Overview on Eligibility For claiming a Refund of TCS

Table of Contents

Overview on Eligibility For claiming a refund of Tax Collected at Source

Tax Collected at Source (TCS) is a tax that is collected by the seller from the buyer at the time of sale. The seller then deposits this tax with the Income Tax Authorities.

Section 206C of the Income-tax Act, 1961 in India governs the provisions related to Tax Collected at Source. This section specifies the goods on which the seller is required to collect tax from the buyers. The objective behind Tax Collected at Source is to collect tax at the source from specified transactions rather than collecting it at the end of the financial year.

Example of Tax Collected at Source : in case a buyer is purchasing a car that costs Rs 10.01 lakhs then an amount of Rs 10,010 would be payable as TCS. This amount would need to be submitted to a particular branch of the bank which has been given permission by the government for receiving such payments.

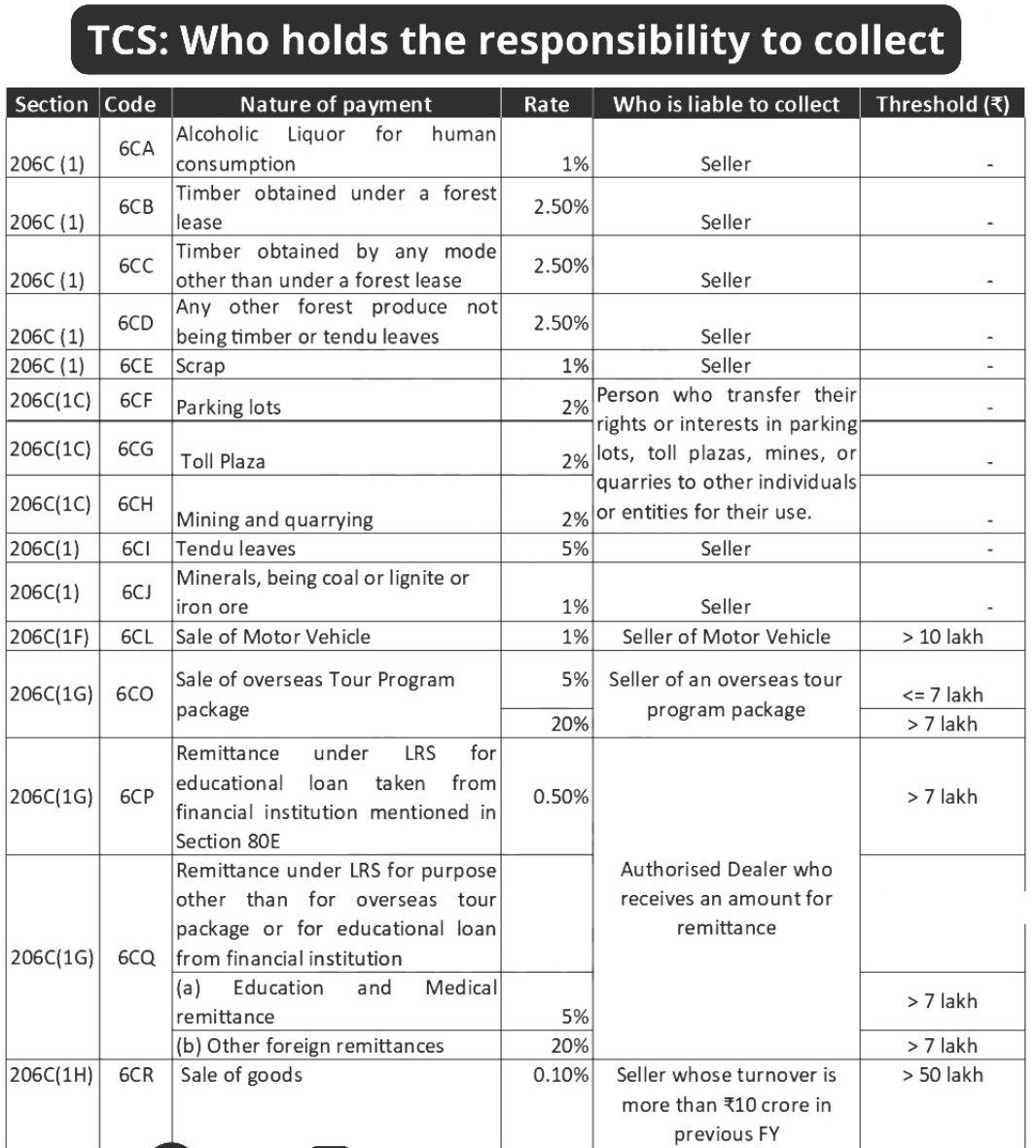

Who is responsible for Collecting the TCS

The government specifies certain transactions and goods on which TCS is applicable, and sellers engaged in these transactions are responsible for collecting TCS from the buyers. The rates at which TCS is collected can vary depending on the nature of the transaction and the applicable provisions of the Income Tax Act.

It’s important for sellers to accurately collect TCS as per the prescribed rates and timelines and comply with all the reporting and deposit requirements specified by the tax authorities. Failure to comply with TCS provisions can lead to penalties and other legal consequences.

Eligibility For claiming a refund of Tax Collected at Source:

If the total Tax Collected at Source amount is higher than the Income Tax taxpayer’s tax liability for the year. If the taxpayer files their ITR Return on time. If the Income Tax taxpayer possesses supporting documents for remittances, such as bank statements & Forex card statements. It’s important to ensure that all details provided in the ITR regarding Tax Collected at Source transactions are accurate and match the information available with the Income Tax Department. So Provide the details of the Tax Collected at Source transaction, including the amount, the seller’s PAN, and the TCS certificate details. Any discrepancies may lead to delays or complications in processing your refund claim. Taxpayer can indeed claim a Tax Collected at Source refund via Tax Department’s e-filing portal by following these steps:

- Visit the official Income Tax Department’s e-filing portal and log in using your credentials.

- File Income Tax Return (ITR) via Navigate to the option to file your income tax return (ITR) for the relevant assessment year.

- While filling out your ITR, provide details of the Tax Collected at Source transaction for which you are claiming a refund. This includes information such as the amount of Tax Collected at Source paid, the seller’s PAN & details of the Tax Collected at Source certificate.

- Claim Tax Collected at Source refund : Within the ITR form, there should be a specific section or schedule where you can claim a refund for the Tax Collected at Source paid. Fill out this section accurately with the required details.

- File & and verify ITR: After completing the relevant sections of the ITR form, submit it through the e-filing portal. Ensure that you verify your return using any of the available methods (e-verification, digital signature, or sending a physical copy).

- Taxpayers may Track TCS refund status. After filing your return, you can track the status of your refund through the Tax Department’s online e-filing portal. Once processed, the refund amount will be credited to your bank account.

In summary

it can be Say that TCS is income tax collected by seller from buyer on sale so that it can be deposited with the tax authorities. Section 206C of the Income-tax act governs the goods on which the seller has to collect tax from the buyers. The list of goods on which Tax Collected at Source is applicable may vary and is updated by the government from time to time. Sellers are required to collect tax at the prescribed rates and deposit it with the government within the specified timelines. This mechanism helps the government in tracking transactions and preventing tax evasion. For claiming TCS refund its is essential to meet these eligibility criteria and provide accurate information while claiming a refund of TCS.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.