CORPORATE AND PROFESSIONAL UPDATE -MAY 2021

The Government of India provides the following updates in the month of May 2021, under various laws.

-

Table of Contents

INCOME TAX

- The due date for depositing TCS for the month of March -2021 has been extended up to 15th May 2021.

- Income Tax Department issued a notice stating that it has issued over Rs 17,061 crore of refunds to more than 13 lakh taxpayers out of which refunds worth Rs 5,575 crore were issued to over 12.71 lakh individuals while the remaining Rs 11,486 crore were issued to 29,592 corporate taxpayers.

- Certain specified High-Value Transactions that can welcome notice from the IT Department. These transactions are –

- CASH DEPOSIT IN SAVINGS ACCOUNT – An assessee can deposit a maximum of Rs. 10 lakhs in cash in its savings bank account. In case the above limit is breached, the Bank is required to report this to the Income Tax department and in case the assessee fails to report the explanation for such income in the Income Tax Return then the IT Department may issue notice for Reassessment of income under the Income Tax Act, 1961.

- NON-REPORTING OF INTEREST ACCRUING TO SAVING ACCOUNT AND FDR – In case an assessee earning the interest from saving account and FDR fails to report the same in its ITR, the Bank is required to submit a report to the Income Tax Department providing details with respect to such amount as a failure by the Bank in such reporting, be termed as under-reporting of income and due to this the department may issue a notice with respect to under-reporting of income.

- CASH DEPOSIT IN CURRENT ACCOUNT – In case an assessee makes a cash deposit or cash withdraw of more than Rs.50 lakhs to/from their current bank account either in a single transaction or aggregate of transactions during a financial year, the bank in which such current account is maintained is required to report it to Income Tax authority.

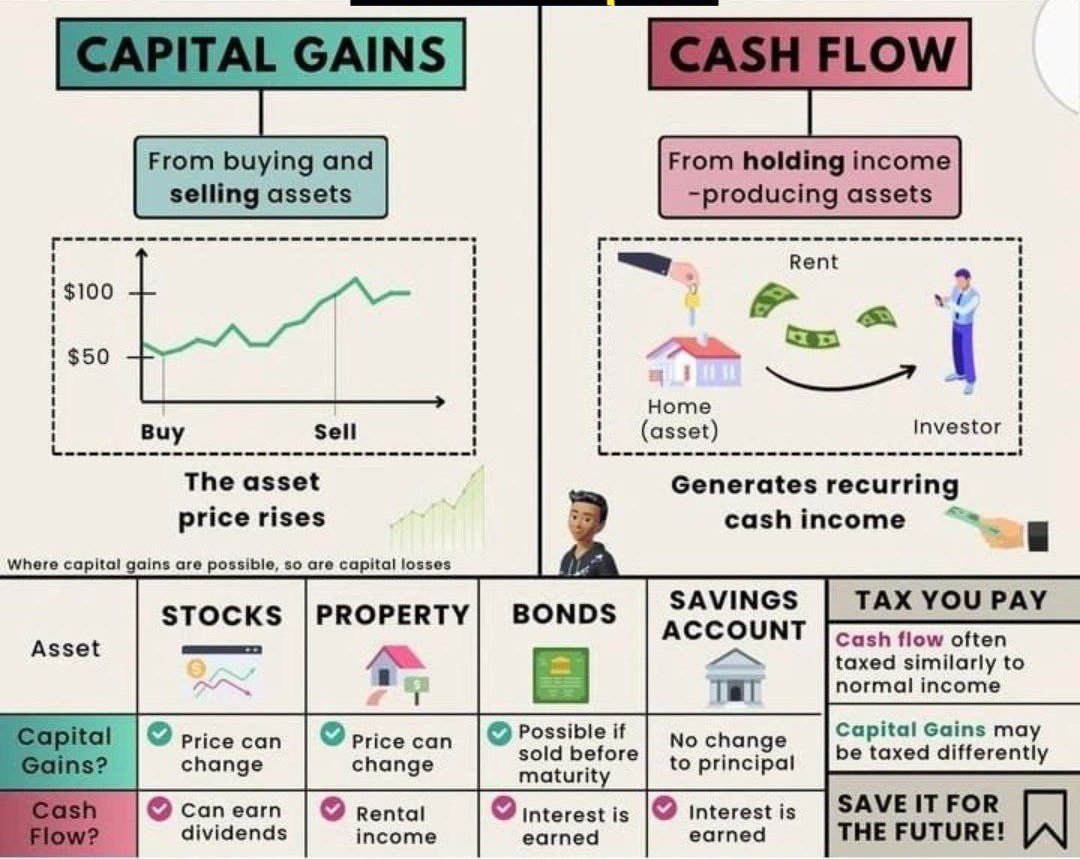

- HIGH-VALUE TRADING IN SECURITIES -: An Assesses investing in mutual funds, stocks, bond, or debenture involving cash transactions, must ensure that the amount of cash involved in such trading does not exceed Rs. 10 lakhs in a financial year.

- CREDIT CARD PAYMENTS – Where an assessee makes payment by means of a credit card and the amount in the aggregate exceeds Rs.10 lakhs in a financial year, the respective Credit Card Company is required to report to the Income Tax authority. In case the above transaction involves cash payments, the above limit of Rs 10 lakhs is reduced to Rs 1 lakh.

- FIXED DEPOSIT AND BANKS – In case, an assessee is having a fixed deposit of more than Rs.10 lakhs, whether in cash or not in a financial year then the requisite bank will report it to the Income Tax authority.

- PURCHASE OF BANK DRAFT, BANKER’S CHEQUE AND PAY ORDERS – An assessee can purchase bank draft, banker’s cheque and pay orders, only up to Rs 10 lakh in cash in a financial year. In case, the prescribed limit is breached, the bank will report it to the Income Tax authority.

- PURCHASE AND SALE OF IMMOVABLE PROPERTY – The Registrar of Properties will have to report the purchase & sale of all immovable property exceeding Rs 30 Lakh whether in cash or not, to the Income Tax authorities.

- SALE OF GOODS OR SERVICE – In case an assessee required to get his accounts audited under section 44AB of the Act is liable to report to the IT department, wherein the amount received from the sale of goods or services exceeds Rs 2 lakhs in cash. Such limit is imposed only on single transaction i.e., the aggregation rule is not applicable.

- EXPENDITURE IN FOREIGN CURRENCY – Any sought of expenditure in foreign currency via debit card, credit card or traveller’s cheque involving amount Rs.10 Lakh or above in a financial year, would create an obligation for the debit/credit card company to report it to the Income Tax authority.

- As per the notification of the Central Board of Direct, a hospital is authorized to accept cash payment in excess of 2 lakh and the same is valid for a period between 1st April – 31st May 2021, provided the payment is accompanied by the permanent account number or Aadhar number of the patient or any of its relative or the person making such payment.

-

GOODS AND SERVICE TAX

- Any person having an annual turnover exceeding Rs 5 crores is required to file GSTR-3B for the month of March, latest by 5 May 2021, while for others the due date is 20 May 2021. Any filing of return after the due date will not attract any late fees but interest for delay in filling be charged.

- As per Notification 12/2021 CT of May 1, 2021, the last date to file the Monthly return of Outward Supplies for April (other than QRMP) has been extended to May 26, 2021.

- GST levied on imported oxygen concentrators has been reduced to 12% IGST. Also, non-profit organisations allowed to accept foreign donation after taking registration under the Foreign Contribution (Regulation) Act, are exempt from the GST on importing oxygen concentrators.

- The last date for of accepting undertaking in lieu of bond has been further extended till June 30, 202, to facilitate the trade and consumption during the COVID-19 pandemic.

- Central Board of Indirect Taxes and Customs issued direction for its offices to not to send any show-cause notices for service tax defaults, merely based on discrepancies between income tax returns and service tax amount, as various tax-related associations complained to the Union finance ministry regarding wrong SCNs sent to them for the financial year 2015-16.

- Arvind Datar appointed as Amicus Curiae, a senior counsel by the Delhi High Court, to assist the court on plea seeking exemption on imposition of IGST on the import of oxygen concentrators as a gift for personal use.

-

MINISTRY OF CORPORATE AFFAIRS

- MCA through its circular 06/2021 and 07/2021, extended the due date for filing of various forms, to be filed by stakeholders (other than a CHG-1, CHG-4, and CHG-9 form), from 01/04/2021 to 31/05/2021, till 31st July 2021 without any penalty or fees.

- MCA has extended the interval between two board meetings by 60 days for the first two quarters of Financial Year 2021-22 i.e., the gap between two subsequent board meetings is now 180 days during the Quarters April to June 2021 and July to September 2021.

- Ministry of Corporate Affairs (‘MCA’) by its notification, amended section 149 (9), 197 (3) of the Companies Act, 2013 (‘2013 Act’) and schedule V of the 2013 Act with effect from March 18, 2021, thereby authorizing companies to pay remuneration to Non-executive director and Independent director even in case of inadequate profit or even in loss.

- MCA clarified that spending CSR funds by the corporates for the establishment of medical oxygen generation and storage plants or manufacturing and supply of oxygen concentrators, ventilators in order to fight against COVID, are eligible to be shown under CSR activities as required by company law. Such an update will therefore encourage corporate in manufacturing oxygen concentrators, ventilators, and cylinders in the country.

-

OTHER LAWS

- ESI contribution due date, required to be made by corporate, for the month of April 2021 has been extended for filing and payment to 15th June 2021 instead of 15th May 2021.

- RBI notified that it would buy securities maturing between 2024 and 2035 in its second tranche of the G-SAP programme to soften the bond yield. The purchase will take place on May 20 and will include buying of Rs 35,000 crore bonds from the market, including the benchmark 10-year bonds, under the Government Securities Acquisition Programme (G-SAP).

- RBI is looking to unveil more measures to support the financial sector in the form of credit guarantee schemes or a blanket moratorium in case the economic stress deepens.

- RBI is looking to inject 500 billion rupees ($6.8 billion) of liquidity in India and thereby allowing new loan relief for small businesses. Many investors, before the news of liquidity injection by RBI, began shifting from securities to dollar bonds, thereby luring the Indian dollar bonds 0.7% in just two weeks.

- RBI Announces New Measures Amid Covid Second Wave which provides on-tap liquidity of Rs 50,000 crore at repo rate and the same is opened till March 31, 2022. Under the scheme, banks will support entities including vaccine manufacturers, medical facilities, hospitals, and patients in getting a hassle-free loan and be classified as a priority sector till the repayment of the loan.

- SEBI with the view to liberalize the “Issue of Capital and Disclosure Requirements” (ICDR), is looking to ease the provision related to the lock-in period for promoters, and thereby rationalizing the definition of “promoter group”. If implemented, the regulatory burden for listed firms would be eased up and could encourage more companies to get listed.

- SEBI notified that the Top 1000 listed entities, based on their market capitalization, are required to comply with disclosure requirements under business responsibility and sustainability reporting, covering environmental, social and governance perspectives.

- ICAI through the Notification decided to waive off Condonation Fees for filing Form No 18 in relation to transactions undertaken between 1st April 2021 to 30th June 2021 till 30th July 2021, in order to provide relaxation to its members and firms amid Covid Pandemic.

- Banks are instructed to create and maintain a Covid loan book where they can park liquidity equal to the Covid loan book at 40 basis points above the reverse repo rate. The RBI has announced lending to small finance banks at a long term repo rate for an amount up to Rs 10,000 crore. These funds available for lending are limited to Rs 10 lakh per borrower and includes smaller micro-finance institutions having asset size of up to Rs 500 crore.

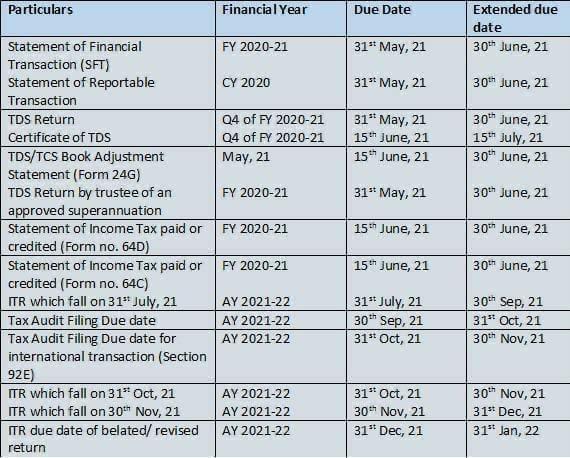

May 2021 – Circular No. 09/2021, (F. NO.225/49/2021-ITA-1I dated 20.05.2021)

Kind of Investment :

Due Date Extended beyond May 2021 by Income Tax (CBDT)

In light of the severe pandemic and rise in Covid-19 instances, the CBDT -Income Tax Department has issued a circular in the exercise of its power under section 119 of the Income-tax Act, 1961 (hereinafter referred to as “the Act”), w.r.t. Extension of time limits of certain compliances to give relief to taxpayers: (circular No. 09/2021, (F. NO.225/49/2021-ITA-1I dated 20.05.2021))

Extension Table

| Sr No | Nature of Extension | New Due Dates | Original due date |

| 1 | Income Tax Returns – Normal assessee without audits – FY 2021 | 30.09.2021 | 31.07.2021 |

| 2 | Filing of Audit Reports viz. Tax Audit Reports, Form 67 etc. – FY 2021 | 31.10.2021 | 30.09.2021 |

| 3 | Issue of TDS certificates in Form 16 for the Financial Year 2020- 21 | 15.07.2021 | 15.06.2021 |

| 4 | TDS/TCS Book adjustment statement in Form 24G for the month of May 2021 | 30.06.2021 | 15.06.2021 |

| 5 | Statement of Income paid or credited by an investment fund to its unit’s holder in Form 64D for FY 2021 | 30.06.2021 | 15.06.2021 |

| 6 | Statement of Deduction of Tax in the case of a superannuation fund for FY 2021 | 30.06.2021 | 31.05.2021 |

| 7 | Belated Returns and Revised Returns | 31.01.2022 | 31.12.2021 |

| 8 | Statement of Reportable Account under Rule 114G | 30.06.2021 | 31.05.2021 |

| 9 | Assessee required to furnish return u/s 92E in respect of international Transactions | 31.12.2021 | 30.11.2021 |

| 10 | Statement of Tax deduction at source for the quarter ending 3151 March 2021 | 30.06.2021 | 31.05.2021 |

| 11 | Corporate assessee or Firm covered whose accounts required to be audited or Partner of Firm whose accounts are required to be audited or an assessee other than Corporate and Firm whose accounts are required to be audited | 30.11.2021 | 31.10.2021 |

| 12 | Due date of Furnishing Report from Accountant in respect of International Transactions covered u/s 92E | 30.11.2021 | 31.10.2021 |

| 13 | Statement of Financial Transactions u/s 285BA (SFT) | 30.06.2021 | 31.05.2021 |

| 14

|

Statement of Income paid or credited by an investment fund to its unit’s holder in Form 64C for FY 2021 | 15.07.2021 | 30.06.2021 |

Kindly Note that: Note: all above extensions is planned in view of New ITD portal to be launched from June 7,,2021.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.