Newly Registered Co. Relaxation: Relief on Annual filling

Table of Contents

Relaxation for Newly Open Registered Companies: Relief on ROC Annual filling exemption

- Good news for a newly registered company who are having struggling to meeting adherence of ROC Annual filling requirement,

- The Ministry of Corporate Affairs has given concession on ROC annual filing & Financial Statements for newly incorporated company on or after 01 Jan to 31st

In case the same situation facing by you then it may be a cost-saving benefit for you. So, have a look into the details below.

- India has made progress in enhancing the ease of doing business. Due to government efforts focused on altering the regulatory environment, balancing the interests of stakeholders, & strengthening institutions for top class corporate governance.

- In response, companies incorporated on or after 1st January to 31st March relish some advantages, inclusive a cost-saving benefits in ROC Annual filing.

Whereas the date incorporation might not affect to shareholders or promoters, It is important to highlight that companies established after 1st January to 31st March are exempt from ROC annual filing for the first fiscal year or could decide to file for either three or fifteen months

But if a company chooses for three months, it doesn’t exempt them from Reserve Bank of India compliance & Normal Income tax return So, filing for fifteen months is a good option to save money while taking care of other laws and regulations related compliances.

The choice to file for three or fifteen months is totally based on the company’s particular conditions, like future plans to apply for a tender or loan, which needs a three-year track history.

Points for considered for newly incorporated subsidiaries

We should further consider few areas that should be considered for newly incorporated subsidiaries.

- In addition to the compliances, the company is required to obtain other registrations that aid in the “ease of doing business.” If you want to maximum advantage of financial transactions and to continue making imports/exports without having to pay IGST, the company must apply for Goods and Services Tax Registration along with the Letter of Undertaking on a periodic basis.

- As per the law, the annual general meeting is to be held within 6 months from the end date of the Financial Year. If it is your newly incorporated company, the exemption of extra three months is granted, so in the matter of these companies, firstly the annual general meeting could be held within 9 months from the end date of its Financial Year.

- The subscription money and foreign remittance must be deposited in the company’s bank account within 60 days of registration. Following that, Form FCGPR must be filed in relation to the foreign remittance within 30 days of the money being received in the company’s bank account.

The Important point here, which most companies neglect, is “the stamp duty payable on the Share Certificates.”

- The company must keep a database of the 1st board meeting, which must be held within 30 days of the company’s incorporation. Furthermore, the company must file Form INC-20A within 180 days of its incorporation, as the company cannot initiate its business without filing this form.

- Another critical point that must be regarded as that the subscription money is not considered as a transaction by most of the firms, where the possibility of hidden these types of transactions increase, that leads to the non-reporting of these transaction in the TP Report (Transfer Pricing Report).

In Summary

Newly registered company in India have some benefit, for example a leave from filing Financial Statements & Annual Returns for the 1st Financial Year, it depends of their date of incorporation. Although, Companies must still obey other legal necessities, such as foreign remittance, filing necessary forms, holding board meetings, depositing subscription and registered for Goods and Services Tax. But Companies must to be in touch with all the transaction, including subscription money, to prevent non-reporting in TP Report (Transfer Pricing Reports). It is also important to maintain the Annual General Meeting within the allotted time frame.

Thanks to government initiatives aimed at changing the regulatory environment, balancing the interests of stakeholders, and establishing institutions for top-notch corporate governance, India has made progress in enhancing the ease of doing business. Ultimately, although there are certain advantages for newly formed businesses, it is critical to comply with all relevant laws and regulations to guarantee an easy business operation.

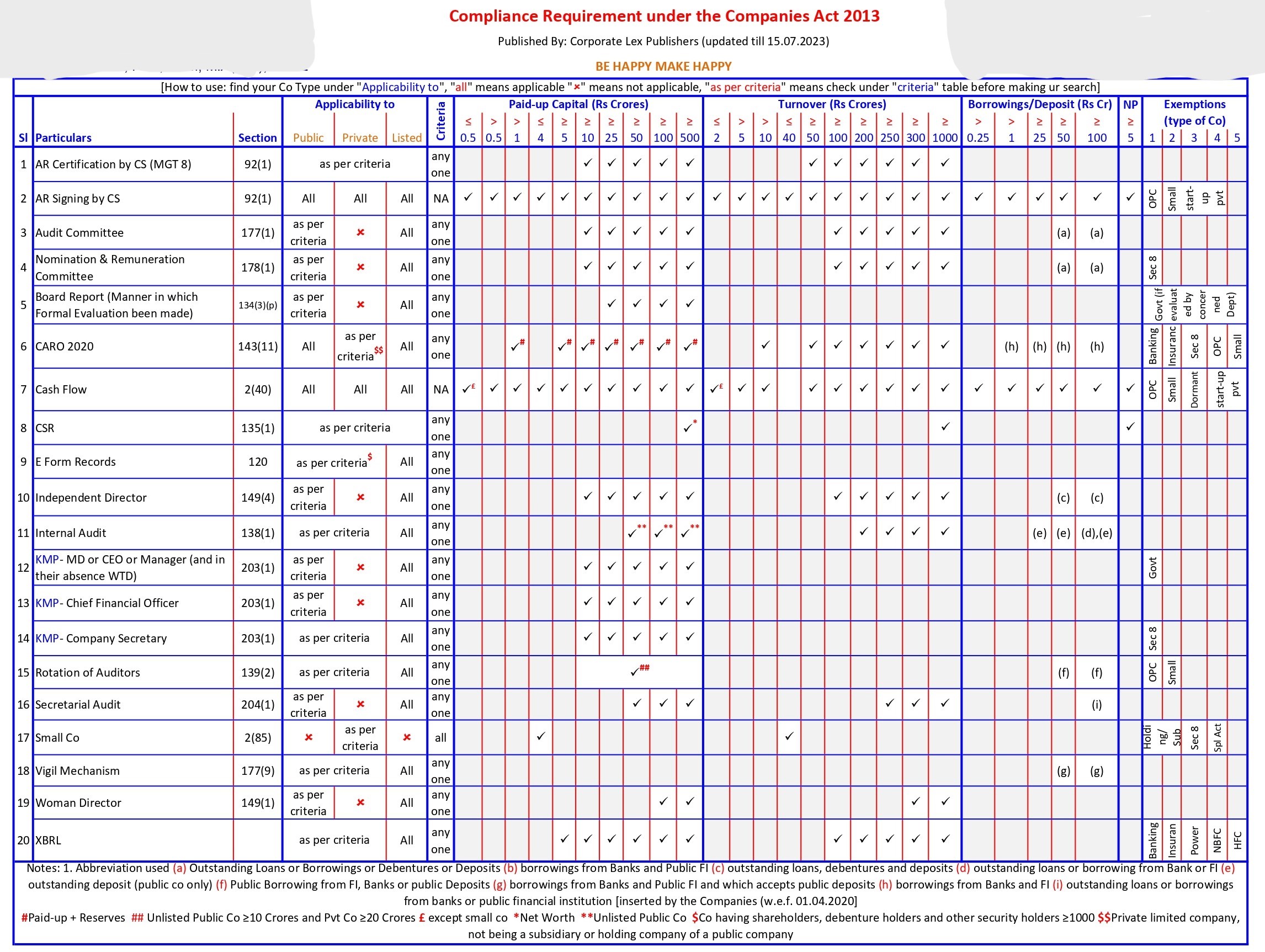

Company Law Compliance under the company Law

Post Written By : Associates – Tarun Kumar

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.