All About Multimodal Transport Operator(MTO) Registration

Table of Contents

Introduction About Multimodal Transport Operator(MTO) Registration

- The process of Multimodal transportation and registration of operators. Which includes delivering goods from suppliers to their respective clients requires transportation on a regular basis. According to the Multimodal Transportation of Goods Act, (MTGA) 1993. In which every Company, Firm, or Proprietary Concern, whether they are operating in the shipping or freight forwarding business, domestically or internationally, you have to register first. This Act regulates the movement of goods from India to destinations inside or outside of India. It is strictly forbidden to use an unregistered multi-modular transport administration.

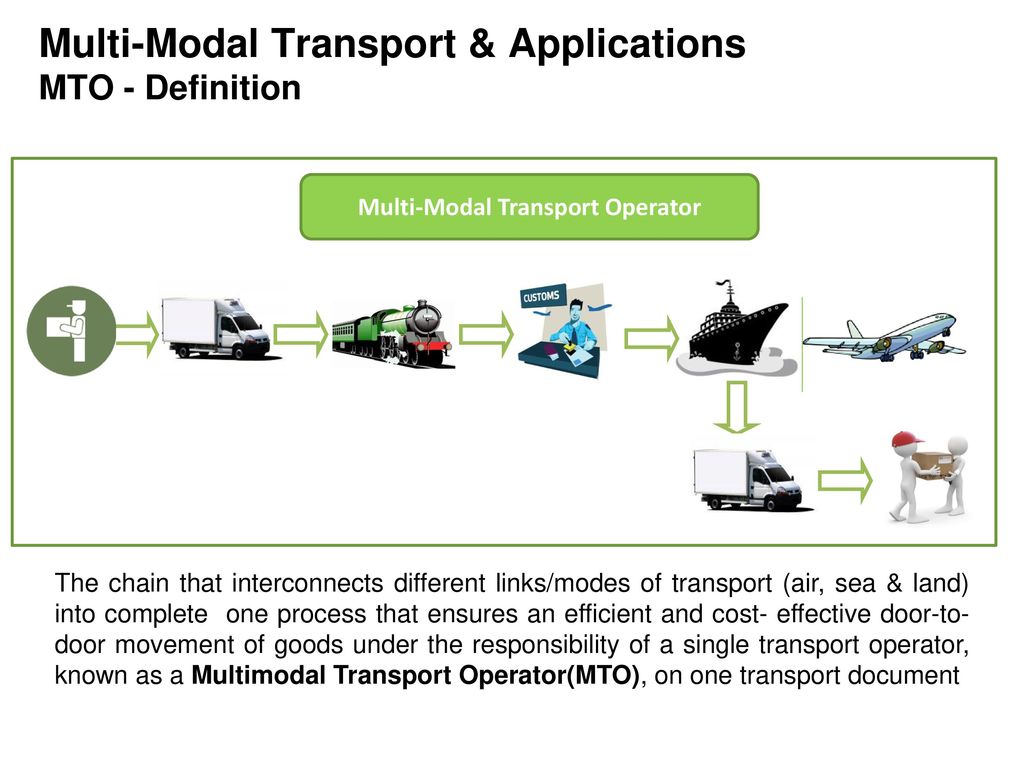

What is Means of Multimodal transport operator?

According to the Multimodal Transportation of Goods Act, 1993. A multimodal transport operators are engaged in the business of carrying goods and utilising at least two ways of transportation under multimodal contract, from the location where the goods are accepted in India to the location where they are delivered either within India or outside of India.

When it is required/necessary to get registration of Multimodal Transport Operator (MTO)?

- As per the requirement of the Multimodal Transportation of Goods Act, (MTGA) 1993, no individual can operate or start a multimodal transport business, unless the applicant or business will register under the Act.

All the Requirement for Enrolment Multimodal Transport Operator (MTO)?

The following requirements must be met in order to enlist as a multi-modular transport administrator:

- The applicant must own a firm, company or business.

- The annual turnover/ capital of the company must be 50 lakhs or above.

- And there must be two agents based on the two different foreign locations.

Document Required Multimodal Transport Operator (MTO)

- A verified Annual turnover certificate from a C.A. of the individual for the last 3 years.

- Acknowledgement of the income tax return of the last three years.

- The applicant has to provide the auditor’s report with all the schedules and detailed notes of all the accounts for the last financial years.

- Agreement copies of the applicant of the multimodal transport operators with two agents (mentioned above in the requirement for enrolment) and verification of the validity of the agreements

With those foreign agents through mail.

- The company has to provide the copy of some important certificates like incorporation certificate, MOA & AOA (Memorandum & Article of Association) & if the individual has its own company or may be if they previously registered in the under partnership Act or having the registered deed of the proprietorship and proof documentary reflecting the registered office address of the applicant / presence in India

- The names of all the partners, directors and proprietors, along with their contact information.

- A list of the offices & key employees who will be permitted to sign the Multimodal Transport Documents (MTDs) with their names, titles, and a sample signature on the applicant’s letterhead as well as documentation of their employment, such as Provident fund returns or TDS on salary.

- A written undertaking on the applicant’s letterhead, signed by the person in charge, to issue an Multimodal Transport Operator (MTO) for managing the export of products from India [as required by the DGS].

How can Registration of Multimodal Transport Operator (MTO)?

Anyone who wishes to operate or start a multimodal transportation firm may submit an application for registration. An application must be submitted online at www.digishipping.gov.in along with a charge of INR 10,000/-

- Click the E-Government tab on the portal, and the screen that follows will displayed.

- Then we go on the left side of the portal, select Internal Reference Links – MTO Registration (New License).

- After clicking, the MTO Registration Form will open with seven tabs that are all the same form.

- After submitting all information/details on the specified form where registration fees must be paid.

- Next step is to generate an application number after successful payment and submitting all tabs of the form, click on Generate Application Number.

- After application number is generated and upload the document in accordance with the checklist.

- If the competent authorities feel that applicant is satisfactory all the requirement after receipt of the application, he may issue a registration certificate with a three-year validity period that may be periodically renewed for further periods of three years at a time.

- After receiving approval & receiving a Certificate of Registration (by mail or email), the applicant must physically present the following documents within thirty days; otherwise, the registration will be presumed to be invalid.

- A Specimenof MTD (available for downloading and printing at www.dgshipping.gov.in/shipping notices/MTO) that includes the registration number, the applicant’s name, full address, and Indian contact information (website, telephone, e-mail etc.).

- Finally the Acceptance of the registration approval of terms (as stated in the email approval)

- Original Insurance coverage for all dues in accordance with the 1993 MMTG Act. (To be returned by this office after verification)

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.