Get your Pan immediately on the basis of Aadhar

Table of Contents

Aadhaar-based instant PAN card only Applicable for Individuals

Permanent Account Number (PAN)

- Permanent Account Number (PAN) is a 10-digit, one-of-a-kind of alphanumeric no. This is allotted by the income-tax department in accordance with the relevant income tax laws and regulations. PAN quotation is required for a number of banking transactions.

Aadhaar-based instant PAN

- The I-T department has opened a facility where PAN will be assigned very instantly. Those who possess an updated Aadhaar card issued by UIDAI (Unique Identification Authority of India). The applicant will receive an electronic, digitally signed e-PAN from the government.

Key characteristics of instant PAN

- Only if the mobile number is registered with Aadhar may individual apply for a quick PAN based on Aadhar.

- “The Individual’s Aadhar no shall not be linked to any other PAN.” If a person has more than one PAN, they are subject to a Rs. 10,000 fine u/s 272B(1) of the Income Tax Act.

- This paperless PAN allocation service does not applicable for the submission of any paperwork.

- The applicant incurs no costs when using the immediate PAN facility based on their Aadhar.

- A Digital Signature Certificate (DSC) is not required to apply for a PAN using this feature. PANs are assigned based on e-KYC using Aadhaar.

- The PAN will have same address as mentioned in Aadhar card.

How will I get an Instant PAN basis of Aadhar Card ?

To apply for Permanent Account Number,

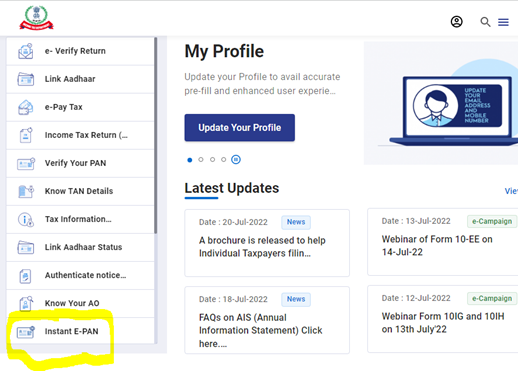

- Visit https://www.incometax.gov.in/iec/foportal to submit an application for a PAN.

- Select “Instant E-PAN” from the portal.

With the help of F&Q and the advice of expertise you can gather more information.

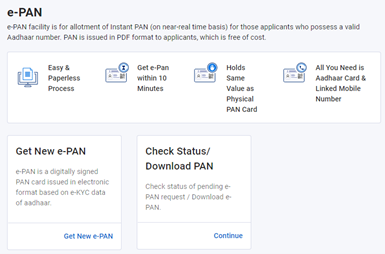

- Click on the tab ‘Get New e-PAN‘.

- Fill the details on the space provided like Aadhar number, captcha, and click on confirm button.

- To verify, the person must have to enter the OTP that was sent to the registered mobile number.

- The generation of an acknowledgment number will be necessary up until the PAN is assigned.

- The applicant will receive a text message confirming the PAN’s successful allocation on the registered mobile phone, and a PDF copy of the PAN will be delivered to the address on file.

Key Note: In case someone need a physical copy of PAN card they can independently apply for it.

- Validity of e-PANs, e-PANs digitally signed, and immediate PANs based on Aadhaar.

- CBDT Notification 19th Nov 2018 – Rule 114(6) of the Income Tax Rules, 1962 and clause (c) in the explanation that follows sub-section (8) of Section 139A of the Income Tax Act, 1961 both underwent changes. – View the PAN in PDF format.

- CBDT Notification 27th Dec 2018 – Since e-PAN includes a QR code that will contain demographic information on PAN applicants, the Ministry of Finance has formally acknowledged e-PAN as valid. A QR code scanner can be used to retrieve these specifics. Install the e-PAN Official QR Code Reader.

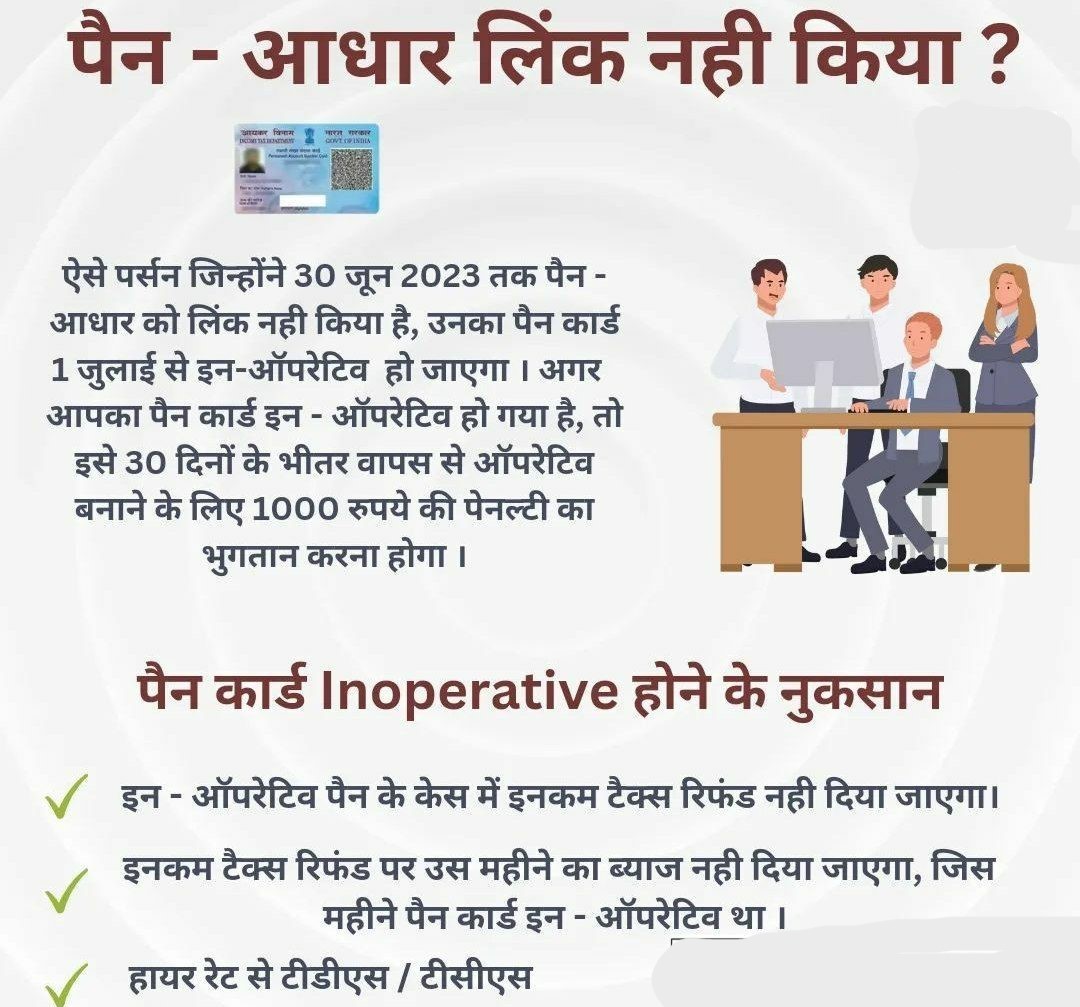

- What is the Timeline for PAN and Aadhaar linking?

- Linking Aadhaar & PAN is mandatory. The time period for linking Aadhaar & Pan has been extended most of the times. The central government has published the updated time period i.e 31st March 2022. If someone not completed the linking process, PAN became ineffective from 1st April 2023.

(Read about –Consequences of non-operative PAN)

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.