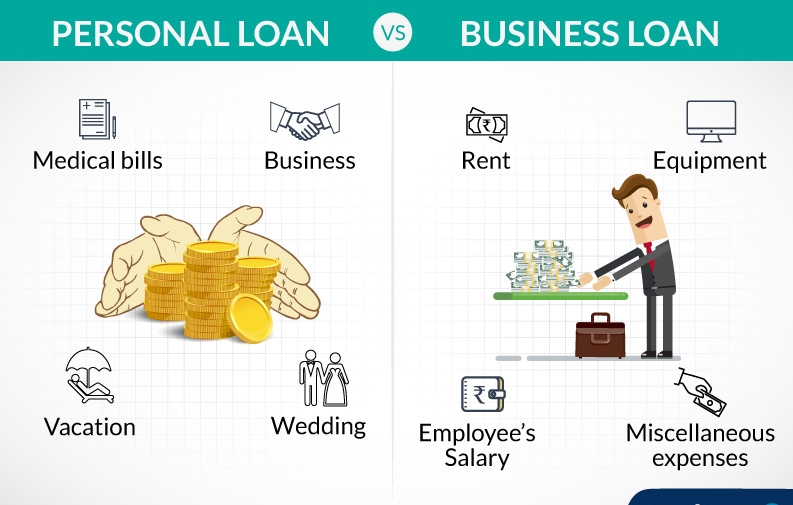

What is a better option for a small business owner – A business loan or A personal loan.

What is business loan ?

A business loan is given to business owners for all the expenses of the organization. Various banks, financial institutions, and non-bank financial companies (NBFCs) provide it. Small business loans can be secured or unsecured, depending on the loan size, the borrowers’ and lenders’ relationship, and the type of loan.

Features and benefits of a Business Loan

| High loan amount | The borrower can take a high loan amount of up to Rs. 1 crore. The amount of loan can be provided based on your business requirements |

| Hassle-free application process | It requires an easy applicational process and less documentation. |

| Repayment loan tenure | The flexible repayment tenure for a business loan is up to 7 years. |

| No collateral required | A Business loan is a collateral-free loan. Therefore, there is less chance of losing their assets if they default while repaying their loans. |

| Easily accessible | Many lenders provide small business loans to their borrowers, it is easy for the corporation to help the need of their business. |

| Quick disbursal | The business person can avail of the business loan by both methods i.e., online and offline. Both methods help you with the quick disbursal |

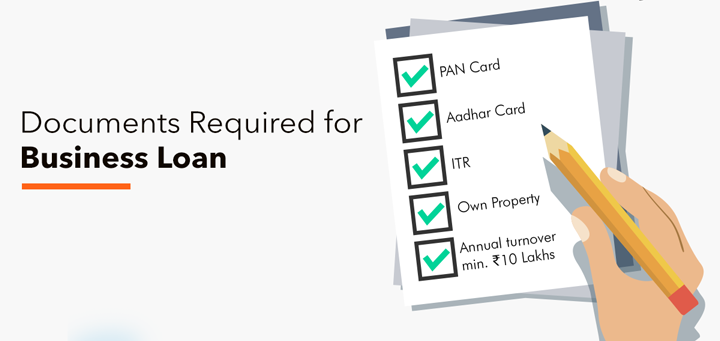

ELIGIBILITY CRITERIA OF A BUSINESS LOAN

Business turnover, repayment , creditworthiness are some factors on which the eligibility depends.

- Age shall be between 25-65

- Business continuity should be a minimum of 3 years

- Minimum of 50 lakh and maximum of 1 crore can be availed as loan.

- Income tax return shall be filed for at least 1 year.

- Sales as well as revenue from operations shall be audited by registered by CA.

Advantages of business loan

- A high amount of business loan can be availed

- Tax benefit can be claimed on paying EMIs of a business loan

- The repayment tenure is higher

- Loan with low interest rate can be availed by person with good CIBIL score.

Disadvantages of business loan

- The repayment tenure is not than flexible

- The credit profile of borrower must be strong

- Extensive documentation is required

- The assets will be lost if the borrower makes a default in repayment

What is a personal loan?

A personal loan as the name suggests can we availed for personal reasons including wedding , home renovation , pay bills , funding a holiday , higher education, it’s an unsecured loan.

Characteristics and advantages of a personal loan

| Less paperwork | Less documentation is required as application form is online. |

| Flexible repayment | Flexible options are provided up to 60 months |

| For various purposes | A personal loan can be used for many purposes including medical expense, weddings, higher education etc. |

| Quick disbursal | The loan is disbursed within 4 to 5 days. |

| High loan amount | Maximum of 25 lakh depending on various factors such as age, capability of repayment, work experiences , financial profile etc. |

Eligibility criteria to obtain a personal loan

For self-employed individual:-

- The borrowers shall be Indian

- Age shall be between 21-68

- CIBIL score shall be 750 or more than 750.

- 2 to 5 years is required to do business.

For salaried individuals:-

- The age shall be between 20-60

- CIBIL score shall be 750 or more than 750

- The minimum salary must be 25000 or above.

- Work experience of 1 to 3 years is mandatory

- The nationality must be Indian.

Advantages of a personal loan

- Personal loan can be used for many purposes

- Speedy disbursement of loan

- No security or collateral is required

- Less documentation is needed

Disadvantages of a personal loan

- As there is no collateral , interests rate are generally high

- Repayment is to be done within a short duration

- Tax benefit on payment of EMI cannot be claimed as tax benefit.

- The amount of loan is low, in comparison with small business loan.

Hence, having a knowledge of IFCCL helps making better decision of business Loan and personal loan.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.