Overview about the Cryptocurrency Vs Digital Rupee

Overview about the Cryptocurrency Vs Digital Rupee

- Central Bank Digital Currency and Cryptocurrency are two distinct kinds of digital currencies that have grown in popularity in recent years. Both have distinct features and applications. It is critical to comprehend the distinctions between them.

- Central Bank Digital Currency is issued and maintained by a central bank is known as digital currency. It functions in the same way as physical currency, with the central bank in charge of distribution and management.

- The Central Bank Digital currency is often backed by the central bank or government that issues it and is intended to be used as a medium of trade for goods and services.

- Cryptocurrency, on the other hand, is a type of decentralised digital currency that is not backed by any government or central bank. It operates independently of any central authority & employs encryption techniques to safeguard transactions and govern the creation of new currency units. Bitcoin, the most well-known instance of a cryptocurrency, was introduced in 2009.

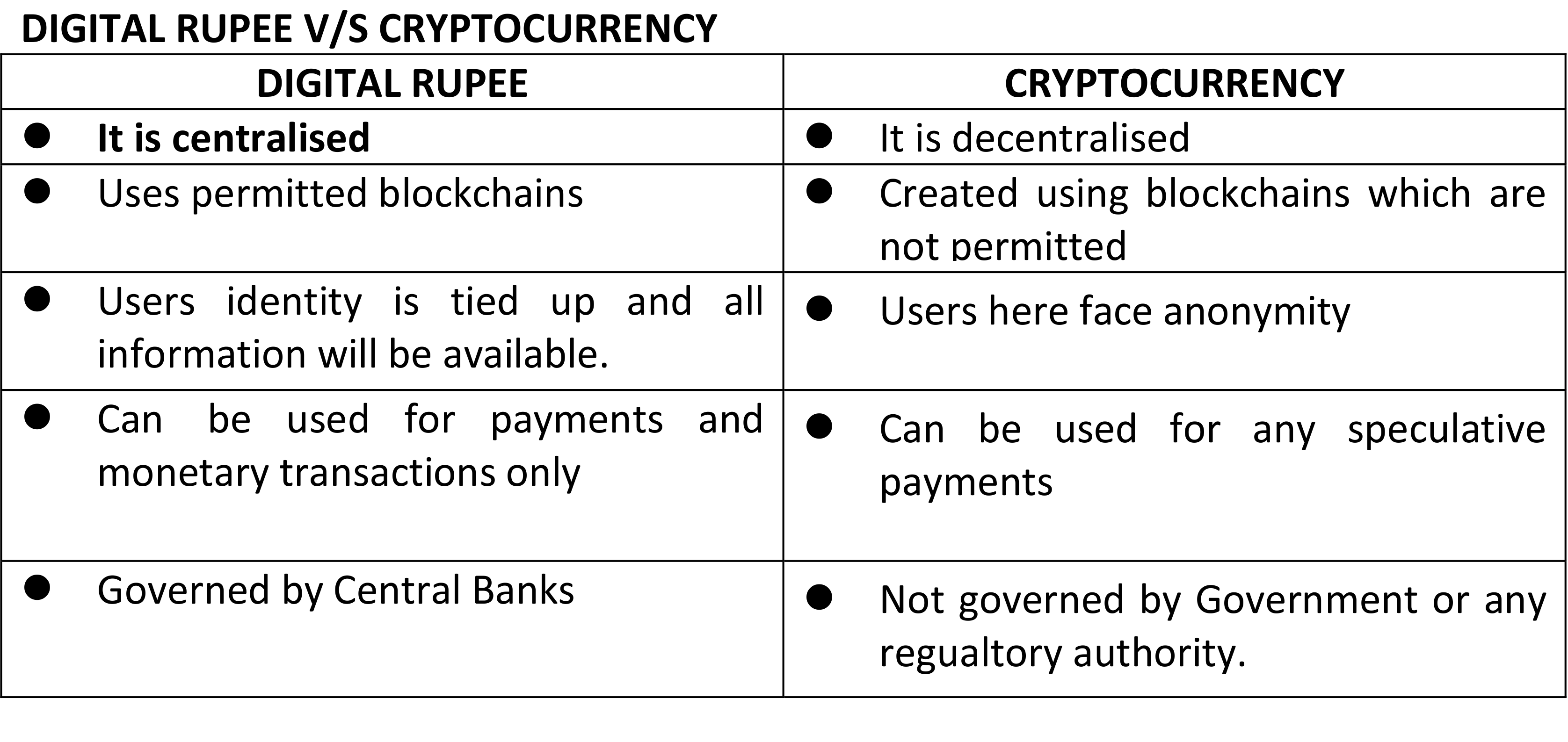

- One of the primary distinctions between Central Bank Digital Currency’s and cryptocurrency is the extent of central bank oversight. Cryptocurrencies are decentralised and self-contained. This means that the central bank has complete control over Central Bank Digital Currency’s supply and value, whereas cryptocurrency is susceptible to market forces such as demand and supply.

Cryptocurrency Vs Digital Rupee

- Another important difference between Central Bank Digital Currency’s and cryptocurrency is the level of protection. Central Bank Digital Currencys are often backed by the government or a central bank, implying that they are secure and reliable. Since they are not backed by a central authority, cryptocurrencies are vulnerable to security risks such as hacking and theft.

- subsequently Central Bank Digital Currency are typically intended to be used as a medium of exchange for goods and services, whereas cryptocurrency is primarily intended for investment purposes. This indicates that Central Bank Digital Currency are intended for use in everyday transactions. Cryptocurrencies are intended to be purchased and held as an investment; nevertheless, while some shops have begun taking Cryptocurrencies, the volume of transactions remains relatively small.

| Particular | CRYPTO CURRENCY | Central Bank Digital Currency |

| Security | Rely on decentralised networks & Cryptography to ensure security | Rely on centralised security systems |

| Issuance | Decentralised & not backed by any Govt or central authority | Issued & backed by central bank |

| Purpose | Created as an alternative to traditional fiat currencies | To enhance the efficiency of the existing financial system and make it more accessible |

| Regulations | Unregulated | Government regulated |

Finally, Central Bank Digital Currency and Cryptocurrencies are two distinct kinds of digital currencies, each with its own set of uses and characteristics. Understanding the distinctions between these two types of digital currencies is essential for anyone considering investing or using in digital currency.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.