Implication of Cash Transaction Under Income Tax Act

Table of Contents

Implication of Cash Transaction Under Income Tax Act, 1961

BRIEF INTRODUCTION

Over the years there are lots of changes happening in terms of advancement and digitization within the business world. Digitization provides convenience and ease in doing business, along with, provides for keeping a check on the black money circulation, being practiced by many. Evasion practices or transactions in black money markets mostly happen in cash and digitization of such transactions is the best mode to avoid it. These practices adversely affect government revenues and shut the way for investment in productive fields.

The government is making all the efforts to push electronic transactions by providing various tax incentives and discouraging cash transactions by imposing various penalties or increasing tax compliances for cash transactions. Over the period of more stringent provisions are introduced under income tax Act associated with cash transactions.

In this article we’ll discuss various provisions of the income tax Act associated with cash transactions.

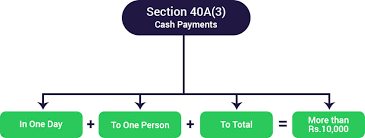

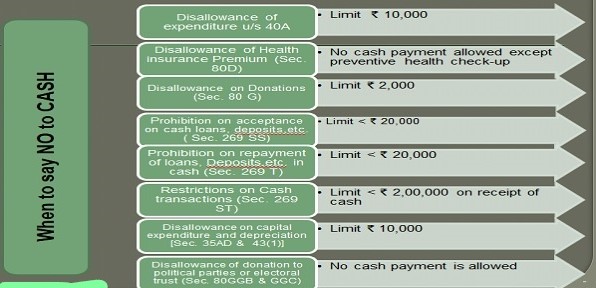

Disallowance of Expenses incurred in Cash

- As per Section 40A (3) of income tax Act, if payment for any expenditure exceeding Rs. 10,000 has been made in cash, i.e., otherwise than by an account payee cheque or account payee draft or ECS, then no deduction would be available in respect of such expenditure.

- However, where the payment has been made in respect of plying, hiring or leasing of products carriage, then the said limit of Rs. 10,000, stand increased to Rs. 35,000.

- Consequences of Non-Compliance: It is to be noted that no specific penalty has been prescribed for the above expense. However, no deduction for such expense shall be allowed from taxable income and it’ll end in increased tax liability.

Disallowance of Depreciation

- As per Section 43(1), if any payment or part payment for purchase of fixed asset is formed in cash exceeding Rs. 10,000 in an exceedingly day then such a part of cost shall be disallowed for the purpose of computation of “Actual Cost” of the said fixed asset.

- Consequently, no depreciation shall be allowed on such part and it’ll lead to increased taxation liability.

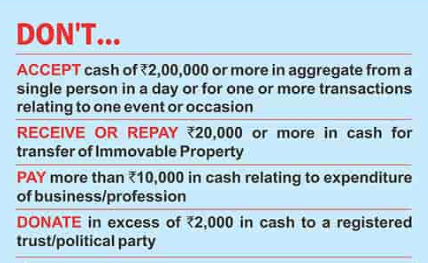

Disallowance of Donation to Political Parties

- As per Section 13A of income tax Act, any income of an organisation by way of voluntary contributions received from any individual shall not subject to income tax.

- However, political parties aren’t allowed to receive donations exceeding Rs.2,000 in cash and such donations shall be subject to tax.

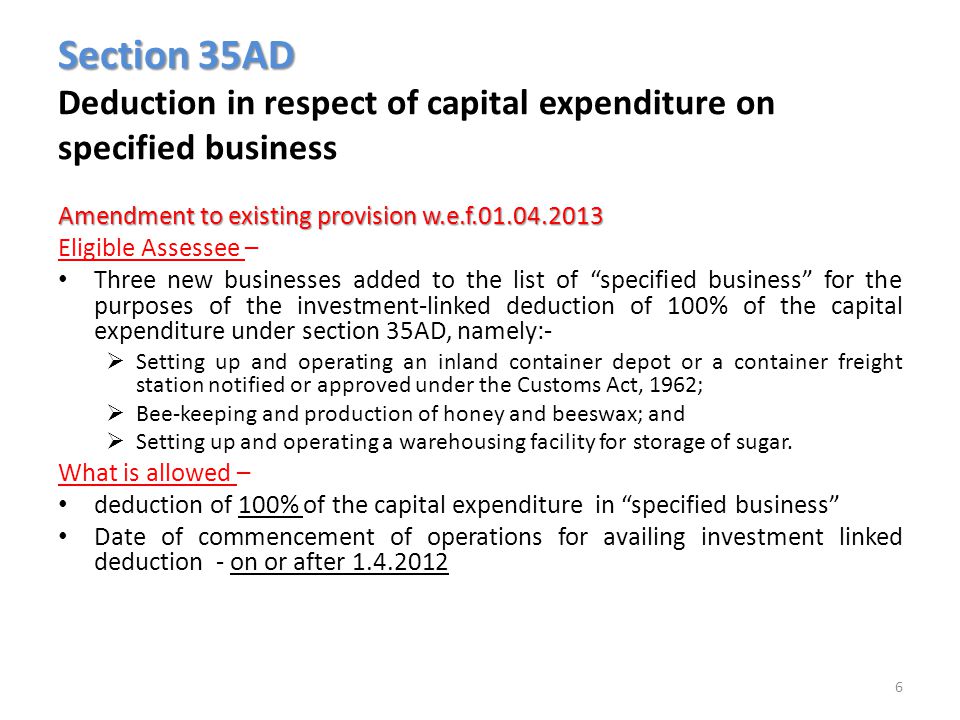

Disallowance of Expense Incurred For Specified Business

- As per Section 35AD, 100% or 150% of the deduction is allowed with relevancy certain expenditures of capital nature, incurred for specified business.

- However, it is to be noted, that no deduction shall be available in respect of expenses exceeding Rs.10,000, being made in cash.

Disallowance on acceptance of money loans, deposits etc.

- As per section 269SS, the acceptance of loan or deposit or any other specified sum has been prohibited, if received in excess of Rs.20,000 in cash.

- Herein, the word “Specified sum” means the amount receivable, in relation to transfer of an immovable property, whether actually transferred or not.

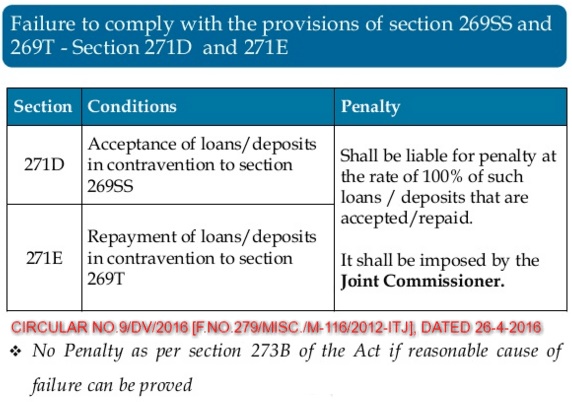

Consequences for Non-Compliance

- If any loan or deposit or specified sum is accepted in contravention of Section 269SS then a penalty adequate to the quantity of such loan or deposit or specified sum shall be levied u/s 271D.

Disallowance On Repayment of Loan In Cash

- No person, including banks, co-operative banks, companies etc., would be allowed to make the repayment of their loan or deposit or any specified advance received, in cash in excess of Rs. 20,000.

- Herein, the word “Specified Advance” means any amount receivable, in relevancy to transfer of an immovable property, whether actually transferred or not.

Consequences for Non-Compliance

- If any loan or deposit or specified sum is repaid in contravention of Section 269T then a penalty adequate the number of such loan or deposit or specified sum shall be levied u/s 271E.

NON-APPLICABILITY OF SECTION 269SS AND 269T

However, provisions of Section 269SS and 269T don’t seem to be applicable loans or advance or specified sum is received from or repaid to:

- Government;

- Banking company, post office savings bank or co-operative bank;

- Corporate entity, established by Central, State or Provincial Act;

- Government company, being defined in section 617 of the Companies Act, 1956;

- Any other institutions, associations or bodies or class of institutions, associations or bodies, being notified by Central Government from time to time.

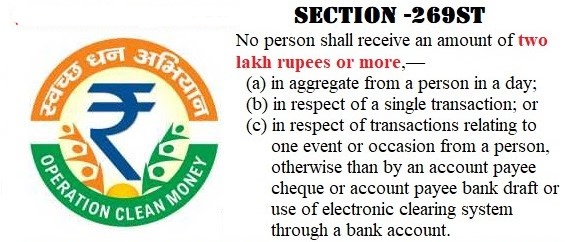

Disallowance on Receipt of Amount In Cash

Section 269ST clearly provides for disallowance of receipt of amount received in excess of Rs. 2,00,000 in cash, in respect of following transactions:

- In aggregate from someone in an exceedingly single day. It includes any amount received from an individual during a single day no matter the actual fact that such amount is received in multiple instalments in an exceedingly day or received against multiple invoices.

• In respect of a particular transaction.

• Transactions involving any particular event or occasion from an individual.

Non-Applicability of Section 269ST

The provision of section 269ST would not be applicable to following entities –

- Any amount received by the govt. or any banking company, co-operative bank or, post office saving bank.

• Transaction of the character which are laid out in section 269SS (Mode of taking or accepting certain loans, deposits and specified sum)

• Certain specified persons, as may be notified by the Central Government.

Penalty Consequences for Non-Compliance

- The government provides for hefty penalty, being leviable on persons not complying with the provisions of section 269ST.

- If any individual receipts amount in contravention of provisions of Section 269ST then a penalty corresponding to the amount received in cash shall be levied u/s 271DA.

Audit Aspect on cash transaction

- Under Section 44AB of income tax Act, every one, whose total sales, turnover or gross receipts in business exceeds INR 1 Crore in any previous year then he’s required to induce his accounts audited under section 44AB of taxation Act.

- However, where a person satisfies the below mentioned conditions, then the limit of Rs. 1 Crore would be increased to Rs. 10 Crores

- Aggregate of all amounts received during the year in cash, including amount received for sales, doesn’t exceed 5% of the said amount and

- Aggregate of all payments made in cash during the year, including amount incurred for expenditure, in cash, doesn’t exceed 5% of the said payment.

- Hence, where the aggregate of receipts and expenditure, being received in case, exceeds 5% of total receipts and expenditure, then the exemption limit for Audit would be Rs. 1 Crore.

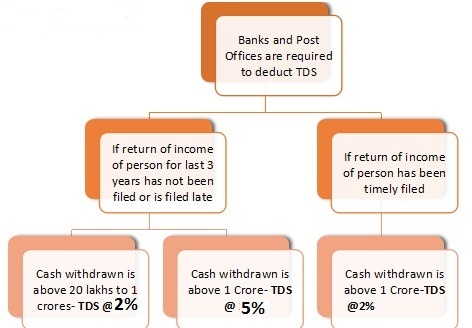

TDS Implications on Cash Withdrawal

- To discourage cash transactions, the govt has introduced a replacement section 194N wherein if an individual withdraws aggregate cash exceeding INR 1 Crore during the year from his one or multiple bank account then Bank (Private or Public Sector), a co-operative Bank or a post office shall deduct TDS @2% on amount withdrawn in far more than INR 1 Crore.

- However, the provisions of Section 194N would not be applicable to the following –

- the Government;

- Banking concern or co-operative society, being engaged in in the business of banking or a post office;

- Business correspondent to that of a banking company or co-operative society, being carrying out activities in accordance with the applicable rules;

- any white label ATM operator of a banking concern or co-operative society engaged in carrying on the business of banking, in accordance with the authorisation issued by the reserve bank of India.

Prohibited Deduction Under Chapter-V

- Payment for Health Insurance Premium

-

- As per Section 80D, for the aim of claiming deduction from Gross Taxable Income, assessee is required to form payment of medical premium or other eligible deductions u/s 80D in any mode aside from cash.

- It is to be noted, that only the payments for preventive health check-ups would be allowed to be made in any mode including cash.

- Donations made in cash

-

- Deduction for donations u/s 80G shall be allowed providing payment of donations are made in any mode aside from cash.

- No deduction shall be allowed in respect of donation of any sum exceeding INR 2,000 unless such sum is paid by any mode apart from cash.

CONCLUSION

- Government of India introduced various rules and provisions, in order to tackle down the tax evasion activities and to make Indian economy grow with the correct use of its finances.

- The above provisions are introduced as a tenet that each taxpayer is required to fits all the provisions of the tax Act for better and clean books of accounts.

- It has been provided that the entities, complying with all the provisions, would be able to reap many benefits, in terms of deductions, better planning of future, and no legal disputes.

- Also, a taxpayer is advised to maximize their digital transaction instead of cash transactions, in order to curb down the black money and increase the efficiency of their own working.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.