Overview of Section 194N- TDS on cash withdrawals

Table of Contents

Overview of Section 194N- TDS on cash withdrawals

The objective of introducing Section 194 N is to discourage cash transactions in the country and promote the digital economy. Section 194N – TDS on cash withdrawals over and above Rs 1 crore’ has been implemented via the Finance Bill, 2019. But Finance Bill 2020 amends this by lowering the limit to INR 20,00,000/- if a few conditions are satisfaction, which will be discussed later.

- Tax deduction at source Under Section 194N is applicable on cash withdrawals made by any person from bank, Cooperative society bank, post office .

- Where Post offices (payer of Tax deduction at source), Cooperative society bank, Nationalized Bank required to deduct Tax deduction at source at specified % and required to pay the balance amount withdrawn to respective individuals

- Tax deduction at source is to be deducted only at the time of payment.

- Rate of Tax deduction at source : Normally its 2%

Section 194N- TDS Threshold limit:

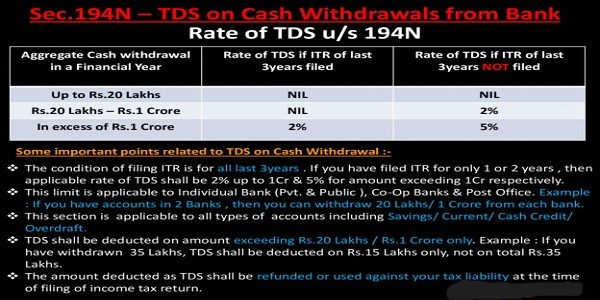

- No Tax deduction at source, if cash withdraw is upto 1 crore in a Previous Year. If cash withdrawal is more than 1 Cr then Tax deduction at source @ 2% only on amount in more than of 1 Cr.

In case payee has not filed their income tax return for last 3 Previous Year for which due date under section 139(1) already expired before starting of current Previous Year then Tax deduction at source shall be deducted as under :

- 2 percentage on cash withdrawals in excess of INR 20,00,000/- upto INR 1,00,00,000/- Cr &

- 5 percentage on cash withdrawals in excess of INR 1,00,00,000/-

FAQs on TDS on Cash Withdrawal Under Section 194N

What is Tax deduction at source on cash withdrawal under section 194N about?

As per the section 194N, Tax deduction at source has to be deducted if a sum or total sum withdrawn in cash in a particular Financial Year More than:

- INR 20 lakh (if no Tax return has been filed for all the 3 Last Assessment Year’s), or

- INR 1 crore (if Income tax return have been filed for all or any one of three previous Assessment Year’s)

What are the Income tax Exceptions to section 194 N ?

No Tax deduction at source will be deducted in case cash withdrawal by:

- Central & State Govt.

- Post offices (payer of Tax deduction at source), Cooperative society Bank, Nationalized Bank and their business correspondent,

- White label ATM operator of banks or Cooperative society Bank

- Money changer, Authorised dealer, their franchise agent and sub agent in respect of withdrawal made for purchasing foreign currency from Nonresident or foreign tourist visiting India or resident Indians on their return to India or for disbursement of inward remittances to recipient beneficiaries in India in cash under Money Transfer Service scheme.

- Registered commission agent / trade operating under Agriculture Produce Market Committee for making payment to farmers.

- Cash Replenishment Agencies

Who deducts Tax deduction at source on cash withdrawal u/s 194N of the income Tax Act?

- Tax deduction at source is deducted by banks (public, private & co-operative) or post offices. The tax is deducted when making any cash payment to any person in more than INR 20 lakh or INR 1,00,00,000/- (As applicable case) from account maintained with such post offices or banks.

At what rate is Tax deduction at source on cash withdrawal Under Section 194N deducted?

- Tax deduction at source will be deducted at a rate of 2% on cash withdrawals in excess of INR 1 crore if the person withdrawing the cash has filed income tax return for any or all 3 Last Assessment Year’s.

- Tax deduction at source will be deducted at 2% on cash withdrawals of more than INR 20 lakh & 5 percentage for withdrawals exceeding INR 1 Crore if the person withdrawing the cash has not filed Income tax return for any of the last 3 Assessment Year’s.

From when is Tax deduction at source on cash withdrawal under section 194N of the income tax Act applicable?

- Tax deduction at source on cash withdrawal under section 194N of the income tax Act is applicable starting 1st Sept 2019, or Financial Year 2019-2020.

To whom is Tax deduction at source on cash withdrawal Under Section 194N of the Income tax Act not applicable?

Tax deduction at source on cash withdrawal under section 194N of Income tax act will not applicable to withdrawals made by the below persons:

- Any cooperative bank

- Post office

- Central or state Govt

- Authorized dealers & related franchise agent & sub-agent along with Money Changer licensed by RBI and its franchise agents

- Central govt Specified commission agents or traders operating under Agriculture Produce Market Committee for making payment to the farmers on account of purchase of agriculture produce.

- Private or public sector bank

- White label ATM operator of any bank

- Business correspondent of any bank

- Any other person notified by the Government in consultation with RBI.

Income Tax exemption for approved Foreign Representatives and Diplomats from section 194N

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.