Applicability of TDS on Purchase of Goods (Section 194Q)

BRIEF INTRODUCTION

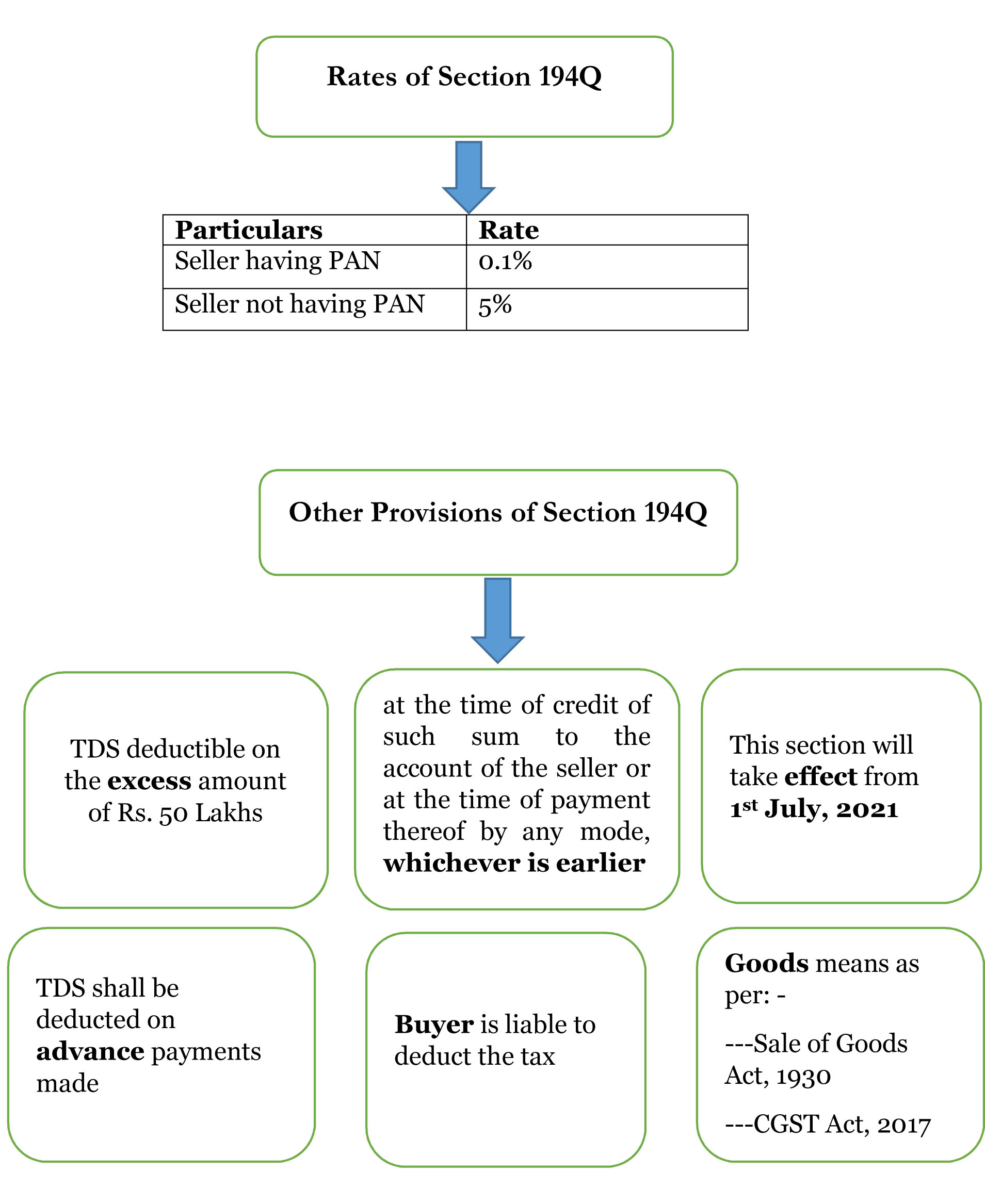

A new section was inserted in the Income Tax Act 1961, named section 194Q, and the same was introduced in Budget 2021-22, which relates to payment of TDS for purchase of goods. Under this section, a person, being a buyer paying any sum to any resident seller for purchase of any goods of the value in single transaction or in aggregate during a financial year exceeding Rs. 50 lakhs, will be required to deduct an amount of TDS @ 0.1% on the amount exceeding Rs 50 lakhs, at the time of crediting the amount in the account of the seller or at the time of payment on the place of purchase, whichever is earlier.

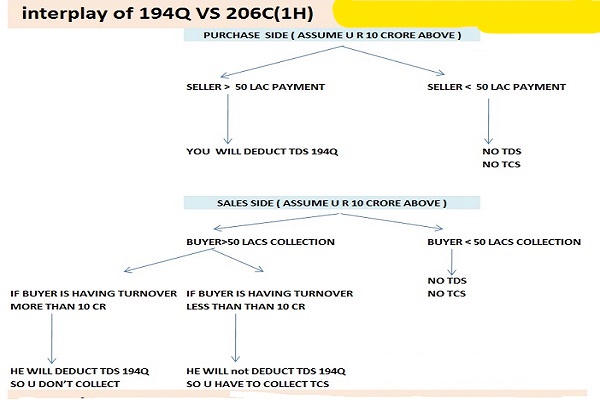

With the introduction of Finance Act 2021, a new section, Section 194Q, was inserted, providing for TDS to be deducted on purchase of goods, to be effective from July 1, 2021. It is similar to the structure of Section 206C(1H) introduced in Finance Act 2020, which relates to collection of TCS on consideration received from the buyer. Thus, the Section 206C(1H) imposes a liability on the seller to collect TCS from the buyer, while the Section 194Q, imposes a liability on the buyer to deduct TDS while paying to the seller.

Treatment of TDS in the context of debit notes issued for shortages or rate differences is largely accurate and well-reasoned:

Table of Contents

TDS Deduction at the Time of Purchase:

TDS is deducted on the basis of the invoice value at the time of booking the purchase. The subsequent issuance of a debit note (for shortages or rate differences) does not necessitate a reversal of the TDS already deducted and deposited. This is because TDS is calculated on the amount paid or credited to the supplier, which is based on the original invoice value.

TIME OF DEDUCTION

TDS to be deducted at the earlier of the following –

- Time where the amount is credited in the account of the seller.

- Time when the payment is made on the point of sale.

KEY ELEMENTS OF SECTION 194Q

- The provisions of section 194Q applies to a buyer, whose makes a total sales, gross receipts or turnover from any business undertaken by them, exceeds Rs 10 Crores during the financial year immediately preceding the current financial year of purchasing the goods.

- Such tax should be deducted only on purchase of goods from a resident seller. The rate of TDS is 0.1% of the value or aggregate value of the goods exceeding Rs 50 Lakh in a financial year.

- However, the said rate shall be @ 5%, where the seller does not hold a PAN card in India.

- The liability to deduct tax would arise at the time of crediting the amount in the account of the seller or at the time of payment on the place of purchase, whichever is earlier.

- The provision of TDS on purchase of goods under section 194Q, shall not be applicable in the following cases:

-

- The said goods are liable for TDS under any of the provisions of the Act.

- TCS has been collected under section 206C of the Act except to transaction referred to under section 206C(1H);

BUYER

Buyer, under this section, is a term used for a person whose total sales, gross receipts or turnover arising out of the business run by them exceeds Rs 10 crores during the financial year immediately preceding the current financial year of purchasing of goods, and shall exclude any, as the Central Government may, by notification in the Official Gazette, specify, subject to certain conditions.

In case the amount is credited to any account, named as “suspense account” or by any other name, in the books of account buyer, such a credit be deemed to be the credit of income to the account of the seller and the provisions under this section shall apply to it.

Adjustments in Future Transactions:

Your suggestion of adjusting the TDS against future invoices from the same supplier is a practical approach and aligns with standard business practices. This adjustment ensures that the TDS liability is appropriately balanced without the need for unnecessary reversals or refunds.

Rate of TDS for Scrap Purchases:

As per Section 194Q of the Income Tax Act, 2% TDS is applicable on the purchase of metal scrap. The rate is applied to the original invoice value and does not change due to debit notes for shortages or rate differences.

Compliance with Revenue Authorities:

It is essential to ensure that the deducted TDS is timely deposited with the revenue authorities and correctly reported in the TDS return (Form 26Q). Any adjustments in TDS should be reflected in subsequent transactions to avoid discrepancies during reconciliation with Form 26AS.

Issuance of Debit Notes:

- For shortages, the debit note should reflect the basic value of the goods not received and the corresponding sales tax (GST).

- For rate differences, the debit note should indicate the difference in price per unit and the applicable tax.

NON-COMPLIANCE

Under the section 40a(ia) of Income Tax Act 1961, where any person is required to deduct TDS but do not comply with it, shall be disallowed to deduct the amount of TDS in profit and loss account, by 30% of the value of transaction. Thus, where the buyer fails to deduct and deposit TDS as applicable then 30% of the amount of expenditure be disallowed, on which TDS was to be deducted and deposited. Apart from the disallowance, the buyer shall also be liable to pay interest @ 1% for every month or part of failure to deduct tax. While in case the buyer fails to deposit the amount of TDS, the same shall be liable to pay interest @ 1.5% for every month or part of failure of deposit.

BASIS OF COMPLIANCE

For every business, purchase of goods is a continuous and an ongoing process, thus it becomes difficult to keep proper check over the requirement of compliance required. Hence, use of technology and full automation will be the only possible way to comply with section 194Q. to have full automation, the following steps be followed –

- Considering the previous year, identify the suppliers from whom the purchases pf worth exceeding Rs. 50 lakhs were made and undertake alteration in the master accounts of these suppliers by activating TDS deduction option in their accounting software.

- Undertaking changes in the software, so that the identification and deduction of TDS wherever applicable, is done automatically.

ADVANTAGE

Even though 0.1% is quite a low rate of TDS. As compared to rates applicable on other transactions, but the same is expected to provide income to the Government in advance of every month.

DISADVANTAGE

With the introduction of a new section, the compliance burden will further increase, requiring staff in the company to properly deduct and deposit TDS within the time limit and also file the TDS return for the amount deposited. In short, it will further increase the cost of the company.

EXAMPLES

- TDS UNDER SECTION 194Q

Given – Seller’s Turnover: Rs. 6 Crores

Buyer’s Turnover: Rs. 20 Crores

Receipt or Payment for purchase of Goods: Rs. 55 lakhs

Taxation

Buyer’s Turnover is more than Rs. 10 Crores

Supplier’s turnover is less than Rs 10 crores

Taxable amount: Rs. 5 lakhs (Rs. 55 lakhs-Rs.50 lakhs)

TDS u/s194Q: 0.1% (5% in case seller do not hold PAN card) on Rs. 5 lakhs = Rs 500

TCS u/s 206C(1H): not applicable

- TCS UNDER SECTION 206C(1H)

Given – Seller’s Turnover: Rs. 20 Crores

Buyer’s Turnover: Rs. 6 Crores

Receipt or Payment for purchase of Goods: Rs. 55 lakhs

Taxation

Buyer’s Turnover is less than Rs. 10 Crores

Supplier’s turnover is more than Rs 10 crores

Taxable amount: Rs. 5 lakhs (Rs. 55 lakhs-Rs.50 lakhs)

TDS u/s194Q: not applicable

TCS u/s 206C(1H): 0.1% (1% in case buyer do not hold PAN card) on Rs. 5 lakhs = Rs 500

- NON-APPLICATION OF SECTION 206C(1H)

Given – Seller’s Turnover: Rs. 20 Crores

Buyer’s Turnover: Rs. 20 Crores

Receipt or Payment for purchase of Goods: Rs. 55 lakhs

Taxation

Buyer’s Turnover is more than Rs. 10 Crores

Supplier’s turnover is more than Rs 10 crores

Taxable amount: Rs. 5 lakhs (Rs. 55 lakhs-Rs.50 lakhs)

TDS u/s194Q: 0.1% on Rs. 5 lakhs = Rs 500

TCS u/s 206C(1H): not applicable as TDS is required to be deducted first, and once deducted TCS cannot be collected.

SOME REQUIREMENTS UNDER SECTION 194Q

- The procurement team of the company shall be required to identify the suppliers from whom they purchase goods worth more than Rs 50 lacs.

- The IT team of the company would be required to make certain essential changes in the software, for automatic identification and deduction of TDS.

- Revision of certain provisions to give effect to this section from 1st July 2021.

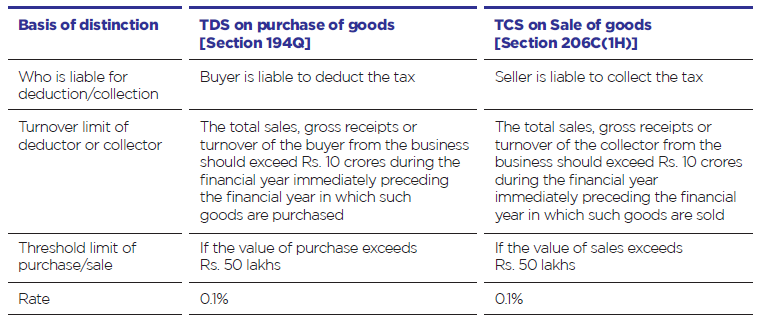

COMPARISON BETWEEN SECTION 194Q & SECTION 206C(1H)

BASIS |

TDS ON PURCHASE OF GOODS UNDER SECTION 194Q |

TCS ON SALE OF GOODS UNDER SECTION 206C(1H) |

| PERSON LIABLE TO DEDUCT/COLLECT TAX | BUYER | SELLER |

| TURNOVER LIMIT | THE AGGREGATE OF SALES, GROSS RECEIPTS OR TURNOVER OF THE BUYER FROM THE BUSINESS SHOULD EXCEED RS. 10 CRORES DURING THE FINANCIAL YEAR IMMEDIATELY PRECEDING THE CURRENT YEAR OF PURCHASING GOODS. | THE AGGREGATE OF SALES, GROSS RECEIPTS OR TURNOVER OF THE SEELER FROM THE BUSINESS SHOULD EXCEED RS. 10 CRORES DURING THE FINANCIAL YEAR IMMEDIATELY PRECEDING THE CURRENT YEAR OF SELLING GOODS. |

| EFFECTIVE DATE | 1ST JULY 2021 | 1ST OCTOBER 2020 |

| RATE | 0.1% | 0.1% (0.075% FOR FY 2020-21) |

| AMOUNT ON WHICH TAX TO BE DEDUCTED/COLLECTED | AMOUNT OF PURCHASE ABOVE RS 50 LAKHS | AMOUNT OF SALE CONSIDERATION ABOVE RS 50 LAKHS. |

| PAN NOT AVAILABLE | 5% | 1% |

| TIME OF DEDUCTION/COLLECTION | EARLIER OF –

1. AT THE TIME OF CREDIT OF PAYMENT 2. TIME OF PAYMENT AT THE POINT OF SALE |

AT THE TIME OF RECEIPT |

| EXCLUSIONS | NOT APPLICABLE WHERE –

1. TAX IS DEDUCTIBLE UNDER ANY OTHER PROVISIONS OF THE ACT 2. TAX IS COLLECTIBLE UNDER 206C OTHER THAN 206C (1H) |

WHERE THE BUYER IS –

1. IMPORTER OF GOODS 2. CENTRAL/STATE GOVERNMENT, LOCAL AUTHORITY 3. AN EMBASSY, HIGH COMMISSION, LEGATION, COMMISSION, CONSULATE AND TRADE REPRESENTATION OF A FOREIGN STATE |

| PREFERENCE OVER OTHER SECTION | PURCHASER IS FIRST LIABLE TO DEDUCT TDS EVEN IF THE TRANSACTION IS SUBJECT TO BOTH PROVISION | SELLER SHALL COLLECT TAX ONLY WHERE THE PURCHASER IS NOT LIABLE TO DEDUCT TDS OR FAILS TO MAKE ONE. |

| WHEN TO DEPOSIT/COLLECT | WITHIN 7TH DAY OF THE MONTH, SUBSEQUENT TO THE MONTH OF TDS DEDUCTION | WITHIN 7TH DAY OF THE MONTH, SUBSEQUENT TO THE MONTH OF TCS DEDUCTION |

| QUARTERLY STATEMENT TO BE FILED | FORM 26Q | FORM 27EQ |

| CERTIFICATE TO BE ISSUED TO SELLER/BUYER | FORM 16A | FORM 27D |

Also read

- TDS Deduction Rate Chart for (AY 2023-2024) FY 2022-2023

- TCS Rate Chart & Overview – TCS Vs 206C(1)(1F)(1H) v. TDS Vs 194Q

- New TDS deduction No cash transactions exceeding 1 Crore -Section 194N

- Extention of TDS/TCS statement filing Date

- Read More about key features of TCS on goods sale section-206c

- COMPLIANCES OF TAX DEDUCTED AT SOURCES(TDS)

- TDS & TCS Rate chart for FY 2024-25

- Comprehensive study about TDS & TCS chapter

You may contact us at singh@carajput.com or singh@caindelhiindia.com in if you have any questions. For query or help, contact call at +91 9555 555 480

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.