We cannot claim ITC even if it is within GST portal Now !

Table of Contents

We cannot claim input tax credit even if it is within GST portal Now

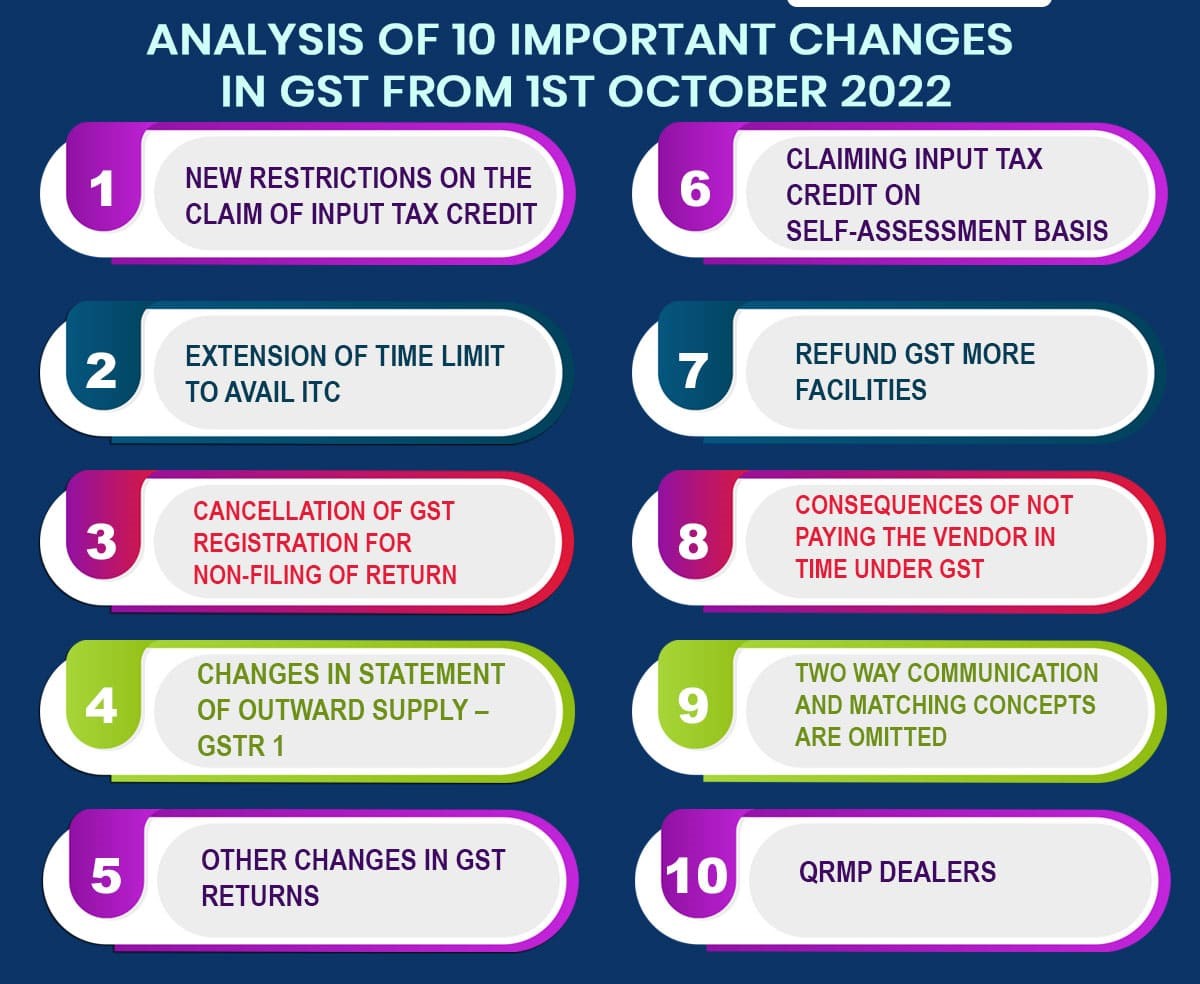

Due to the severity of Input tax credit fraud involving fake entities and invoices, Revised Section 38 was suggested in an attempt to further impose restrictions on Input tax credit claims.

- Input tax credit cannot be claimed if it is restricted in GSTR-2B available under Section 38.

- Time limit to claim Input tax credit on invoices or debit notes of a financial year is revised to earlier of 2 dates.

-

- 1stly, 30th Nov of the following year or

- 2ndly date of filing annual returns.

The provisions of this section will also assist in preventing any legal disputes.

- According to the section 38 is completely revamped as ‘Communication of details of inward supplies and input tax credit’ in line with the Form GSTR-2B. It lays down the time, conditions or manner & restrictions for Input tax credit claims & has removed the two-way communication process in Goods and services tax return filing on the suspended Goods and services tax return in Form GSTR-2. As per section 38 of IGST act also states that GST Taxpayers will be give details of ineligible as well as eligible Input tax credit for claims.

4. As per the section 41 is also revamped to remove the references to provisional Input tax credit claims & specified Self-assessed Input tax credit claims along with requirement & conditions.

5. According to the sections 42, 43 & 43A on provisional Input tax credit claim process, matching & reversal are eliminated.

Important information related to the change in ITC Claim within GST.

It is important to understand that Now scenario change. and, with it, GST procedures & norms also change on time to time. It’s natural for changes to happen because they help improve processes.

Similarly, we have seen a phase in Goods and Services tax law where:

- In case we have GST invoice, so you will receive input.

- If we have GST invoice However, but GST INPUT doesn’t reflect in GSTR 2A, you will still receive input within a limit.

- In case we have GST invoice. However, ITC doesn’t reflect in GSTR 2A, you won’t receive input.

- Lastly, we have GST Invoice & GST Input. Which is reflects in GSTR 2A, but ITC doesn’t show in GSTR 2B, so you won’t receive input.

However New scenario a new phase, where we won’t receive input even when GST invoice reflects in GSTR 2B. We might say that we are referring to situation where we receive goods a month after the bill has been issued by the vendor. So, it is important that your Goods and Services Tax is reconciled with books of account and GSTR-2B on monthly basis.

We are partially correct & we do understand. Why? Because of under section 38 has come into existence. It indicates that under the aforementioned conditions, even if the input appears in GSTR 2B, you will not be allowed to claim it as input.

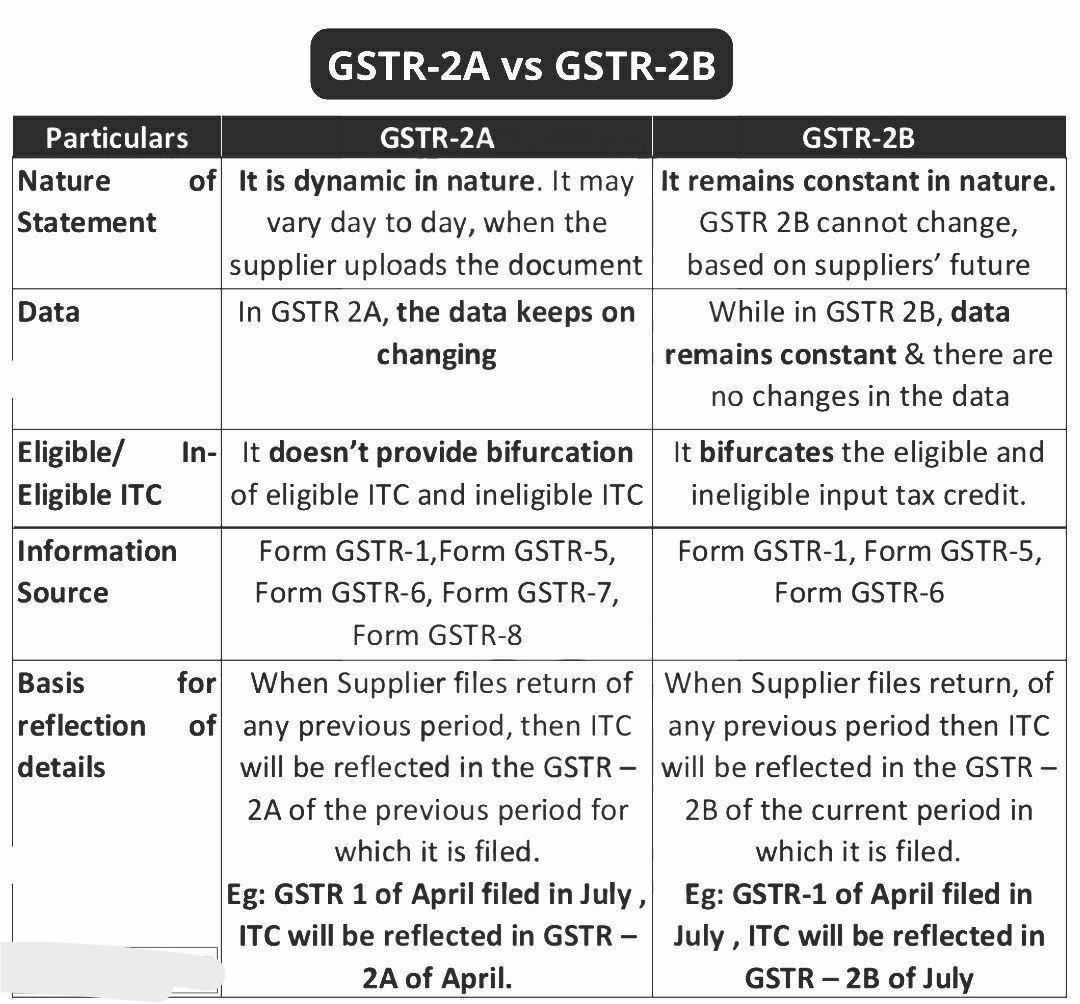

GSTR 2B Vs GSTR 2A

Question : If we have received building materials and filed return shown as ineligible ITC. now, we want to return the material to supplier. How we can reclaim ITC shown as ineligible in earlier returns for set off tax liability on return goods.

At present no other transaction in firm.

Ans : You cannot directly reclaim ineligible ITC already declared, but through a credit note from the supplier, the transaction will reverse, and any tax adjustments can be applied to future transactions.

How can IFCCL Assist?

- By Utilizing IFCCL GST’s expert Services, when you need filing GSTR-9 to make the process of computing the reversal ITC and reporting it in the relevant GST returns simpler.

- We provide GST -9 filling services along with an appropriate GSTR-9 and includes compare GSTR-1, GSTR-3B, and books of accounts and provide recommendations for resolving discrepancies.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.