Income Tax Deductions to NRI in India

Table of Contents

Income Tax Deductions to NRI in India

BRIEF INTRODUCTION

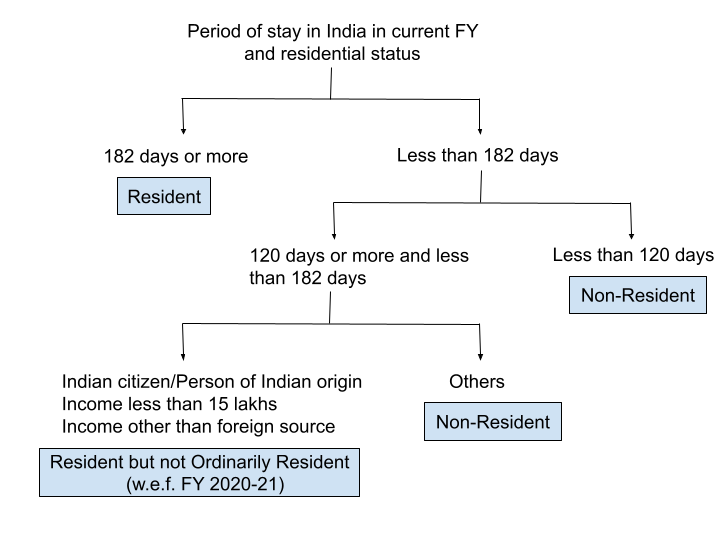

So as defined above, “a non-resident could be a one who isn’t resident in India”, therefore we need to know who shall be considered as Resident in India.

NON-RESIDENT INDIAN

- Where the NRI stayed in India for 182 days or more during the financial year; OR

- Where the NRI have got stayed in India for 60 days within the financial year and for in total of 365 days within the preceding 4 years.

However, there are certain exceptions to the second condition –

- If you’re an Indian citizen who has left India within the yr as a crewman of an Indian ship or for the aspect of employment abroad; or

- If you’re a PIO or a citizen of India who comes on a visit to India;

Then the second condition of 60 Days and 365 days won’t apply to you, which suggests that within the above situations you may be considered resident in India if and only if you were present in India within the relevant year for a period of 182 days or more.

Therefore, you’re a Non-Resident if you do not fulfil any of the above conditions.

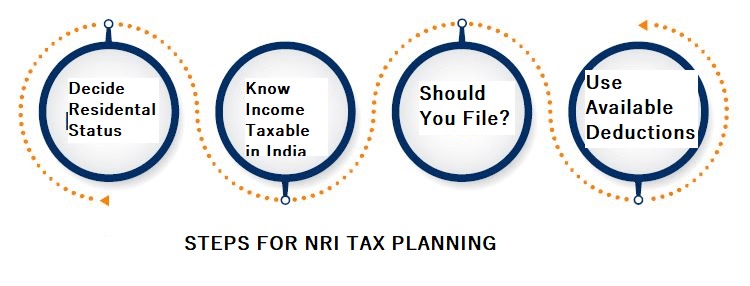

RESIDENTIAL STATUS

- Residential status of an individual is set on the idea of the number of days a personal has physically stayed in India. Residential status has nothing to do with the nationality or domicile of a personal.

- It should also happen that an Indian, who is citizen of India, is also a non-resident for tax purposes during a particular year and an American citizen could also be resident in India for taxation purposes during a particular year.

TYPES OF NON-RESIDENT INDIAN(NRI)

Under income tax Act 1961, non-resident is broadly classified under the subsequent three heads:

- Non-Resident Indian/Person of Indian Origin

- Foreign Company

- Other Non-Resident Person

SALIENT FEATURES

- Residential status is something, which is to be determined for every previous year. Residential status of assessment year isn’t relevant. Also, you’ll be a resident during a previous year and non-resident in another. Hence, it’s to be determined for every previous year.

- It is very much possible to possess dual residential status in a very previous year, i.e., you’ll be a resident in India within the previous year and also resident in another country tell us. it’s going to happen thanks to different set of rules laid down by countries for determination of Residential status.

MEANING OF NON-RESIDENT INDIAN(NRI)

“Non-Resident Indian (NRI)” is a personal who may be a citizen of India or an individual of Indian origin and who isn’t a resident of India. In India Non-Resident Indian is especially governed by two Acts-

- Income Tax Act, 1961 &

- Foreign Exchange and Management Act, 1999(FEMA).

The term “Non-Resident Indian” is defined differently under both the Acts, however one must understand that for the needs of Income-tax, the FEMA Act holds no relevance and you only have to confirm to the provisions of income tax Act 1961.

Person of Indian origin (PIO) – it is an individual who either himself, or any of his parents or any of his grandparents were born in undivided India.

DEFINITION UNDER FEMA ACT, 1999

FEMA, an acronym for foreign exchange Management Act, has its rule stating that if an individual stays within the country for a period but 182 during the continuing fiscal year, then the same shall be regarded as an NRI. Typically, yr starts 1st of April and lasts till 31st March of the subsequent year.

Additionally, the subsequent persons are included within the list of NRIs:

- People employed in organizations and therefore the ones carrying businesses overseas.

• People staying outside India because of some constraints for an unfixed period.

• Government servants deputed by the govt to be stationed overseas.

DEFINITION UNDER INCOME TAX ACT

Currently, an individual shall be considered to be NRI under the IT Act if he or she fulfils the subsequent conditions.

- If the concerned person is absent for more than 182 days within the current yr.

- If the concerned person has not been present for a period of twelve months or more during four preceding financial years.

NRI tax consultants are available in handy in cases like these. they supply services within the sector of advisory, consultation, analysing residential status, consultation on paying and filing IT returns, investment advice, checking eligibility for residency, etc.

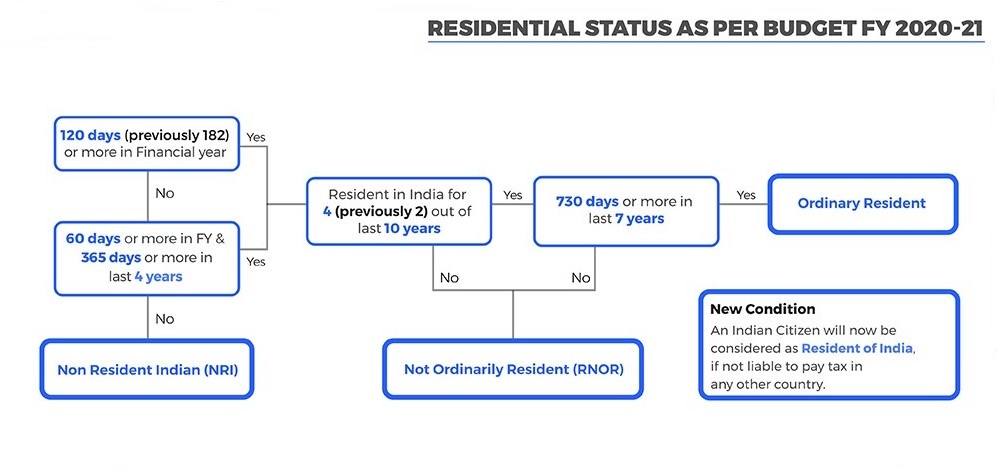

DEEMED RESIDENCY PROVISION

- According to the finance bill of 2020, an individual is to be considered as a resident of India if that person isn’t being taxed in the other country.

- This bill has been introduced as a countermeasure to prevent the tax evaders. These people last and settle in countries that have little to no tax-paying requirements. this protects their money from tax-paying.

- Umpteen numbers of misinterpretations of this bill have surfaced, like someone working during a country like Dubai or Qatar if he/she doesn’t pay tax in this country, then they have to pay tax in India. this can be completely baseless and wrong.

- In accordance with the new bill, an individual shall pay tax in India after settling outside if he/she makes money from India itself.

PAYMENT OF INCOME TAX BY NON-RESIDENT INDIAN(NRI)

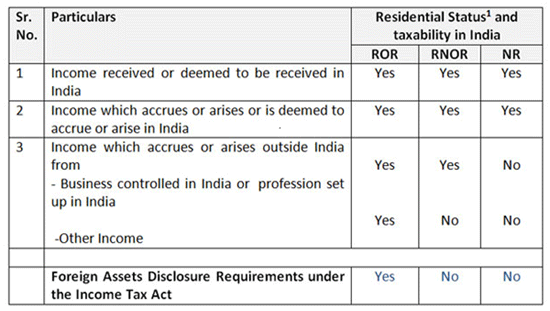

After you’ve got determined your residential status, the subsequent step is to spot income taxable in India as per your residential status. Simply put,

- In case of Resident Individuals: The global income would be taxable in India i.e., the entire income earned by the said person would be taxable in India, whether in India or outside India.

- In case of Non-Resident Individuals: The income earned or accrued in India or which is deemed to accrue in India, shall be taxed in India. Therefore, your income from any country besides India isn’t taxable in India.

INCOME EARNED OR ACCRUED IN INDIA

India follows “source rule” basis of taxation, i.e., the entire income which accrue or arises in India shall be taxable in India. Hence, the identification of the source of Income becomes a matter of utmost importance. Where it has been determined that the income has its source in India, irrespective of whether direct or indirect, the said income shall be taxed in India. Some of these incomes are:

- Salary income received in India.

• Salary income received, in respect of services rendered in India.

• Rental income received, in respect of property situated in India.

• Capital gain arising in respect of transfer of property or asset situated in India.

• Any income from deposits in India like interest on fixed deposits

• Any interest received on savings checking account, etc.

NON-RESIDENT INDIAN(NRI) INCOME TAXABLE IN INDIA

- Income from Salary: Your salary income is taxed in India under two situations.

- Situation A: If it’s received in India- If you’re an NRI and you have got received any salary in India directly into an Indian Account or somebody else has received it in your behalf in India, then such salary income would become taxable in India.

- Situation B: If it’s earned in India- Your income is claimed to be earned in India if it’s earned for services rendered in India. Therefore, if you’re a NRI and your salary earned is for the services rendered in India, it shall be taxed in India.

You will be taxed at the slab rate to which your income belongs to.

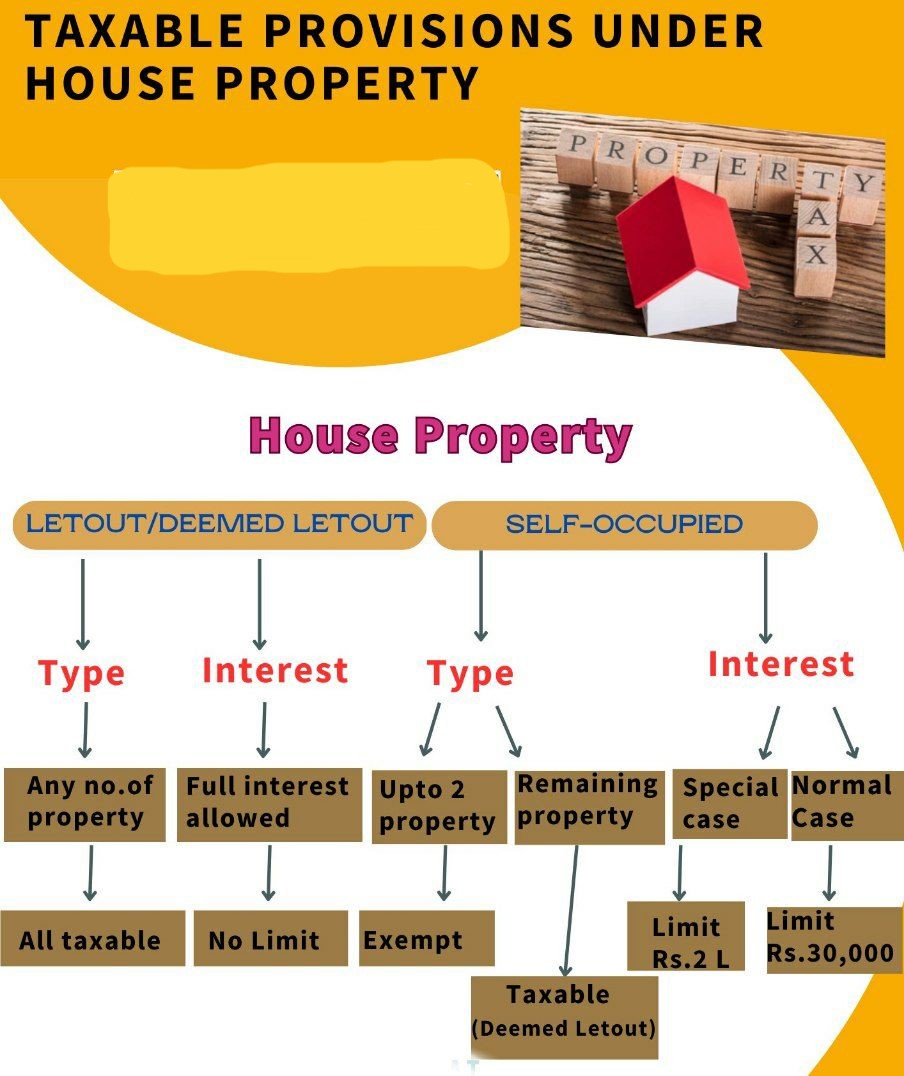

- Income from House Property: Income arising from property located in India, whether in the form of rented or lying vacant and the same be taxed for an NRI. The calculation of such income shall be within the same manner as for a resident.

An NRI, like resident is allowed

- A standard deduction of 30%,

• To deduct property taxes,

• To take advantage of interest deduction if there’s an equity credit line, and

• Claim the principal repayment of loan as deduction under section 80C. Also, tax and registration charges paid on purchase of a property can even be claimed under section 80C.

It is to be noted that, where the income is received in NRO account, whether or not received directly, the same would be susceptible to tax in India since the source of income i.e., the property is situated in India.

- Income from Other Sources: Indian sourced income within the sort of interest on fixed deposits and saving accounts is taxable in India. However, the amount received in NRE and FCNR account shall be tax free, whereas that received in NRO account would be subject to taxation in India.

- Capital Gains: Any sought of capital gain arising in relation to transfer of capital asset, being situated in India, shall be taxed in India. Also, the capital gains on investments made in India in the form shares, securities shall be taxable in India.

Where an NRI sell a capital asset, being a house property, then

- TDS be deducted @ 20%, in case of Long-term capital gains, or

- TDS be deducted @30%, in case of Short-term capital gains.

The buyer whether or not he’s an individual is liable for deducting tax at source and paying it to the govt. Since the onus of deducting tax on payments made to NRI, lies on the customer, and hence the same shall obtain a Tax Deduction Account number (TAN) and issue a TDS certificate for the same.

SPECIFIC PROVISIONS WITH INVESTMENT INCOME OF NRI

As a NRI you’ll be able to avail of a special provision associated with investment income. A NRI income shall be taxed @ 20%, where he invests in certain assets in India.

INVESTMENTS ELIGIBLE FOR SPECIAL TREATMENT

The income derived from the subsequent assets in India acquired in foreign currency shall qualify for special treatment:

- Investment in the shares of Indian Companies (Public or Private company)

• Investment in the debentures, being issued by a publicly-listed Indian company.

• Deposits made with the banks and public companies.

• Any security of the Central Government

No deduction under Section 80 is going to be allowed while calculating investment income.

SPECIAL PROVISION IN RESPECT OF LONG-TERM CAPITAL GAINS

On long term capital gain arising from the transfer or sale of those assets, no advantage of indexation and deduction under Section 80 is allowed. But you’ll be able to still save your taxes, by availing exemption on the gains earned under Section 115F. Under this, you’re required to reinvest the web consideration received within the amount of six months from the date of sale of the first asset, into the subsequent assets:

- Shares in an Indian company

• Debentures of an Indian public company

• Deposits with banks and Indian public companies

• Central Government securities

• NSC VI and VII issues

The entire capital gain would be exempt if the entire of the net consideration is re-invested. However, if the price of recent asset purchased, falls short than the consideration, then the capital gain would be exempt proportionately, i.e.,

Total Capital Gain X Cost of New Asset

—————————–

Total net consideration

Exemption=

NOTE: The exemption is withdrawn if the new asset purchased is transferred or converted into money within a period of three years from the date of purchase. The NRI is eligible to withdraw the amount from the special provision, at any point of time and in such an event, the investment income and LTCG shall be charged to tax as per the standard provisions of Income Tax Act, 1962.

Just like resident individuals, the NRIs have been provided with the exemptions under section 54, section 54EC and section 54F on long-term capital gains, arising on account of sale of house property. The long-term capital gain is often invested under:

| SECTION | ASSET SOLD/ TRANSFERRED | ASSET TO BE INVESTED IN | TIME PERIOD FOR INVESTMENT | QUANTUM OF EXEMPTION |

| 54 | · RESIDENTIAL HOUSE PROPERTY

· HOLDING PERIOD OF 3 OR MORE YEARS |

· RESIDENTIAL HOUSE PROPERTY IN INDIA |

· WITHIN ONE YEAR BEFORE THE DATE OF TRANSFER OF ASSET. · PURCHASED AFTER 2 YEARS FROM THE DATE OF TRANSFER OF ASSET. · CONSTRUCTION WITHIN 3 YEARS FROM THE DATE OF TRANSFER OF ASSET. · THE NEW ASSET CANNOT BE SOLD OR TRANSFERRED BEFORE THE END OF 3 YEARS. |

· WHERE THE ENTIRE CAPITAL GAIN HAS BEEN INVESTED FOR ACQUISITION OF NEW ASSET, THE FULL AMOUNT OF CAPITAL GAIN WOULD BE EXEMPTED.

· WHERE PARTIAL CAPITAL GAIN HAS BEEN INVESTED, THE CAPITAL GAIN NOT ADJUSTED IN NEW ASSET, SHALL BE CHARGED TO LONG-TERM CAPITAL GAIN TAX. |

| 54F | · CAPITAL ASSET OTHER THAN HOUSE PROPERTY

(NOTE: YOU SHOULD NOT OWN MORE THAN ONE RESIDENTIAL HOUSE PROPERTY AT THE TIME OF TRANSFER OF THE CAPITAL ASSET) |

· TO CLAIM FULL EXEMPTION, ENTIRE SALE PROCEEDS SHOULD BE INVESTED IN NEW ASSET.

· WHERE THE PARTIAL INVESTMENT HAS BEEN MADE, THE EXEMPTION WOULD BE: COST OF THE NEW HOUSE X CAPITAL GAINS SALE RECEIPTS |

||

| 54EC | · CAPITAL ASSET BEING RESIDENTIAL HOUSE PROPERTY | · BONDS OF NATIONAL HIGHWAY AUTHORITY OF INDIA (NHAI) OR RURAL ELECTRIFICATION CORPORATION (REC) | · THE SAID INVESTMENT BE MADE WITHIN 6 MONTHS FROM THE DATE OF TRANSFER.

· THE MAXIMUM AMOUNT OF INVESTMENT THAT CAN BE MADE IS RS. 50 LAKHS. · THE NEW ASSET CANNOT BE SOLD OR TRANSFERRED BEFORE THE END OF 3 YEARS. |

· AMOUNT INVESTED OUT OF CAPITAL GAIN; OR

· RS.50 LAKHS; WHICHEVER IS LOWER |

- Relevant proofs should be shown to the customer so no TDS is deducted by him.

• In case, the customer deducts TDS, advantage of these exemptions may be availed at the time of return filing by NRI and refund of such TDS may be claimed.

DEDUCTIONS AVAILABLE TO NRI

- Deduction under Section 80C:

The maximum amount of deduction available under the section is of Rs.1,50,000. Section 80C comprises of –

- Life premium Payments-

Deduction would be available, where the policy has been purchased in NRI’s name or in the name of his/her spouse or any child’s name. The premium must be but 10% of sum assured. - Tuition Fee Payment-

- NRI can claim deduction of tuition fees paid to any school, colleges or any universities situated in India for the aim of full-time education of their children.

- Principal repayment of home loans-

Like Residents, NRIs may claim deduction for principal repayment of house property loan borrowed for the needs of constructing or purchasing a residential house property. Other expenses like tax charges, registration fees, being incurred in respect of acquiring of such property, shall also be eligible. - Unit Linked Insurance Plan (ULIP)-

Investment in ULIP’s offers twin advantage of insurance and investment under one integrated plan. The lock-in period is of 5 years. Premium paid in respect of own, spouse and children shall be eligible for deduction. - Equity Linked Tax Saving Scheme (ELSS)-

- Deduction under Section 80D:

NRIs can claim deduction for premium got insurance of themselves and family or parents in India.

The three possible situations and tax benefits for every is shown below:

| POLICY TAKEN FOR | DEDUCTION ALLOWED | TOTAL TAX BENEFIT |

PARENTS BELOW 60 YEARS |

RS. 25,000

RS. 25,000 |

RS. 50,000 |

| 2. SELF, SPOUSE & CHILDREN BELOW 60;

PARENTS ABOVE 60 |

RS. 25,000

RS. 30,000 |

RS. 55,000 |

| 3. SELF, SPOUSE ABOVE 60 & CHILDREN;

PARENTS ABOVE 60 |

RS. 30,000

RS. 30,000 |

RS. 60,000 |

3. Deduction under Section 80E:

- Section 80E allows NRIs to assert a deduction of interest paid on an education loan. Such a loan shall be taken for pursuing higher education of the NRI, or his spouse or children or for a student, in respect of whom, the NRI is a trustee.

- There’s no limit on the number which might be claimed as a deduction under this section. The deduction shall be available, for the earlier of, period of 8 years or the interest is paid. No deduction would be available in respect of principal repayment of loan.

4. Deduction under Section 80G:

- Where the NRI makes eligible donations, as prescribed under section 80G of the IT Act, 1962, the same shall be eligible for deduction to NRIs.

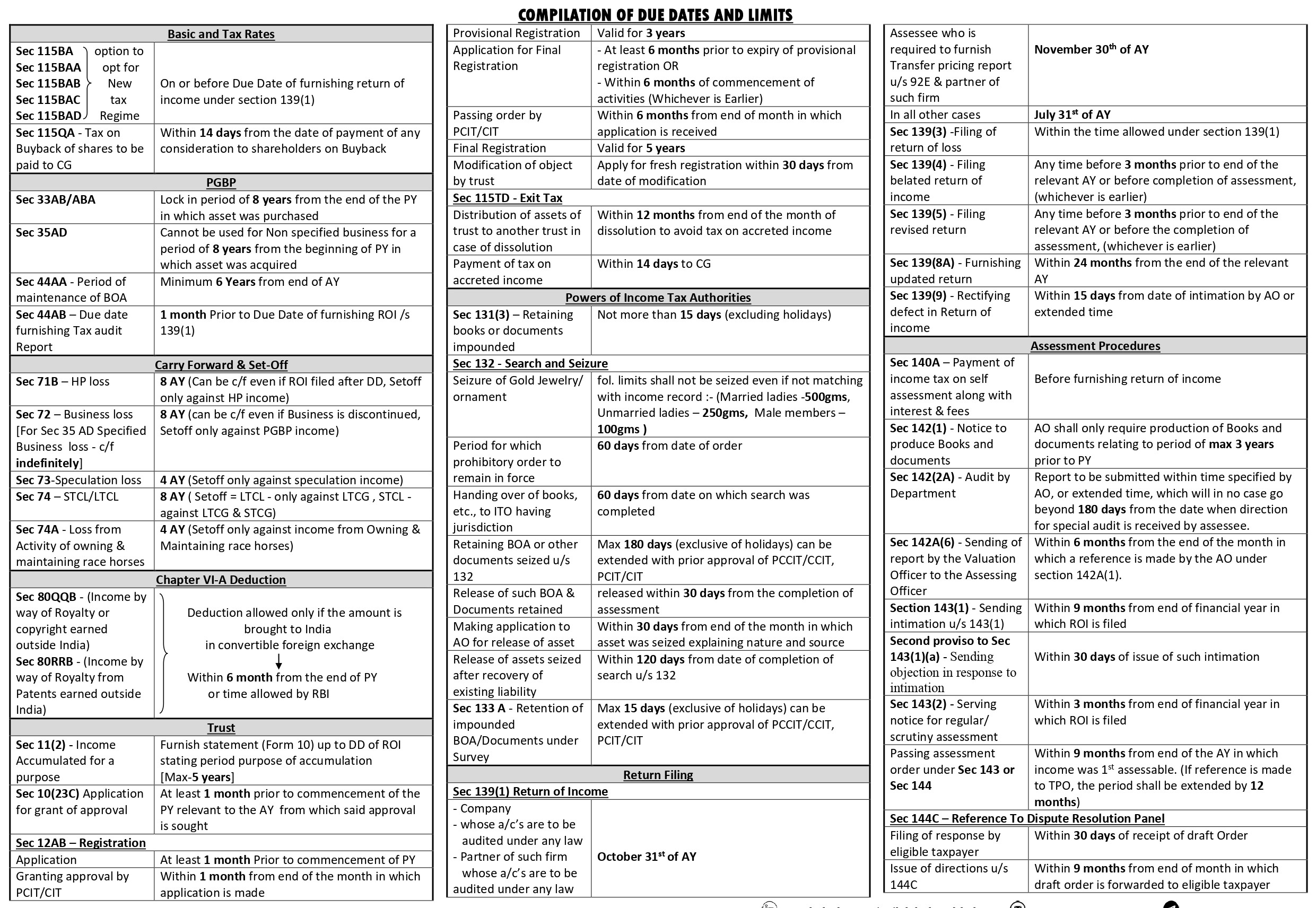

Income Tax Deductions applicable for the Financial Year 2024-25

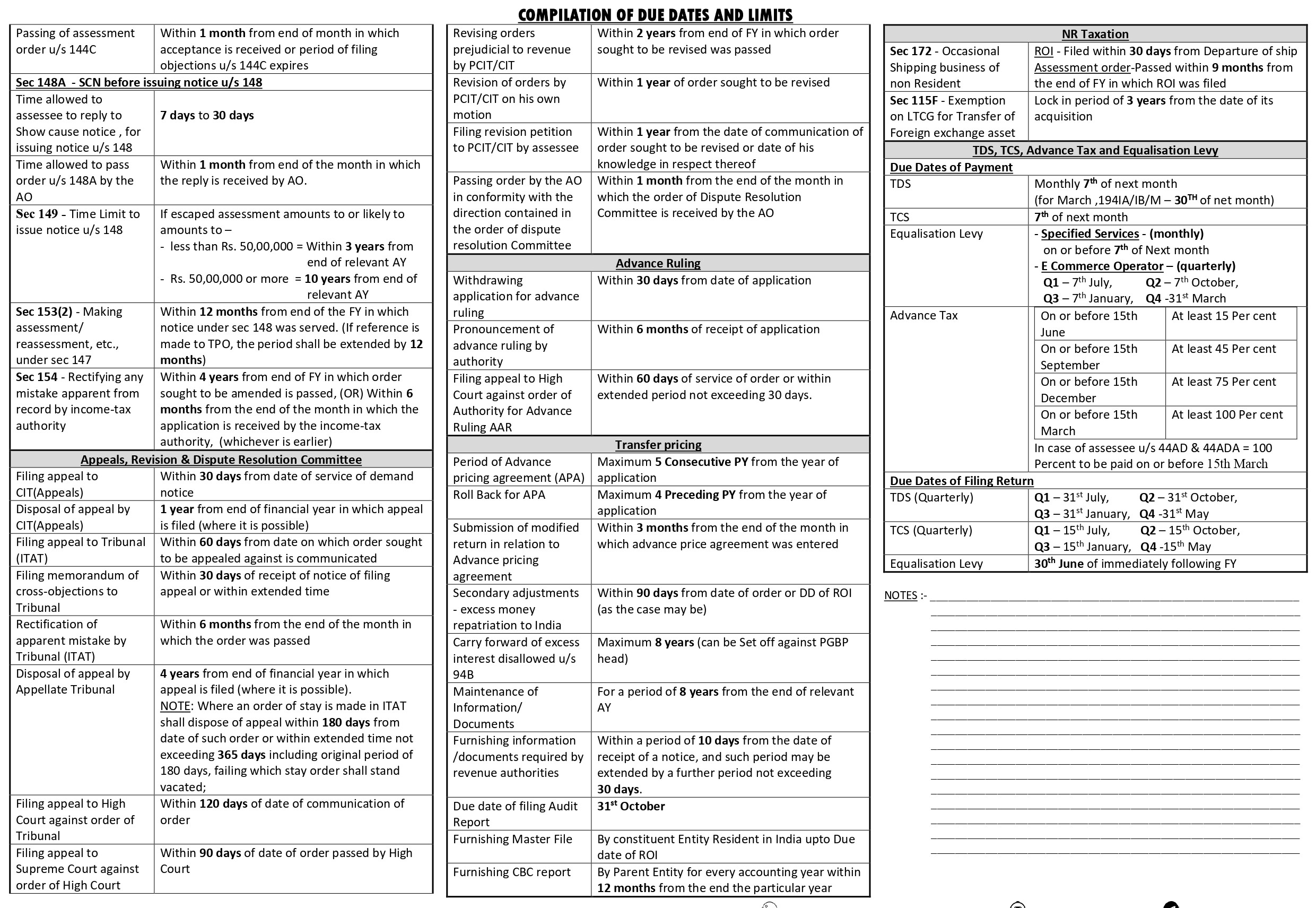

All the Important Income Tax Applicable Due Dates & Limits

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.