Analysis of CBDT circular on TDS on Perquisites U/s 194R

Analysis of Obligations to Tax deduction at source on Benefits or Perquisites U/s 194R & CBDT Circular No. 12/2022 dated 16.06.2022

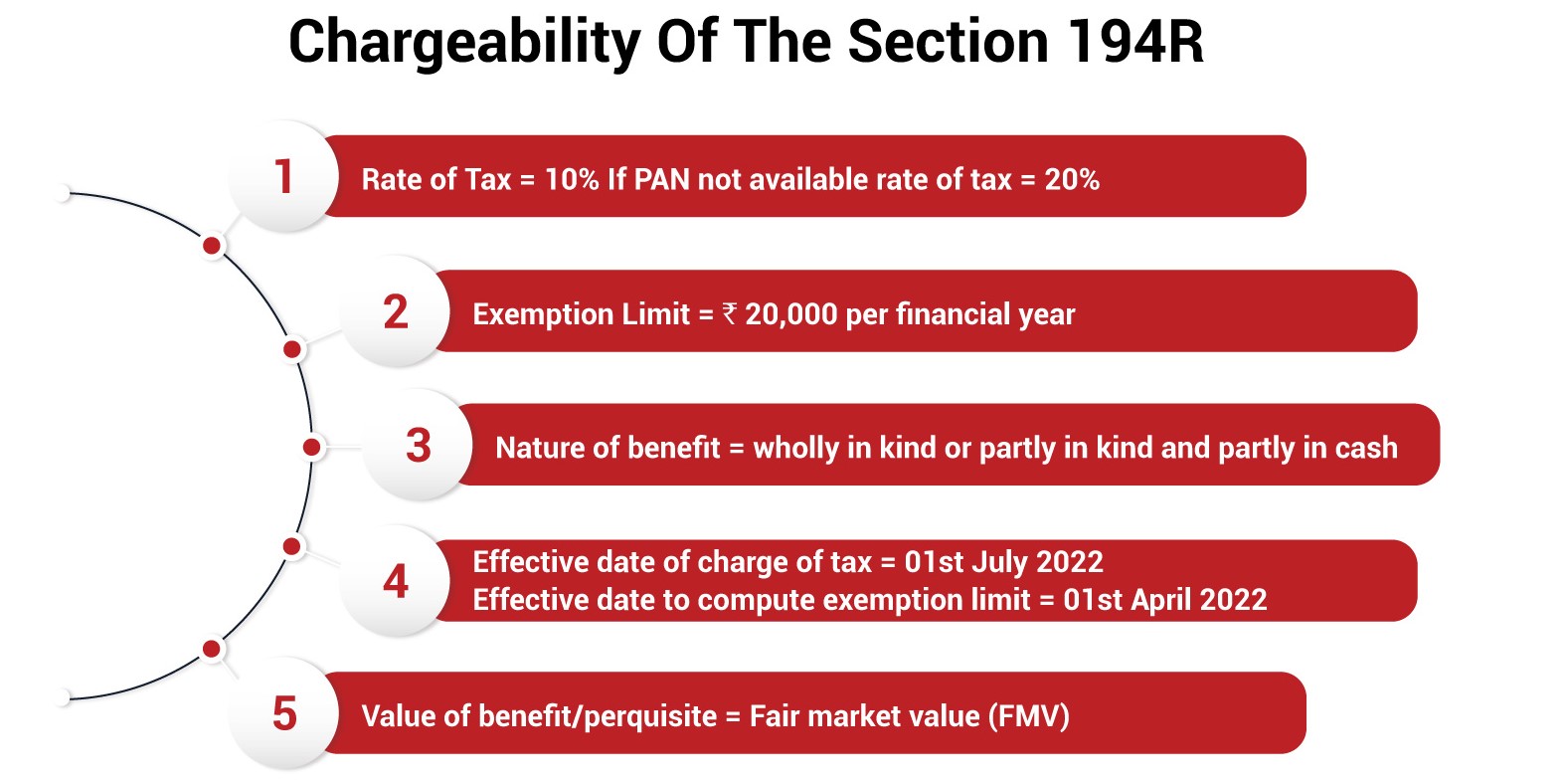

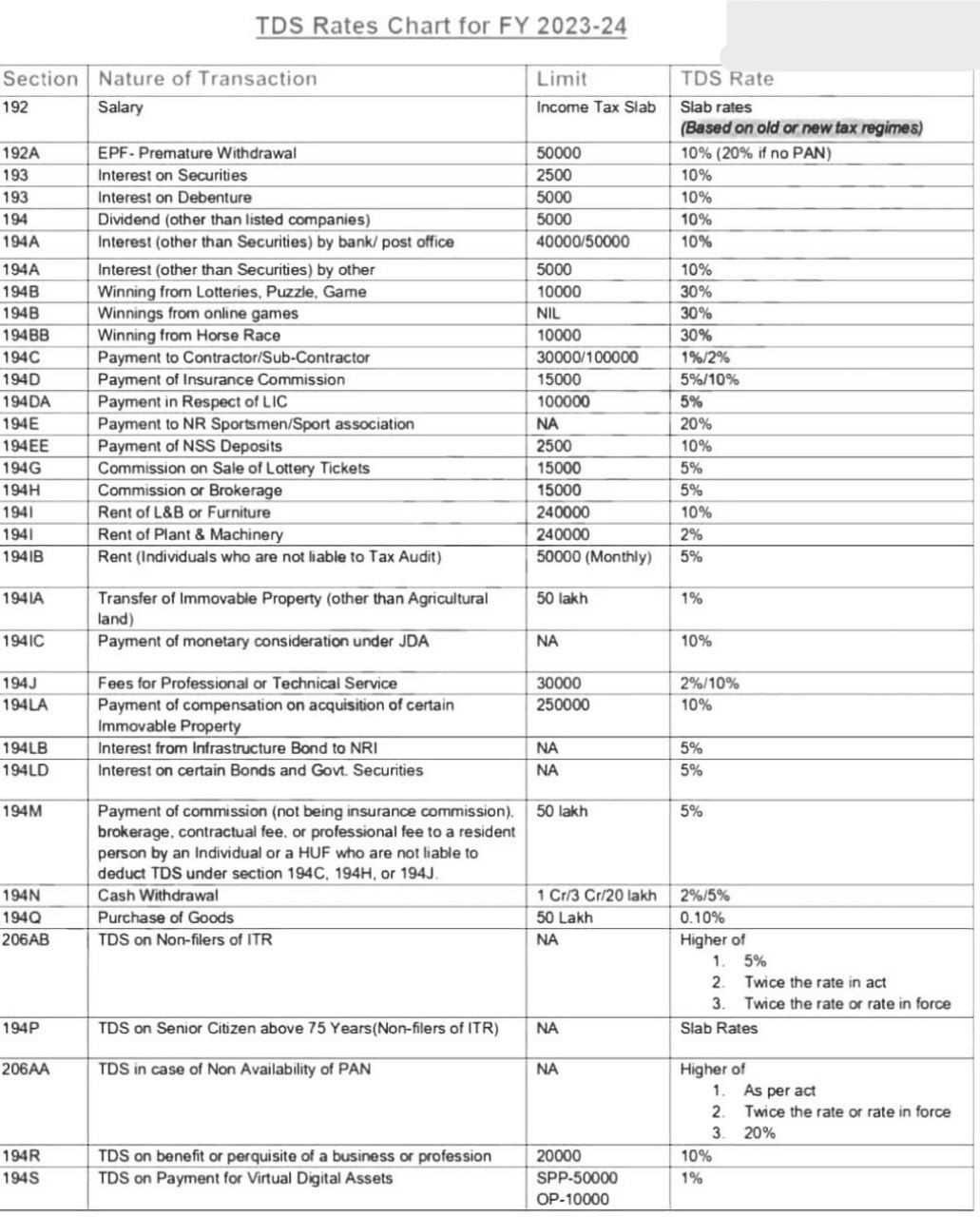

Section 28(IV) of Income Tax Act, 1961 provides for including value of any benefit or perquisite whether convertible into money or not, arising from the business or exercise of profession as income from business or profession. This clause was inserted to bring to tax any incidental benefit like gifts, pleasure trip, etc. in the course of business or profession. Considering the fact many of these are given in kind and remains unreported, the Finance Act, 2022 has inserted section 194R to put an obligation on every person responsible for providing to a resident any benefit or perquisite whether convertible into money or not, arising from business or the exercise of profession to deduct tax at source at the rate of 10% of the value of such benefit or perquisite. This amendment is effective from 1St July, 2022.

Now, in order to address some of the issues arising from this amendment, Central Board of Direct Taxes recently issued Guidelines on 16th June, 2022. Before analyzing these guidelines, it may first be relevant to briefly discuss the provision of this newly inserted section 194R.

Brief overview of provision of U/s 194R

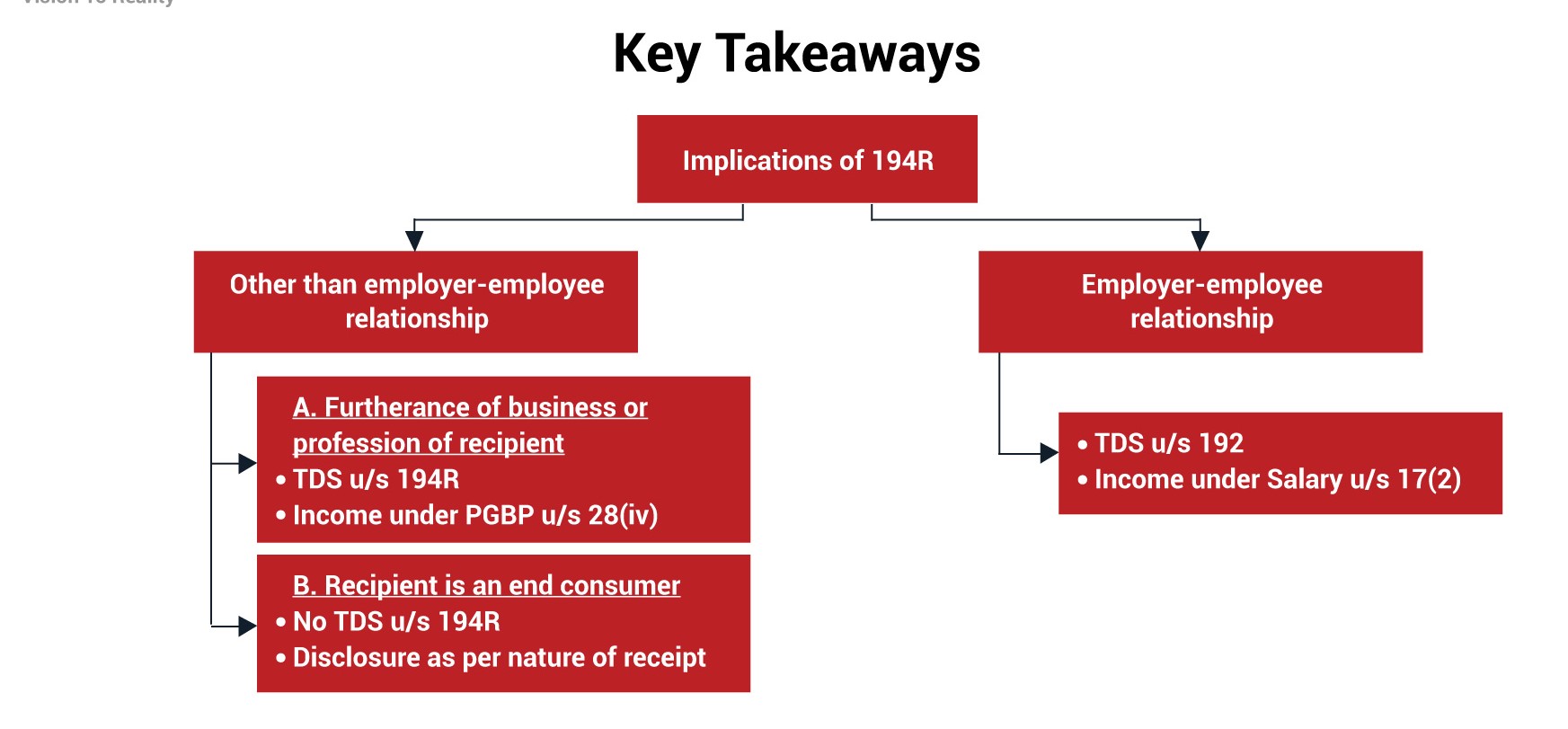

Under this section 194R, any person responsible for providing any benefit or perquisite arising from business or exercise of profession to a resident is required to deduct tax at source at 10% before providing such benefit or perquisite. The obligation to deduct tax at source under this Section 194R is in case any ‘benefit’ or ‘perquisite’ arising from business or exercise of profession is provided to a resident. The term ‘benefit’ or ‘perquisite’ has a very wide connotation. Any concession given by any vendor or even by a customer may be termed as a benefit arising in the course of business. However, it may be relevant to highlight that carrying on business/profession by the resident recipient is a prerequisite in order to invoke section 194R. Thus, in case any benefit or perquisite is not arising in the course business or profession, there should be no obligation to deduct tax under the

newly inserted section 194R. Further, in case recipient is not carrying on business or profession, there should be no obligation to deduct tax under this section.

It may be noted that the obligation to deduct tax is not limited to benefits or perquisites in kind. According to section 194R(1) expands the scope of section 194R and requires deduction of tax at source U/s 194R even in respect of benefits or perquisites which are wholly in cash or partly in cash and partly in kind. The only condition is that such ‘benefit’ or ‘perquisite’ should arise from the business or exercise of profession by the recipient. Though the objective behind insertion of section 194R was, apparently, to subject only those payments to Tax deduction at source which are taxable U/s 28(iv) in the hands of resident recipient (which as per the dictum laid down by Hon’ble Apex Court in the case of Mahindra and Mahindra Ltd in Civil Appeal Nos. 6949-6950 of 2004 covers only benefits in kind and not cash benefits), however, the way this section has been worded, it is applicable on all kinds of benefits, whether provided in cash or kind.

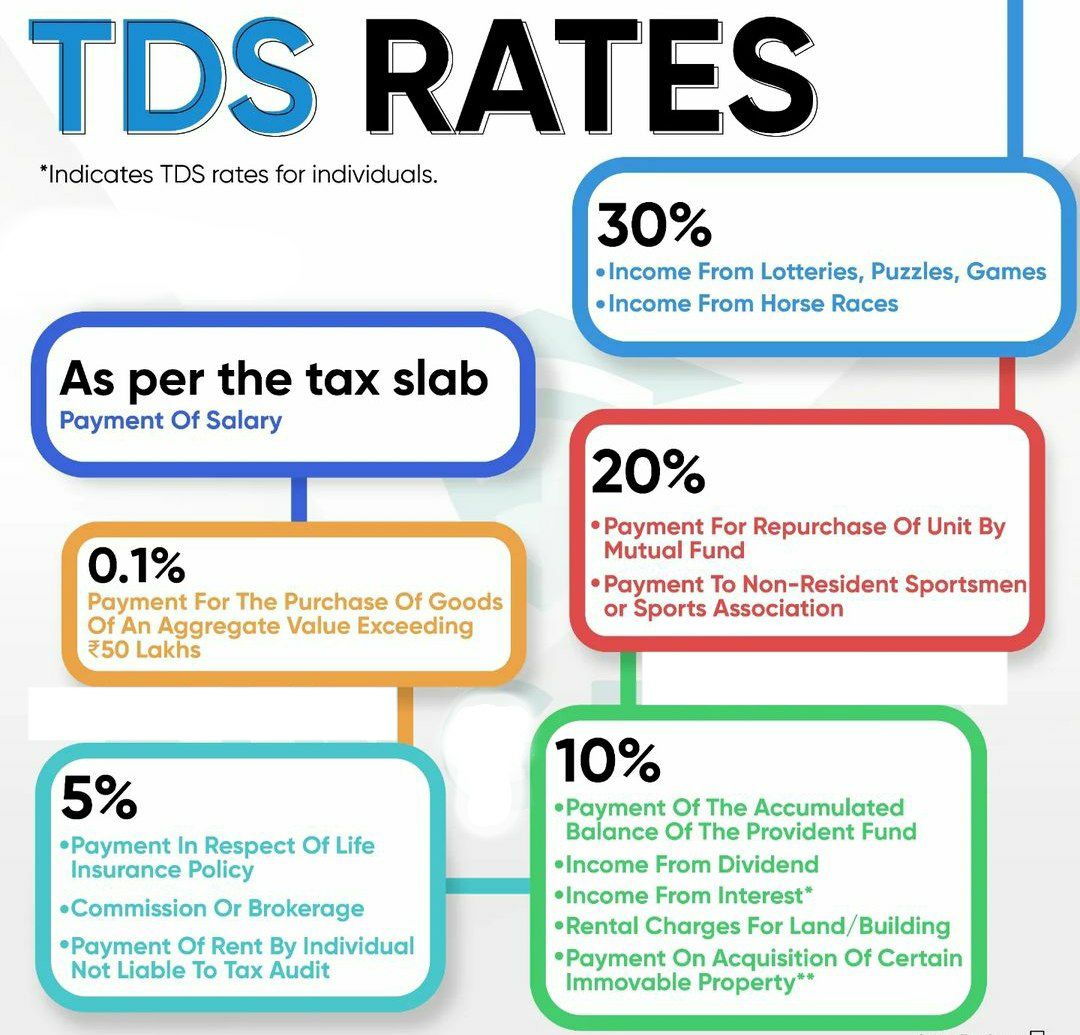

It may be noted that this newly inserted section 194R is applicable only in respect of benefit/perquisite provided to a resident. Thus, this section is not applicable in respect of any benefit or perquisite provided to a non-resident. This doesn’t mean that there is no Tax deduction at source obligation in respect of benefit or perquisites provided to a Non-Resident. The obligation to deduct tax in respect of non-resident is already covered under the provisions of section 195, wherein Tax deduction at source is deductible if the income is chargeable to tax in the hands of non-resident in India. Moreover, U/s 195, Tax Deduction At Source is to be deducted at the rates in force which are mentioned in the Finance Act or the rates provided in Double Taxation Avoidance Agreement’s, whichever is more beneficial to the assessee. However, in case benefits/perquisites are paid to a resident, the newly inserted section 194R shall be applicable which provides that Tax deduction at source shall be deducted @ 10%.

As regards the category of ‘payers’ who are required to deduct Tax deduction at source U/s 194R of the Income tax act, it is to be noted that any ‘person’ responsible for providing any benefit or perquisite as aforesaid is required to deduct Tax deduction at source U/s 194R of the Income tax act. Thus, the provision is applicable on all kind or payers such as individuals, Firm, Hindu joint family, Company,

Firm, limited liability partnership, etc. But, in view of the exception carved out under the 3rd proviso to section 194R, an individual or Hindu joint family whose total sales, gross receipts or turnover does not exceed INR 1,00,00,000/- in case of business and INR 50 lakhs in case of profession in the preceding financial year shall not be required to deduct Tax deduction at source U/s 194R of the Income tax act. Thus, in case the person providing benefits/perquisites is an individual/ Hindu joint family, then they will not be covered under the provisions of section 194R if:

- They did not carry any profession/ business in the preceding financial year, or

- They carried profession/ business in the preceding financial year, but the turnover from such business or gross receipts from profession was less than INR 1,00,00,000/- or 50,00,000/- respectively.

But, in case the person providing the perquisite/ benefit is any other entity such as a limited liability partnership, Society, Company, partnership firm, AOP, etc, then these will be covered under the provisions of section 194R, irrespective of whether these entities carried on any business/profession in the preceding financial year or not. The only requirement is that these entities should provide any perquisite/benefit to a resident, and such perquisite/benefit should arise in the hands of a recipient in the course of business/profession of such recipient and such recipient is a resident.

Moreover, it may be noted that a blanket threshold exemption limit of INR 20,000/- per financial year has been provided U/s 194R i.e. in case the aggregate value of benefit or perquisite provided during the financial year does not exceed INR 20,000, then there shall be no requirement to deduct Tax deduction at source U/s 194R of the Income tax act.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.