Online Income Tax E-filing & Its Benefit

Table of Contents

Point to be taken care while filling Online Income Tax E-filing

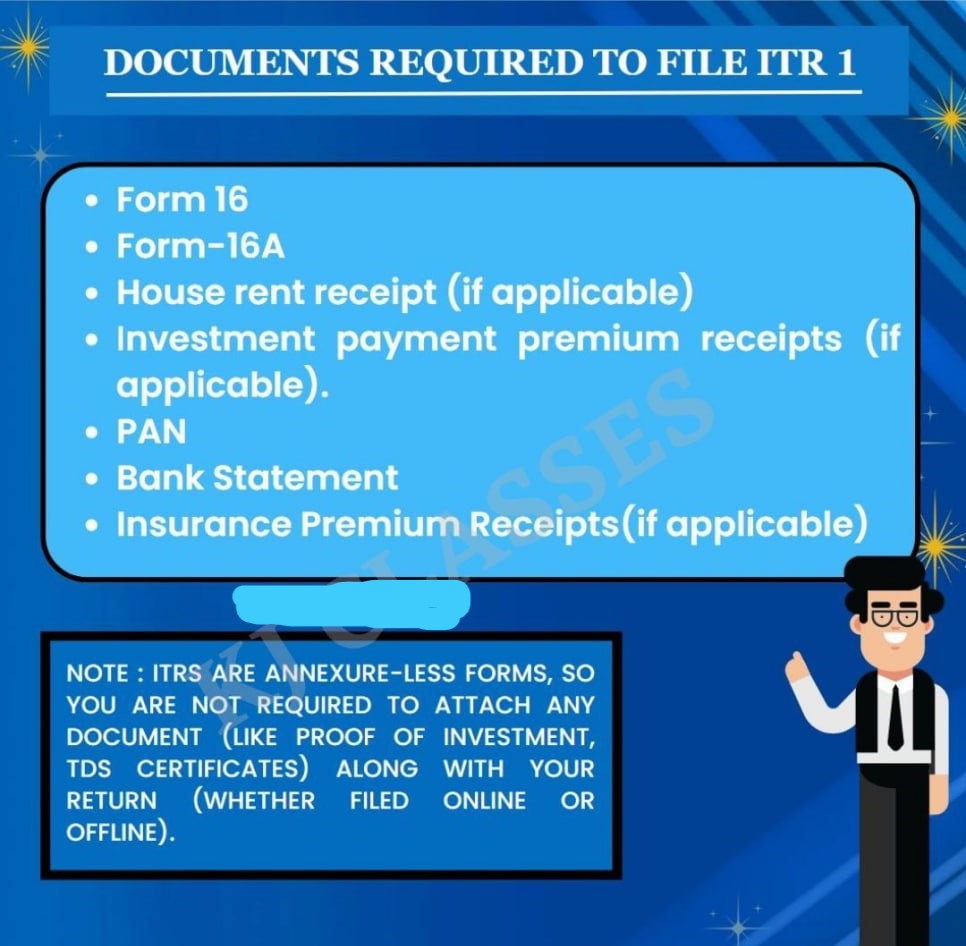

- Confirm that the pre-filled details are correct by verifying PAN, permanent address, contact information, bank account information, etc. Find the appropriate return for you (from ITR-1 to ITR-7). Provide all pertinent information in the return, including the total amount of income, any deductions, any interest payments, any taxes paid or collected, etc.

- Safety measures must to be taken before filing an ITR : The income tax return should not contain any additional papers. The taxpayer needs to determine which return form is appropriate in his situation. Complete the return form’s information with care. Verify the total income, any deductions, interest, tax liability, refund, and other computations.

- taxpayers should compare the data in their AIS statement with their bank passbook, interest certificate, Form 16 & capital gains statement from brokerages also In the case of the purchase and sale of equity/mutual funds.

- State details of all Indian bank accounts

- Complexly mentioned your details of unlisted equity shares

- All the details bout directorship carried in foreign companies as well as Indian.

- The schedule liabilities and assets: the details of the specified assets like movable assets, land, building etc, & financial assets (shares & securities, bank deposits, cash in hand, etc.), as well as the liabilities, required to be disclosed if income of person is more than INR 50,00,000/-.

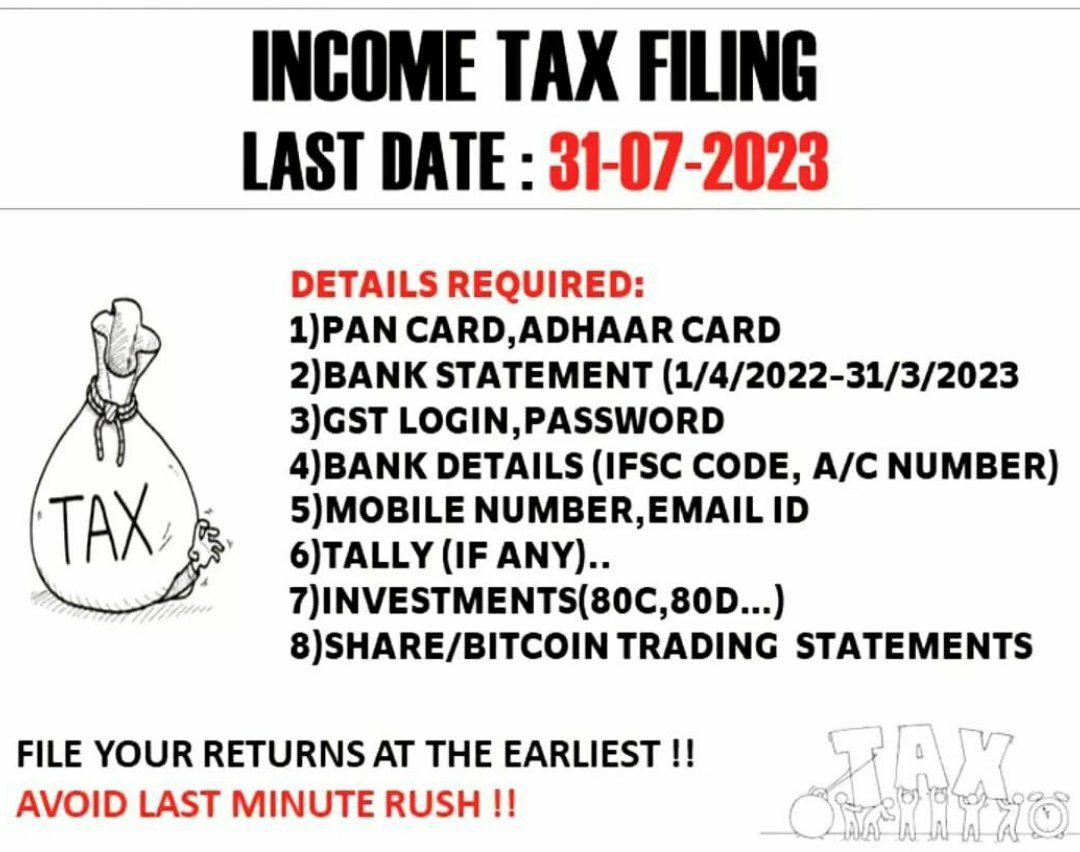

- The finance Ministry has been sending out reminders to taxpayers via email, SMS, and media campaigns, advising them to not wait until the last minute to file their income tax returns.

- To help taxpayers with e-filing ITRs, the Directorate of Systems is hosting webinars for frontline department staff (ASK Centres and TPS).

- The Directorate of Systems, in coordination with Infosys personnel, is using the ICAI platform to promote knowledge about how to resolve issues that arise during the e-filing process.

- ITD has created educational videos on its YouTube channel for the benefit of taxpayers.

- All income tax taxpayers who have not yet filed their ITRs returns for the FY are urged to do so as soon as possible.’

Online Income Tax E-filing – Benefit

Tax E-filing has been made mandatory by the Govt of India. The Income tax process is very simple as compared to previous paper base filing process. The Benefit of Online Income Tax filing are mentioned below :

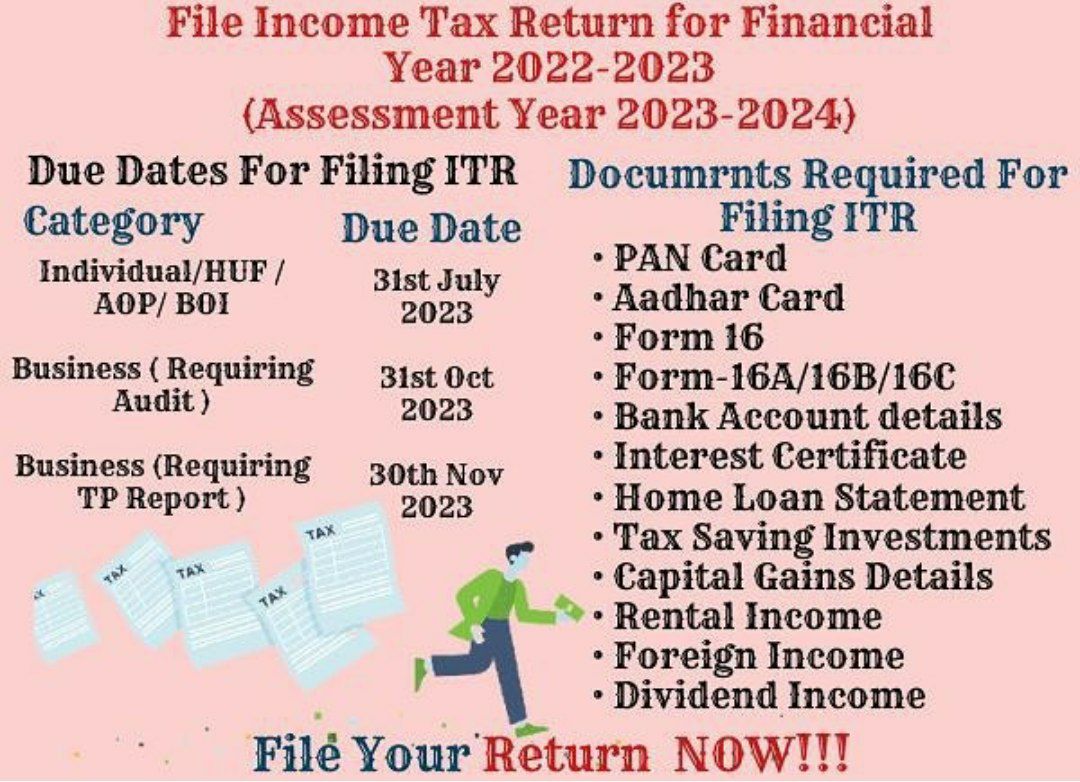

- Every year on July 31st, tax returns have to be submitted. Clients can complete the task more rapidly and with less congestion if they submit it one or two months before the deadline because servers tend to be become overloaded as the deadline draws near.

- Online tax return filing allows the taxpayer to more effectively maintain track of all financial transactions with the Tax Department.

- If the Income tax taxpayer later needs to conduct business with any other organisation that maintains such information, this record may come in handy.

- The Income taxpayer is responsible for paying penal interest for each additional day until the day that the payment is made if he is unable to file an ITR for the preceding year.

ITR-1 for AY/FY 2023-24/2022-23 is available now on Income Tax portal

Our Services :

- Financial Reporting & Compliances: Setting Up, Running and Supervising Financial Accounting, Tax Payments (Direct, Indirect and Employee Related), including MIS, Interim Financial Statements, Data Analytics and More…

- Risk Management & Internal Audit: Review of Operations, Illustrative Coverage in Business Processes, Management Issues tailored as per your needs.

- Advisory Services: Business Strategy, Corporate Restructuring, Corporate Finance, Shareholder Wealth Management, Corporate Governance, Building Accounting Manuals, Global Accounting Services.

- Taxation: Transactional advice and tax planning relating to Corporate, Non-Corporate Entities etc.

- Valuations: Business Valuation, Real Estate, Brands, Intangible Assets, Securitization etc.

- Legal Advisory & Support: We support in managing your litigations by coordinating with lawyers on our panel or as identified by client to offer support and systematic approach.

- Regulatory Filings: Filings with MCA (ROC), RBI, FEMA, FCRA, Municipal Corporation, Sub Registrar

- Funding: We offer solutions to raise Debt from Banks, NBFCs and Equity from Angel Investors, Growth Funds, Venture Funds, and even Private Equity and from Primary Markets like NSE, BSE

Popular blogs :

- F&Q on NRI Income Tax Compliance (Help Centre)

- Key Provision for NRI Taxation

- Tax implication for NRI on selling property

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.