Section 194C : TDS on car hire charges

Table of Contents

Section 194C : TDS on car hire charges

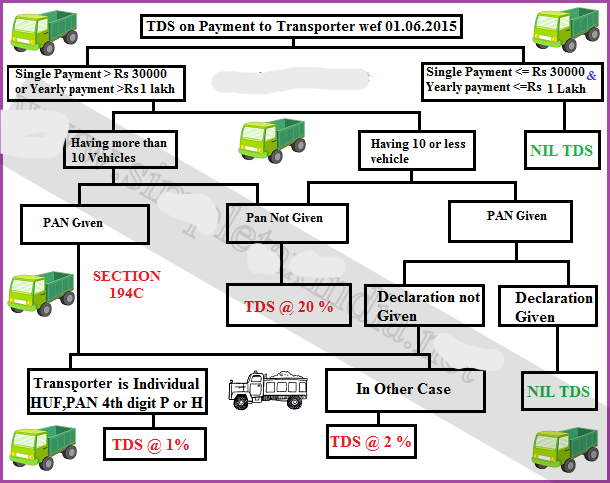

Tax Deducted at Source to be deducted on payment made on car hire. Tax Deducted at Source on car hire charges is needed to be deducted u/s 194C. When a person makes a payment to contractor on a contract, Business owner has to deduct Tax Deducted at Source on such payment made for car hire charges.

Applicability of Tax Deducted at Source provisions on Car Hire Charges under Section 194C

When there is a contract between a contractor & specified persons and a payment is made to the contractor for undertaking any ‘work’, a Tax Deducted at Source is to be deducted as per the specified rate.

Note: A contract between specified persons & a subcontractor will also be liable to Tax Deducted at Source u/s 194C.

Meaning of Car hire charges: Section 194C

A car hired for a specific purpose at a charges that includes without any maintenance or running cost falls under the purview of Section 194C.

Meaning of specified persons for purpose of TDS on car hire charges?

A specified person, as per Section 194C includes:

- Firm;

- Trust;

- Local Authority;

- Central Govt;

- State Govt;

- Company;

- Co-operative society;

- Any State authority responsible for providing housing accommodation or planning or development of cities, towns, etc.

- Society

- University

- An individual, body of individual, association of person or Hindu Undivided Family has total sales, turnover or gross receipts of more than INR One Crore (in case of business) or INR 50,00,000/- (For Profession).

- Govt of a foreign country or a non-resident corporate entity or any other association or body of such foreign State;

Rate & Amount for Tax Deducted at Source deduction for Car Hire Charges u/s 194C of the Income Tax Act, 1961

The rate of Tax Deducted at Source to be deducted is as under: –

- Tax Deducted at Source shall be deducted at the following rates U/s 94C depending on whether the payment is made to an Individual/ Hindu Undivided Family or other than Individual/ Hindu Undivided Family:

- Credit/ Payment is made to a person other than an Individual/ Hindu Undivided Family – Two Percentage.

- Credit/ Payment is made to an Individual/ Hindu Undivided Family – One Percentage

- No Surcharge & HEC shall be added to the above-mentioned rates.

According to Section 206AB: Tax Deducted at Source @ 20 shall be deducted where the payee does not give Permanent account number to the deductor.

Time of Tax Deducted at Source deduction on payment of Car Hire Charges u/s 194C

- Tax Deducted at Source needs to be deducted whichever event takes place earlier.

What is deeming provisions of Tax Deducted at Source on Car Hire Charges?

Where the amount is credited to the Suspense A/c in the books of Accounts of the person who is liable to make payment to the payee, it will be deemed to be credited to the A/c of the payee & Income tax provisions for Tax Deducted at Source on car hire charges will applicable.

Celling for Tax Deducted at Source deduction on Car Hire Charges u/s 194C

Celling for Tax Deducted at Source deduction on Car Hire Charges u/s 194C is as follows :

-

- Payment should not exceed Rs. 30,000 in case of a single transaction and;

- Aggregate payments made during the relevant FY should not exceed Rs. 1,00,000.

- In case it exceeds celling, then the TDS rate as provided u/s 194C will be applicable, i.e., 1% or 2%.

Income Tax deduction Exemption for limit under Section 194C:

- Amount doesn’t exceed INR 30k : Where the amount credited/ paid does not exceed INR 30k in a one single transaction, No Tax Deducted at Source shall be deducted.

- Non-Resident Contractor: In case payment made to a Non-Resident contractor shall not attract Tax Deducted at Source u/s 194C. But, Non-Resident Contractor shall be governed by Income Tax Provisions of Sec 195.

- Amount Not exceed in total of INR. 1 lakhs: Further, no Tax Deducted at Source shall be deducted, where the amount or aggregate of amounts credited/ paid to the recipient during the Financial Year not exceed INR 1,00,000.

- Business of leasing, or Hiring or plying goods carriage: Where contractor owned 10 or less carriages in the PY & a declaration is provided with Permanent account number to the person paying or crediting the amount to the Deductor.

- In case the payment made towards Personal Purpose: In case consideration paid by an individual or Hindu Undivided Family is on a/c of personal purpose, No Tax Deducted at Source is to be deducted on such consideration.

Important Judgements related to the Car hire for Section 194C

- Where Car hire charges are paid without any maintenance or running cost, it will be covered u/s 194C. (Akshatam Construction LLP v. DCIT )

- Car was hired for transporting employees & visitors, it will be covered u/s 194C.(TATA AIG General v. Income-tax Officer)

The Central Board of Direct Taxes Clarification: Circulars

- Tax Deducted at Source on payment made for car hire charges shall be deducted on invoice value, excluding the value of GST (if such value is mentioned separately in the invoice) – CBDT Circular No. 23/ 2017.

- But, Tax Deducted at Source shall be deducted on entire invoice value (if the value of Goods and Services Tax is indicate in invoice separately) – CBDT Circular No. 23/ 2017

Tax Deducted at Source on car hire charges is needed to be deducted u/s 194C @ 1% or 2% for payments to residents of India.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.