Steps in The Process Flow for income tax audit report

Table of Contents

Access or Availability to Chartered Accountants Audit Reports & Steps in The Process Flow for audit report & online Filing 2.0

The post includes a list of 22 audit reports and information on how to file them, as well as Process Flow Steps In Online Filing 2.0 on the New Income Tax Portal for all audit forms, including Form 15CB & Form 10CCB.

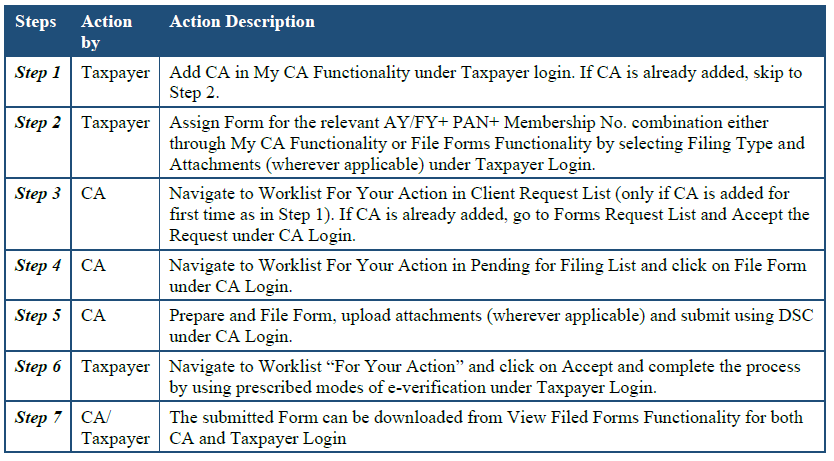

ALL INCOME TAX AUDIT FORMS AND ITS PROCESS FLOW

Below mention for all Audit Forms except Income Tax Form 15CB & Form 10CCB

| Steps | Action by | Action Description | ||||||

| STEP-1 | Income tax Assesses or Taxpayer | Add Chartered Accountants in My Chartered Accountants Functionality under Taxpayer login. If Chartered Accountants is already added, skip to Step 2. | ||||||

| STEP-2 | Income tax Assesses or Taxpayer | Assign Income tax Form for the relevant Assessment Year / Financial Year + Permanent account number + Membership No. combination either via My Chartered Accountants Functionality or File Forms Functionality by selecting Filing Type and Attachments (wherever applicable) under Taxpayer Login. | ||||||

| STEP-3 | Chartered Accountants | Navigate to Worklist For Your Action in Client Request List (only if Chartered Accountants is added for 1st time as in Step 1). If Chartered Accountants is already added, go to income tax Forms Request List & Accept Request under Chartered Accountants their respective Login. | ||||||

| STEP-4 | Chartered Accountants | Navigate to Worklist For Your Action in Pending for Filing List & click on File income tax Form under Chartered Accountants Login. | ||||||

| STEP-5 | Chartered Accountants | Prepare and File income tax Form, upload attachments (wherever applicable) and filling via using Digital Signature Certificate under Chartered Accountants Login. | ||||||

| STEP-6 | Income tax Assesses or Taxpayer | Navigate to Worklist “For Your Action” & click on Accept & complete the process | ||||||

| by using prescribed modes of online e-verification under income tax Taxpayer Login. | ||||||||

| STEP-7 | Chartered Accountants or Income tax Assesses or Taxpayer | Filled Income tax Form can be downloaded from View Filed Income tax Forms Functionality for both Taxpayer Login & Chartered Accountants. | ||||||

ALL INCOME TAX AUDIT FORMS AND ITS PROCESS FLOW – APPLICATED FOR INCOME TAX FORM 15CB & INCOME TAX FORM 10CCB

| Steps | Action | Action Description | ||||||

| by | ||||||||

| STEP-1 | Income tax Assesses or Taxpayer | Add Chartered Accountants in My Chartered Accountants functionality under income tax Taxpayer login. If Chartered Accountants is already added, skip to Step 2. | ||||||

| STEP-2 | Income tax Assesses or Taxpayer | Assign Income tax Form for relevant Assessment Year / Financial Year Permanent account number + Membership No. combination via My Chartered Accountants Functionality by selecting Filing Type under Taxpayer Login. | ||||||

| STEP-3 | Chartered Accountants | Navigate to online e-file Form. Select income tax Form & submission of Permanent account No of income tax Taxpayer for which you wish to fill the Form and other Assessment Year / Financial Year details under Chartered Accountants Login | ||||||

| STEP-4 | Chartered Accountants | Prepare and submit income tax Form, upload attachments (as per applicable) & Filling via using Digital Signature Certificate under Chartered Accountants Login. | ||||||

| STEP-5 | Income tax Assesses or Taxpayer | Navigate to Worklist “For Your Action” & click on Accept & complete the process | ||||||

| by using prescribed modes of online e-verification under income tax Taxpayer Login. | ||||||||

| STEP-6 | Chartered Accountants or Income tax Assesses or Taxpayer | Form after submission can be downloaded from View Filed income tax Forms Functionality for both Taxpayer & Chartered Accountants Login | ||||||

LIST OF INCOME TAX AUDIT REPORTS

| Sl. | Form No. | Form Description | Mode of | ||||||||

| No. | Submission | ||||||||||

| 1 | FORM-3AC | Chartered accountants -Audit Report U/s 33AB (2) | Via On-line mode | ||||||||

| 2 | FORM-3AD | Chartered accountants -Audit Report U/s 33ABA (2) | Via On-line mode | ||||||||

| 3 | FORM-3AE | Chartered accountants -Audit Report U/s 35D (4)/35E (6) | Via On-line mode | ||||||||

| 4 | FORM-3CA-3CD | Chartered accountants -Audit report U/s 44AB, in a case Chartered accountants -where the accounts of the business or profession of a person have been audited under any other law | Via Off-line Mode | ||||||||

| 5 | FORM-3CB-3CD | Chartered accountants -Audit report U/s 44AB, in the case of a person referred to in rule 6G(1)(b) | Via Off-line Mode | ||||||||

| 6 | FORM-3CE | Chartered accountants -Audit report U/s 44DA(2) | Via On-line mode | ||||||||

| 7 | FORM-3CEA | Report of an Chartered accountants to be furnished by an assessee under sub-section (3) of section 50B relating to computation of capital gains in case of slump sale | Via On-line mode | ||||||||

| 8 | FORM-3CEB | Report from an Chartered accountants to be furnished U/s 92E relating to specified domestic transaction or international transaction(s). | Via On-line mode | ||||||||

| 9 | FORM-3CEJA | Report from an Chartered accountants to be filed for purpose of section 9A regarding fulfilment of certain conditions by an eligible investment fund | Via On-line mode | ||||||||

| 10 | FORM-3CLA | Report from an Chartered accountants to be furnished under sub-section (2AB) of section 35 of the Act relating to development facility and or in-house scientific research. | Via On-line mode | ||||||||

| 11 | FORM-10B | Chartered accountants -Audit report U/s 12A(1)(b), in the case of charitable or religious trusts or institutions | Via On-line mode | ||||||||

| Chartered accountants Audit report U/s 10(23C), in the case of any fund or or trust or institution or other educational institution or any university or any hospital other medical institution referred to in sub- clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via) of section 10(23C) | Via On-line mode | ||||||||||

| 12 | FORM- 10BB | ||||||||||

| 13 | FORM-10CCB | Chartered accountants Audit report U/s s 80-IB/ 80-IC/ 80-IAC/ 80-IE/80-I(7)/ 80-IA(7) | Via On-line mode | ||||||||

| 14 | FORM-10CCC | Chartered accountants Certificate rule 18BBE(3) | Via On-line mode | ||||||||

| 15 | FORM-10CCF | Chartered accountants Report U/s 80LA(3) | Via On-line mode | ||||||||

| 16 | FORM-10DA | Chartered accountants Report U/s 80JJAA | Via On-line mode | ||||||||

| 17 | FORM-15CB | Certificate of an Chartered accountants | Via On-line mode / | ||||||||

| Via Off-line Mode | |||||||||||

| 18 | FORM-29B | Chartered accountants Report U/s 115JB for computing the book profits of the company | Via On-line mode | ||||||||

| 19 | FORM-29C | Chartered accountants Report U/s 115JC for computing Adjusted Total Income and Alternate Minimum Tax of the person other than a company | Via On-line mode | ||||||||

| 20 | FORM-56F | Chartered accountants Report U/s 10A or 10AA | Via On-line mode | ||||||||

| 21 | FORM-6B | Chartered accountants Audit report U/s 142(2A) | Via On-line mode | ||||||||

| 22 | FORM-66 | Chartered accountants Audit Report under clause (ii) of section 115VW | Via On-line mode | ||||||||

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.