FCRA REGISTRATION IN INDIA

Table of Contents

BRIEF INTRODUCTION

The Foreign Contribution Regulation Act (FCRA), 2010, commenced from May 1, 2011, to monitor, control, and regulate international contributions that were being received by the persons residing in India. As per the provisions of the FCRA Act, FCRA registration mandatory if any registered trust, society, agency, organization, or NGOs, who want to receive foreign contribution or donation or grant, must obtain or receive an FCRA Registration Certificate granted by the Government of India to receive such donations. Normally FCRA registration consultants are proving help in getting registration of NGO.

The foremost objective of FCRA registration is, to provide a license to registered NGOs to accept foreign donations and, also to ensure that such donations are used only for the objects for which the respective NGO was established.

BENEFITS OF FCRA REGISTRATION

FCRA registration’s main advantage is that any non-profit organization, section 8 corporation, trust, or community, can take foreign donations and grant within India. As a result, they get the freedom to directly take donations from some renowned organizations namely –

- British High Commission

- New Zealand High Commission

- Canadian High Commission

- European Commission

- Japanese Embassy

- Infinity Foundation

- BORDA

- Oxfam

- SWISSAID

- GIFRID

- AUSAID

- UNESCO

TYPES OF FCRA REGISTRATION WITH ITS PREREQUISITES

There are generally two types of pf FCRA registration granted in India, namely – Prior Permission and Proper Registration. Each of the above types requires some prerequisites such as –

- FCRA -PRIOR PERMISSION REGISTRATION

-

- The entity applying for registration must be a newly established entity.

- The amount of money raised be utilized for the specified objects only.

- At the time of registration, complete details in the form of the name and address of the foreign donor are provided.

- The entity must not accept any amount of foreign donation before obtaining such registration.

- PROPER FCRA -REGISTRATION

-

- The entity must be registered and taken prior to permission registration.

- The entity must be working for its objects for a continuous period of at least 5 years.

- The entity must have spent at least Rs. 10 lakhs on its objects during the 3 years immediately preceding the year of taking registration.

- The entity is required to submit the audited annual statement of accounts and return for the last 3 previous years.

ENTITIES ELIGIBLE FOR FCRA REGISTRATION

As discussed earlier, FCRA registration is required for every Non-government Entity, charitable trusts, and societies, who want to take foreign donations in India. In order to receive any kind of foreign donation and take registration under FCRA, the entity must –

- Not be a profit-making entity.

- Not be restricted or prohibited to be registered under Section 3 of the FCRA, 2010.

- Be an entity registered as a society under the Society Registration Act, 1860.

- Be an entity registered as a Trust under the Indian Trust Act, 1882.

- Be a Section-8 company registered under The Companies Act, 2013.

- Be a registered non-profit organization (NPO) incorporated for the objects of encouraging health, education, economic advancement, promotion of art, music, faith, athletics, and so on.

- Not be restricted under any provision of the Foreign Contribution (Regulation) Act.

- Not be in receipt of any foreign contribution to threaten the life or welfare of any person or result in any crime.

DISQUALIFICATION FROM FCRA REGISTRATION

An entity would be disqualified from taking FCRA registration if –

An entity would be disqualified from taking FCRA registration if –

- The entity or any of its members are fictional or Benami in nature.

- The person applying for registration has been arrested or tried for indulging in some unfair action.

- The person applying for registration has been convicted or charged for causing communal unrest in any area of a given district or anywhere in the world.

- The entity is involved in any unlawful or activities against public policy.

- The entity has used the foreign donations for personal use instead of using them for its objects.

- The entity is barred from receiving any international reception or foreign award under any provision of law.

- The entity is working against India’s sovereignty.

- The objects of the entity are against the public interest.

- The entity is receiving donations from a country with which India is not having the Most Favored Nation status.

- The entity is a profit-making entity.

FCRA REGISTRATION – DOCUMENTATION REQUIREMENT

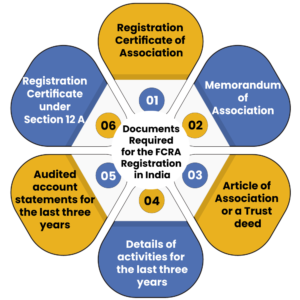

To apply for FCRA registration, the entity should be in receipt of the following documents –

- PAN card duly issued in the name of the entity.

- Copy of Memorandum and Article of Association of the entity duly specifying their objects and area of operation.

- Self-certified copy of Incorporation certificate or trust deed, or any other document certifying the incorporation of the entity.

- Chief Justice’s signature in the format of JPG file.

- A report specifying the objects on which the entity is working exclusively during the last 3 years.

- An audited copy of financial reporting, P&L account, income-expenditure information, and cash flow statement for the 3 years before the year in which application for FCRA registration is made.

- Certified copy of the resolution passed by an NGO-authorized governing body specifying the approval for obtaining the registration.

- Certificate issued under sections 80G and 12A of the Income Tax. These certificates exempt non-profit organizations from paying taxes under the Income Tax Act.

STEP BY STEP PROCESS FOR – FCRA REGISTRATION

FCRA Registration for NGO is quite a normally complicated task, even though it comes on the online registration process. The FCRA registration process in India involved as mentioned below are –

FCRA Registration for NGO is quite a normally complicated task, even though it comes on the online registration process. The FCRA registration process in India involved as mentioned below are –

- FCRA ONLINE REGISTRATION PORTAL

-

- Begin logging into the FCRA registration.

- Go to FCRA online form portal.

- Select the new registration link and the Form FC3 will be opened.

- Under form FC3, select the registration tab.

- FCRA ACCOUNT CREATION

-

- The entity must register on the FCRA portal by clicking on the sign-up option.

- All the necessary information and details be provided and the same be saved.

- After providing complete information, select the submit button and the account will be created.

- LOGGING INTO FCRA PORTAL

-

- After successful creation of an account, the user must log in into the porta; using the ID and password created at the time of account creation.

- Under the access bar, choose the option of FCRA registration.

- From the drop-down menu, choose to apply for new registration.

- After selecting the tab, Form FC3 will be opened and will ask for respective details step by step.

- FILLING OF DETAILS

-

- From the menu, choose the type of entity that is taking registration.

- After selecting the type, fill in the necessary information like –

- Darpan ID of the entity.

- The registered office of the entity.

- Registration Number received at the time of incorporation.

- The effective date of registration of the entity.

- The type of entity and its nature.

- The primary objects for which the entity is incorporated.

- After providing complete information, select the save tab.

- DETAILS OF EXECUTIVE COMMITTEE

-

- Choose the tab related to the executive committee to fill in the requisite details.

- Fill in the information of all the members in the Executive Committee and keep on adding their respective details.

- Enter the details related to the bank account like the account number, IFSC code, and branch name, etc.

- After this, submit the details after rechecking the same.

- UPLOADING DOCUMENTS

-

- After submission of all the required information, the entity is required to upload the documents supporting the information provided in the above steps.

- These scanned copies are in PDF format and the size of the file be in conformity with the standards mentioned in the form.

- FINAL SUBMISSION

-

- After completing the information and uploading documents, the entity shall choose the final submission option.

- On final submission, a pop-up will appear asking for final approval.

- FEE PAYMENT

-

- After giving final approval for application submission, the portal will redirect the page to a payment gateway for paying the requisite fees through the online payment system.

- Click on continue payment and choose the appropriate means of payment.

- After making the payment, an acknowledgment number be generated and mailed on the registered id of the entity.

- The application is then forwarded to the concerned authority for verification and approval.

BASIC POINTS TO TAKEN INTO CONSIDERATION

- Once applied for FCRA registration, the NGO shall not change its decision.

- The entity should not use ATM or debit cards as the Foreign Contribution Bank usually does not have an ATM or debit card. Thus, if the entity is already having an ATM card, they should not make any cash payment through it.

- The NGO registered in India shall not save or invest the Foreign Contribution money in any mutual fund or securities.

- The FCRA Registered NGO shall not use the foreign donation for any form of the personal or administrative function.

- The FCRA Certificate NGO may not accept any foreign donation wherein their FCRA registration is on hold, canceled, or approval has not been given.

- The NGO must never combine domestic receipts with any international donation and follow all FCRA registration rules and regulations.

- The foreign contribution is received only in the foreign contribution account and no other income be received in that account.

- All the returns required to be filed under Section 18 be filed on time.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.