Process of submission of Form 10A at New e-filing portal

Table of Contents

Process of submission of Form 10A at New e-filing portal

CBDT compulsory all the non-governmental organization or institutions/ trust/societies/ fund/ hospitals registered NGO U/s 12A and Sec 80G or Sec 12AA to be taken fresh Income tax registration in the specified format U/s 10(23C).

The non-governmental organization applicant needs to make an application in Income tax Form 10A with the Commissioner or Principal Commissioner authorized by the Central Board of Direct Taxes on or before the Deadline.

Income tax filing process of Income tax Form 10A is now enabled on the new e-filing portal. The present post summaries Process to submission Form 10A on New Income tax E-Filing Portal.

Income tax Form 10A

Income tax Form 10A was notified by the Central Board of Direct Taxes to enable non-governmental organization or institutions/ trust/societies/ fund/ hospitals to apply for migration of its registration to the new registration scheme as per section 12AB. Any application for registration of non-governmental organization or institutions/ trust/societies/ fund/ hospitals needs to be submit in Income tax form 10A. Form 10A is used for the below purposes:

- For Present non-governmental organization or institutions/ trust/societies/ fund/ hospitals which are registered U/s 12A or sec 12AA before 1-4-2021

- In case Newly established non-governmental organization or institutions/ trust/societies/ fund/ hospitals that are applying for provisional registration U/s 12AB

Deadline date for submission of Income tax Form 10A

Central Board of Direct Taxes vide Circular No. 12/2021 extended the date for filling Income tax Form 10A from 30th June 2021 to 31st Aug 2021. Deadline date for submission of Income tax Form 10A has been complete due to the fact the new income-tax e-filling portal which was started on 7th June 2021 which cannot make Income tax portal Form 10A operational. Aforesaid form was not available on the e-filing portal till 23rd July 2021. This Online e-filing process of Income tax Form 10A is started now on the new income tax e-filing portal.

Object of Income tax Form 10A

Purpose of Income tax Form 10A is mentioned in detail information here under:

- As stated above, Income tax Form 10A is used for re-registration U/s 12AB for trusts or institutions which are already registered or approved under these provisions before 1-4-2021.

- New Income tax Form 10A is also used by trusts or institutions which are newly established and are applying for registration U/s 12A for the first time.

- Moreover, a trust or institution which is in existence for many years but is never registered U/s 12A is also required to use the new Income tax Form No. 10A.

Note: Note: The new Income tax Form No. 10A is used only once in the lifetime of the trust/institution for registration or approval. Income tax Form No. 10AB is needed to be used For subsequent renewal of it,

Eligible Applicants to file Form 10A

The Below Ngo’s can be needed to submit income tax Form No. 10A for register U/s 12A of the Income Tax Act:

- Currently Existing Registered NGO’s: NGO’s that are already registered under any of the erstwhile section 12A or section 12AA before 1-4-2021 shall apply for re-registration U/s 12AB in Form No. 10A.

- Existing Unregistered NGO’s: NGO’s that have already started NGO’s charitable activities However are not registered with Tax dept under any of the erstwhile sec 12A or sec 12AA before 1-4-2021 shall apply for new registration U/s 12AB in Income tax Form No. 10A. Such NGO’s will be given provisional registration for a max period of 3 FY.

- Newly Established NGO’s: New NGO’s which wish to get themselves registered with the Tax dept for availing Income tax exemption U/s 11 & 12 are needed to file application for NGO’s provisional registration in Income tax Form No. 10A

What is specified Date to submission of Income tax Form No. 10A?

Income tax Form No. 10A for re-registration U/s 12AB is needed to be made within 30th June 2021. Currently Unregistered non-governmental organization or institutions/ trust/societies/ fund/ hospitals or New non-governmental organization or institutions/ trust/societies/ fund/ hospitals seeking New registration required to submit Income tax Form 10A within 1 month before the started of the last year from which such Income tax exemption is to be claimed.

List of documents Required for Form No. 10A Filling ?

The list of documents needed for submit Income tax Form 10A are as mentioned below:

- List of documents related with the evidencing the establishment of the NGOs/ trusts.

- Registrar of Public Trusts or Registrar of Firms and Societies or Registration certificate with ROC for section 8 companies,

- FCRA Registration certificate under Foreign Contribution (Regulation) Act, 2010(42 of 2010), if the applicant is registered under such Act

- Existing order granting registration U/s 12A or section 12AA or section 12AB of Income Tax Act

- Order of rejection of application for grant of registration U/s 12A or section 12AA or section 12AB

- The annual accounts of the applicant relating to the prior year for which such accounts have been made up

- Self-certified copy of the report of audit as per the provisions of section 44AB The documents evidencing adoption or modification of the object

What are the Procedure to submission Form 10A on New E-Filing Portal?

Basic Procedure to Income tax online file Form 10A on the new e-filing income-tax portal is as below:

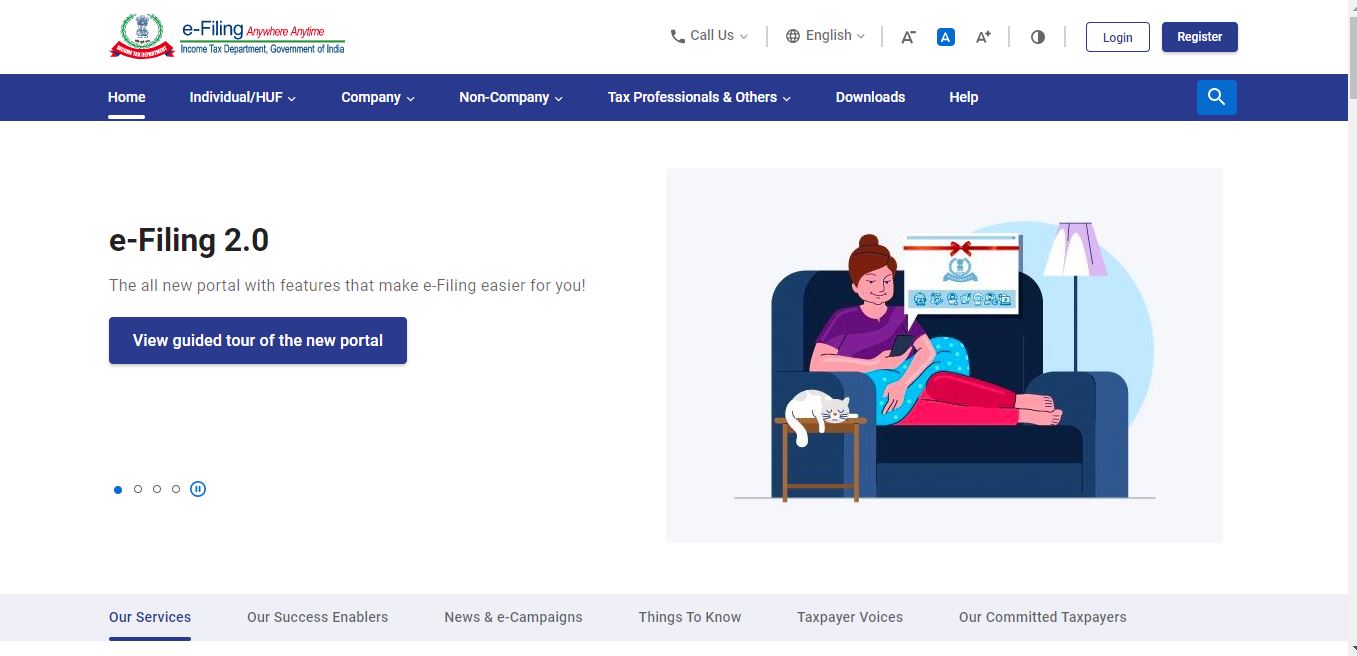

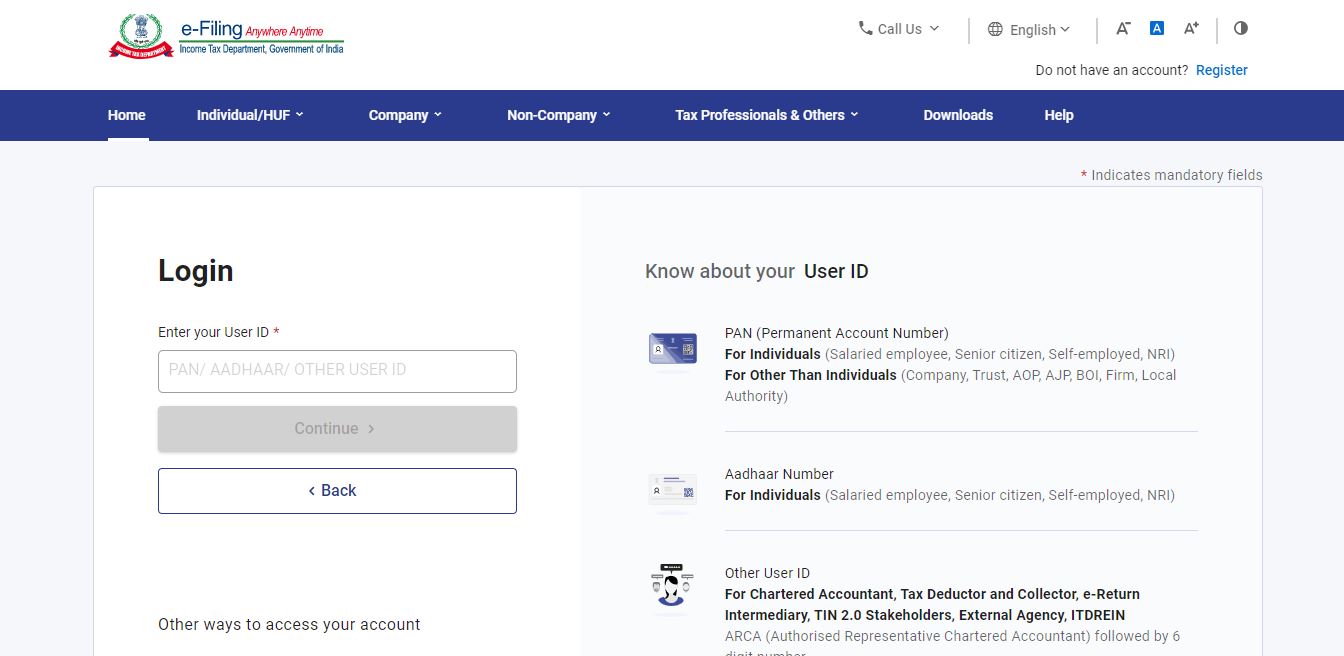

Non-governmental organization or institutions/ trust/societies/ fund/ hospitals registered NGO is needed to access the new e-filing portal and log in to the income tax portal by entering the income tax user ID and password.

Procedure to submission of Income tax Form 10A on New E-Filing Portal – Income tax Homepage

The income tax user can apply Form 10A only after completion of successful income tax logging.

Procedure to File Income tax Form 10A on New E-Filing Portal – Login

- Initially you have to Click on menu titled ‘file & then select ‘File Income Tax Forms’.

- Next Go to Tab titled ‘Persons not dependent on any Income Source (So here Source of Income not been relevant)’. Select ‘Income tax Form 10A – Application for Income tax registration or provisional Income tax registration or intimation’.

- The permanent account number & Filling mode ‘Online at Income tax’ will be prefilled & cannot be edited. Finally we needed to Provide value in field ‘AY’ as 2022-2023

The Income tax Form 10A is reproduced below for reference:

https://incometaxindia.gov.in/forms/income-tax%20rules/103120000000007795.pdf

- Next we go to Click option for ‘Continue’ & then click on ‘Let’s Get Started’ to proceed further. The Income tax form 10A application will be shown. Provide the below mandatory details:

- constitution details or Incorporation details

- Other NGO registrations details

- Religious activities information

- Information of Main Key Persons details

- Assets and Liabilities Details

- Details of Income

- Finally, the Income tax form is needed to be check and verified by EVC or DSC according to the income tax Rule 17A(3)/(4). The name, along with father’s name, & nature of the constitution of NGO, as well as capacity, will be prefilled. After giving details, then you needed click on attach option of button to upload all necessary documents required.

- After the data or information are submitted in that, You have to pic the click on ‘Save’ button option. After all the nassaery sections are completely filled in, each & every option show in the green-ticked & status will be shown as ‘completed.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.