Last Date to File Revised or Belated ITR for AY 2023-24

Table of Contents

Last Date to File Revised or Belated ITR for AY 2023-24

- 31/12/2023 is the Last Due-Date to File Revised or Belated Income Tax Return (ITR) for Assessment Year 2023-24 (Financial Year 2022-23)

Late Filing fee for Belated Income Tax Return

- No Late Filling Fee if GTI (Gross Total Income) upto INR 2,50,000

- Late Filling Fee is ₹1,000 if GTI above INR 2,50,000

- Late Filling Fee is ₹5,000 if TOTAL Income above INR 5,00,000

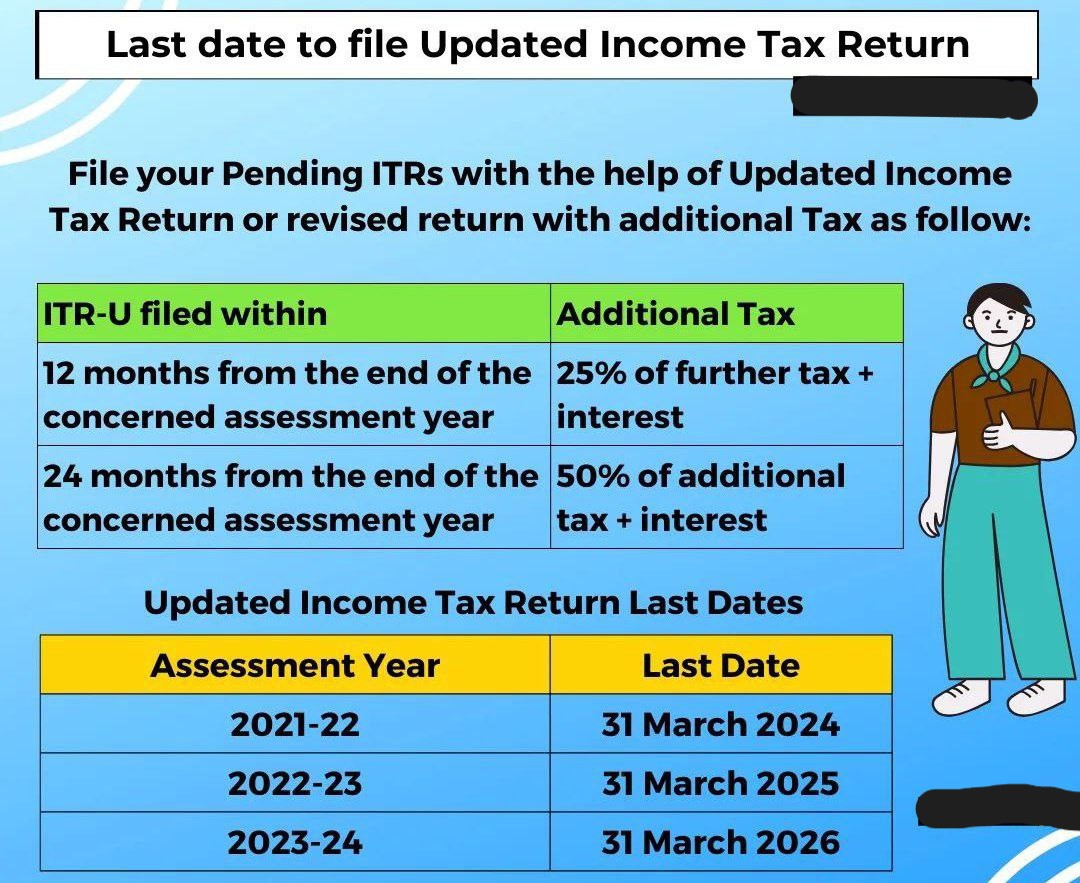

In case Taxpayer filling : After 31/12/2023 Filling of Tax Return :

- You Can file an Updated Return if you are eligible but through Updated Return you Can’t claim Income Tax refund And Late Fee + Additional Income Tax bourdon under Section 140B also applicable on the Income tax Assesses.

- In the above contains conclusion means 31/12/2023 is the last date to file your Income Tax Return with Income Tax refund.

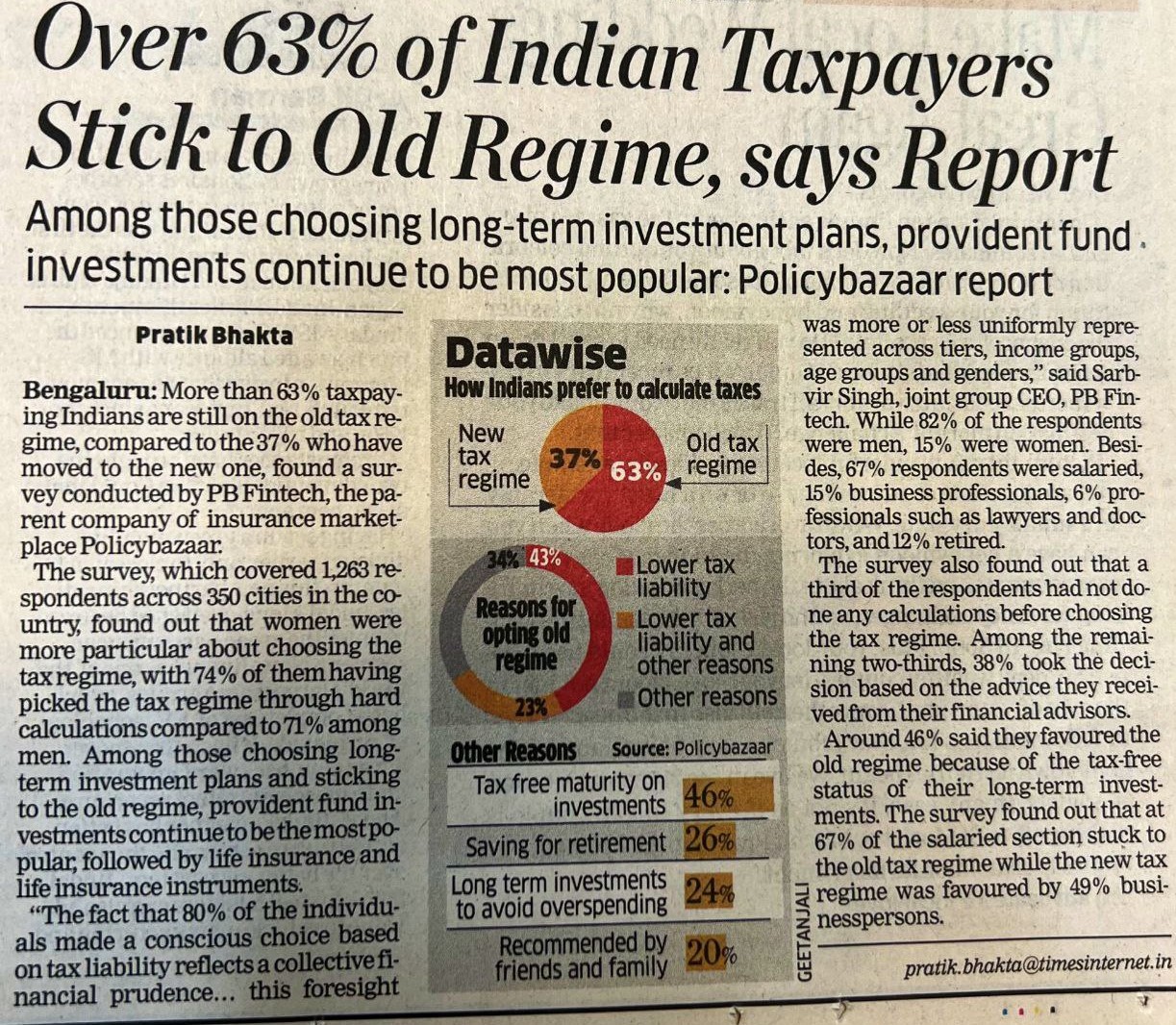

Tax Dept Launches Calculator for AY 2024-25 which is very much User-Friendly,

- Facilitating simple Income tax Comparison of Income tax Liabilities under the Income Tax in Old and Income Tax New Regimes : This calculator is easy to use has been released by the Income Tax Dept for the Assessment Year 2024–25 (Financial Year 2023–24).

- You can Access this calculator in below link : https://incometaxindia.gov.in/Pages/tools/115bac-tax-calculator-finance-act-2023.aspx

- The tool effectively contrasts the tax obligations under the Old and New Regimes. In addition, it provides a quick and easy experience for taxpayers by highlighting possible tax savings depending on the selected regime.

Taxpayers should not to make false claims for exemptions or deductions on their ITR,

- Don’t include incorrect exemptions or deductions on your income tax return. Kindly file and File Accurately. In a recent tweet from Income Tax Dept cautioned taxpayers not to make false claims for exemptions or deductions on their income tax returns.

- Please Pay Attention, Taxpayers! In order to ensure compliance with tax legislation and prevent potential problems, the advise highlights the significance of accurate reporting and filing and encourages taxpayers to follow the guidelines.

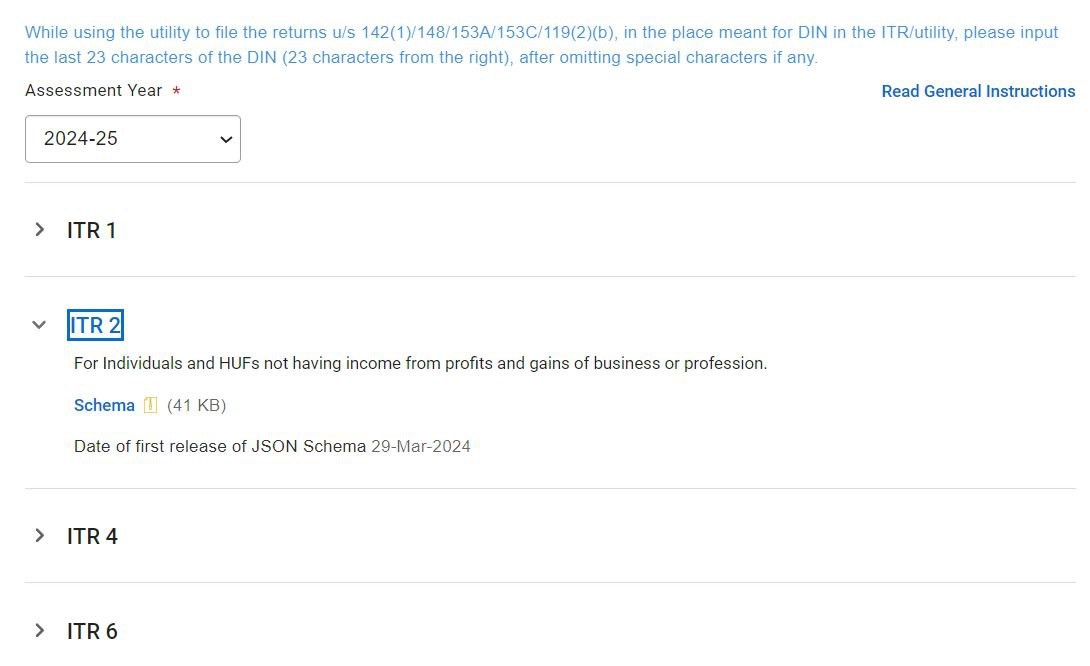

INCOME TAX RETURN (ITR) FORM UPDATE FOR THE AY 2024-25:

Filing all income Tax return Forms 1 to 6 will be effective from April 1, 2024. This New changes in income tax made in Assessment Year 2024-25 income Tax return forms follow primarily from amendments made to the Income-tax law, as stated in the Finance Act, 2023.

- ITR-2 & ITR-6 Form Schema released by Central Board of Direct Taxes

- Date of first release of JSON Schema: 29-Mar-2024

- ITR-1 & ITR-4 Form Schema Updated

- Date of latest release of JSON Schema28-Mar-2024

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.