How to close down LLP in India

Table of Contents

How to close LLP in India

LLP Strike Off (Closure)

First we need to understand LLP then we will understand closer of LLP:

Limited Liability Partnership is a sought of an alternative corporate business, which strives to provide the benefits of limited liability of a company and the flexibility of a partnership. Change in partners does not affect the existence of LLP. Change in partners structure does not affect the existence of LLP. It has the ability to make contracts and own property in its name.

The Limited Liability Partnership is a separate legal entity with full accountability for its assets, but the partners’ liability is limited to their agreed-upon contribution to the LLP.

LLP Strike Off:

- If the Limited Liability Partnership wishes to stop down its operations or if it has not carried on any business operations for a year or more:

- In case Limited Liability Partnership wishes to stop down its operations or if it has not carried on any business operations for a year or more,

- Make application for close down the Limited Liability Partnership. When the LLP does not start business operation or fails to submit yearly returns, the registrar may suo-moto close down the LLP.

What are the reasons for an LLP to strike off?

-

Penalties/Fines must be avoided:-

If an inactive or non-functioning LLP breaks the law, its officers may face harsh fines, penalties, and punishments, including the Directors being prevented from forming another LLP in some cases. As a result, in order to avoid future fines or liabilities, it is better to officially dissolve an inactive LLP.

-

Closure in a shorter amount of time:

Traditional techniques are more time-consuming and inconvenient, but inactive or non-functioning LLPs can be closed in 3 to 16 days.

-

No Obligation to Comply:

The promoters or directors are liberated of their compliance responsibilities and the risk of non-compliance because the LLP ceases to exist once it is closed.

Pre-Conditions for striking off LLP-

LLP need to be closed down / LLP close down can be done on the following conditions:

- LLP must not have any business activity from inception or period of more than one year. and

- When partner agreed to remove name of LLP from register of LLP.

- Before filing Form 24, file due date is overdue Form 8 and Form 11 returns up to the end of the financial year in which the limited liability partnership ceases to carry on business or commercial operations.

- For the purpose of closer of LLP partners must clear all the outstanding payment of all payment of creditor.

PROCEDURE FOR REGISTRATION OF LLP

- Limited Liability Partnership same as a traditional partnership with a advantage of limited liabilities of each partners. In fact, LLP has its own legal terms and conditions and LLP and have separate rules and regulation for registrations. There is a process for registration of LLP. In LLP there is various advantage but subject to some disadvantage.

- LLP registration process take three to six month to register LLP subject to Registrar’s office work. Ministry of Corporate Affairs place the details on website of MCA after approval of the application of LLP registration for a period of one month.

- Many person who want to register their organization under Limited Liability Partnership do not know How to register LLP Company but, most of them does not know how to close the LLP.

- We explain the details to register Limited Liability Partnership and closer of LLP in India. In this matter following steps would be required in for closer of LLP firm in India.

Seven Important steps to Close an LLP in India

- Step 1 – Pass a Resolution

- Step 2 – ROC Form 1 Filings

- Step 3 – Declaration of the Debt

- Step 4 – ROC Form 4 & Value of the Assets

- Step 5 – Obtain consent from the Creditors

- Step 6 – Filings and Appointment of Liquidator

- Step 7 – Finalization of the Accounts of LLP

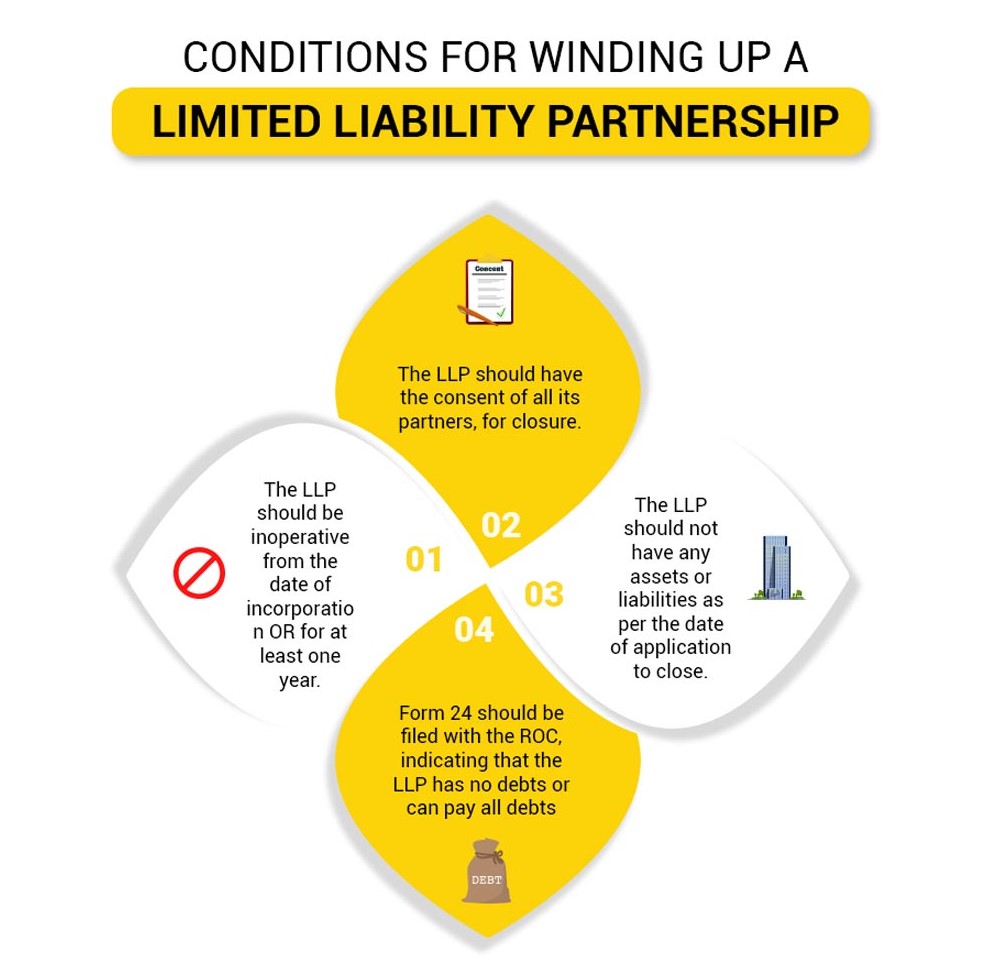

CONDITIONS TO CLOSE AN LLP

For closer of LLP to file an application with Registrar’s officer with consent of partner and creditor, statement of assets and liabilities, indemnity bond, acknowledgement of ITR, resolution and other documents.

- The Limited Liability Partnership must not have carried its business or commercial activity for the duration of one year or more.

- A statement of account, certified by a Chartered Accountant, showing zero assets and liabilities as of the date of filing, but not earlier than thirty days.

- Limited Liability Partnership should not own any liabilities and assets.

- LLP should not own an active Bank Account. In case LLP has bank account then it must be closed and certificate from bank showing closer of Bank Account.

- Required the consent of all partners of LLP.

- All Designated Partners must sign a statement of fact and an Indemnity Bond pledging to protect the Registrar against any responsibility that may arise after the name has been scratched out.

- When LLP maintaining any business and has filed then a copy of the last Income-tax return must be filed by the LLP.

- Confirmation letter required from all the creditors that the LLP has no liability or payment due.

- IT returns for the last Financial Year is filed

- The designated partner PAN card copies is required.

- scanned copy of Adhar proof of all the partners and designated Partners is required.

- Copy of partners agreement with LLP is required.

- Permanent address of all the designated partners and partners must be submitted.

PROCEDURE TO WINDUP AN LLP

- If an LLP want to close down its business or if it has not carried on any commercial operations for a year or longer, it can apply to the Registrar to removed the name of LLP from the register of LLPs.

- If a limited liability partnership does not begin or maintain its business operations for a set amount of time, it is considered inactive in the eyes of the law, and its name is removed from the register. The following situations result in the dissolution of an LLP:

- One or more partners die or go bankrupt. By Court Order / Mandatory Judicial Decision The term has come to an end.

- The penalty in case of defaulting in statutory filing return is Rs 100 per day. So, it is the best option to windup dormant LLP’s to avoid unnecessary penalty and compliances.

- We already discussed the Limited Liability Partnership (Amendment) Rules in 2017, in which process of wind up a LLP was very difficult and very time consuming but introduction of LLP Form 24 make it very easy and simple.

- it is better for Enterprise to close dormant or defaulting LLPs which generate penalty and additional compliances

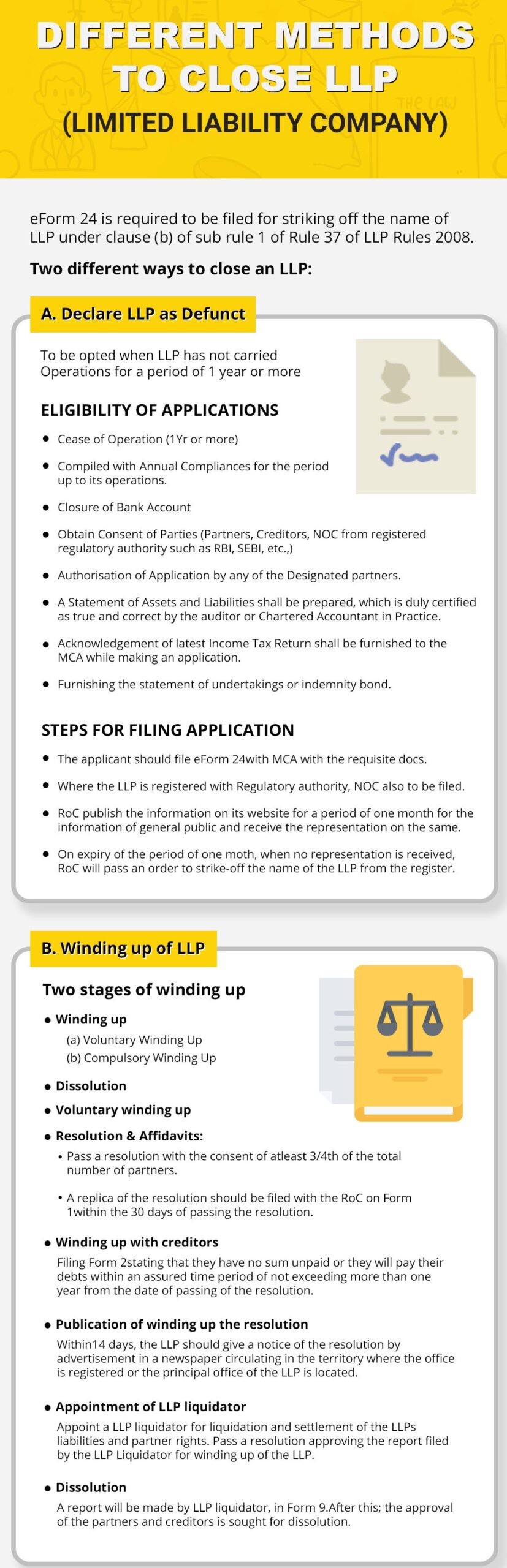

FILING LLP FORM 24

Following steps should be followed in India for closing an LLP by filing Form 24:

STEP 1: COMMERCIAL ACTIVITY – CEASE

- LLP which never commenced any business activity or have to ceased commercial activity can file Form 24.

- A LLP which is operational but promoters want to close down the LLP then first they need to ceased their all commercial activities before filing Form 24.

STEP 2: CLOSE BANK ACCOUNT

- Creditor and Bank account of LLP should be nil or zero before filing LLP Form 24 that means before filing Form 24 creditor should be fully paid off and bank account opened in the LLPs name must be closed and evidence supporting to closure of bank account in the name of LLP must be obtained from Bank.

STEP 3: AFFIDAVITS & DECLARATION PREPARATION

- Every Designated Partner of the LLP must be execute the facts of declaration, either jointly or separately, so that the Limited Liability Partnership (LLP) ceased to carry forwardcommercial activity from the Date of commencement of business.

- In other words LLP Partners should declare that LLP does not have any liability, and if any liability arise after removal of LLPs name from register. Processing through Form LLP 24, partner liability shall not be stopped even after the strike off the LLP.

STEP 4: PREPARE DOCUMENTS

- Income tax return statement of the LLP and the LLPs deed must be offered with Form LLP 24.

- The income tax return shall not be required, if LLP has not filed any income tax return it not has any business activity or else, with the application to close the LLP, an acknowledgment copy of the most recent filed income-tax return can be attached.

STEP 5: FILE ALL PENDING DOCUMENTS

Within thirty days of registration, agreement must be entered with the MCA after the LLP incorporation. . If this compliance was missed to be filed along with the LLP agreement due to unavoidable circumstances, then the first LLP agreement; whether it is entered into and not filed, along with any amendments, should be filed duly.

In additional, on or before filing Form 24, overdue return (in Form 8 and Form 11)up to the end of current financial year in which the limited liability partner (LLP) ceased to exist their commercial activity or business should be filed on or before filing the LLP Form 24.

On the date when Limited Liability Partnership ceased their money generation operation that date deemed to be date of cessation date of said limited liability partnership, and other subsequent procedure which is required for said LLP strike off such as cash receipts from debtors or money payment to creditors and other activity which is not part of cessations will not be part of the part of the money generation business.

STEP 6: OBTAIN A CHARTERED ACCOUNTANT CERTIFICATE

An account statement showing nil assets and nil liabilities must be obtain, which is authorized by a Chartered Accountant till the date not more than 30 days from the date of filing Form 24, once the mandatory document for filing LLP Form 24 is prepared.

STEP 7: FILE LLP FORM 24

All documents along with the LLP Form 24(Download- LLP Form 24) must be filed with the MCA to remove the name of LLP. While processing the application; found any reservation then Company’s Registrar will send detailed notice to be published on MCA website announcing the name of removal of limited liability partnership.

Note:

- If a limited liability partnership (LLP) is close down, all designated partner’s liability carry on and can be changed by creditors if LLP had never been dissolved.

- After the prescribed had passed since notice was published in the notification, Registrar of Companies should remove the name & Limited Liability Partnership(LLP) will stand dissolved.

- Note: if limited liability partnership have been close down, Liability of all Designated Partners of the LLP would continue & can be enforced as if the LLP had never been dissolved.

Conclusion

- The provision of removal of Limited Liability Partnership is the good news for the entrepreneurs having dormant or defaulting LLP which is not carrying any activity.

- After LLP Amendment Rules 2017 introduction has made the operation of winding up less cumbersome.

- Enterprises are now able to close off the limited liability partnership’s that are non-functioning and are accruing fines.

The process will ensure that the owners of the LLP’s get relief from heavy compliances.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.