Crypto currency As per Income Tax Provisions U/S 115BBH

Table of Contents

What is means of Crypto currency according to Income Tax provisions ?

Crypto currency and Income Tax

- In the introduction of Budget 2022, the government has announced taxation norms on the same. Key pointers regarding income tax implications on crypto currencies in India are as follows –

Crypto currency – Meaning as per Income Tax provisions

- A form of virtual digital asset

- Not being an Indian currency or foreign currency as per the provisions of Foreign Exchange Management Act, 1999

- Functions as a store of value, unit of account

- Can be transferred, stored or traded electronically

Classification of Virtual Digital Asset

- As per the Finance Bill, 2022, the crypto currencies are classified as a capital asset for the purpose of taxation and hence, income under the head capital gain will arise on transaction of the same.

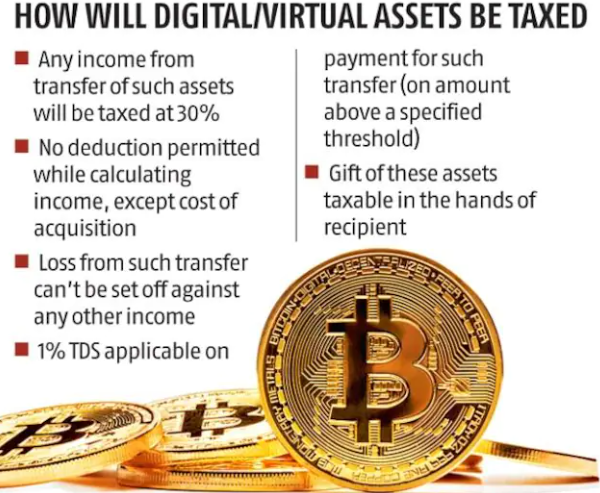

Tax on income from Crypto currencies [Section 115BBH]

- Income from transfer of crypto currencies will be taxed at the rate of 30% Deduction – No deduction of any expenditure except for cost of acquisition will be allowed Set off/ Carry forward of losses – No set off of losses against any income is allowed as well as carry forward of losses in this respect is also not allowed

Computation of capital gains on transfer of Crypto currencies

The following should be ignored while computing capital gains on transfer of crypto currencies

- Cost of improvement relating to the asset

- Selling expenses e. the expenditure incurred in connection with the transfer of virtual digital asset

Indexation of cost of acquisition

- Any exemption under section 54F Further, no deduction under Chapter VI- A shall be allowed. However, relief under section 87A i.e. rebate can be

Applicability of TDS provisions [Section 194S]

- A new section 194S is proposed to be inserted in The Income Tax Act, 1961 e.f.07.2022 regarding TDS.

- Deductor – Any person responsible for paying any sum by way of consideration for the transfer of crypto currency.

- Deductee – Tax is required to be deducted if amount is payable to a resident person

Rate of TDS – 1% of consideration

- When to deduct – At the time of payment or at the time of credit of such sum to the account of resident, whichever is earlier

Exemption from TDS

- If consideration is payable by any person (other than a specified person) and its aggregate value does not exceed 10,000 during the financial year

- If consideration is payable by a specified person and its aggregate value does not exceed Rs. 50,000 during the financial year

Meaning of “specified person” – An individual or a HUF, whose total sales, gross receipts does not exceed Rs. 1 crore in case of business or Rs. 50 lakh in case of a profession, during the financial year immediately preceding the financial year in which such virtual digital asset is transferred An individual or a HUF who does not have any income under the head profits and gains of business or profession.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.