Top Ten Cryptocurrency And Crypto Features

Table of Contents

TOP 10 CRYPTOCURRENCY AND ITS FEATURES (OTHER THAN BITCOIN)

Best Cryptocurrencies to Buy:

-

- Most Promising Layer 2 token: Polygon (MATIC)

- Holds Most Market Enthusiasm: Ethereum (ETH)

- Best Payment Solution: Stellar Lumens (XLM)

- Highest Growth Potential: Chainlink (LINK)

- Best Store of Value: Bitcoin (BTC)

- Best Hedge Against ETH: Cardano (ADA)

-

Ethereum (ETH) Launched: 2015 Market value: $70 billion

Features – Built-in programming language lets developers write computer programs, called smart contracts, running on the blockchain. Most Initial Coin Offerings (ICOs) have been based on Ethereum smart contracts.

Disadvantage – It also uses proof of work, making it relatively slow and energy-hungry. Most of its smart contracts are vulnerable to hacking, and the field of smart-contract security is immature.

-

Ripple (XRP) Launched: 2012 Market value: $32 billion

Features – Ripple is basically a crypto-token, called XRP, and the same be used as “bridge currency” by the financial institutions in order to settle cross-border payments faster and more cheaply than they do now. It uses a novel consensus protocol that enables for much more quickly faster transactions than Ethereum & Bitcoin

Disadvantage – Ripple is a privately owned company, leading to excessive control over the system.

-

Cardano (ADA) Launched: 2017 Market value: $5.9 billion

Features – Cardano’s provides a platform for trading and transferring its token, and thereby provides greater emphasis on privacy and regulatory compliance. It is also expected to host smart contracts as well and will therefore in nowhere behind Ethereum.

-

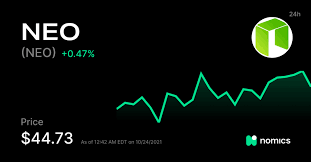

Neo (NEO) Launched: 2014 Market value: $5.8 billion

Features – Neo a smart-contract platform that uses a consensus protocol known as delegated Byzantine fault tolerance to allow for 10k transactions per second.

Disadvantage – It is highly centralized.

-

Stellar Lumens (XLM) Launched: 2014 Market value: $5.6 billion

Features – Stellar aims for its lumens to be a bridge currency for cross-border payments and it is run by a Non-Profit organization. It is also planning to provide a platform for initial coin offerings.

Disadvantage – there is a lot of competition in the field in which they are serving.

-

Eos (EOS) Launched: 2017 Market value: $4.3 billion

Features – They are traded on Ethereum, using the smart-contract platform. Just like Cardano, it uses a proof-of-stake protocol instead of proof of work, therefore making its transactions faster and more efficient.

-

Monero (XMR) Launched: 2014 Market value: $4.3 billion

Features – It uses ring signatures, a type of digital signature, thereby providing any member of a group to perform a transaction without revealing its real identity. Thus, it let its users to transact privately, and its mining process is designed to be “egalitarian.”

Disadvantage – Due to its features, it has become a preferred coin among cybercriminals, thereby leading to hike in “cryptojacking,” where the hackers use malware to make other people’s computers mine cryptocurrency for them.

-

IOTA (MIOTA) Market value: 3.8 billion

Features – It has a shared ledger based technology on a mathematical structure called a directed acyclic graph. Its aims is to serve as a currency used by internet-of-things devices to buy, sell, and trade data, whether the transaction partners are other devices or customers like technology companies.

Disadvantage – IOTA is too centralized, and numerous cryptography researchers have questioned the system’s overall security.

-

Chainlink

Features – Chainlink is a decentralized oracle network that bridges the gap between smart contracts, like the ones on Ethereum, and data outside of it. Decentralized oracles allow smart contracts to communicate with outside data so that the contracts can be executed based on data that Ethereum itself cannot connect to.

It helps in monitoring water supplies for pollution or illegal syphoning going on in certain cities. Sensors could be set up to monitor corporate consumption, water tables, and the levels of local bodies of water. A Chainlink oracle could track this data and feed it directly into a smart contract. The smart contract could be set up to execute fines, release flood warnings to cities, or invoice companies using too much of a city’s water with the incoming data from the oracle.

-

Compound (COMP)

Features – COMP is a lending platform on Ethereum that has moved the space forward in the sense that users no longer need to sell their crypto assets in order to gain liquidity for other activities. COMP, is the native token on that platform and is used to determine governance functions on the platform such as interest rates, collateralization ratios and other properties relevant to the network.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.