Important Income Tax Aspect to be consider in March ending

Table of Contents

Few Main important Income Tax Aspect to be consider in the March ending!

Q: The FY financial year 2022-23 is about to end, and the New financial year is about to start. How should a taxpayer prepare himself for this year’s march ending?

Ans : The month of March is very important for all Taxpayers. In our Country, the Financial Year from April to March is applicable to all Tax related laws. Thus Books of Accounts are prepared for the period of April to March.

Q: Which are the important tasks of income tax which should be undertaken before this march end?

Ans : Few important points which the Income tax taxpayer should keep in their mind details are mention here under –

- Payment of Income tax Advance Tax: If Income tax Taxpayers have not paid Advance tax before 15thMarch, then it shall be paid before 31st March so that less interest will be levied.

- Tax deduction at source deducted on Salary: Salaried Employees should give the details of Investments and deductions to the Employer so that less Tax deduction at source deducted will be deducted in the month of March.

- Regular Bank Reconciliation – It is very important to reconcile all the bank accounts and loan accounts at the year’s end.

- Annual Information Statement (earlier call Form 26AS): Every Income tax Taxpayer should download Income tax Form 26AS & verify Tax deduction at source deducted/Tax collected at source . Similarly, taxpayers should also verify the Income as mentioned in 26AS and Annual Information Statement(AIS) with Books of Accounts. Also check whether the Statement of Financial transactions like purchase of mutual funds above Rs. 2 Lakh, purchase of four-wheeler above Rs. 10 Lakh, purchase or sale of the property above Rs. 50 Lakh, etc are reflected in Income tax Form 26AS or not.

- Income Tax Deduction on Investment: If deduction u/s 80 is to be claimed in Income tax for financial Year 2022-23, then every taxpayer should verify the limits of Income tax and their tax liability and should invest, donate, etc. before 31stMarch 2023.

- Income tax Form 15 G/ H – The taxpayers who have income only from interest and the income is less than the prescribed limit, then can file a declaration manually or online in Income tax Form 15 G/ H.

- Calculation of dep. – The Income tax taxpayer should do the calculation of the dep on fixed asset at the time of year-end.

- Verification of Closing Stock– The Income tax taxpayers should do the verification of Stock at the year’s end. Along with that, immovable property verification should also be done & match them with book value.

- Deduction for statutory dues – If the taxpayer follows the cash basic accounting system and he wants to claim the deduction of the statutory dues paid, then he must make the payment of said dues before 31st March.

- Comparative Profit and loss A/c & Balance sheet – Income Tax Taxpayers should prepare a Comparative Profit and loss A/c with Balance sheet for the year. So that they will come to know total Profit – loss, Expenditure, turnover etc, Moreover, You may check basic accounting ratios also.

- PAN & Aadhar linking: Aadhar- permanent account number linking is now compulsory for permanent account number holders requiring the filing of Income Tax returns. The last date to link PAN & Aadhar is 31 march 2023. In case Aadhar & permanent account number are not linked till 31 march 2023 the permanent account number will thereafter become in-operative and consequently, the taxpayer would be unable to complete any permanent account number-related transactions.

- GST Reconciliation: You needed to Reconciliation of GSTR-3B with books of account GST, Reconciliation of GSTR-2A/2B with GSTR-3B, Reconciliation of GSTR-1 & books Reconciliation of GSTR 1 with GSTR 3B, Reconciliation of GSTR-2A/2B with books,

Q: What lesson Income tax taxpayer should learn from this?

Ans : Income tax taxpayers shall take precautions at right time i.e., March Year ending, so that they can save themselves from litigations under Income Tax law. The benefit of taking precautions at March year end will support in Income tax taxpayers to overcome all the offences in the upcoming new year.

India Financial Consultancy corporation Pvt Ltd. Services

With our expertise and commitment to excellence, India Financial Consultancy corporation Pvt Ltd. Services offers a range of tailored services to meet your specific accounting and bookkeeping needs. Our comprehensive solutions include:

-

Accounting Services:

Our team of qualified professionals excels in providing accurate and timely financial reporting, ensuring compliance with international accounting standards. From general ledger maintenance to financial statement preparation, we offer end-to-end accounting services to support your decision-making process.

-

Bookkeeping Services:

We provide meticulous bookkeeping services to maintain your financial records with utmost accuracy. Our experienced bookkeepers handle accounts payable and receivable, bank reconciliations, payroll processing, and more, enabling you to focus on core business activities with confidence.

-

Tax Preparation & Lodgement:

Our tax experts stay abreast of the latest tax regulations and changes, ensuring that your company remains compliant while optimizing tax efficiency. We offer comprehensive tax planning and preparation services, including Corporate tax returns, GST Returns, Tax Returns, Partnership Tax returns, Trust tax returns and individual tax Returns.

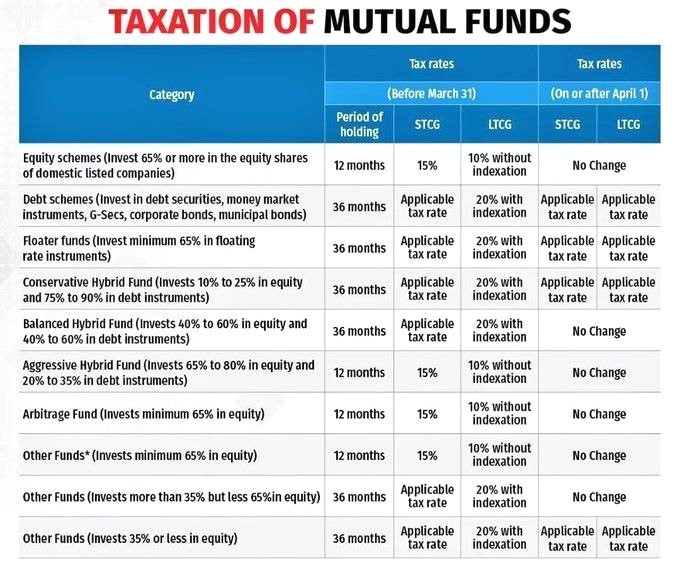

Taxation change in Investing in Mutual Funds

Remember that income tax policies and legislation are subject to change, so it’s always advisable to keep informed and consult a professional when making financial decisions.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.