Compulsory Audit Trail in Accounting Software w.e.f. 1.04.23

Table of Contents

Compulsory Audit Trail in Accounting Software w.e.f. 1.04.24

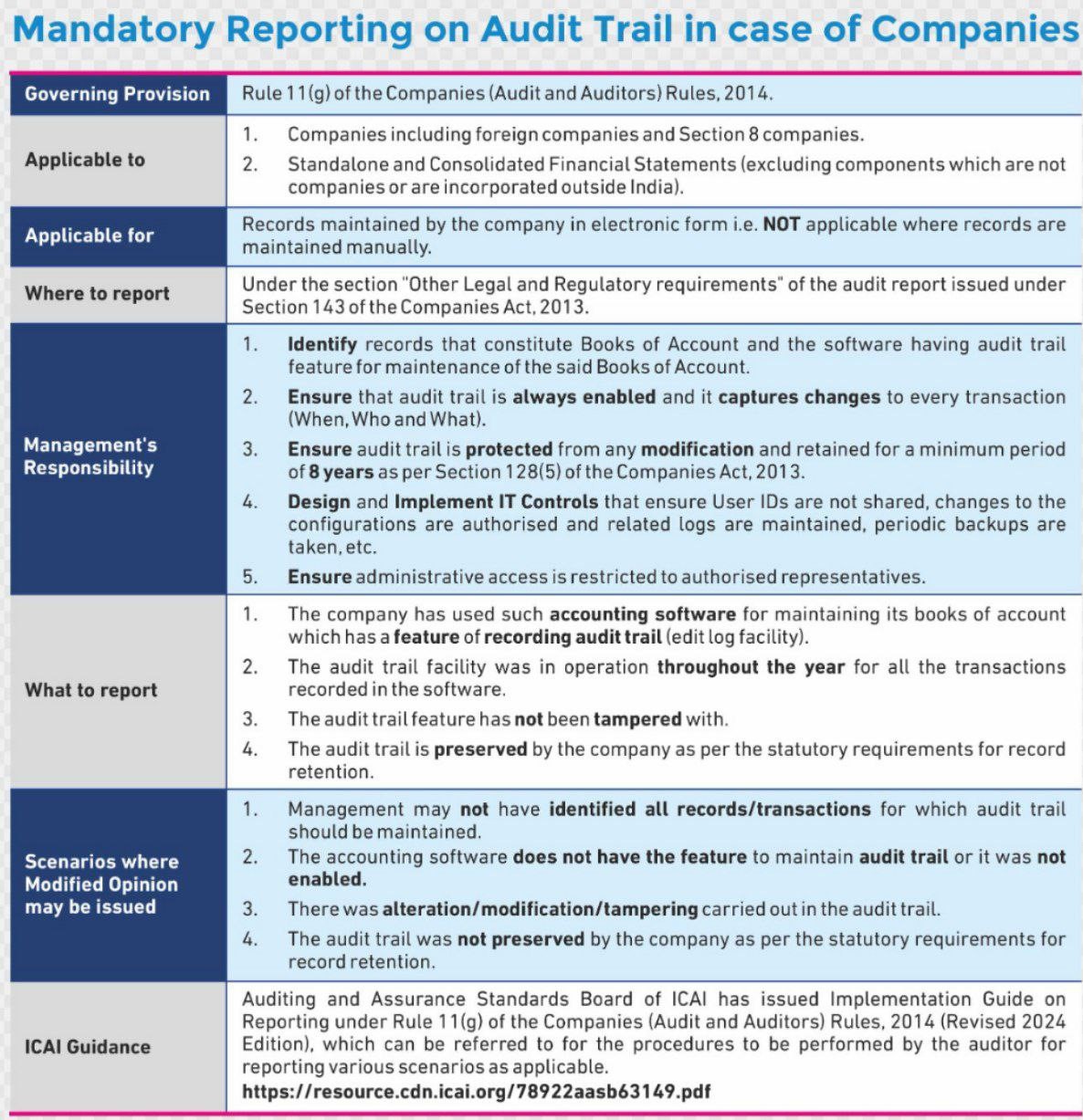

Ministry of Corporate Affairs via notification no. G.S.R. 205(E) dated 24.03.2021, needed companies to comply with using the accounting software which has a feature of recording the audit trail of each and every transaction. An edit log of each change has to be made in books of account along with the date when such changes were made. companies to comply with using the accounting software has been incorporated in the companies (accounts) Rules,2014 in proviso to rule 3(1).

MCA has made it mandatory to conduct and retain audit trials of all transactions in their accounting software.

- The major rationale for implementing audit trail maintenance in accounting software is to promote accountability and transparency in business transactions or processes.

- MCA has issued a notification dated 24-03-2021 regarding Companies (Accounts) Amendment Rules, 2021 and Companies (Audit and Auditors) Amendment Rules, 2021, as well as a subsequent notification dated 01st April, 2023, which includes audit trail in accounting software for companies as a new sub rule to Section 128 of the Companies Act, 2013. However, it was subsequently postponed to later dates, and they are now ultimately required as of April 1, 2023.

- Companies that keep their books of accounts electronically must utilise accounting software that includes audit trails. It provides an Audit Log, which contains information about all changes made to Financial Transactions. Companies are required to compulsorily use these software’s where Audit Trial function is available & functationlity of Audit Trial is enabled.

- The Auditor is in charge of ensuring that the Company maintains Books of Accounts in Accounting Software where Audit Trial is permitted. If not, the auditor must provide their thoughts or opinions in their audit report not only during the audit but throughout the year. Auditors must also verify the legitimacy of the Audit Trial and determine whether it has been tampered with.

Companies (Audit and Auditors) Amendment Rules, 2021, and Companies (Audit and Auditors) Second Amendment Rules, 2021,

- According to the Companies (Audit and Auditors) Amendment Rules, 2021, and Companies (Audit and Auditors) Second Amendment Rules, 2021, which take effect on April 1, 2021, the following clause is inserted in Rule 11 of the Companies (Audit and Auditors) Rules, 2014, on which the Auditor of the Company will give their views and comments while preparing audit report.

- “Whether the company, in respect of FY Commencing on or after 1.04.2023, has used such accounting software to keep its books of account which has a capability for recording audit trail (edit log) facility and the same has been operated throughout the year for all transactions recorded in the software and the audit trail characteristic has not been tampered with and the audit trail has been preserved by the company in accordance with the statutory requirements for record retention.”

- More transparency in the disclosures of a company’s annual report will result from the inclusion of such a capability in accounting software. However, it may also bring with it some difficulties, such as the fact that fixed errors will always be recorded in logs and add to the workload for both businesses and auditors.

- In addition, the auditor must provide commentary on whether or not the company’s transactions are recorded in the software, as well as on whether or not the audit trail function has been tampered with and whether the company is maintaining the audit trail.

Chartered Accountants Services

We boost Your company via CA Practice Efficiency & we are Chartered Accountants are already experiencing the benefits

- Get Tax Audits (Clause 44) Done Faster – Ensure quick compliance by verifying total business expenditure from registered & unregistered dealers.

- MCA-Compliant Audit Trail – Spot discrepancies or unauthorised modifications, facilitating timely corrections, with BUSY Audit Trail.

- 3x Faster GSTR-1/2A/2B/3B Reconciliation – 99% of Accounting Professionals, agree that BUSY saves them and their clients time by automating Reconciliation.

- Single Click GSTR 1/IFF Upload – Easily upload GSTR-1/IFF returns.

- Create Bulk Vouchers within Seconds – Quickly create multiple vouchers, ensuring zero errors and more time for higher-value tasks like analysis and client advice.

- Dedicated CA Helpdesk – Get prompt resolutions to your queries through working hours customer support available.

- For additional information on many topics relating to the Ministry of Corporate Affairs and the Accounting field, please contact India Financial Consultancy Corporation Pvt Ltd, a team of professionals and expert CA CS in Delhi.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.