GST Has a Positive Impact on the Real Estate Industry.

Table of Contents

GST Has a Positive Impact on the Real Estate Industry.

One of the most important pillars of the Indian economy is the real estate industry. The real estate industry contributes between 6 and 8% of India’s GDP and ranks second only to the IT industry in terms of job creation.

With multiple taxes previously applicable, such as service tax and VAT, the indirect taxation in this sector has been completely revamped with the introduction of GST.

-

The pre-GST taxability of Real Estate Transactions

| Nature of Duty | Rate of Tax | When was tax required to be paid? or What triggered tax? |

| VAT* | 1 to 4% |

On Sale of Under Construction Properties |

| Service Tax | 4.5% | |

| Registration Charges | 0.5 to 1% | |

| Stamp Duty Charges* | 5 to 7% |

*VAT, Registration Fees, and Stamp Duty Charges vary from state to state. VAT was not applicable on completed or ready-to-sell properties. Cenvat’s credit on inputs used to build or build civil or any part of the building was limited under the former indirect tax regime.

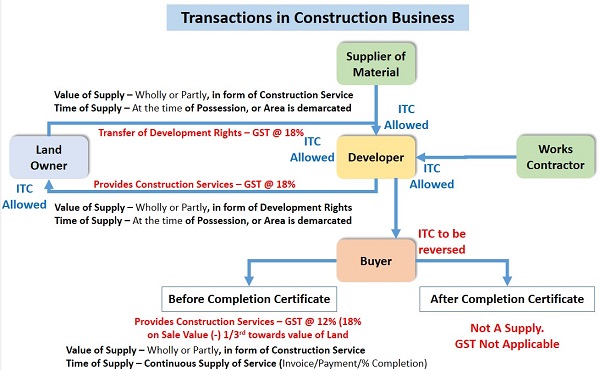

2. Taxability of Real Estate Transactions under GST

| Particulars | Applicability | Rate of Tax | Input Tax Credit |

| On ready-to-move (RTM) properties for which completion certificates are issued | Not applicable – Because Sale of building is treated as activity or transaction which shall be treated neither as a supply of good nor a supply of service as per SCHEDULE III of CGST Act,2017 | – | Not available |

| On Under Construction Properties (For Homes Purchased Under Credit-Linked Subsidy Scheme) | Applicable as supply of services as per Schedule I of CGST Act, 2017 | 8%* | Available |

| On Under Construction Properties (Other than above) | Applicable as supply of services as per Schedule I of CGST Act, 2017 | 12% | Available |

| On resale properties | Not applicable | – | Not available |

| On Land purchase and sale | Not applicable. As per Schedule III, sale of land is neither supply of goods nor services. | – | Not available |

| Works contract | Applicable | 18% | Available |

| Composite supply of works contract | Applicable | 18% | Available |

| Composite supply of works Contract to Government Authorities | Applicable | 12% | Available |

| Composite supply of works contract – for use by general public | Applicable | 12% | Available |

| Composite supply of works contract – Affordable Housing | Applicable | 12% | Available |

NOTE: Homes purchased through the Credit-Linked Subsidy Scheme (CLSS) are subject to a 12 percent GST rate. After subtracting the 1/3rd sum for land costs, the relevant rate will be 8%.

3. Buyers’ impact.

Buyers of houses under construction had to pay VAT, Service tax, Registration fees, and Stamp duty under the previous tax regime. Furthermore, because VAT, registration fees, and stamp duty were all imposed by the states, property prices differed from one state to the next. Moreover, developers were required to pay numerous fees such as sales tax (CST), custom duty, OCTROI, and others for which there was no credit available. In accordance with GST, a single 12 percent tax rate is applied on construction properties and GST does not apply to properties completed or ready to sell as in previous law. Buyers will therefore benefit from a GST price reduction. In the short term, purchasers may follow the “wait and watch” approach to understand more about the impact of GST on property prices and to postpone purchasing decisions. In addition, GST has a long-term positive consequence on buyers when the advantage of the developer’s input tax credit is passed on to the buyer.

4. Impact on developers, builders and contractors:

Previously, developers had to pay Excise duty, VAT, Customs duty, Entry taxes, and other taxes on raw materials/inputs, as well as Service tax on various input services such as approval charges, architect professional fees, labour charges, legal charges, and so on. For CST, Customs duty, Entry Tax etc…, the ITC was not available. This affects the price and was subsequently transferred to the purchaser. Given that multiple taxes are subsumed and input tax credits available, developers’ buildings are substantially reduced in accordance with GST. A reduction in logistical costs will be a benefit as well. As a result, developers may notice an increase in profit margins. On the negative side, developers must perform various computations to arrive at ITC, which they must then pass on to buyers. As a result, they can usually only pass on the ITC at the final phases. Because of the lack of transparency on ITC, developers may be harmed because purchasers may take a “wait and watch” strategy and postpone purchasing decisions. Furthermore, under the previous laws, a considerable part of expenditure went unaccounted for. Under GST, the availability of credit on inputs and cloud storage of invoices has decreased when it comes to expenditure recording.

5. Other Stakeholders’ Impact

The impact on associated services such as labour, material suppliers, and service providers is determined by the amount of tax paid on these items and services. This will have implications for the real estate industry as a whole. Cement, for example, was previously taxed at an effective rate of 27-31 percent, but will now be taxed at 18 percent. Increases in cement prices will raise the overall cost of construction. The following are the GST rates for some goods related to the construction industry:

| Product | Rate of GST |

| Sand | 5% |

| Sand & Fly ash Bricks | 12% |

| Steel | 18% |

| Paints | 18% |

| Marble and granite | 28% |

| Cement | 18% |

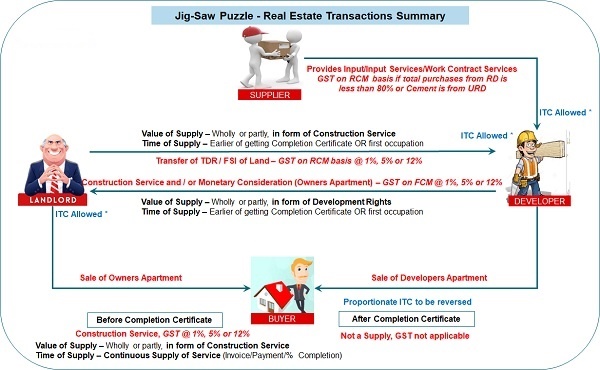

6. RCM and Its Impact

The RCM concept was derived from the previous Service tax statute. In GST, the scope of RCM has been greatly enlarged, which may have a negative impact on developers.

- One of the significant additions to RCM under the GST law is that if goods or services are obtained from a person who is not registered under GST, a registered person under GST is required to pay GST on all such supplies.

- Developers must pay GST on services acquired from goods transporters, legal services received from an individual or corporation, services acquired from the government or local authorities, such as municipalities, and so on (subject to exclusions).

- Furthermore, under GST, the developer cannot compensate the RCM tax payable with the input credit available from the GST paid on the inputs. It must instead be paid in cash or via bank transfer.

This will drive up expenses and have a negative impact on developers, particularly small ones.

7. Eligibility and Ineligibility of the Input Tax Credit

Subject to exceptions, credit for taxes paid on all inputs and/or input services used or intended to be used in the course of business would be available under GST.

8. Requirements for Claiming ITC

A registered person may claim input tax credit only if the following conditions are met:

- He possesses a tax invoice (purchase invoice) / debit note.

- He has received the goods and/or services, or both.

- The tax levied on such supplies is paid to the government by the supplier.

- He has submitted a valid return.

- The goods and services should not have been used for personal gain.

9. Restriction on ITC

Other than plant and machinery, input tax credit is not available on supplies received for the construction of an immovable property on his own account.

NOTE: The term “construction” includes reconstruction, renovation, additions, alterations, or repairs to the extent of capitalization to the said immovable property.

Example:

- If the cost of changing the interiors of a service apartment is added to the cost of immovable property (in this case, a service apartment), it becomes part of the cost of the service apartment (immovable property), and thus no input tax credit is available for the taxes paid on changing the interiors of a service apartment.

- Birla Developers constructs a branch office building. In this case, ITC is not available. Example 3: Tata builds a drainage machine for the construction of a branch office. ITC is available in this case.

10. Stamp Duty Applicability

Stamp duty and registration fees are excluded for the sole purpose of calculating GST. Stamp duty will continue to be levied on both completed and under-construction properties, as it were before the GST regime.

FAQ’s ON REAL ESTATE INDUSTRY.

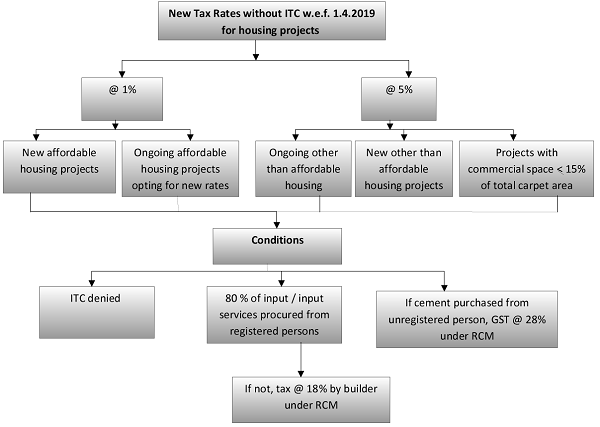

Q.: What are the new GST rates for residential apartment construction?

The revised tax rates for housing projects without ITC, implemented from April 1, 2019, are listed below:

| Rate | Description |

| 1% | New affordable housing projects |

| Ongoing affordable housing projects opting for new rates | |

| 5% | Ongoing other than affordable housing projects |

| New other than affordable housing projects | |

| 1% | Projects with commercial space <15% of total carpet area |

The following conditions must be met in order to receive the previously mentioned rates:

Claim for input tax credit: It is not possible to claim ITC.

Purchasing inputs from registered individuals: Purchasing at least 80% of the total value of inputs and input services from registered suppliers is required.

The following services employed in the construction of residential units, however, are not included in this calculation:

- Grant of development rights

- Long-term land lease

- Index of floor space

- Electricity value

- High-speed diesel value

- Motor spirit and natural gas value

The promoter must pay GST at 18 percent on a reverse charge basis on all such inward supplies that fall short of 80 percent from registered suppliers, with the exception of cement, which must be taxed at 28 percent (if purchased from unregistered persons).

Q.: What is the definition of a residential real estate project?

A Real Estate Project in which the commercial space’s carpet area does not exceed 15% of the total carpet area of the project’s units.

Q.: What is the definition of a low-cost residential apartment?

A low-cost residential apartment is one that.

- For metropolitan cities, the carpet area might be up to 60 square metres.

- For cities and villages other than major centres, the carpet area might be up to 90 square metres.

- The builder will not charge more than Rs.45 lakh in total.

For example, Mr. Ram is a Pradhan mantri awas yojana CLSS beneficiary, and the carpet area of his house under construction is 150 square metres. Is he qualified for a new one-percentage-point tax rate?

Yes, but only if the developer did not take advantage of the option to pay tax at the old rates. The square metre area here is greater than the prescribed limits, but it is still considered an affordable residential apartment because Mr. Ram is a Pradhan mantri awas yojana CLSS beneficiary.

Q.: What is a current project as of April 1st, 2019?

If the following conditions are met, a project is considered to be an ongoing project:

- Where a Commencement Certificate is required and was issued by the competent authority on or before March 31, 2019, and it is certified by a registered architect, chartered engineer, or licenced surveyor that construction of the project began on or before March 31, 2019. For example, if a single tower with 50 floors is registered as a single project, the competent authority may issue separate commencement certificates. If one or two certificates are received on or before March 31, 2019 and some later, the project is still considered ongoing.

- If a competent authority is not required to issue a Commencement Certificate, one must be issued by a registered architect, chartered engineer, or licenced surveyor stating that construction on the project began on or before March 31, 2019.

- The completion certificate will not be issued on or before March 31, 2019. For example, suppose a project has three blocks and one block receives a completion certificate before April 1st, 2019 and the others after that date. In such a case, the project is considered ongoing because, according to a government notification, a project is considered complete only if a Completion Certificate is issued for the entire project and not a portion of it.

- The project’s first occupation did not occur before March 31, 2019. For example, if an occupation certificate is received only for a portion of the premises (up to March 31, 2019) in a large project and not for the entire project, the project is considered ongoing.

- Apartments are partially or entirely booked on or before March 31, 2019. Example 1: This condition does not apply to slum restoration initiatives because the recipients are not required to pay any monetary compensation for the units given to them.

Note: A project where bookings have not yet started but construction has begun prior to March 31, 2019, will not be considered a ‘ongoing project.’ It will be treated as a new project and subject to the new tax rates.

Q.: What are the requirements for certifying that a project’s construction has begun by March 31, 2019?

A building project is regarded to have commenced on or before March 31, 2019, if the construction work for site preparation has been finished and construction for the foundation has begun on or before that date.

Q.: Is it possible for a promoter or a builder to pay tax at the old rates of 8% and 12% with ITC?

Yes, a promoter or builder can exercise a one-time option to pay tax at previous rates in the case of an ongoing project.

This must be submitted in the prescribed form to the Jurisdictional Commissioner by May 20, 2019. If they do not communicate, it is assumed that they have chosen to pay taxes at new rates. Additionally, once a choice has been submitted, it is not possible to change it.

Note:

- This option must be used independently for each ongoing project. As a result, promoters have a variety of options for various projects he is now working on.

- This option is also accessible for specific government housing programmes such as PMAY, Housing For All, RAY, or any other housing programme run by the state and central governments.

- This option can only be used by a promoter or a builder, not by the buyer.

Q.: What is the GST rate that will be applicable on the construction of commercial apartments [shops, godowns, offices, etc.] in a real estate project beginning on April 1, 2019?

| Description | Rate (after deduction of the value of land) |

| Commercial Apartments in Residential Real estate Project (RREP) where the construction has commenced on or after 1st April 2019 or; An ongoing project where the promoter has opted for new rates | 5% without ITC on the total consideration |

| Commercial Apartments in Real estate Project (REP) other than RREP or; An ongoing project where the promoter has opted for old rates | 12% with ITC on the total consideration |

Q.: What are the GST rates for TDR, FSI, and long-term land leases?

Development rights or FSIs are exempt from tax by means of an agreement on or before 31 March 2019 even if the consideration is paid in whole or in part on or after 1 April 2019 (cash or nature).

The tax rates are as follows:

If the supply of TDR, FSI, or long-term lease of land is used for the construction of residential apartments, the TDR tax must be calculated using the following formula:

- GST is levied on the proportionate value of the construction of residential apartments that remain unbooked on the date of issue of the Completion Certificate/first occupation. The tax rate is 18%, subject to a tax amount that is limited to 1% or 5% of the apartment’s value, depending on whether the TDR/FSI is used for an affordable residential apartment or for a non-affordable residential apartment.

- If the supply of TDR, FSI, or long-term lease of land is used to build commercial space, the GST rate is 18%

Q.: Who is responsible for GST on TDR and floor space index?

On or after 1 April 2019, the developer is liable to pay reverse fees for the GST on a TDR or floor space index. Even when the landowner is not regularly engaged in land-related business, the transfer by such a person of development rights to the promoter is liable to the GST as considered service provision under section 7 of the CGST Act. In addition, GST applies at 18 per cent for reverse charge in the case of external delivery of TDR from one developer to another.

Q.: When should the promoter’s tax responsibility on the delivery of TDR, FSI, and long-term lease be discharged?

| Description | Point of taxation |

| TDR | The liability to pay tax arises on the date of completion or first occupation of the project whichever is earlier. Thus, GST would be applied on the value which is proportionate to the construction of residential apartment that remains unbooked on the date of issue of Completion Certificate/first occupation. |

| FSI | For FSI received after 1st April 2019: If consideration for FSI is in the form of construction of commercial or residential apartments – Liability arises on the date of issuance of Completion Certificate. If consideration for FSI is in monetary form–For Residential Apartment Construction: Liability arises on the date of issuance of Completion Certificate.For Commercial Apartment Constructions: Liability to pay tax shall arise immediately. |

| Long term lease | For long term lease received after 1st April 2019: Liability arises on the date of issuance of the Completion Certificate in case of construction of residential apartments. However, liability to pay tax shall arise immediately if such long term lease is related to commercial space. |

Q.: Is it possible for the promoter (begun on or after 1 April 2019) to pay tax at an old 12% or 8% (with ITC) for the new project?

No, such an option does not exist. This option is not available for any housing projects run by the federal or state governments, including PMAY, Housing for All, RAY, and others. Promoters must pay tax at the new rates for projects that begin on or after April 1, 2019.

Q.: Can a promoter revise an invoice in accordance with Section 34 of the CGST Act by issuing debit/credit notes?

If invoices issued by a promoter prior to the 20th of May 2019 are not in accordance with the tax rate option exercised by him, a debit/credit note can be issued to bring the transaction in accordance with the final option exercised by him.

Q.: What is the classification and tax rate of a contractor’s contractual service to a developer or developer under the new scheme?

- Accessible housing project – 12%, providing more than 50% of the total area of the tapestry is affordable housing.

- Project for residential housing Aside from Accommodation Access – 18%.

- Commercial lodging -18%.

Q.: How to calculate the credit note tax adjustment, if the unit has been booked before 1 April 2019 but has been cancelled later?Suppose the purchaser paid the Rs.10 lakhs gross reservation before 1 April 2019. On the booking amount, the developer paid GST of Rs.1.2 lakhs (12 percent of Rs.10 lakhs). In this situation, a developer can make a tax adjustment of Rs.1.2 lakhs at the time of cancellation, as long as the full price is reimbursed to the buyer by September 2019.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.