Form 15CA & 15CB- Revised rules related to Filling Form

Table of Contents

Form 15CA & 15CB- Revised rules related to Filling Form

While making payments outside India it is needs few compliances. These compliance to be done form 15CB & 15CA, when it is need. The several transaction where you required to field this form as per explained in this article. `

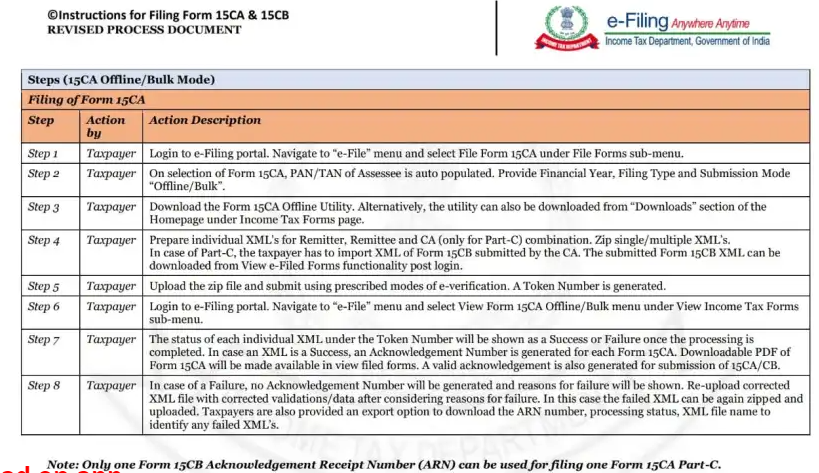

Before sending the payment to payment foreign, A person responsible for making such remittance (payment) must submit the form 15CA. Both online and offline submission of this form are available at income tax portal. Before uploading the form 15CA online, a Certificate from Chartered Accountant in form 15CB may be needed in some situations.

A CBDT Notification issued on 14th June 2021, Govt Tax dept. has simplify to filed the form 15CB/15CA in online on the new website on www.incometax.gov.in. The assesse can also filed this form in manual mode to the AD till 30th June 2021.

The tax department has changed the rules & regulation for made and filed of form 15CB and Form 15CA (check old rules of form 15CB)

The changed rules applicable from 1st April 2016. The main aspect revision are given below-

- Form 15CB & 15CA will not be need remittance for individual. As per RBI guideline.

- List of payments for specific purpose in explained in Rule 37BB. Where do not need filed Form 15CB & 15CA. which is explain from 28 to 33 as well as payment for Imports.

- 15CB Form will always need to payment done non-residents, when amount to be chargeable to tax and where payment increase Rs. 5 lakhs.

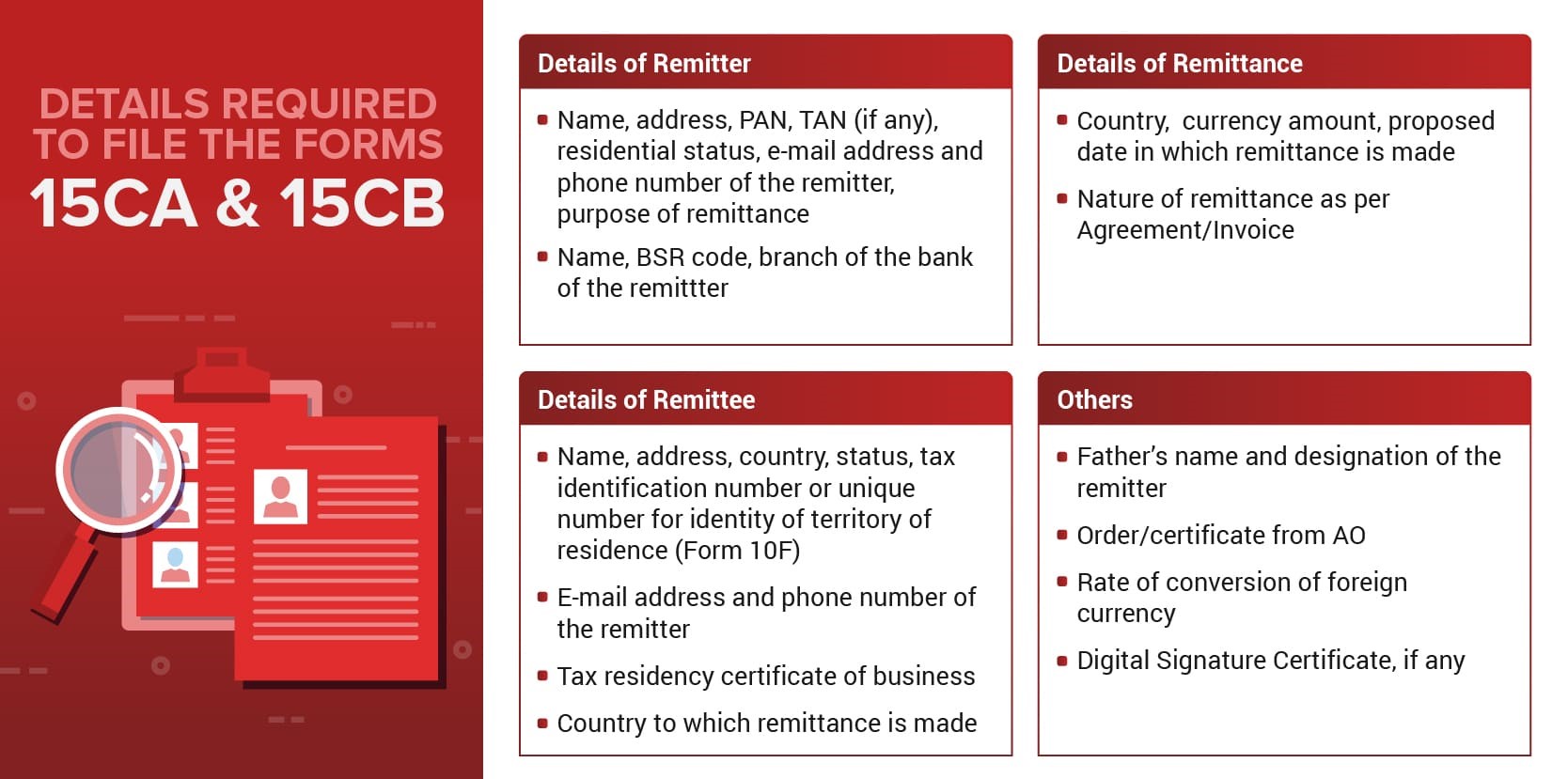

A person responsible for making a payment to payment foreign company or to a non-resident has to be avail the following information & details.

When foreign payment made is less than the amount of Rs. 5,00,000/-.

- For such payments information is needed to be filed in Part A of Form 15CA

When foreign payment made above Rs. 5,00,000/-

Following documents are need to be filed.

Part B : Form 15CA of part B has to be submitted

Form 15CB Certificate issused from CA

Part C : 15CA of Part of C

When the foreign payment made is not chargeable to tax under Income tax act.

Part D of Form 15CA of Part D is need to be file .

Under the belew mention cases, No filling of details or information is require.

The amount paid non-resident by individual & it is not need initial approval of RBI { The FEMA 1999 (42of 1999) of section 5 and read with Schedule III to the Foreign Exchange ( Current Account

- Transaction) Rules,2000} As per the Rule 37BB follow remittance is nature prescribed in the specified below:

Rule 37BB

- Remittance towards donations to religious and charitable institutions abroad

- Loans extended to Non-Residents

- Travel for medical treatment

- Freight insurance – relating to import and export of goods

- Indian investment abroad-in branches and wholly owned subsidiaries

- Travel for education (including fees, hostel expenses etc.)

- Payment- for operating expenses of Indian shipping companies operating abroad

- Remittance by non-residents towards family maintenance and savings

- Indian investment abroad -in subsidiaries and associates

- Payments by residents for international bidding.

- Refunds or rebates or reduction in invoice value on account of exports

- Indian investment abroad -in real estate

- Remittance towards payment or refund of taxes.

- Imports by diplomatic missions

- Payments for maintenance of offices abroad

- Remittance towards personal gifts and donations

- Maintenance of Indian embassies abroad

- Contributions or donations by the Government to international institutions

- Indian investment abroad -in debt securities

- Remittance towards grants and donations to other Governments and charitable institutions established by the Governments.

- Indian investment abroad -in equity capital (shares)

- Remittances by foreign embassies in India

- Postal Services

- Construction of projects abroad by Indian companies including import of goods at project site

- Payment towards imports-settlement of invoice

- Advance payment against imports

- Imports below Rs.5,00,000-(For use by ECD offices)

- Intermediary trade

- Travel for pilgrimage

- Travel under basic travel quota (BTQ)

- Operating expenses of Indian Airlines companies operating abroad

- Remittance towards business travel.

- Booking of passages abroad -Airlines companies

FAQ’s on 15CB & Form 15CA

What are consequences with for non-submission of Form 15CB & Form 15CA?

- When an individual where is need to submit Form 15CB 15CA default to file the Form 15CA 15CB before making payment to out-side India or foreign Company, then he will be responsible to penalty as per section 271I of The Income Tax Act, 1961.

- As well as penal section shall be attracted even if the individual filed wrong data. The amount can paid by assesse as per demand of assessing officer for non-Compliance is Rs. 1 lakhs.

Is any time prescribed for revised or cancelled of Filing Form 15CA\15CB?

Form 15CB\15CA can be cancelled/Revised up-to 7 days form the filed. This Form 15CB\15CA service withdraw the filed form will be shown on e-filling portal of the assesse area.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.