Penalty for not Linking PAN with Aadhaar: Section 234H

Table of Contents

Penalty for not Linking PAN with Aadhaar: Section 234H

The annual union budget of the year 2021, a particular provisions for non-compliance is mentioned u/s 139AA(2) was initiated. Introduction of New Section 234H the penalties regarding the linking of PAN & Aadhaar within deadline

Furnishing Aadhaar made compulsory for I-T department.

- Under Section 139AA(1) of Income tax, if an individual is entitled to give Aadhaar No. then it is compulsory to furnish your Aadhaar number or the enrolment ID of the Aadhaar applicant.

⇒ When the application done for the issuing PAN, Form 49A is filled by applicant.

⇒ When filing of return of income are under process. (Inserted vide Finance Act 2017 w.e.f. 01.04.2017)

Who has to link PAN and Aadhaar ?

- According to the section 139AA(2), all the individuals who have allotted PAN card No On or before 1st July 2017 and either has an aadhaar No or is eligible to obtain an aadhaar No.

Key Note: If the applicant allotted their PAN after passing 1st July 2017 are linked with Aadhaar (furnishing Aadhaar No or Aadhaar enrolment No was made compulsory while filing PAN application form-49A)

Who is not needed to link PAN & Aadhaar?

- According to section 139AA(3), it is mentioned that linking Aadhaar card with PAN are not mandatory for the relevant individuals or group of individuals, This is informed by govt. of India:

⇒ Non-resident taxable person

⇒ Not a citizen of India

⇒ Super Senior Citizens (80 years and above)

⇒ Individuals from Assam, Meghalaya, and Jammu & Kashmir

What was the Deadline to link PAN with Aadhar?

- The timeline for linking PAN with Aadhaar had been extended many time concerning about sufficient time lap to follow the provided procedure. The last extended due date given by government was 31st of March 2022 published on 17th September 2021 through the income tax Notification no. 113.

What is the penalty u/s 234H?

Individuals are facing defaults and cannot link their PAN with Aadhaar till 31st March 2022, eventually some penalties are applicable: Then

- Penalty of Rs 500/- if an individual can link their PAN with Aadhaar within 30th

- A penalty of Rs 1000/- if an individual can link their PAN with Aadhaar after 30th of June 2022.

Key Note: Penalties mentioned above was reduced on 29th March 2022 through Notification no. 17/2022.

Note: the functionality to link Aadhaar with PAN was reinstated on 1st June 2022 Rather than 1st April 2022 due to numerous technical issues . Less than a month was actually given to taxpayers who wanted to join with the lower penalty of Rs 500.

How do I pay the PAN-Aadhaar linkage penalty?

The e-Pay Tax functionality on the NSDL (now Protean), This portal must be used to pay the fine in a SINGLE challan.

- Major Head 0021 [Income-tax (Other than Companies)]

- Minor Head 500 (Fee)

- Assessment Year 2023-24.

- Challan ITNS 280

Key Note: There is no income tax provision for Income tax refund of payments made under the minor head 500 (Fee).

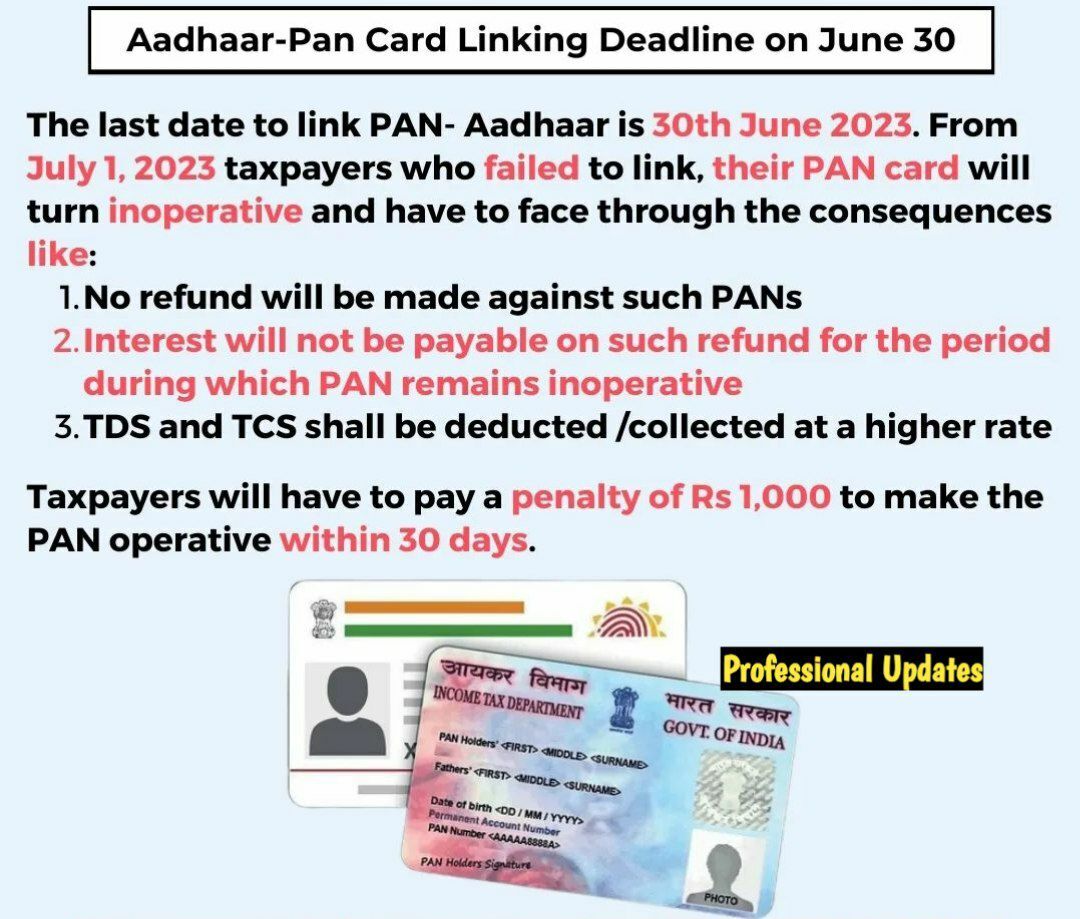

When will PAN stop functioning or inoperative?

- If PAN and Aadhaar were not linked, as required under Income Tax Rule 114AAA(2), PAN will expire after the deadline for linkage, dated March 31, 2022.

- In light of the difficulties faced by the taxpayers, the CBDT further eased the aforementioned condition that PAN will be considered inoperative if not linked up to the 31st of March 2023. By issuing Circular No. 7/2022 on March 30, 2022.

Consequences of not linking Aadhaar with PAN

What happens if PAN is not linked with Aadhaar till 31st March 2023? Consequences of not linking PAN with Aadhaar & Consequences of an inactive PAN.

⇒ Income tax Return filing is not permitted when PAN becomes inoperative as a result due to non-linking; instead, the person must suffer with some penalties as if the PAN had never been applied for, assigned, provided, or quoted.

⇒ Income tax Return filing shall not be allowed.

⇒ Even the pending ITR filing are not completed/ processed.

⇒ Refunds shall not issued, even if the refunds are under process.

⇒ All the ongoing/ proceedings cannot be not completed.

What if PAN is not linked with Aadhaar up to 31.03.2023?

⇒ Income tax Section 206AA : TDS will be deducted at a higher rate in accordance with Section 206AA. If the payee does not provide the Permanent account number,

⇒ Income tax Section 206CC : If the Permanent account number is not provided mentioned under Section 206CC – TCS will be collected at much higher rate.

⇒ Income tax Section 234A/B/C : Income Tax Sections 234A, 234B, & 234C prohibit taxpayers from providing an income tax return before linking. Failure will furnish a return on time will result in interest U/s 234A, 234B, and 234C.

⇒ Income tax Section 234F – Taxpayers are not permitted to submit their income tax returns before to linking, according to Section 234F. A fine of up to Rs 10,000 shall be assessed for failure to file a return under Section 234F.

⇒ Income tax Section 234H : As per Section 234H, a Income tax taxpayer can only activate their Permanent account number by linking it to their Aadhaar and paying a cost or penalty of either Rs. 500 or Rs. 1,000.

⇒ Penalty Under Section 272B – as per section 139A, it is needed to quote Permanent account number for certain financial activities. The PAN will become invalid if it is not linked, which will result in a violation of Section 139A’s requirements and subject the non-compliance or violator to a fine of up to Rs 10,000 under Section 272B.

TDS deduction: The day is not far when your employer will need the demonstration the proof whether or not your Permanent account number is linked with your Aadhaar No. This will enable them to determine the necessary tax deduction rate. . (Soon confirmation will be required that Aadhaar is linked with PAN for TDS deduction)

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.