Registration of Merchant Banker License in India

Table of Contents

Registration of Merchant Banker License in India

Who is Merchant Banker?

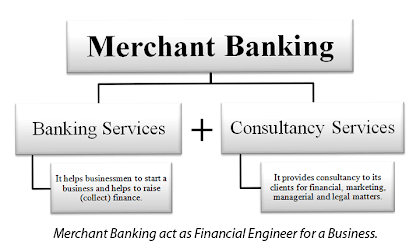

A merchant banker is defined as any person who is engaged in the business of issue management, either by making arrangements for buying, selling, or subscribing to securities or by acting as a consultant, manager, or rendering corporate advisory services in relation to such issue management, according to the SEBI (Merchant Bankers) Regulations, 1992.

Merchant bankers provide advice to entrepreneurs from the first stages of a project through the start of production, and they are in charge of the issue process. Merchant bankers serve as middlemen between businesses and investors. They are in charge of prospectus preparation as well as marketing issues.

Merchant banker is a company and is a combination of consultancy and banking services. Activities of merchant bankers in India are regulated by SEBI (merchant banker) rule 1992.

Any person who is engaged in the business of issue management either by making arrangements regarding buying, selling or subscribing to securities or acting as manager, consultant or rendering corporate advisory services in relation to such issue management.

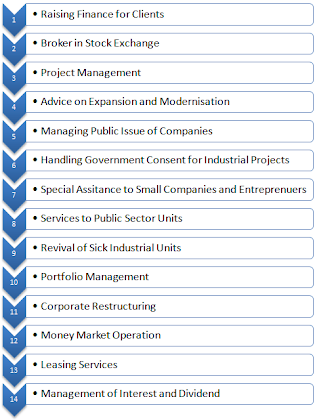

Services can be offered by the Merchant Banker:

- Issue Management

- Credit Syndication

- Project Appraisal

- Handles Government consent for industrial projects

- Security Trustee Services

- Buy back assignment

- Share valuation

- Lead Managers to the IPO

- Issuing and paying Agent

- Capital Structuring

- Post Issue Management

- Underwriting

Categories of Merchant Bankers:

- Category I: To operate as adviser, consultant, manager, underwriter, portfolio manager to carry on the activity of issue management.

- Category II: To operate as adviser, consultant, manager, underwriter, portfolio management.

- Category III: To operate as underwriter, advisor or consultant to an issue.

- Category IV: To operate only as advisor or consultant to an issue.

Requisites for applying for Merchant Banker License:

- No person shall carry on the activity as a merchant banker unless he holds a certificate granted by SEBI.

- A merchant banker is required to have a minimum net worth i.e Capital Adequacy of not less than Rs. 5 Crore.

- There should be no relation to any other entity which is already registered as a Merchant Banker by the applicant.

- Two employees having prior experience in Merchant Banking Applicant is the requirement of minimum employees.

- An applicant required to send application form A along with additional information along with a non-refundable fee of Rs. 50,000/- by way of demand draft.

- Every merchant banker is required to pay Rs. 20 Lakhs as registration fee (as per SEBI regulation, 2014) at the time of grant of certificate of initial registration by SEBI. And this certificate of initial registration remains for 5 years. The merchant banker must apply to SEBI for a permanent certificate, 3 months before the expiry of the validity of the initial registration certificate, if he wishes to continue as a merchant banker.

- For permanent registration, the merchant banker is required to pay Rs. 9 Lakhs for the first block of 3 years towards permanent registration payable in term of schedule iii of SEBI regulation 1992.

- Merchant banker is required to take SEBI’s prior approval for change in control.

Fees Registration of Merchant Banker:

| S. No. | Particulars | Fees |

| 1. | Application fee (Initial and permanent registration) | 50,000/- |

| 2. | Initial Registration | 20,00,000/- |

| 3. | Permanent Registration | 9,00,000/- |

Requirements Registration of Merchant Banker:

- MOA & AOA of company (Memorandum and Article of Association of the applicant company)

- Provide the UIN (Unique Identification Number) obtained under MAPIN i.e Central Database of Market Participants (MAPIN) Regulations, 2003, for the applicant

- Details of Directors/ Promoters alongwith their Qualification, experience in Merchant banking & other related Financial Services

- Shareholding pattern of the Company

- Details of Key Managerial Personnel alongwith their Qualification, experience in Merchant banking & other related Financial Services

- Details of infrastructure facilities

- Organisational Structure of the Company

- Financial Accounts of the applicant

- Report from principal bankers

- Details of associated registered intermediaries

- Undertakings

- Declaration by at least two directors

- Businesses handled by the applicant during last three years in relation to the following:

-

- Issue Management

- Investment Advisers

- Underwriting

- Portfolio Management

- Consultants/advisors to the Issue

Earlier there was capital adequacy Requirement varies according to categories, But now its 5 Crores.

Time Limit 4-6 Months

Merchant Bankers License in India- Package Inclusions

- Complete Merchant Banking Business Plan

- Requirement of Filing of the application before SEBI

- Day to day Advisory services

- Demographics Research & Targeting

- Marketing Plan

- Target Cost as per Acquisition Optimization

- Assistance in post compliance

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.