PPF : Investment Limit, Income Tax Benefit, Features

Table of Contents

PPF SCHEME: INVESTMENT LIMIT, INCOME TAX BENEFIT, FEATURES

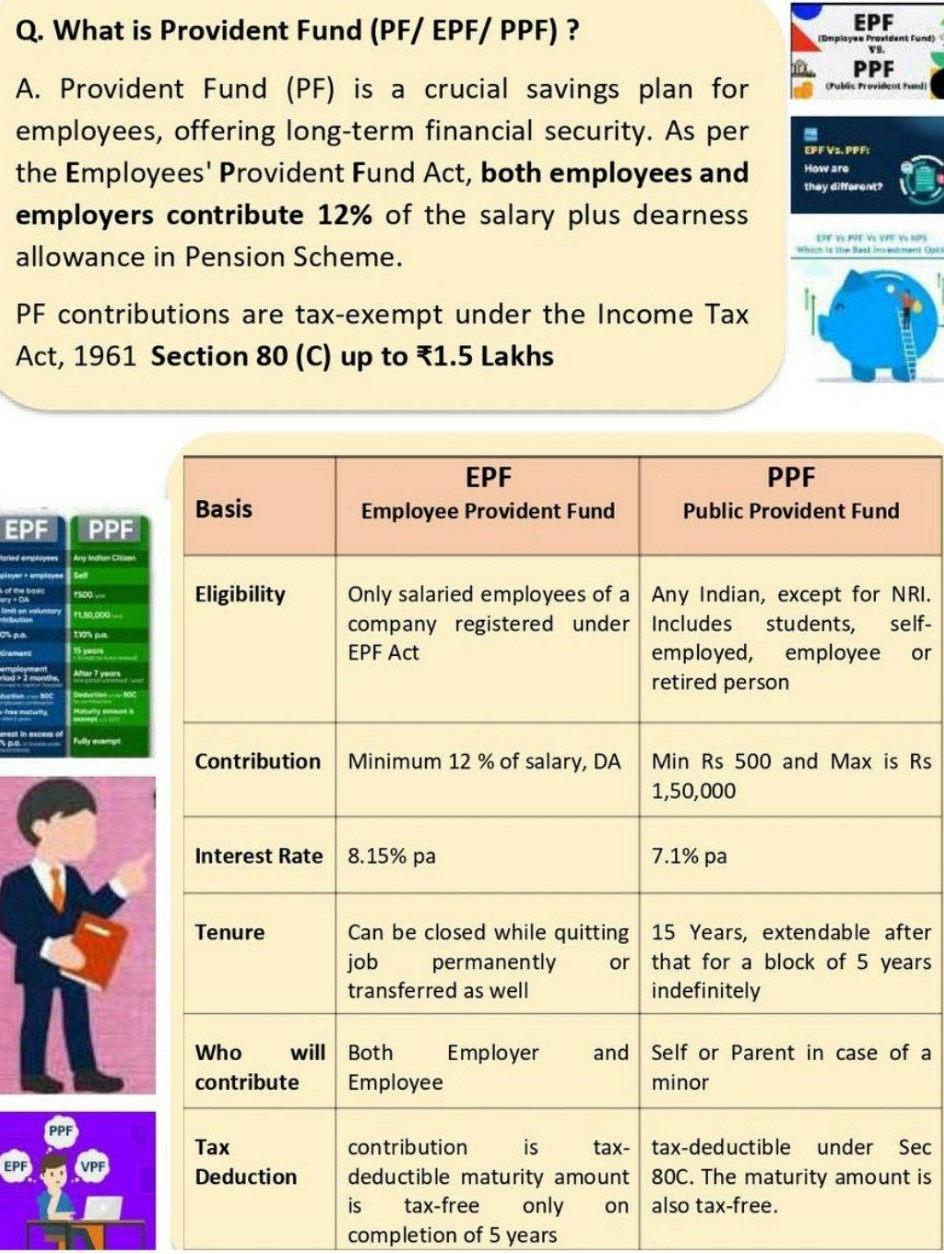

The Public Provident Fund is the darling of all tax saving investments. No wonder! You invest in it and you get a deduction on your income. Besides, the interest you earn on it is tax-free. Since it is a scheme run by the Government of India, it is also totally safe. You can be sure no one is going to run away with your money. Here, we summarise the scheme, tell you how to open a PPF account and what to expect.

Features on PPF

- To open a PPF account, drop by a State Bank of India branch. SBI’s subsidiary banks can also open accounts. Alist of these subsidiary banks is available on the bank’s Web site. You can even visit the nationalised bank in your neighborhood. Selected branches of nationalised banks can also open accounts. The head post office or selection grade sub-post offices also open PPF accounts.

- You will have to fill up a form. You can take a look or download the form from SBI’s web site. Along with the form, attach a photograph and submit your Permanent Account Number. If you do not have a PAN, then furnish an attested copy of either your ration card, voter’s identity card or passport. When you open an account, you will be given a passbook (just like a bank pass book) in which all subscriptions, interest accrued, withdrawals and loans are recorded.

- You can have only one PPF account in your name. If, at any point, it is detected that you have two accounts, the second account you have opened will be closed, and you will be refunded only the principal amount, not the interest.

- You cannot open a joint account with another individual. The account can only be opened in one person’s name. You are free to nominate one or more individuals. On the death of the account holder, nominees cannot keep the account going by making contributions. If there are no nominees, the legal heirs get the money. You can open one account for yourself and others for your child/ children. But, on your death, your children cannot make any additional contributions.

- The minimum amount to be deposited in this account is Rs 500 per year. The maximum amount you can deposit every year is Rs 70,000 or as such declared by Govt of India. The interest you will earn is 8% per annum.

- Let’s say you open an account for your minor child. You can deposit Rs 70,000 in your account and Rs 70,000 in your child’s account. In this case you can in my opinion take the maximum benefit of Rs. 1,00,000/- U/s. 80C. As Limit of Maximum Investment in a year of 70000/- is fixed by Public provident Fund Act not by Income Tax law.

- You can make up to 12 deposits in one year. You don’t have to put in this money at one go.

- The PPF account is valid for 15 years. The entire balance can be withdrawn on maturity, that is, after 15 years of the close of the financial year in which you opened the account. So, if you opened it in FY 2006-07 (this financial year), you will be able to withdraw it 15 years later, starting March 31, 2007 (end of this financial year). That means your PPF matures on April 1, 2022. It can be extended for a period of five years after that.

- During these five years, you earn the rate of interest and can also make fresh deposits. Once your account expires, you can open a new one. The only limitation is that you cannot withdraw it until seven years are completed, after which 50% of your deposits can be withdrawn, if needed.

-

Deposit date in Cheque payments:-

Till recently, in case of a PPF when a subscriber used to make deposits by local cheque or demand draft, the date of tender of cheque or draft at the accounting office was treated as the date of deposit of PPF, provided the said cheque was duly honoured on presentation for encashment. In contrast, in case of other small savings schemes like Post Office Savings Scheme (POSS), Senior Citizen Savings Scheme 2004 (SCSS) any money deposited in these accounts by means of a cheque, the date of encashment of the cheque is treated as the date of deposit.Thus, in order to remove inconsistency between PPF and other small savings schemes and to bring in uniformity in the reckoning of the date of deposit of all the schemes, the government has issued necessary instructions through the circular to banks / other intermediaries which hold PPF accounts for the individuals to treat the date of realisation of the cheque or demand draft by the subscriber as the date of deposit.This issue becomes particularly relevant in respect of deposits made towards the end of the financial year by cheque / demand draft because if the same is not realised by March 31, then the same will be treated as deposits for the following financial year. This would also have ramifications in respect of the tax deduction being claimed by the individuals in a particular tax year.

-

Opening an account for a minor:-

There have been certain practical hurdles in respect of opening of accounts for minor vis-à-vis some intermediary agencies. This clarification reiterates that as per the rules under PPF scheme, an individual may on his own behalf or on behalf of a minor of whom he is a guardian, open a PPF account. Further, either father or mother can open PPF account on behalf of his / her minor child, but both cannot open the account for same child.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.