Re-Availment Of Input Tax Credit Reversed

Table of Contents

Re-Availment Of Input Tax Credit Reversed

BRIEF INTRODUCTION

As per the section 16 of CGST Act, 2017, the eligibility and conditions in respect of availment of input tax credit has been provided. Thus, every person, registered under GST, would be entitled to claim credit in respect of input tax, being paid by them on supply of products or services or both, being exclusively used in the course or furtherance of their business.

Also, section 17 of CGST Act, 2017, provides for the apportionment of credit and blocked credit.

As per the clauses (g) and (h) of sub-section 50 of section 17 envisages the subsequent goods or services, namely;

-

- (g) Goods or services or both, being specifically used for private consumption.

- (h) Goods lost, stolen, destroyed, written off or disposed of in the form of gift or free samples.

These situations are of such nature that the ITC in respect of these goods become ineligible after the availment of credit under section 16. For e.g., a trader of electricity appliances purchases air-conditioners purchasable and avails of the input tax credit of the same. However, after some time, the trader puts one of the air-conditioner for his personal use.

There may additionally be cases where the input tax credit is availed of on goods purchased to be used in manufacture but the same is found ineligible at a later point of your time because of unforeseen future events like goods being lost or stolen before use in manufacture.

Now, in such cases, the registered person, having availed the ITC, would be required to reverse the amount of ITC in respect of such goods as per the provisions of section 17 (5).

ISSUES

In this regard the subsequent issue arises namely;

- Manner of reversal as per the provisions of section 17(5)

- Interest Application as per the provisions of section 50 and

- Re-availment of credit reversed as per the provisions of section 17(5), provided the events causing reversal of credit gets nullified.

The present write-up seeks to look at the above issued in its proper perspective.

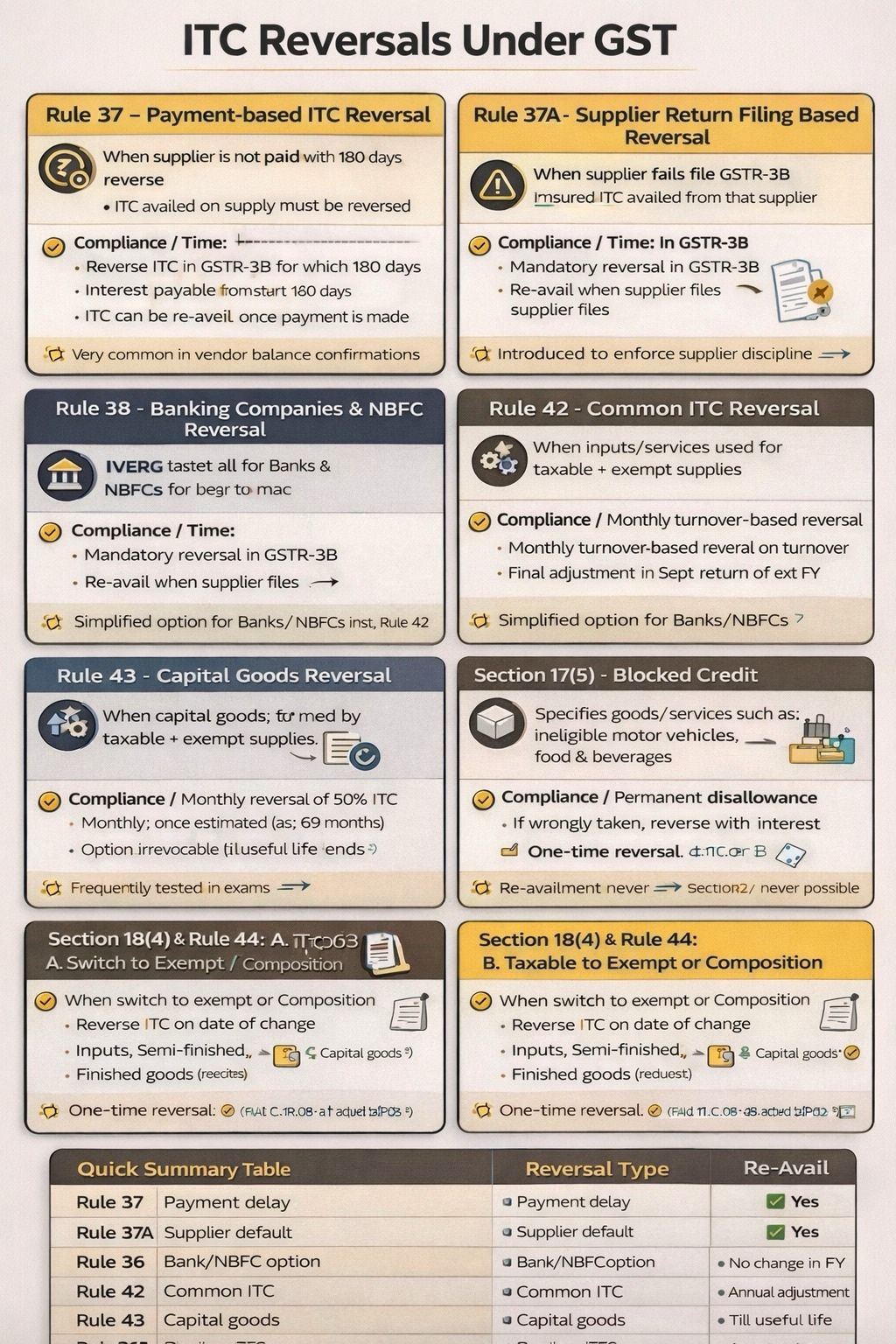

Reversal of Input tax Credit

Under the GST law, a selected procedure is prescribed for the style of reversal of credit on account on non-payment of consideration to the seller within 180 days as per the 2nd proviso of section 16(2), or use of supply in providing exempt supplies. However, it is seen, that no specified mechanism has been provided in respect of the way reversal of credit be undertaken.

Now, in the absence of a specific mechanism, it would be beneficial, that the registered person shall debit the restricted credit within the table of ineligible ITC, under the GSTR-3B.

INTEREST UNDER SECTION 50

- According to section 73(1), it has been provided that, in case the proper officer believes that certain amount of tax stands unpaid or falls short or has been erroneously refunded, the same requires an explanation of fraud or any wilful-misstatement and the officer may ask the registered person make the payment of tax being short-paid or not paid. Sub-section (1) of section 50 provides for payment of interest where somebody who is susceptible to pay tax fails to pay the tax or any part thereof within the prescribed period.

- As per section 50(3), provisions have been provided in respect of charge of interest in respect of under or excess claim of ITC, arising due to mismatch of credit or excess reduction claimed.

- A careful reading of section 50 suggests that no interest liability is provided where the wrongful availment of credit doesn’t cause a situation where there’s short-payment of tax, because of accumulation of eligible credit.

RE-AVAILMENT OF INPUT TAX CREDIT

- As per the GST law, re-availment of ITC already reversed by the registered person has been provided for and the same is envisaged by the section 16(2)(3) of GST Act. For availaing such credit, the recipient must have made payment in respect of supply of products or services or both along with the amount of GST thereon.

- Thus, where the products have been lost or stolen, are subsequently traced and the same is included in the inventory, then the said taxpayers would be eligible for re-availment of ITC.

- Hence, where an assessee is ready to ascertain that the event resulting in the reversal of input tax credit under section 17(5) has been nullified, it is concluded that he would be entitled to re-avail the credit so reversed.

- However, it’s advisable to keep up an entire record so on establish the fact of credit eligibility. it’s also prudent to tell the Department about the fact of re-availment of the credit so on avoid litigation within the future.

LIMITATION PERIOD FOR RE-AVAILMENT

Sub-section (4) of section 16 envisages the deadline for taking of input tax credit in respect of any invoice or debit, not for the availability of products or services or both. Accordingly, the ITC shall not be available in respect of invoice or debit note, that are dated after the date of furnishing of the return in relation to the month of September of the subsequent year or furnishing of the relevant annual return whichever is earlier.

As per sub-rule (4) of rule 37 of the CGST Rules, the closing date per subsection 94, of section16 shall not apply to assert for re-availing of any credit, that has been reversed earlier. It may be noted that rule 37 prescribes the way of reversal of input tax credit within the case of non-payment of consideration. However, the Rule 37(4) provides for the re-availment of ITC.

Thus, it is advisable, that the registered person should always be in receipt of proper track and documentation of event resulting in reversal of ITC.

MOTOR VEHICLES BLOCKED CREDIT

| CATEGORY | MOTOR VEHICLE WITH SEATING CAPACITY OF 14 OR MORE | MOTOR VEHICLE WITH SEATING CAPACITY OF 13 OR LESS | |||

| FOR RESALE-TRANSPORT BY TRANSPORT OPERATOR, DRIVING SCHOOL | OTHER USE | ||||

| CREDIT ON MOTOR VEHICLE | AVAILABLE | AVAILABLE | NOT AVAILABLE | ||

| CREDIT ON REPAIR, INSURANCE, SERVICING ETC | AVAILABLE | AVAILABLE | NOT AVAILABLE | ||

| CREDIT ON RENTING, LEASING OR HIRING | AVAILABLE | AVAILABLE | NOT AVAILABLE | ||

Similar provisions apples to Aircraft and Vessel. However, Aircraft and Vessel being specifically utilized for the purpose of transport of goods shall be eligible for input tax credit availement.

- It is to be noted, that there are certain cases, where the credits are blocked, provided they are supplied in making a further outward supply as a composite or mixed supply-

| FOOD & BEVERAGES | + | OUTDOOR CATERING | + | BEAUTY TREATMENT | + | HEALTH SERVICES | + | COSMETIC &PLASTIC SURGERY |

–

| RENT A CAB | + | LIFE/HEALTH INSURANCE | + | MEMBERSHIP OF CLUB | + | HEALTH & FITNESS CENTRE | + | TRAVEL BENEFIT TO EMPLOYEES |

- As per amended section 17(5), input tax credit of all above services shall be eligible if it’s obligatory on a part of employer to supply the same to its employees under any law for the present in effect. For E.g., Credit of GST paid on outdoor catering services utilized in factory could also be allowed after effective date, as Factories Act made it compulsory to supply canteen services if factory has certain no of employees. Earlier, this credit wasn’t allowed.

- Even though, the credit is blocked on above supplies, the registered person would be eligible to claim the ITC, provided the same is utilized for effecting further taxable supply of same category; or as taxable composite or mixed supply.

- Construction of Immovable Property (excluding PPE)- Work contract services, excluding the service where the same acts as an input for further supply, being received by taxable person for construction of an immovable property on his own account even when utilized in course or furtherance of business, the ITC would not be available.

- The word Construction consists of re-construction, renovation, additions or alterations or repairs, provided the same is capitalized. So, what does it mean??? It means if not capitalised you’ll be able to claim ITC, yes, you’ll claim but keep in mind you have got to differentiate between capital and revenue expenditure.

- Self-construction- Inward supply of products or services for construction of an immovable property for ‘own use’ would also not be eligible for input tax credit. This restriction applies even when such immovable property is employed within the course or in furtherance of business. Understanding the scope of ‘immovable property’ is extremely important.

- Immovable property is well understood to be land and building but it also includes everything that’s attached to or forming a part of the land and rights-in-land. ITC would be blocked, where all the inward supplies are utilized for the establishment of any immovable property.

- Also, the inward supply of services, being received from a property agent, architect, interior decorators and contractors, all comes into the category of blocked credit, since the same are involved within the establishment of the immovable asset.

- But, if inward supplies like security, house-keeping and property maintenance are used after construction, then such credits don’t seem to be blocked as these are received after establishment of the immovable property.

- Goods or services or both on which tax has been paid under Section 10- Section 10(4) provides the conditions to be fulfilled for an individual falling under composition scheme, with respect of input tax credit. one in all the conditions state that an individual choosing the composition scheme mustn’t collect any taxes from the recipient. As no taxes are paid by the recipient, no input tax credit will be availed by them either.

- Goods or services or both received by a non-resident taxable person except on goods imported by him- A non-resident taxable person (NRTP) could be a one that temporarily supplies any goods or services within India while they’re not a resident of the taxable territory.

- In respect of the products or services received within India, no input tax credit will be availed by them. However, they’re liberal to avail the input tax credit of the products imported by them from outside India.

- Personal consumption- Now what’s personal consumption?? There must be some sought of chain creation between ITC availed and the outward supply made. This clause provides a check to work out if the ‘immediate and ultimate’ use or consumption any item is personal benefit to the person or not,

- then in such a case, the Input Tax Credit shall not be available however, where the ultimate benefit is rendered to the company, then the Input Tax Credit credit would be available.

- Goods lost, stolen, destroyed, written off or disposed of in the form of gift or free samples- as per the section 16 (1), it has been provided that the ITC will be claimed, provided the same is utilized in course or furtherance of business. Thus, Simple No use No ITC.

- Lost goods refer to goods that are missing and cannot be traced.

- Stolen goods refer to goods that are found to be lower, determined upon the physical verification of stock.

- Destroyed – Any goods which get destructed because of any natural calamity like flood, earthquake or a man-made event like fire, water leakage etc

- Written off – If any goods are having a particular value as per the books of accounts but are completely written off thanks to any reason like obsolescence or lapse of your time

- Disposed of by way of gift or free samples- Disposed of means to urge rid of-unfit for sale- by way of gift or free sample– Gift means if it’s irrevocable and free samples indicates delivery of products to be used or consumption on non-contractual basis.

- Some examples- prescription medicine samples marked ‘Physician’s sample shall not be sold’

- Any amount of tax paid as per the provisions of Sections 74, 129 and 130-

- Section 74 provides for the payment of taxes during a situation where taxes isn’t paid or short paid or erroneously refunded or input tax credit wrongly availed.

- Section 129 provides for the detention, seizure and release of products and conveyance in transit.

Further, Section 130 mentions about confiscation of products and/or conveyance and levy of penalty. In above cases if any payment is formed by anyone under these sections, no input tax credit in respect of those would be available.

Goods returned / goods price revision under which act concerned document will be issued.

Delivery Challan on return of Goods sent for repair & testing:

- When goods are originally sent for repair/testing: As per Section 31(1) & Rule 55 – CGST Rules & GST Circular No. 142/12/2020-GST applies. When goods are sent without supply, Consignor (original owner of goods) issues Delivery Challan. Under GST, the requirement to issue a fresh Delivery Challan on return of goods sent for repair and testing depends on who is sending the goods back.

- Delivery Challan position in case of return of goods after repair/testing: Yes, a fresh Delivery Challan is required. In this case basic Question arises that Who will issue the Delivery Challan: Movement of goods again takes place, as per GST Rule 55 of CGST Rules mandates a Delivery Challan for every movement otherwise than by way of supply. Repairer is the sender at the time of return, hence responsible for Delivery Challan. So Consignee (the repairer/service provider) will issue the Delivery Challan for returning the goods to the owner.

- It is to be noted that Fresh Delivery Challan is mandatory at the time of return. Original Delivery Challan reference should be mentioned in return Delivery Challan. E-Way Bill is required if Consignment value exceeds prescribed limit & distance threshold is crossed. Moreover, that for the repair charges, Tax Invoice to be issued separately by repairer for service portion & GST applicable on repair charges

- In summary about Goods sent for repair & testing:

| Stage | Nature of Movement | Who issues DC | Document |

| Goods sent for repair | Not a supply | Owner/Consignor | Delivery Challan |

| Goods returned after repair | Not a supply | Repairer/Consignee | Fresh Delivery Challan |

| Repair charges | Supply of service | Repairer | Tax Invoice |

GST law provision related Goods returned / goods price revision

Section 142 of the Central Goods And Services Tax Act, 2017 was enacted precisely to avoid confusion during the transition from Old Laws to GST. Below is a clean, exam-ready and practice-ready explanation of which Act governs the document (Old Act or GST) in cases of goods return and price revision after the appointed date (01-07-2017). Core Principle or Thumb Rule related to indirect tax is GST/ VAT Tax follows the law applicable to the event that triggers tax liability, as specifically overridden by Section 142.

Goods Returned after Appointed Date :

Section 142(1) of the Central Goods And Services Tax Act, 2017: Situation:

- Goods sold before 01-07-2017

- VAT / Excise already paid

- Goods returned on or after 01-07-2017

Two separate treatments:

Case A: Goods returned by Registered Person : as per Proviso to Section 142(1) of the Central Goods And Services Tax Act, 2017 stated that Goods Return is deemed supply under GST

| Particular | Treatment |

| Governing law | GST Act |

| Document | GST Tax Invoice |

| Tax | GST payable |

| ITC | Available to recipient |

Case B: Goods returned by Unregistered Person then No GST supply & Refund allowed under Old Law that Conditions applicable for that Goods returned within 6 months from appointed date & Goods identifiable to satisfaction of officer

| Particular | Treatment |

| Governing law | Old VAT / Excise Act |

| Document | VAT Credit Note |

| Tax | No GST |

| Refund | VAT refundable to seller (benefit passed to buyer) |

Price Revision after Appointed Date : Section 142(2)

- Contract entered before 01-07-2017

- Price revised after 01-07-2017

Goods Returned by Unregistered Person :

Two small practical remarks:

Goods Returned by Unregistered Person & Upward price revision:

Goods Refund under old law is handled as per Section 142(3) (read with respective VAT/excise provisions). And Price Revision provision u/s 142(2) the Central Goods And Services Tax Act, 2017. This is one of the most misunderstood provisions, and your explanation is crystal clear. Supplementary invoice/debit note must be issued within 30 days (Rule 53 read with 142(2)). When Price is Revised Upward then following Treatment will be follow by Taxpayer

| Particular | Treatment |

| Document | Supplementary Invoice / Debit Note |

| Governing law | GST Act |

| Nature | Deemed outward supply under GST |

| Tax | GST payable |

Even though original supply was pre-GST, revision attracts GST

Goods Returned by Unregistered Person & Downward price revision:

When Price Revised Downward then following Treatment will be follow by Taxpayer. Reduction in tax liability is subject to Section 34(2) the Central Goods And Services Tax Act, 2017 conditions (credit note declaration and ITC reversal by recipient).

| Particular | Treatment |

| Document | Credit Note |

| Governing law | GST Act |

| Effect | Reduction in GST liability |

Credit note deemed issued under GST, not under old law

Goods Sent on Approval Basis under section 142(12) :

The 6‑month period can be extended by another 2 months by the commissioner. Advance & Invoicing for Services (142(11)) Accurately captured. A reinforcing point Where VAT portion of a works contract exists, VAT law continues to govern pre‑GST portion, while service component follows 142(11). As per Section 142(12) of the Central Goods And Services Tax Act, 2017. Goods sent before GST (≤ 6 months prior) then Goods returned within 6 months from 01-07-2017. Then then following Treatment will be follow by Taxpayer

| Treatment | Result |

| Tax | No tax payable |

| Law | Neither VAT nor GST |

As per Section 142(12) of the Central Goods And Services Tax Act, 2017: When Goods is Returned after 6 months then GST tax will pay by Person returning goods as per GST Invoice as per GST law

As per Section 142(12) of the Central Goods And Services Tax Act, 2017, if Goods are not returned at all then Person who sent goods will pay the tax as per GST Law

Services – Advance & Invoicing (Section 142(11))

| Event | Applicable Law |

| Advance received before 01-07-2017 | Service Tax Act |

| Invoice issued after 01-07-2017 (to extent advance received) | Service Tax |

| Balance service after GST | GST Act |

✔ Credit of Service Tax allowed via TRAN provisions

In Summary

Section 142 overrides Sections 12 & 13 and decisively determines whether Old Law or GST applies. Documents are issued strictly as per the law deemed applicable u/s 142 not based on invoice date alone. Overall Validation of legally accurate and covers all the transition edge cases exactly as interpreted in departmental clarifications and common practice following section apply as per GST law :

- Section 142(1) → Goods return

- Under Section 142(2) → Price revision

- Section 142(12) → Goods sent on approval

- Under Section 142(11) → Advances and services

Section 142 overrides Sections 12 & 13 where transitional events are concerned.

Tax follows the trigger event as per Section 142 not invoice date, not pre‑GST supply date. Goods Returned by Registered Person (142(1) proviso) that Goods Return is to be consider as deemed supply and then GST applies and ITC allowed. Moreover, that Additional precision law understanding to be made that “Deemed supply” is not because of Schedule I, it is a special deeming under the proviso to 142(1). And Time of supply is determined u/s 12, since this is now a fresh supply under GST. One-Page Summary Table

| Scenario | Applicable Act | Document |

| Goods sold pre-GST, returned by registered person | GST Act | GST Invoice |

| Goods sold pre-GST, returned by unregistered person | Old VAT Act | VAT Credit Note |

| Price revision upward post-GST | GST Act | Debit Note |

| Price revision downward post-GST | GST Act | Credit Note |

| Approval goods returned within 6 months | No tax | DC only |

| Approval goods returned after 6 months | GST Act | GST Invoice |

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.