Know your income tax under each slab in India

Table of Contents

How do you calculate your income tax under each slab in India?

Do you know how much you pay as taxes each year from your income? If you get your auditing done from an external source or have the firm you are working for make the deductions, there’s not much you would know about it. So, let’s get ahead of the game and understand these taxes and, most importantly, how to calculate your income under each slab for 2024.

What are Income Taxes?

Before we get to the core of this subject, let’s get our basics right.

Income tax is a direct tax that is paid to the Government of India based on different sources of income. It is paid by Indian residents and non-residents. The accurate or exact value of the Income Tax is calculated according to various factors. Deductions and tax slabs play a major role in this, and it requires special mention.

But the main question here is, how do you calculate income tax according to the income tax slab?

Income Tax Calculation According to Tax Slabs

Income tax calculation based on the slab is pretty simple and easy to understand. All you need to do is follow the steps mentioned below:

-

Consider All Of Your Income

Now, it might seem right to only consider your income from the main source, but that is not how it exactly works. You will have to consider your income from all the sources. You might have income from different sources, such as your salary, commission, business turnover, and more. All this income is to be accounted for.

-

Exclude the Exemptions

An exemption is a form of income that can be deducted from gross income when computing income taxes. Agriculture income, conveyance allowance, transfer allowance, and so on are all excluded from income tax calculations.

-

Calculate Deductions that Apply to You

Deductions refer to expenses that could be reduced from taxable income in order to reduce the income tax that you have to pay.

For instance, let’s look at the Section 80C deductions of the Income Tax Act:

- Deductions for investments that you make in PPF, ELSS, Life insurances, NSC, Mutual Funds, ULIPS, Senior Citizen Saving Schemes, and more.

- Deductions on the interest that is received on a savings account, education, rent, and more.

- The deductions for the premiums paid in medical insurance, donations, and more.

-

Draw Your Net Taxable Income and Apply the Tax Slab

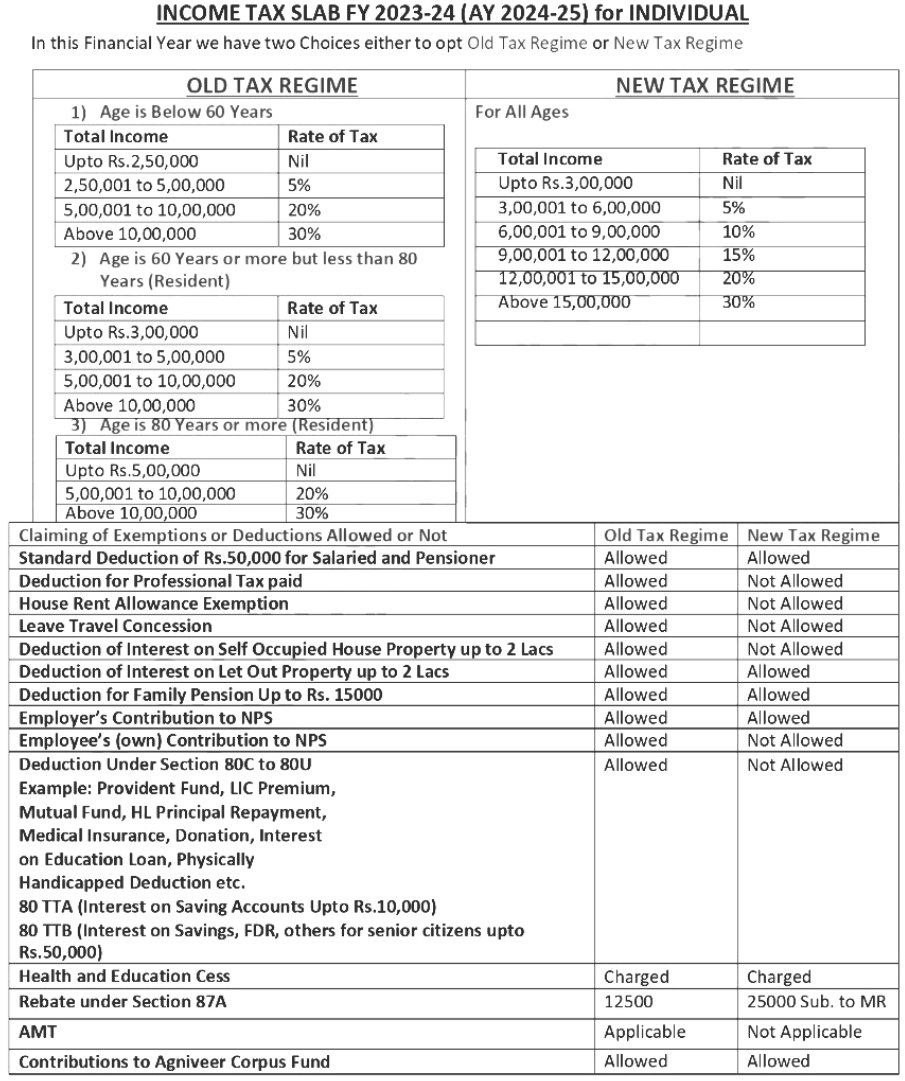

Taxpayers are divided into varied groups based on their taxable income. So, for every range of income, you will find a different tax slab. The current tax slab is provided here; have a look for a better understanding. Here are the tax slabs for the Financial Year 2023-24 (Assessment Year 2024-25) under the old regime:

Up to ₹2,50,000: Nil

₹2,50,001 – ₹5,00,000: 5%

₹5,00,001 – ₹10,00,000: 20%

₹10,00,001 and above: 30%

A surcharge is applicable for total income beyond certain limits. For example, a surcharge of 10% is applicable for total income between Rs.50,00,000 and Rs.1,00,00,000, and it increases to 15%, 25%, and 37% for higher income brackets.

The Income Tax Slabs for FY 2023 – 2024

| Income Range | Tax Slab |

| Up to Rs. 2.5 lakhs | 0% |

| Rs. 2.5 lakhs to Rs. 3 lakhs | 0% |

| Rs. 3 lakhs to Rs. 5 lakhs | 5% |

| Rs. 5 lakhs to Rs. 6 lakhs | 5% |

| Rs. 6 lakhs to Rs. 9 lakhs | 10% |

| Rs. 9 lakhs to Rs. 10 lakhs | 15% |

| Rs. 10 lakhs to Rs. 12 lakhs | 15% |

| Rs. 12 lakhs to Rs. 15 lakhs | 20% |

| More than Rs. 15 lakhs | 30% |

Now, based on this tax slab, let’s understand how you fit in. As mentioned previously, if you fit into the range of Rs. 5 lakhs to Rs. 6 lakhs, your tax slab will be 5% of your income. This income needs to be the net income after you deduct exemptions and various other deductions.

Why It’s Important For You to Pay Taxes

The thought of whether every individual needs to pay taxes might pop into your head; well, there are reasons why no one should skip this aspect.

-

It is the Source of Building Our Nation

What is the cost of running an entire country? Especially when it is the most populated in the world. It is through the taxes that we pay the Government to perform all kinds of civil activities.

In simpler terms, without taxes, it wouldn’t be possible for the Government to run the country. Income tax is the Government’s major source of income. Most of us might feel it’s a burden, but that can directly affect the growth of the country, and mostly also a social collapse.

-

There Will be Improvements in Healthcare and Education

A significant amount of the taxes collected each year is driven toward the healthcare and education spectrum. There are government hospitals and schools that offer services even without a minimum cost.

The quality of these services has been growing, and more is being spent on infrastructure developments. All of this ultimately makes the country more prosperous and powerful.

-

You will Contribute to Welfare Schemes

At present, there are more than 50 union government schemes in the country. Beginning from employment programs, home loan subsidies, cooking gas concessions, pension schemes, and more, the Government has always been launching them to help the public and society.

These schemes come as an added advantage to millions of citizens. But the schemes required crores of rupees to be established successfully. By the payment of income tax, you play a role in the success of these schemes and provide the Government with more ability to establish more schemes.

This is just a heads-up for you to pay your taxes in time according to your tax slab!

Final Thoughts

This is the simplest way you can understand your tax slabs and how to calculate your income to apply it to these tax slabs. Knowing your tax slabs becomes even more important when you are self-employed or are a freelancer since you need to pay taxes by filing an ITR. We hope this post helped you to know your taxable income and how to calculate it.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.