Timeline reduce to 21 day for filling response of 245 notice

Directorate of Income Tax (Systems) issue instruction to AO on time bound reply to response against intimation U/S 245

- Central Board of Direct Taxes has issued Instruction No. 06 of 2022 to the AO for response to notice / intimation U/s 245 issued by Centralised Processing Centre Bangalore for decreased in timeline for filling response to notice or intimation under section 245 by the AO.

- This is in the light of the directions of the High Court of Delhi, issued on their own motion due to writ of mandamus issued for necessary action by the Tax Dept.

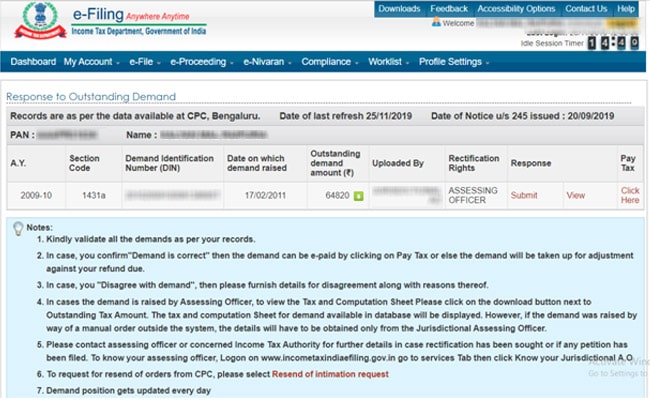

- In Few matters, consequent to the issue of notice or intimation under section 245, the Income tax assessees had responded on the demand portal that the demands are incorrect, in as much as that the demands are stayed by AO or High Court. or Income Tax Appellate Tribunal

- It has been reported that incorrect categorization of such demand as “correct and collectible” or not providing feedback by the AO on the Income tax assessee’s response has resulted in incorrect adjustment of Income tax refunds by Centralised Processing Centre Bangalore against such Income tax demands, leading to avoidable litigations & grievances.

- If the Income tax assessee either does not agree or partially agrees for adjustment, the matter shall be referred by Centralised Processing Centre Bangalore immediately to the Assessing Officer, who shall, within Twenty One days from the date of such reference, shall provide feedback to Centralised Processing Centre Bangalore as to whether the adjustment should be made or not, and in case of partial adjustment to be made then, amount of Income tax demand to be adjusted for each Assessment Year. Requires to be prescribed in income tax demand online portal.

- In case no feedback is received from the AO within Twenty-One days, Centralised Processing Centre Bangalore shall either release the refund without adjustment or adjust the Income tax refund to the extent of demands agreed for adjustment by the Income tax assessee.

- The Directorate of Income Tax (Systems) issue the instruction that Centralised Processing Centre Bangalore shall not hold these Income tax refunds after the period of Twenty-One days from the date of reference to the Assessing Officers & shall release the same to the income tax assessee, without delay.

- Did you receive tax notice? Let us support you reply to the Income tax Dept. IFCCL has expertise in responding to Tax Dept. IFCCL experts would support you avoid legal consequences by assisting in responding correctly.

- IFCCL is a group of Chartered Accountant CS and Advocate & leading Consultancy Company in India. We are amongst the top 20 upcoming startups of India. We have wide industry experience from different industry where he has handled various international as well as national assignments handled.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.