Key legal framework for corporate governance in India

Table of Contents

Key legal framework for corporate governance in India

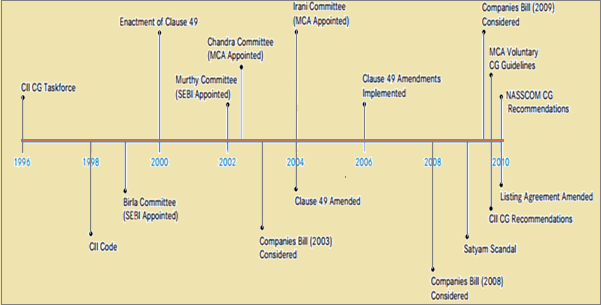

The Companies/ firm framework for corporate governance initiatives in India consists of MCA and SEBI. SEBI monitors and regulates corporate governance of listed companies in India through Clause 49.

The Companies Act 2013

- The Companies Act has placed greater emphasis on corporate governance through the board and board processes. The Act covers corporate governance through its following provisions:

- Every company is required to appoint 1 (one) resident director on its board.

- Nominee directors shall not be treated as independent directors.

- Listed companies and specified classes of public companies are required to appoint independent directors and women directors on their boards.

- Companies Act for the first time codifies the duties of directors.

- Listed companies and certain other public companies shall be required to appoint at least 1 (one) woman director on its board.

- Companies Act mandates following committees to be constituted by the board for prescribed class of companies:

- Audit committee

- Nomination and remuneration committee

- Stakeholders relationship committee

- Corporate social responsibility committee

Listing agreement – Applicable to the listed companies

- SEBI has amended the Listing Agreement to align it with Companies Act.

- Clause 49 of the Listing Agreement can be said to be a bold initiative towards strengthening corporate governance amongst the listed companies. This Clause intends to put a check over the activities of companies in order to save the interest of the shareholders. Broadly, cl 49 provides for the following:Clause 49 of the Listing Agreement can be said to be a bold initiative towards strengthening corporate governance amongst the listed companies. This Clause intends to put a check over the activities of companies in order to save the interest of the shareholders. Broadly, cl 49 provides for the following:

-

1. Board of Directors

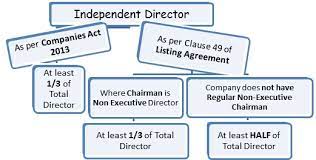

The Board of Directors shall comprise of such number of minimum independent directors, as prescribed. In case where the Chairman of the Board is a non-executive director, at least one-third of the Board shall comprise of independent directors and where the Chairman of the Board is an executive director, at least half of the Board shall comprise of independent directors. A relative of a promoter or an executive director shall not be regarded as an independent director.

-

Audit Committee

The Audit Committee to be set up shall comprise of minimum three directors as members, two-thirds of which shall be independent.

-

Disclosure Requirements

Periodical disclosures relating to the financial and commercial transactions, remuneration of directors, etc, to ensure transparency.

-

CEO/ CFO Certification

To certify to the Board that they have reviewed the financial statements and the same are fair and in compliance with the laws/ regulations and accept responsibility for internal control systems.

-

Risk Management

The 2013 Act and Revised Clause 49 specify requirements related to risk management. Audit Committee and the independent directors of the company are entrusted with the responsibility of evaluating the robustness of the risk management systems and policy laid down by the Board.

-

Code of Conduct

Clause 49 mandates directors of every listed company to lay down a Code of Conduct and post the code on their company’s website. The Board members and all senior management personnel are required to affirm compliance with the code annually and include a declaration to this effect by the CEO in the Annual Report.

-

Report and Compliance

The Company shall obtain a certificate from either the auditors or practicing CS of-compliance with the conditions of Corporate Governance and annex the same with the Directors’ Report.

-

Executive Remuneration

The 2013 Act and Revised Clause 49 mandate the formation of a Nomination & Remuneration Committee comprising of at least three directors, all of whom shall be non-executive directors and at least half shall be independent. The NRC is to ensure that the level and composition of remuneration is reasonable and sufficient; the relationship of remuneration to performance is clear and meets appropriate performance benchmarks; and the remuneration to directors, key managerial personnel and senior management involves a balance between fixed and incentive pay reflecting short and long-term performance objectives appropriate to the working of the company and its goals.

Landmark Cases of failure of Corporate Governance

Satyam Case

-

- Satyam Computer Services scandal was a corporate scandal affecting India-based company Satyam Computer Services in 2009, in which Chairman Ramalinga Raju admitted that the company’s accounts had been manipulated. The Satyam scandal was a Rs 7000 crore corporate scandal in which accounts had been manipulated.

- On 7-1-2009, Ramalinga Raju sent an e-mail to SEBI, wherein he confessed to falsify the cash and bank balances of the company. Weeks before the scam began to unravel with his popular statement that he was riding a tiger and did not know how to get down without being killed. Raju had said in an interview that Satyam, the fourth largest IT company, had a cash balance of Rs 4000 crore and could leverage it further to raise another Rs 15,000-20,000 crore.

- Ramalinga Raju was convicted with 10 other members on 9-4-2015. Ramalinga Raju and three others were given six months jail term by Serious Fraud Investigation Office (SFIO) on 8-12-2014. Even auditors Price Waterhouse Coopers (PWC) had to face a hard time.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.