Guide on Pvt Ltd Company Registration Process in India

Table of Contents

Guide on Pvt Ltd Company Registration Process

- Creating a company in India is an essential first step on your path to entrepreneurship. And establishing a company is not as simple as you would think.

- There are procedures to follow and documents to submit, of course, but once you understand how to do them, the entire company registration process will go rather smoothly and fast. Continue reading to discover how to simply register a private limited company!

What is the Minimum needs for Company formation Process?

The four requirements for registering a private limited company in India are mentioned below before we go on to the company registration procedure in India.

Indian Registered office address in India.

- Companies should have their RO (Registered office) in India but company have option of among residential or commercial property either of the two as a Registered Office Address

Unique business name

- Entrepreneurs give a lot of consideration to the name of their company. But, they must ensure that it is sufficiently unique. The name must also include a suffix that defines the company’s line of business, like as MotherPride daily Fruit & Vegetable Pvt Ltd. The company deals with dairy products, vegetables & fruits just by looking at the name.

Minimum Two shareholders

- Shareholders might be a person or Company or organization. In the case of a Company entity, a Nominated person via authorised representative is qualified to act in the capacity of a shareholder on behalf of the company.

Minimum Two directors

- According to the Companies Act of 2013, one director must be an Indian resident who has resided there continuously for at least a year (as recently amended). One more might be a resident who is foreign or Indian.

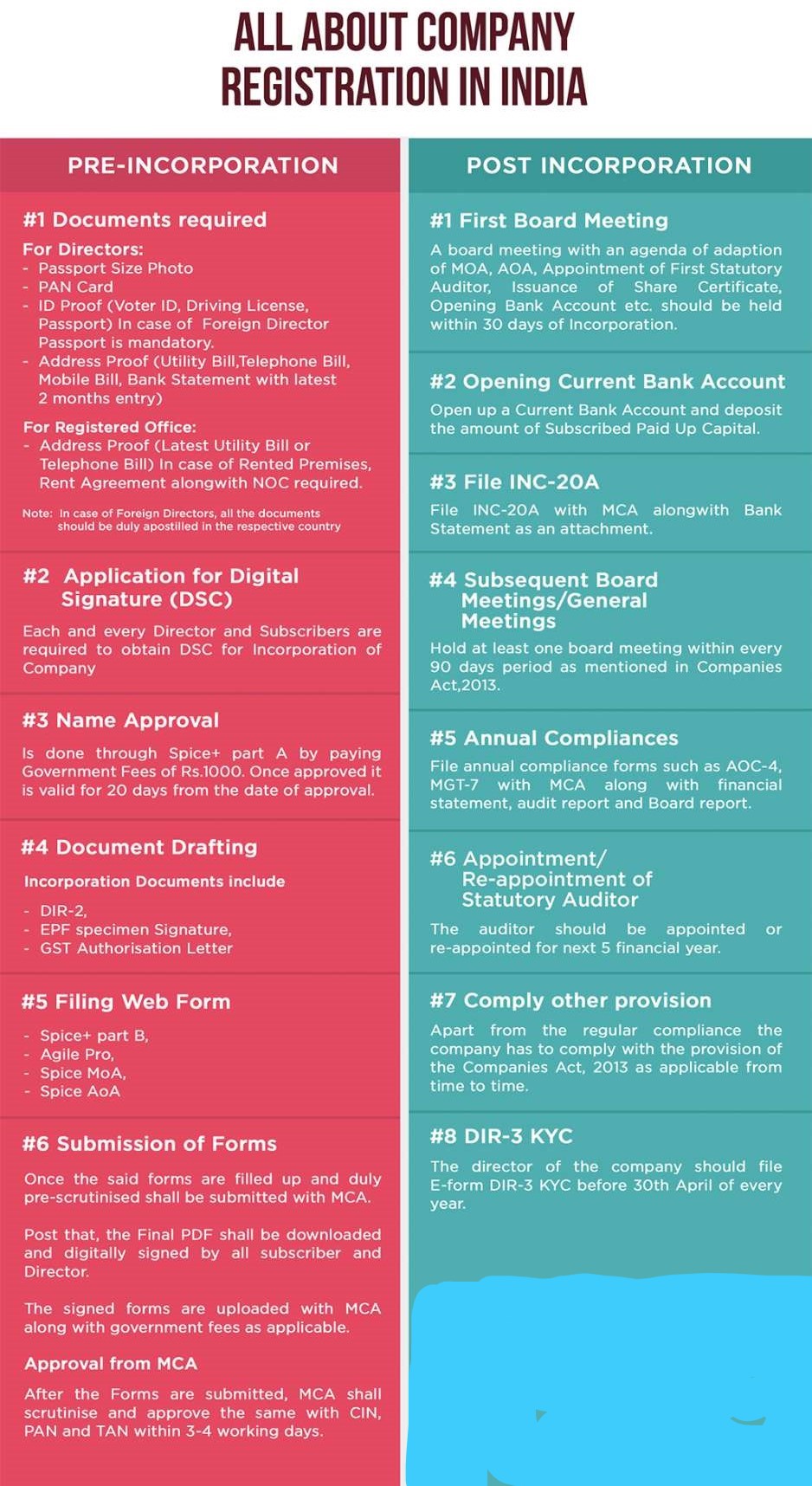

What is list of document Checklist for company Registration?

You are finding here list of all documents of shareholders/ directors that are needed to Company register in India.

For Indian Nationals

- Aadhar Card Copy

- Identity of Directors & members (Passport/Driving License/ Voter ID) must be Self-Attested Proof

- Copy of PAN card all the Directors and members must be Self-Attested.

- Address proof which must be in the Director or shareholder name (i.e Telephone Bill/Electricity Bill/ Mobile Bill/Latest Bank A/c Statement showing name & address along with the last page of transaction with recent activities) which required be Self-Attested.

- Photograph i.e Passport size

In case Foreign Country person

In the case of a foreign shareholder/ director, below documents must be apostilled & notarized.

- Foreign national subscribers required to give their passport as proof of nationality

- Photograph i.e Passport size

- Foreign national address proof including, Bank Statement/ Driving License/electricity/utility bill which must not be older than two months

What is documents needed for Company Registered address for Office?

- Rent Agreement copy if rented property

- NOC Certificate from Property owner.

- Company business proof of address (Water Bill/Gas Bill/ Electricity Bill/Telephone Bill) must not older than last two months.

Company incorporation process- Simplifying here under :

According to the Companies Act, 2013, the MCA governs the incorporation of a Private limited Company registration. It is focused on making sure that laws and regulations adhere to company law. . MCA Registration form fees depend upon two factors i.e, Stamp Duty and Normal Form filing fees. The minimal incorporation expenses for Private Limited Firm registration are necessary because Stamp Duty varies depending on authorised capital and the state in which the company is incorporated. Rajput Jain & Associates assists business owners in establishing a private limited company in just 4 simple steps:

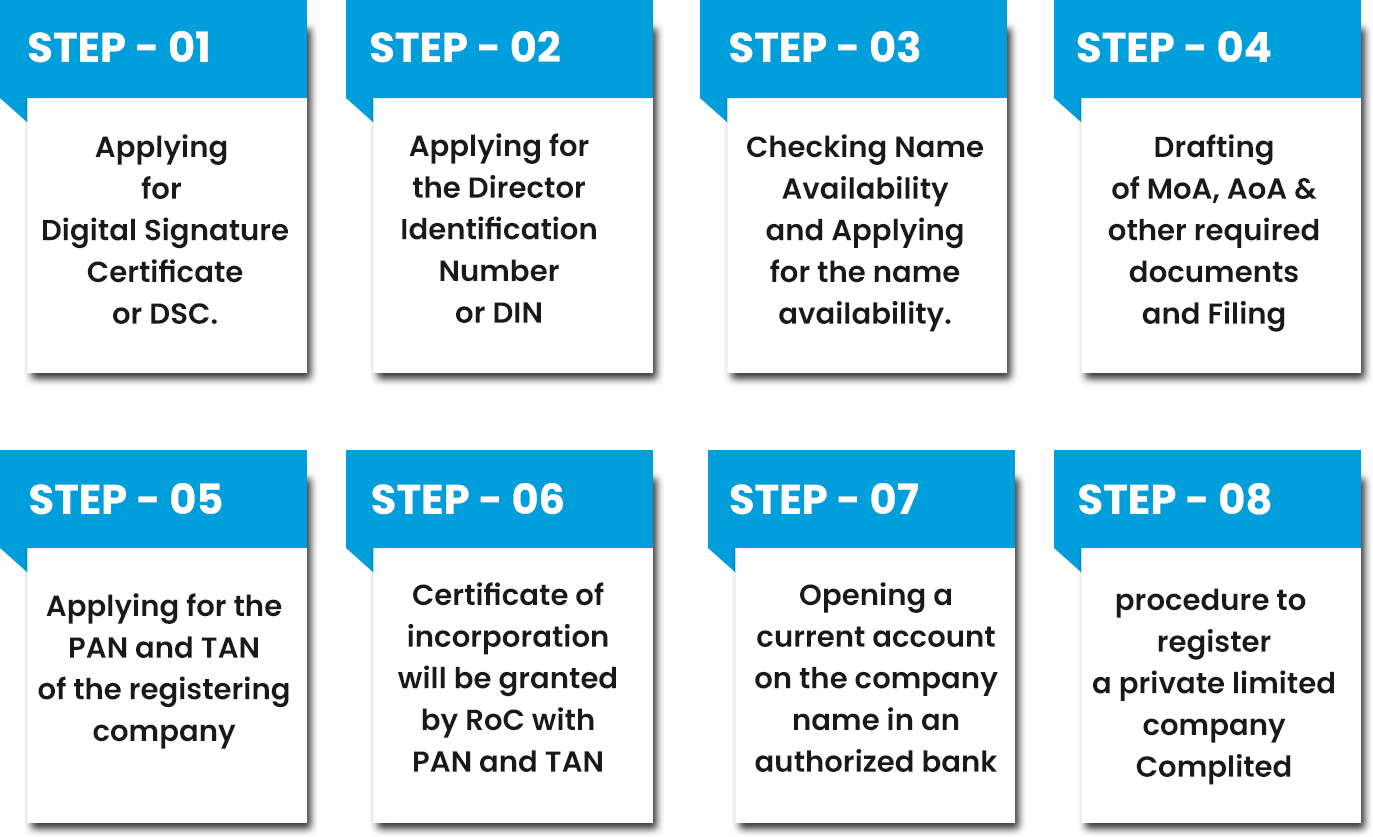

The Four step process begins with the application for a DSC & filing SPICe+ forms. Now we Let’s go step by step process !

Step-1: Applying for Directors DSC

- All Director & shareholder of a Pvt Ltd C. required to take a DSC as per the MCA. This Digital Signature Certificate will be used on all the documents for filing the e-forms in a secured manner, as per guidance issued by “Information Technology Act”.

- 1st step is to acquire Digital Signature Certificate to File online documents securely. Digital Signature Certificate is get from the Controller of Certification Agencies (CCA). The minimum validity is one year. But, 1 can extend the validity to two years.

All Applicant needs to furnish the following individual details for applying for DSC:

- Photographs i.e. Passport-size

- Aadhaar Card No

- Mobile/Phone No.

- E-mail Address

- Permanent Account No

In case 1 or more shareholders or directors are foreign country nationals, they required apostilled and notarized documents will also be needed.

Step-2: Applying for Company Name Reservation (SPICe+ Part A)

- We shall have apply some name options for company. We needed to chose best 2 to submit in MCA SPICe+ Part A form, which is normally used to reserve a unique Name of company for our new Pvt LTD Company. We should require help of professionals practising CA/ CS to fill out & file SPICe+ Part A form. In this case firstly we should go, We can pick two options of Company name.

SPICe+ Part A form has the mention following option’s:

- Type of Company:We needed to Select ‘Pvt Ltd Co.’ from various kind of company structures listed down in the MCA form. Other type of business structures include Section 8 Company, IFSC Company, Producer Company, Nidhi Company, Unlimited Company etc.

- Class of Company:This section key significant whether a company is private, public, or one person company. We have to choose ‘private’.

- Category of Company:Select if you’d want the company to be limited by shares, by guarantee or have unlimited shares. Important popular is to keep the limited by shares company.

- Sub-category of Company: select the sub-category applicable with help of CA / CS practising professional.

- Industrial Activity main division:what industry will we be operating in? Ministry of Corporate Affairs has designated distinguishing codes to the main divisions. Select one that fits for our company business with help of CA or CS Practising professional.

- Main division Description: This is where we can clarify our Company business idea, & specify main purpose of services or products that we are going to offer to our client in a detailed manner.

- Proposed Company name:We can propose two names so which we like to keep as our name of company.

And done! After filed, Ministry of Corporate Affairs will take two or three days to get approve SPICe+ Part A form. In case initial names get questioned or rejected, We will get a 2nd chance to submit for two more name of company options of our liking.

In case all your 4 name choices get rejected, you will need to file the SPICe+ Part A form all over again. Pro Tip: Come up with very unique brand name choices & check company name availability beforehand. Before filing the form, we should check if a company with a similar name is already registered or not on the Ministry of Corporate Affairs portal.

After names of Company approved by Ministry of Corporate Affairs, SPICe+ Part B form will be made available to you to furthermore with our company registration process.

Step-3: Submit details for the Proposed Company (SPICe+ Part B)

SPICe+ Part B form is where you fill in the key details about business & Company. We needed to make sure all details are provided to practising professional CA / CS correctly. SPICe+ Part B required to be filed in eight parts:

- Capital Details:

- Registered Office Address:

- Subscriber and Directors’ details:

- Stamp Duty:

- TAN & PAN Application:

- Require Attachments: like a utility bill, identity & residential address proof of the 1st director & shareholder, director consent & No Objection Certificate from owner of the registered address etc.

- Necessary declaration: DSC to declare that we follow guidelines of the Companies Act 2013.

- Required declaration & Certificate by Professional: Lastly SPICe+ Part B form, the CA, CS, or CMA practicing professionals helping us out with company formation registration process will be needed to give their DSC.

Step 4: Drafting and filing of MCA Registration Form

- An Registration Form will be drafted & filed as per the significant clauses of SPICe+ Memorandum of Association(MOA) by the CA in practicing. Let’s understand clauses quickly & briefly.

SPICe+ Memorandum of Association (MOA):

- Company Name clause: we required to disclose pic company name & use of word “Pvt/ Private Limited” after Name of company.

- The Company Capital clause: Company authorized capital & share capital of company is required to be disclose.

- Liability clause: Under the liability clause determines that Company shareholder member’s liability is limited by shares.

- Company Subscriber clause: We required to state details of the first subscribed/shareholder & No of subscribed shares.

- Registered office clause: Under Registered office clause identifies Indian state where we have to company registered.

- Company Object clause: This is an important company clause as you required to mention main object- that is we idea to deal with the Company business activities.

After above clause is added, Proposed subscribers of company & CA/ CS professionals affix the Digital Signature Certificate to submit with the Ministry of Corporate Affairs for approval.

SPICe+ Articles of Association (AOA):

Then comes the SPICe+ AOA (Articles of Association)

SPICe+ AOA give below information correctly to be submitted in the Table F of the company:

- Clause 1: The interpretation of your company

- Clause 60: Mention the company details

- Company Name is auto filled

SPICe+ AOA ROC form also state responsibility & power of the management decisions, director, dividend policy, transfer of shares & many other significant information related to structure of company.

Similar as Memorandum of Association, the CA/ CS professionals affix their own Digital Signature Certificate as well as Companies director’s Digital Signature Certificate to file with Ministry of Corporate Affairs for approval.

AGILE-PRO-S

- AGILE-PRO-S form is also significant phase in the formation of a company process.It must be provided in order to register a GST number, EPFO (Employees Provident Fund Organization) credentials, and ESIC information (Employee State Insurance Corporation). You must also inform the bank account and shop and establishment licence, depending on the state where your company is registered. All the above can be done with a professional’s help.

- After completion of above ROC forms,INC-9 will be issue automatically as a declaration of ROC form

- Finally, After above process is done, ROC Challan is to be paid along with ROC Stamp duty & Govt Charges. If there are no objection or rejected generated by ROC, MCA issue Certificate of Incorporation (COI).

Certificate of Incorporation

- The MCA issues the Certificate of Incorporation after carefully verifying your application and the accompanying paperwork.

- When the company’s incorporation date, Company Identification Number (CIN), PAN, and TAN are mentioned along with the Registrar’s signature and seal, it is irrefutable evidence of the company’s existence. Furthermore, directors are given DINs upon registration approval.

- The Certificate of Incorporation mention CIN receipt acts as adequate evidence of your company’s legitimacy & you are now free to engage in the commercial activity you had planned.

Post Registration Compliances

Compliances are one of the things that need to be done once the firm is incorporated so that business owners can concentrate on their key functions. Furthermore, it assists companies in establishing a proper structure that outlines the responsibilities of shareholders and directors. Read more about how Rajput Jain and Associates’ professionals and subject matter experts assist new businesses with managing post-registration compliances.

This effectively summarises the company registration process. We hope that by now you have a better understanding of how to set up a private limited company in India and are prepared to start your own company. You can submit a query using the form below if you need more clarification or assistance. We would be delighted to participate in your innovative project.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.