Cost Inflation Index for computation of capital gains

Table of Contents

Cost Inflation Index

The Cost Inflation Index (CII) is a tool used in India to adjust the purchase price of assets for inflation, primarily for the purpose of calculating capital gains tax. The index is published annually by the Central Board of Direct Taxes (CBDT) under the Ministry of Finance. The CII plays a crucial role in income tax calculations, especially for long-term capital gains, by allowing taxpayers to inflate the purchase price of an asset, thus reducing the taxable gains and consequently the tax liability. For example, if you purchased a property in a previous year and are selling it now, the CII helps adjust its cost to reflect the current value considering inflation, which can significantly lower your capital gains tax

The CII is used to adjust the purchase price of assets for inflation, ensuring fair taxation on long-term capital gains. Here’s a detailed explanation and example of how to use the CII:

Calculation Example

If you acquired a property in the financial year 2005-06 for ₹20,00,000 and sold it in the financial year 2023-24, you can calculate the indexed cost of acquisition as follows:

- Determine the CII values:

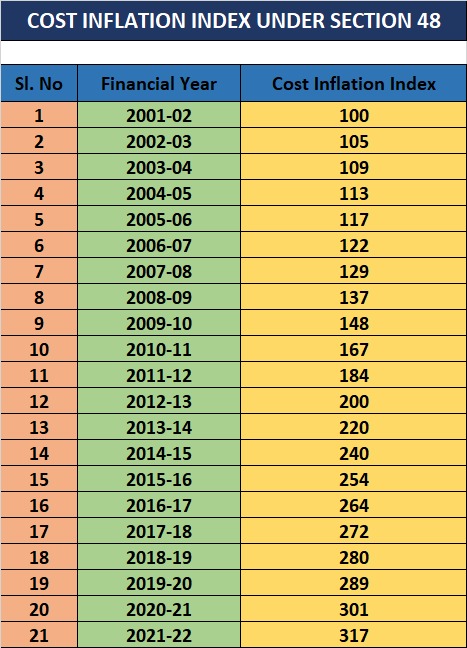

- CII for FY 2005-06: 117

- CII for FY 2023-24: 348

- Calculate the Indexed Cost of Acquisition:

Indexed Cost of Acquisition=(CII for FY 2023-24CII for FY 2005-06)×Cost of AcquisitionIndexed Cost of Acquisition=(348117)×20,00,000=59,48,717.94

Thus, the indexed cost of acquisition of the property would be approximately ₹59,48,717. This amount is used to determine the capital gains for tax purposes.

Purpose of CII

The CII helps in mitigating the impact of inflation on capital gains, ensuring that taxpayers are taxed on real gains rather than nominal gains. This adjustment lowers the taxable gains and reduces the tax liability for the taxpayer. Using the CII helps in reducing the tax burden on long-term capital gains by accounting for the inflationary increase in asset prices. This makes the taxation system more equitable as it taxes the real gain rather than the nominal gain.

Example Calculation

Here’s a practical illustration using the figures provided:

- Original Cost of Acquisition: ₹20,00,000

- CII for FY 2005-06: 117

- CII for FY 2023-24: 348

Using the formula, the indexed cost of acquisition is calculated to be approximately ₹59,48,717.94.

UPDATED COST INFLATION INDEX

22 2022-23 348

23 2023-24 363

Central Board of Direct Taxes (CBDT), Department of Revenue, Ministry of Finance, Government of India notified the Cost Inflation Index for Financial Year 2023-24 is 331 & 2023-24 is 348.

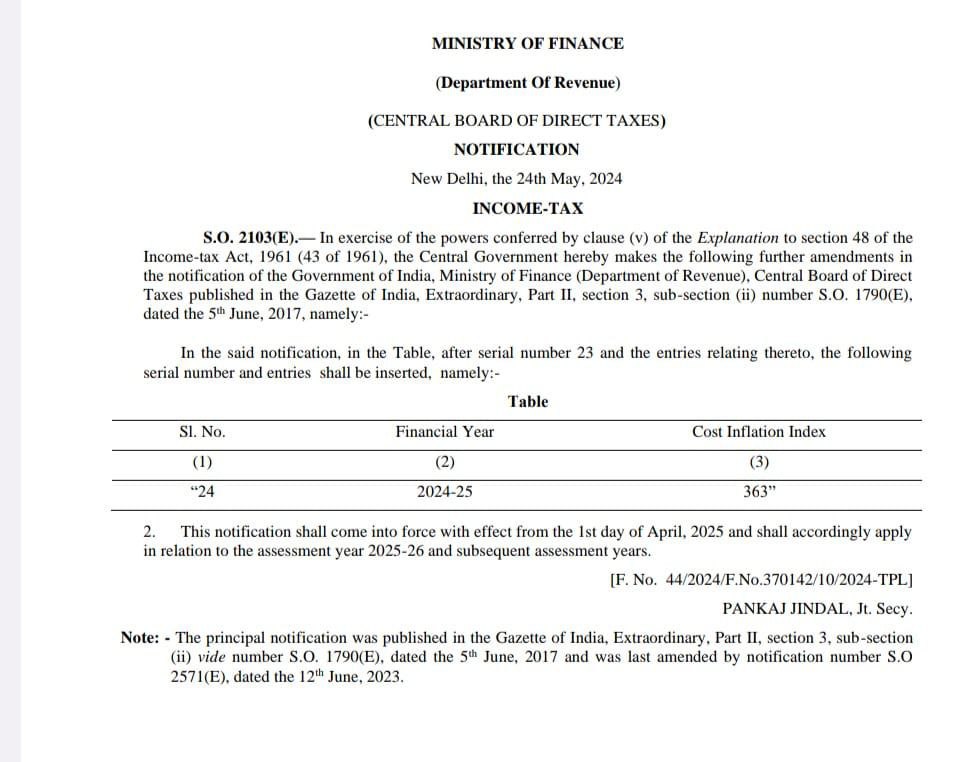

Cost Inflation Index for F.Y.24-25 is 363

The Cost Inflation Index (CII) for the financial year 2023-24 is 348. The Cost Inflation Index (CII) for the financial year 2024-25 has been notified as 363 by the Central Board of Direct Taxes (CBDT) under the Ministry of Finance. This index is used to adjust the purchase price of assets for inflation when calculating long-term capital gains tax in India. It helps in mitigating the impact of inflation on taxable gains, thereby ensuring fair taxation

What is take the Base Year in CII Index?

In India uses a CII to account for inflation when calculating Income tax capital gains for taxation objective. This Cost Inflation Index is based on a specific “base year,” which was most current changed from 1981 to 2001. This means that the Cost Inflation Index for the FY 2001-02 is considered 100, & Cost Inflation Index for all other years is calculated relative to this starting point.

Cost Inflation Index specified for the purpose of Old year computation of capital gains are as follows:-

| FINANCIAL YEAR | COST INFLATION INDEX |

| 2015-2016 | 1081 |

| 2014-2015 | 1024 |

| 2013-2014 | 939 |

| 2012-2013 | 852 |

| 2011-2012 | 785 |

| 2010-2011 | 711 |

| 2009-2010 | 632 |

| 2008-2009 | 582 |

| 2007-2008 | 551 |

| 2006-2007 | 519 |

| 2005-2006 | 497 |

| 2004-2005 | 480 |

| 2003-2004 | 463 |

| 2002-2003 | 447 |

| 2001-2002 | 426 |

| 2000-2001 | 406 |

| 1999-2000 | 389 |

| 1998-1999 | 351 |

| 1997-1998 | 331 |

| 1996-1997 | 305 |

| 1995-1996 | 281 |

| 1994-1995 | 259 |

| 1993-1994 | 244 |

| 1992-1993 | 223 |

| 1991-1992 | 199 |

| 1990-1991 | 182 |

| 1989-1990 | 172 |

| 1988-1989 | 161 |

| 1987-1988 | 150 |

| 1986-1987 | 140 |

| 1985-1986 | 133 |

| 1984-1985 | 125 |

| 1983-1984 | 116 |

| 1982-1983 | 109 |

| 1981-1982 | 100 |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances; Hope the information will assist you in your Professional endeavors. For query or help, contact us : singh@caindelhiindia.com or call at 9555 555 480

Also Read :

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.