CBIC SOP for Scrutiny of GST Return of 2019-20 & onward

Table of Contents

SOP Instruction for Scrutiny of GST Returns of FY 2019-20 & onwards: CBIC.

New instruction issued by CBIC for the Scrutiny of GST returns filed by taxpayers.

The Central Board of Excise and Customs has recently issued instruction no. 02/2023-GST on 26.05.2023 regarding the standard operating procedure (SOP) for the scrutiny of Goods and Services Tax Returns for the financial year 2019-20 and onwards. The standard operating procedure will provide procedures & guidelines for the scrutiny of Goods and services Tax returns and ensure a time-bound and efficient scrutiny process.

Key points specified in the Central Board of Excise and Custom instruction.

Important points set out in the instruction are as follows:

- The Directorate General of Systems has developed an online workflow functionality that will allow the GST Officer to Communicate discrepancies and orders to the registered person, receive replies or take actions such as conducting an audit or investigation.

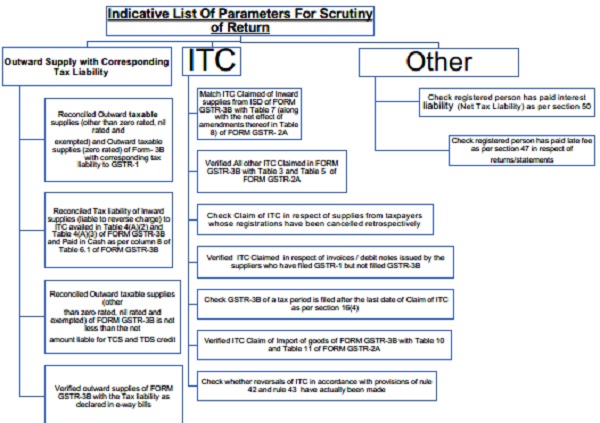

- The selection of Goods and Services Taxpayer Identification Number’s for scrutiny will be done based on the identified risk parameters and such selected Goods and Services Taxpayer Identification Number’s along with the details of risk, and the amount of tax or discrepancies involved will be made available to the proper officer on the scrutiny dashboard.

- GST Officer shall conduct scrutiny of a minimum of 4 Goods and Services Taxpayer Identification Number’s in a month.

- The instruction emphasizes conducting scrutiny in a time-bound manner and minimizing the need for physical interaction between the proper officer and the registered person.

Process of scrutiny by the Goods and services Tax officer.

The GST officer will follow the following process for scrutiny of returns as specified in the instruction:

- The officer shall use the information available to him on the scrutiny dashboard and other relevant information which could be available on sources such as the E-way bill portal to scrutinize the returns filed by the taxpayer for a tax period.

- The officer shall then issue a notice to the taxpayer in Form ASMT-10 informing him of the discrepancies noticed and seeking his explanation on the same. The ASMT-10 shall contain the details of discrepancies and the amount involved. The officer may also send any supporting document in this regard.

- Taxpayer may accept the discrepancies set out in the notice and decide to pay the tax and communicate the same through filing a reply in ASMT-11. The payment against notice shall be made while filing DRC-03. If the taxpayer does not accept the discrepancies, he shall provide an explanation for the same in ASMT-11.

- If the explanation filed is satisfactory or the taxpayer has paid the tax, the officer shall conclude the proceeding by informing the same to the taxpayer in form ASMT -12.

- If the explanation filed by the taxpayer is not satisfactory or if no such explanation is filed by the taxpayer within 30 days from the issue of notice, the officer shall initiate proceedings under section 73 or 74 of the Central Goods And Services Tax Act, 2017 within 15 days from the end of the stipulated time period for reply in Form ASMT-11.

- The GST officer could also refer the matter to Audit Commissionerate or Anti-evasion wing if the officer is of the opinion that further investigation is required to determine the correct liability of the taxpayer.

Conclusion:

- The CBIC’s instructions have offered guidelines for how the officer should undertake the scrutiny of returns. To prevent further consequences, the taxpayer must constantly monitor the communications made by the officer on the GST Portal and make sure that they are promptly followed. Maintaining accurate records is equally crucial to back up any justification offered for the notices. It should also be noted that the clarification, which stated that the officer must take the cause of GSTR 2A & GSTR 3B differences into account and must permit Input Tax Credit when the GST taxpayer presents the officer with ledger confirmation or a Chartered Accountant’s Certificate, was not yet issued for the financial year 2019-20.

GST Update :

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.