GST Dept. Notice : How to Deal with GST ASMT-10

Table of Contents

GST Department Notice – How to Deal with GST ASMT-10

Introduction

Many taxpayers are receiving GST discrepancy notices in the form of GST ASMT-10 these days. The Goods and Services Tax (GST) has been in effect for four years. As a result of the department’s increased scrutiny of GST returns filed in the last four years, taxpayers are receiving more ASMT-10 notices. We hope to outline all of the key provisions and data about GST ASMT-10 in one post.

What does GST ASMT-10 stand for?

A GST Officer is mandated under Section 61 to review GST returns based on specified risk indicators. This examination is to ensure that the return is accurate. A scrutiny notice in the form of GST ASMT-10 is given if the assessment reveals a high risk of default or any hint of fraud. This assessment, however, does not include a personal hearing. GST ASMT-10 is essentially a notice informing taxpayers of irregularities discovered.

In the ASMT-10 itself, the Proper Officer may quantify the amount of tax, interest, or any other sum payable by the taxpayer.

Form GST ASMT-10 is a notice issued under Section 61 of the CGST Act, 2017, read with Rule 99, advising the taxpayer of inconsistencies in his or her GST returns and demanding an explanation. The tax officer might send the notice to the taxpayer by SMS or email.

Within 30 days of receipt of the GST ASMT-11, the taxpayer must file a response. He has the option of requesting a 15-day extension.

How do I respond to ASMT-10?

According to Section 61 of the CGST Act, the taxpayer must respond to ASMT-10 in the form of ASMT-11 within 30 days.

In the present circumstance, there are 2 possible output.

- The taxpayer has the option of accepting disparities. In this scenario, the taxpayer must pay the tax, interest, or other sum mentioned in ASMT-10 via DRC-03 first, and then notify the Tax Officer via ASMT-11. He intends to pay with one of the following methods:

-

- Use Form DRC to pay your taxes.

- Provide a GSTR1 invoice/debit note/amended invoice/amended debit note.

- Pays taxes while completing GSTR-3B.

- The taxpayer may object to the disparities that have been identified. In this situation, he may furnish the Proper Officer with an explanation and workings via ASMT-11. Consider the case of a taxpayer who receives notice of a discrepancy between GSTR1 and GSTR3B liabilities. In that scenario, the taxpayer can point to the invoices or other findings that are creating the discrepancies and explain his reasoning.

Forms, Timelines, Mode, and Contents in ASMT-10: GST Scrutiny Notice

- Form: A scrutiny notice is provided in Form ASMT-10, informing of GST return errors, as well as tax, interest, and penalty, if applicable. Form ASMT-11 should be used to respond.

The tax officer might send the notice to the taxpayer by SMS or email.

Timelines: Receiving a scrutiny notification does not have a set time restriction. However, a taxpayer must respond to such notices within 30 days of receipt or request an extension within 15 days of receipt.

Contents: The following are the contents of ASMT-10:

- Basic details: The basic details such as GSTIN, name, address and tax period.

- Discrepancy Observed: The details of any discrepancy and asking for an explanation.

- Particulars of the tax officer: The DIN, name, signature and designation of the tax official issuing notice.

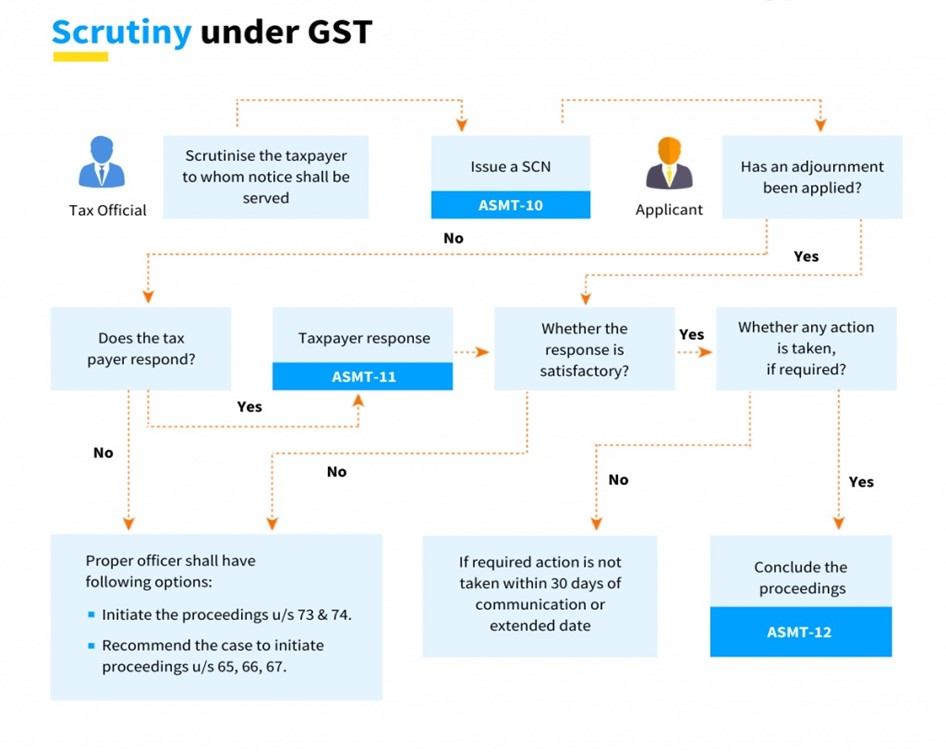

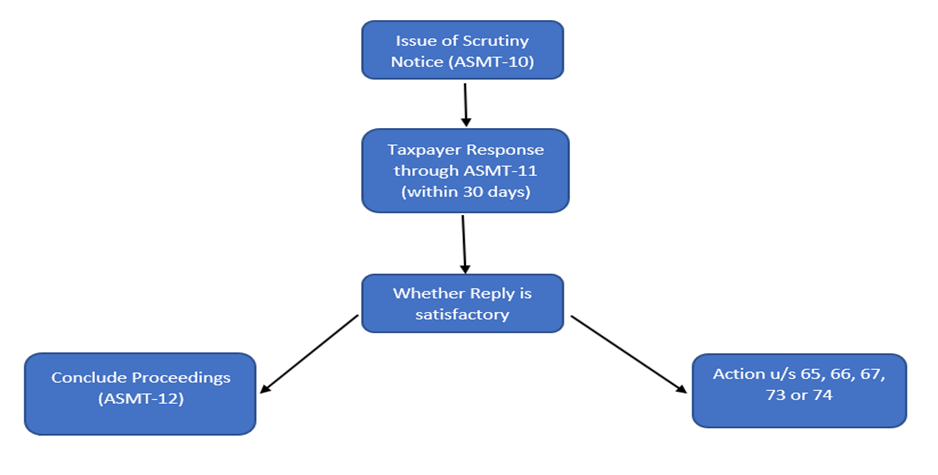

The below flowchart will explain the process of scrutiny at a Summary:

Why is ASMT 10 being released, and when will it be released?

In GST, How To Respond To ASMT 10 & 11 Notices With Format?

The ASMT 10 is a notice for informing anomalies in a GST return. The ASMT 11 stands for Reply to the Notice of Discrepancies in the Return given under Section 61. As a result, if you’re looking for ASMT 10 format to file a response, you’ll find it here.

If you are a GST taxpayer and receive an ASMT 10 notice, you must file it as soon as possible to prevent receiving additional notices and actions from the department. As a result, please follow the steps below and respond to the notice using form ASTMT 11.

If there are any anomalies in the GST returns, the GST officer issues an ASMT 10 notice to the taxpayer. As a result, if there is a gap in tax paid, clarification on input tax credit claimed, improper filing, and so on, a taxpayer should expect to get a notice.

After receiving the notification, a person has the option of accepting the inconsistencies and paying the tax, interest, and penalty, as well as informing the tax Official, or providing an explanation in ASMT 11.

The Tax Official may also issue an order of acceptance of reply if the explanation is adequate. If the response is insufficient, the Tax Official may undertake an audit, a special audit, or even issue a search and seizure order.

How to file the GST Notice reply?

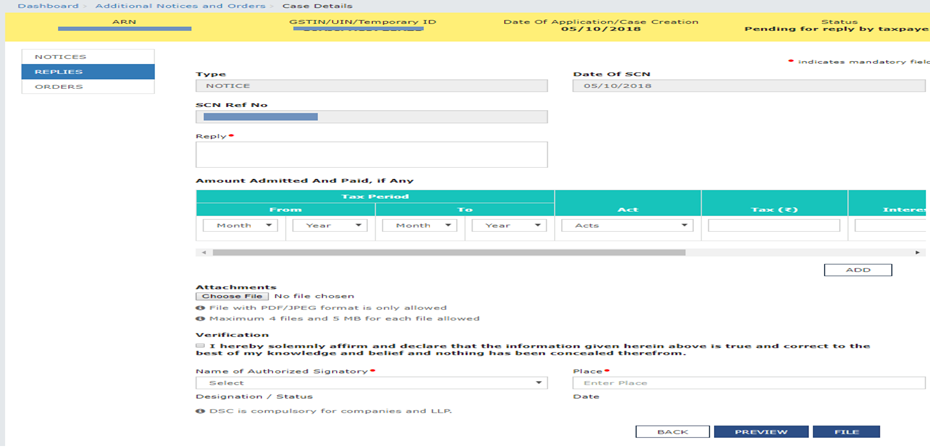

pleases click or Select the ‘replies’ tab on the case details page

- Click on ‘Notice’ to add a response

- Enter your response and payment information

- Click on ‘ADD’ for more information

- Select a file to send with the response.

- Select an authorised signature by checking the verification box.

- Use the ‘Preview’ option to double-check details before clicking ‘File.’

- EVC or DSC can be used to file a reply.

When you submit a response, you will receive a success message. “Reply Furnished, pending with Tax Officer” will appear in the Replies tab.

NOTE: Although the online reply filing procedure is straightforward, it is recommended that all papers, together with the GST ASMT-11 reply, be submitted manually to the proper official to be on the safe side and explain the matter. The reason for this is that the taxpayer can persuade others of his points of view while describing the pertinent facts and circumstances.

Post-Reply Procedure

If the Proper Officer is pleased with the response after receiving it, he will dismiss the case by making an order under GST ASMT-12 and notifying the taxpayer.

However, if the proper official does not find the response adequate, he may take appropriate action under Section 65, 66, or 67 and then proceed to take action under Section 73 or 74.

- Section 65: Audit by tax authorities

- Section 66: Special Audit

- Section 67: Inspection, search or seizure

- Section 73: Determination of tax not paid, underpaid, incorrectly refunded, or input tax credit wrongfully obtained or utilised for any reason other than fraud or wilful fabrication or suppression of facts.

- Section 74: Determination of tax not paid, underpaid, erroneously reimbursed, or input tax credit wrongfully availed or utilised for any reason involving fraud, deliberate deception, or suppression of facts.

If the Proper Officer is dissatisfied, audits under sections 65 and 66, as well as inspections and seizures under section 67, may be done. Action can be taken under Section 73 (non-fraudulent cases) or Section 74 (fraudulent cases) of the CGST/SGST Act based on the findings.

GST ASMT-12 will not be released on a certain date. With the receipt of GST ASMT-12, the proceedings come to a close.

The following is a summary of the preceding discussion:

How do you respond to ASMT-10 on the online ?

The response to the ASMT 10 notice must be submitted in ASMT 11 format. This can be done online through the Government of India’s GST webpage. Here are the simple procedures to filling out ASMT 11 and submitting it.

1. Visit GST portal

- Go to www.gst.gov.in and login • Go to www.gst.gov.in and log in. Then select Services > User Services > View Additional Notices/Orders from the drop-down menu.

- To view the notification, click the View link.

2. Filling Reply

- On the case details page, click the REPLIES tab. This tab will show you the responses you’ll need to provide in response to the Notices you’ve received.

- Click NOTICE to add a response.

- In the reply field, type your response.

- If applicable, fill in the Amount Admitted and Paid data.

- You can use the scroll bar to input more information by scrolling to the right

3. Upload Supporting documents

- If you want to attach any supporting documents to your response, select Choose File to upload your reply and then upload.

- Select an authorised signatory by checking the Verification checkbox.

- Type the name of the location where the paperwork will be lodged.

- To download and review your response, click PREVIEW.

4. File the ASMT 11

- You may now begin filing your reply in ASMT 11 after validating the response in preview mode.

- To submit your response, click the “File” button.

- You can use your DSC or EVC to file your response if it is applicable to your registration. You’ll get a success message and get a reference number for your response. You can check the status of your order by entering this reference number into the site later.

The consequences of failing to reply to a Scrutiny Notice

If the taxpayer does not respond to the scrutiny notice, the tax officer will take action under sections 73 and 74 (non-fraudulent) of the Internal Revenue Code (fraudulent). He has the authority to issue a show-cause notice in the form DRC-1, seeking the tax owed, plus interest and penalty. The penalty amount will vary based on the reason for the disparity. The officer can also recommend audits under sections 65, 66, and 67.

Conclusion

In recent years, a large number of taxpayers have received inspection notices, which they have ignored. It is strongly urged that you do not disregard the ASMT 10 alerts. If not dealt with in a timely manner, it can cost taxpayers a lot of money in terms of time, effort, and tax liabilities.

NEW GST RULES ON NON-FILLING FORM GSTR-3B – FOR THE PAST TWO MONTHS,

The Goods and Services Tax Network (GSTN) recently issued an advisory stating that Rule-59(6) of the Central GST Rules, which restricts GSTR-1 reporting, will take effect on September 1, 2021. “A registered person will not be allowed to supply the information of outward supplies of goods or services or both in Form GSTR-1 if he or she has not furnished the return in Form GSTR-3B for the previous two months,” according to the new rule.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.