Taxability on Shares & ESOP outside India

Table of Contents

Income Tax Taxability on Shares & ESOP outside India

- Basic primary goal behind any loan term & short-term investment strategy is to generate the maximum return on our investment. So this the basic reason, people use to move towards investment in foreign stocks for good return on investment.

- To demonstrate, long-term investment in scalable, alluring worldwide firms can generate hug profits. For instance, if you had made an investment in one of the major digital firms such as Apple, Google, Amazon, Facebook, Netflix, etc. about ten years ago, you would currently be enjoying excellent return.

- Therefore, if you are a knowledgeable investor, you could indeed diversify your stock investments by geographically.

The following are some principles for buying overseas/ foreign stocks.

You could purchase shares of a foreign firms via using various methods such as Direct Investment or

- Personal Investment

- (ESOPs) Employee Stock Option Plan of an regime whose start-up business is located outside from India. Therefore, Employee Stock Option Plan gives the right to Indian employees to subscribe to shares of the parent company at a predetermined rate.

Moreover, tax implications allied with such investment become a sufficient points of Ideas for local investors. Therefore, we’d like to shed some light on the tax implications of

- Investment in foreign stock from India.

- Employee Stock Option Plan (ESOP) of start up firms which is situated outside from india.

The Actual Fact

Now in trend that Investment in the global stock market is a fresh, growing rapidly practice among Indian investors.

Those who are not aware absolutely, Indian residents can buy shares of global firms which are listed on foreign stock exchanges. However, they should hold about 10% shares in the entity in which the investment is being made, and must not have any control over it.

Yes for sure, if you’re an Indian resident, you can buy a stock in companies such as Apple, Amazon, Microsoft, etc.

How?

By:

Either create an account with an Indian broker who has connections to foreign agents like HDFC Securities, Axis Securities, Kotak Securities, ICICI Direct, etc.,

Or, via straight away open an account with foreign broker who is active in India such as Trade station, Saxo Bank, Charles Schwab.

Though, now a days MNCs are hiring employees from through out the world since then, the ESOP is also way of investing in the Start-up companies which is located outside India.

Those Employees who consent for Employee Stock Option Plan could obtain the stocks of the Employer firms if they accomplish some condition such as accomplishment of a specific Nos. of year in the entity or revenue goals set by the entity etc.

On realization of the conditions proposed by the employer company, the ESOP is vested with the employees.

Foreign companies frequently grant shares under the ESOP Plan to Indian residents who work for or serve as directors of a parent company office or branch in India.

Residents alone may occupy up to 10% of such overseas company paid-up capital in shares under the Employee Benefits Scheme they propose, whether listed or unlisted, at a fixed or predetermined price (normally below market value of shares).

ESOP has mutual benefits for the his employees & employer,

- By providing ESOP, the employer is able to conserve skilled people, conserve cash flow, boost productivity, and get increase profitability. The employee is encouraged to work hard because he stands to gain if the employer company succeeds, creating a win-win situation. This increased profitability also has an impact on the market value and intrinsic value of the employer company’s shares.

Tax Implications associated with Direct Investment

- Reserve Bank of India Permits Investment in Multinational Companies via numerous way such as Income Tax Act 1961 companies, Liberalised Remittance Scheme (LRS), overseas Direct Investment (ODI) under The Foreign Exchange Management Act, 1999 Certain rules set forth by the Indian government may be required of investors in foreign stocks.

- First of all, we must identify income tax taxpayer’s location in respect of establish whether taxes are appropriate. It is dependent on how much time that the tax payer’s existence in India since the past year, the income taxpayer’s living location would be change.

According to above mention computation, residential status can be categorized as below:

- Resident but not ordinarily resident – Taxability boost-up only when overseas income is got or acquired in India from a profession controlled or business or set-up in India.

- Resident and ordinarily resident- For residents, all the income that earned and got worldwide is taxable in India.

- Non-resident – Earning is taxable only when overseas income is got or grow in India.

After defining residential status, capital gain emerges when overseas stocks are sold for more than the purchase price. Even so, capital gains are further classified into two types based on the holding period of the investment.

- Short Term Capital Gain

- Long Term Capital Gain

Long Term Capital Gain

- Long Term Capital Gains emerge when stocks of overseas companies have been holding for more than twenty-four Months or Two Years.

- Long-term capital gain from the sale of International stocks would be taxed at a flat @ 20%, plus health and education cess (plus surcharge, if apply) and Listing advantage on investment cost.

Short Term Capital Gain

- Short Term Capital Gain shall emerge when stocks of oversees Business have holding a period of upto twenty-four months or two years.

- Short Term Capital Gain is merged to the taxpayer’s total Income and is taxable at Normal income tax slab rates.

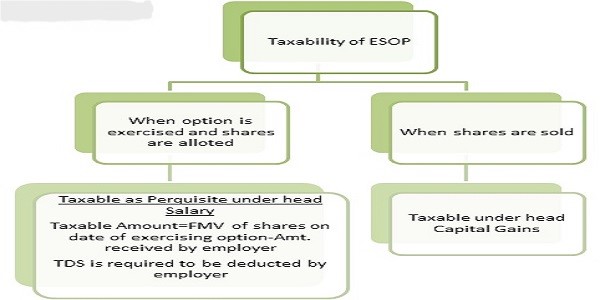

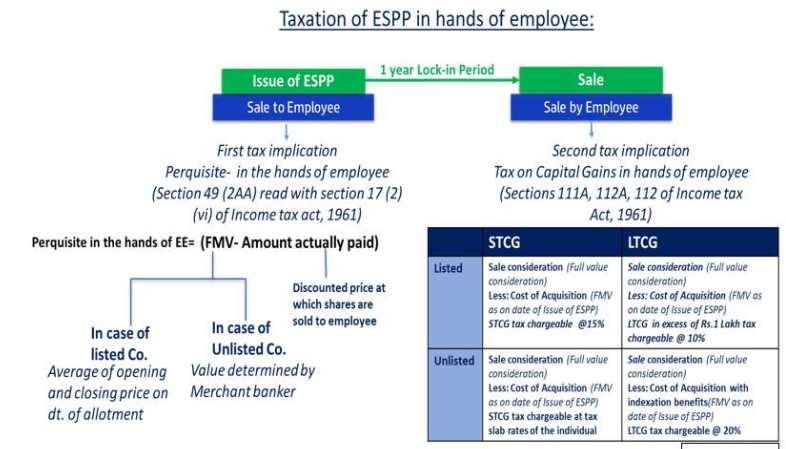

Tax Implications via ESOP

- Employee Stock Option Plan allows Indian employees to register to parent company stock at a pre – determined rate (usually below the price in the current prevailing market). However, the difference between the fair market value and the exercise price is taxable in the employee’s hands as a “perquisite.”

- Moreover, In case shares are sold, Distinguish between the fair market value & sale price at the time of sale is taxed as capital gain. The tax rate appropriate at the time of sale will be exactly the same as in the case of direct investment, depending on the employee’s holding period of the option.

Disclosure & Reporting in ITR Form.

- According to Income Tax law, it is compulsory for every to taxpayer of holding a international stocks or earning income from international equities, to submit ITR in India, irrespective of the fundamental exemption limit.

- In ITRs, the Assesses must expose all the overseas investments with overseas equities in Schedule-FA of ITR 2 or ITR 3, According to the source of his income, he might face criminal charges.

- Furthermore, India has entered into DTAA more than 95 countries, which can assist you in claiming tax credits.

To summarize- Complete Framework ESOP / RSU Taxation & Compliance (India)

- When analyzing an investment in foreign stocks or in foreign entities, one must consider not only the potential for income and capital appreciation or the fluctuation of foreign exchange rates, but also the after-tax yield from such an investment.

- Income tax Taxability on Employee Stock Option Plan is depends on persons / employees residential status. In case an employee is a resident but not ordinarily resident or non-resident & have exercised their Employee Stock Option Plan options or sold their shares, then in that case they may have to pay tax outside of India,

- With increased scrutiny on foreign assets & AIS data, ESOP/RSU taxation is no longer optional knowledge. Here’s the full lifecycle explained

Grant Stage (ESOP / RSU)

- No tax at the time of grant- Grant is only a right, not income & Applies to Indian & foreign ESOPs/RSUs, No reporting, no tax.

Vesting Stage

Indian ESOPs

- Taxable as Perquisite (Salary Income) under Section 17(2)(vi), Perquisite value = FMV on vesting – Exercise price and Reported in Form 12BA, Form 16 & ITR – Salary Schedule

ESOP Tax Deferral – Section 80-IAC (Startups) :

- Eligible employees of DPIIT-recognized startups get tax deferral: Tax on perquisite deferred to earliest of Sale of shares, Exit from company, & 5 years from vesting. Capital gains still taxed separately at sale.

RSUs / ESOPs from Foreign Companies (US, EU, etc.)

-

Taxable in India on vesting for ROR individuals

-

Taxed as Salary / IFOS depending on employer structure

-

US withholding tax may apply at vesting : Eligible for DTAA credit in India & Mandatory Schedule FSI, Schedule TR & Form 67

FMV Determination

Indian ESOPs

-

-

Merchant Banker valuation (Rule 3(8))

-

FMV as on vesting date

-

RSUs

-

-

FMV = Market value on vesting date

-

If received at cost / discounted → differential taxed

-

Wrong FMV = incorrect perquisite + future capital gains mismatch.

-

Sale of Shares – Capital Gains

Holding Period Rules

| Nature of Shares | STCG | LTCG |

|---|---|---|

| Listed shares | ≤12 months | >12 months |

| Unlisted shares | ≤24 months | >24 months |

Capital Gains Tax Rates (Post 23 July 2024)

-

Listed LTCG: 10% (above exemption threshold),

-

STCG (listed): 15%

-

Unlisted LTCG: 20% with indexation

-

Foreign shares: Treated as unlisted shares

-

Report in Schedule CG

Dividend Income : Taxable under Income from Other Sources. Foreign dividend → DTAA credit available. Report in Schedule OS, Schedule FSI & Schedule TR + Form 67

Non-Resident Indian (NRI) Services: Tax & Regulatory Compliance and Advisory

We providing Comprehensive solutions ensure compliance with FEMA and other statutory regulations, making it easier to manage financial and legal obligations for For NRIs, PIO, & OCI, Navigating the tax and regulatory landscape in India can be complex. Below are the key areas of focus:

Income Tax Compliance

- we are helping the DTAA provisions help avoid being taxed twice on the same income in India and the country of residence. also Assistance in filing income tax returns in India, including guidance on income from Indian sources such as property, investments, and business operations.

Employment Considerations

- we provide tax implications and compliance for NRIs working in India, including salary structuring and deductions. Guidance on how Indian tax laws apply to income earned from foreign employment.

Residency Issues for Expatriates

- we used to determining residential status as per Indian Income Tax laws and its impact on tax liability. also Advisory on maintaining or changing residency status for tax benefits.

Inheritance and Gifts

- we are handling tax implications and compliance for inheritance and gifts received within India.

- Advisory on receiving or sending inheritance and gifts from/to other countries, ensuring compliance with Indian tax laws and FEMA.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.