All About Presumptive Taxation Section 44AD, 44ADA, 44AE

Table of Contents

Presumptive Taxation- Section 44AD, 44ADA, 44AE For Business And Professions

What is Presumptive Taxation Scheme?

- Owners of small businesses make up a sizable portion of the Indian economy and significantly increase GDP. For many of them, however, keeping up the books of accounts and having them audited can seem like a laborious task.

- To relieve small business owners of the burden of keeping books of accounts and having the accounts audited, the income tax department devised the presumptive income tax plan.

- Small taxpayers such as independent contractors, physicians, solicitors, advocates, professionals, MSME enterprises, and lawyers are all included. The presumptive income scheme’s provisions are covered in three sections.

Budget update for 2021:

- Taxpayers must pay advance tax on dividend income only after the dividend is declared or paid.

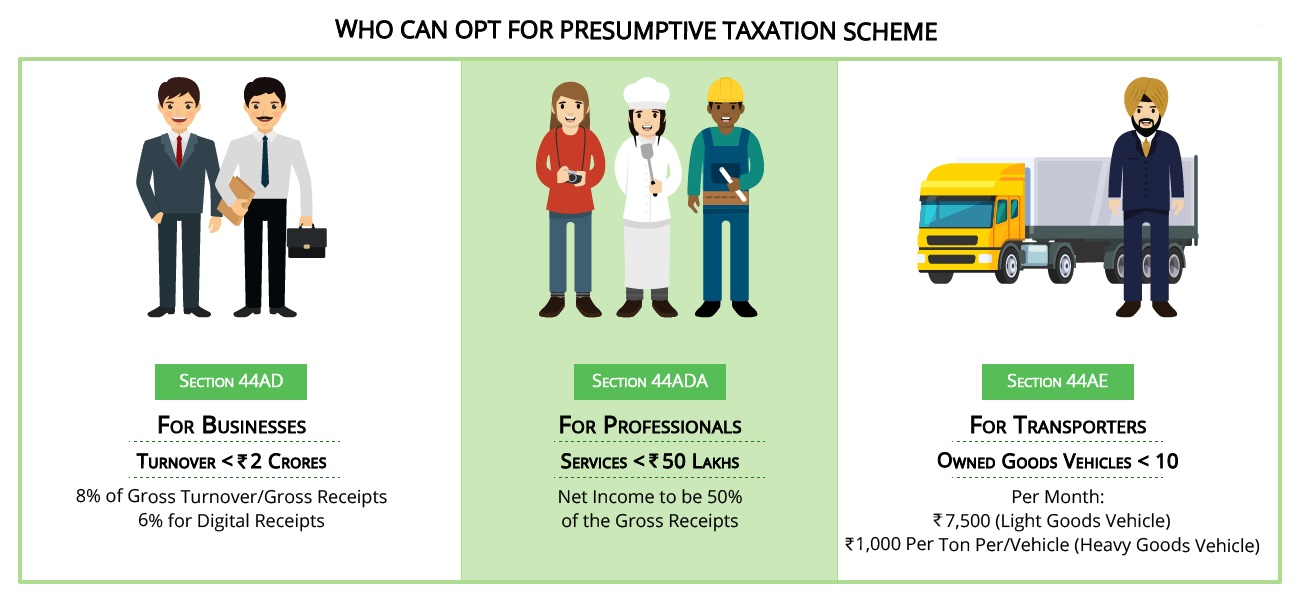

- The Income-tax Act has framed the presumptive taxation scheme under sections 44AD, 44ADA, and 44AE to relieve small taxpayers of the tedious task of maintaining books of account and having the accounts audited.

- This section will teach you about the various provisions of the presumptive taxation scheme of sections 44AD, 44ADA, and 44AE.

Definition of a Presumptive Taxation Scheme.

- The Presumptive Taxation Scheme is a provision in the Income Tax Act that provides relief to small taxpayers. A small taxpayer is one with a turnover of less than two crore rupees for the purposes of the scheme.

- Government of India (GoI) wanted assessees in the specified businesses to be able to do business without being burdened by excessive compliance-related requirements. As a result, Section 44AD was added to the Income Tax Act. The section allows assessees to declare income at a prescribed minimum rate and be relieved of the laborious task of maintaining books of account.

- There will also be some leeway in the requirement to have your accounts audited. In the reference to section 44AD, entities that have registered under the presumptive taxation scheme shall be entitled to calculate revenue on an estimated basis.

- In addition, entities enrolled in the scheme are exempt from keeping books of accounts. As a result, taxpayers can use the presumptive taxation scheme to reduce their compliance burden. The current article discusses the Income Tax Act’s presumptive taxation scheme.

The Income-tax Act has established two presumptive taxation schemes for small taxpayers, as shown below:

- Section 44AD’s presumptive taxation scheme.

- Section 44ADA’s presumptive taxation scheme.

- Section 44AE’s presumptive taxation scheme.

A person who adopts the presumptive financial scheme may claim income at a prescribed rate and is, on the other hand, exempt from tedious work of maintaining account books and also from being audited by accounts.

Section I: Businesses

- Choosing a Legal Entity:

When starting a new business, one of the very first questions you’ll face is determining what legal entity you should establish. Some of the legal entity options available depend on the nature and size of the business.

- Sole Proprietorship.

- L.P. (Limited Liability Partnership).

- Private Company.

- Public Company.

- Joint venture.

As a result, there is no legal requirement that a ‘company’ be formed in order to start a business. Incorporating a business has both advantages and disadvantages. The formation of a corporation increases the amount of compliance work.

If you grow fast and are unable to manage your business, it will help you divide it into a separate legal entity that has its own PAN and files a separate tax return. Otherwise, as a sole owner, you can choose to run your business.

Presumptive Taxation Scheme Eligibility Criteria under Section 44AD

The following individuals may use the presumptive taxation system in accordance with Section 44AD.

- Any person who is an Indian resident.

- HUFs resident in India.

- A partnership company resident in India.

Any of the above-mentioned entities may participate in this scheme if they claimed tax deductions for the relevant assessment year under the following sections.

- 10A

- 10AA

- 10B

- 10BA

- 80HH

- 80RRB

The following persons or individuals are ineligible to use Section 44AD’s presumptive taxation scheme.

- Any Limited Liability Partnership Corporation (LLP).

- Non-residents. •Anyone who is not a Hindu Undivided Family or a partnership firm.

Businesses that are not covered by Section 44AD’s Presumptive Taxation Scheme.

Although the presumptive taxation scheme under Section 44AD is designed to relieve small taxpayers who do business, there are a number of exclusions that the taxpayer cannot use as far as the type of business described in Section 44AD is concerned.

- Any undertaking in accordance with Section 44AE involving cargo renting, hiring or plying.

- Any company related to organisations.

- Persons receiving brokerage commission or income.

- Any person participating in any profession referred to in Article 44AA (1).

- Insurance agents, as their income is paid through commissions.

- Any individual with a yearly gross income of more than Rs 1 lakh. However, there is an exception to this rule if the gross income does not exceed the audit limit of Rs 1 lakh as specified in section 44AB.

- Accounting books must be kept up to date.

If any of the following criteria are met as a business, then keeping books of accounts in accordance with the Income Tax Act is required:

- Income goes up Rs. 1,20,000.

- Total sales, turnover, or gross receipts exceed Rs. 100,000.

In any of the three years immediately preceding this one. This condition has been further relaxed for individuals and HUFs, who will only be required to keep books of accounts if.

- Income is greater than Rs 2.5 lakhs or

- In all three years immediately preceding the previous year the total sales, turnover, or gross receipts are greater than Rs 25 lakhs.

Note: penalty for non-keeping accounts books:

You would be liable for a punishment of up to Rs 25,000 if you did not keep the accounting records that you ought to have maintained according to law.

- Tax Audit

The tax audit shall be subject to the tax audit for enterprises with gross receipts exceeding Rs 1 crore in one fiscal year. The due date is 30 September of the assessment year for the filing of the tax audit report. Form 3CD must be used to electronically file the tax audit report. For taxpayers who are subject to a tax audit, the due date for filing an income tax return is also September 30 of the assessment year. A tax audit report cannot be revised under normal circumstances. However, in cases where the accounts have been revised, the tax audit report can be revised.

- The deadline.

- The deadline for filing a tax audit report is September 30th of the assessment year.

- Return filing deadline (if a tax audit is required) – September 30th of the assessment year.

- Return filing deadline (if no tax audit is required) – July 31st of the assessment year.

- Taxation on the basis of a presumption

In accordance with section 44AD of the Income Tax Act, presumed taxation for companies is covered. Any company that has a turnover below Rs 2 may presumably be taxed. You have to report profits of 8% for non-digital transactions or 6% for digital transactions, whatever the application.

The following companies are not subject to presumptive taxation.

- The agents of life insurance.

- Any type of Commission.

- The plying, leasing or hiring of carriages of goods.

6. Presumptive taxation computation.

As an example,

Laxmi Traders has gross receipts of Rs 1.5 crore for financial year 2020-2021 but does not keep books of accounts. Presumptive taxation has been chosen by Laxmi traders. Laxmi Traders received Rs. 70 lakhs in non-digital transactions (cash payments) and Rs. 80 lakhs in digital transactions during the year.

What is the expected income under the headings business and profession?

The solution.

Earnings from business and profession:

70,00,000 * 8% = Rs. 5,60,000 for non-digital transactions

80,00,000 * 6% = Rs. 4,80,000 for digital transactions

The income under the category of “Business or Profession” will be Rs 10,40,000.

7. Advantages of Presumptive Taxation

- The Central Government’s National Defense Fund;

- The Central Government’s National Defense Fund;

- Your net income is deemed 8% of your turnover under presumptive taxation under Section 44AD, and you must pay tax on that income.

- If your receipts are digital (non-cash), only 6% of your receipts are considered net income, and you will be taxed on that amount.

- Presumptive taxation permits you to pay your taxes on the basis of a fictitious income. In other words, you don’t need to estimate your income by subtracting your expenses from your revenue. You can simply deduct a proportion of your entire income from your tax bill.

- However, one of the advantages of presumptive taxation may be the elimination of the need to keep books of account. However, it is not that simple because you would still like to know your actual gain or loss in the activity.

- You are not required to keep accounting records.

- You are not required to have your accounting records audited.

- You are obliged to pay advance tax – but rather than estimating income and paying income tax each quarter, you can pay all of your advance tax before March 31. If you expect your income tax liability to exceed Rs.10,000 in the fiscal year, you must pay advance tax by the 15th March of the relevant fiscal year if you have opted for the presumptive scheme.

- This is also a restriction because if you choose presumptive taxation, you cannot deduct or claim expenses from your revenue.

- So the advantage is that you might not have to present bills and financial statements while submitting your taxes. However, as a good businessperson, you must still keep track of your finances. Later in this essay, we’ll explain why.

8. International Transaction

TDS deducted by the foreign client.

Payments may be obtained via paypal or as a direct credit to your bank account if you work for clients outside of India. Typically, the overseas client will deduct taxes from the money before transferring it to you, in compliance with local tax rules. As an Indian resident, you would be subject to income tax on all of your earnings. However, you can claim a tax credit for taxes paid outside of the United States on your income tax return.

The foreign client does not deduct TDS.

There is no need to be concerned if no TDS has been deducted. Because you will be a tax resident of India, you must include these receipts in your total income when calculating your income and pay the applicable tax on them. To meet advance tax obligations, you may be required to estimate your annual income from all sources.

9. Income Return.

An individual or HUF operating a business is required to file an income tax return in form ITR 3. A taxpayer who chooses presumptive taxation must file his return in ITR 3.

10. Businesses can opt in or out of Section 44AD.

Any person who meets the eligibility requirements for Section 44AD can choose the Presumptive Taxation scheme at any time.

Furthermore, a person can opt out of this at any time. However, according to the most recent amended laws, if a person opts out of the Scheme of Presumptive Taxation of Section 44AD, he will be unable to benefit from the Scheme of Presumptive Taxation for the next five years.

The same information is summarised in the table below:

| Particulars | Presumptive Taxation under Section 44AD for Business |

| AY 2017-18, 2018-19, AY 2019-20 | Opts for Presumptive Taxation |

| AY 2020-21 | Does not opt for Presumptive Taxation |

| AY 2021-22 to AY 2025-26 | Cannot opt for Presumptive Taxation |

If a person opts out of the provisions of Section 44AD, he must also have his accounts audited by a Chartered Accountant under Section 44AB.

11. Calculation of Taxable Income for Individuals Using Section 44AD’s Presumptive Taxation Scheme

If a person or individual seeks to take advantage of the provisions outlined in section 44AD, his or her taxable income will be calculated on the basis of presumption. This means that the individual’s presumptive income will be 8% of his or her yearly turnover or gross income. This revenue, estimated at an 8% rate, will be regarded the individual’s final absolute income, with no further expenses taken into account.

12. Other Points of Interest Concerning Section 44AD

- If an assessee has more than one business, the entire turnover of all of the enterprises should be considered.

- However, if the assessee is engaged on both business and profession, Section 44AD can be applied to business revenue. The income obtained from a profession would be computed in accordance with the Income Tax Act’s normal rules.

- An assessee who declares his income pursuant to presumptive taxation under section 44AD may also claim the tax benefit of deductions under chapter VI-A.

If an assessee uses presumptive taxation under section 44AD, he must file his income tax return in ITR Form 4 – Sugam.

Section II: Professionals

- Professions as defined by Indian tax laws.

Section 44ADA: Professionals are subject to presumptive taxation at a rate of 50%.

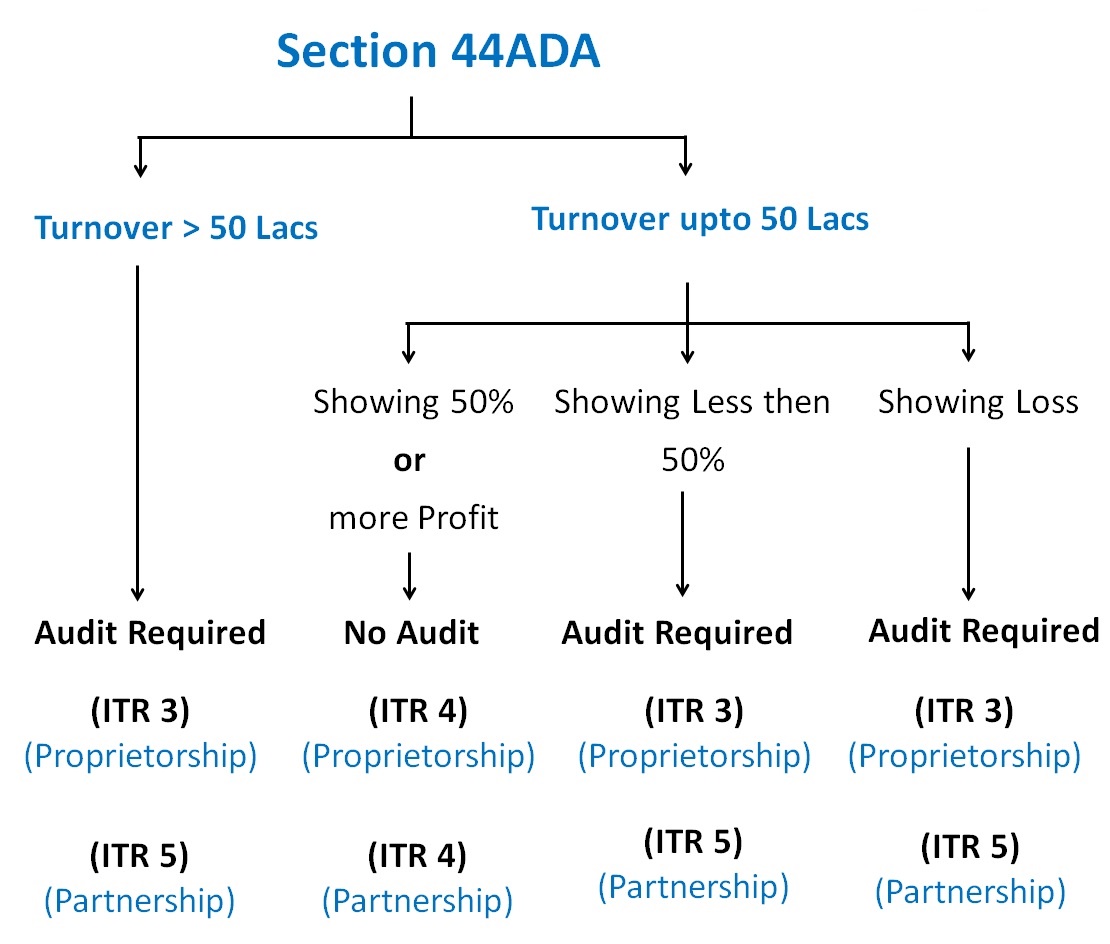

The benefit of Presumptive Taxation, which was previously only available to certain businesses, has now been extended to Professionals. Professionals whose total gross receipts do not exceed Rs. 50 lakhs in a fiscal year can claim the benefit of this Section beginning with the fiscal year 2016-17.

The income of everyone who takes advantage of this section is deemed to be 50% of the total gross receipts for the year. The professionals listed below are regarded to be professionals who can benefit from this section:

- Architectural Profession

- Profession of Accountancy

- Technical Consultancy

- Interior Decoration

- Legal

- Medical

- Engineering

Only a resident assessee who is an individual, a HUF, or a partnership, but not a Limited Liability Partnership firm, is eligible for this plan.

The assessee will be assumed to have been allowed the deductions under Sections 30 to 38 under this scheme. The assessee will not be allowed any additional expenditure deductions, and it will be assumed that he has already claimed all of his expenditures.

- Maintaining the books of accounts.

Professionals engaged in specific occupations.

Professionals engaged in the above-mentioned professions must keep books of accounts in accordance with Rule 6F of the Income Tax Rules. If gross receipts exceed Rs. 1.5 lakhs in any of the two preceding years, such professionals will be required to keep accounting records. If he began his profession in a specific year and his receipts exceed Rs 1.5 lakhs for that year, he is required to keep accounting records for that year.

These are the accounting records that are required by Rule 6F.

- Cash Book – A book in which you record all cash receipts and payments in order to determine your cash balance at the end of the day or month.

- Journal – You must keep track of all of your daily transactions in a journal. When you use the mercantile system of accounting, you must record all debits and credits.

iii. Ledger – A book in which all of your entries flow from the journal, where all of your accounts are detailed, and which simplifies the preparation of your financial statements at the end of the year.

- If the amount is more than Rs. 25 lakhs, you must keep photocopies of all bills and receipts.

- Finally, if the value exceeds Rs. 50 lakhs, you must keep the original bills or receipts.

If you work in the medical field, you must also keep these additional records.

- Daily case registers containing information about patients, fees received, services provided, and the date of receipt.

vii. Maintain a daily inventory of medicines and other consumable items.

The assessee is also not required to:

- keep books of accounts in accordance with sub-section (1) of Section 44AA, or

- have the accounts audited in accordance with Section 44AB in respect of such income.

However, if the assessee claims that his profits and gains are less than 50%, he must prepare Books of Accounts under Section 44AA, keep receipts for all expenses, and have his accounts audited by a Chartered Accountant.

Professionals engaged in non-specified occupations.

If you work in a profession other than those mentioned above, you must keep books of accounts that allow an assessing officer to calculate your taxable income in accordance with Income Tax laws. However, if you are an individual, this mandate would apply only if your income exceeds Rs. 2.5 lakhs or your gross receipts exceed Rs. 25 lakhs in any of the three preceding years.

- Taxable Income Calculation

A professional could easily calculate his taxable “Income under the Head Profits and Gains from Business or Profession” by deducting all of his profession-related expenses from his gross receipts. Salary (if you have employed someone), rent for the premises where you carry out your profession, internet expenses, mobile expenses, official travel, lunch expenses (if met officially), and so on are examples of profession-related expenses.

As an example,

Reena is a professional interior designer. For the financial year 2017-18, she earned a total of Rs 15 lakhs from her profession. The following expenses have been incurred by her.

- paid to 2 staff – Rs 3 lakhs

- Rent for Internet and mobile – RS 25,000

- Salary premises – Rs 1.5 lakhs

- Lunch expenses – Rs 24,000

- Travel expenses – Rs 1.5 lakhs

Here is how we determine her taxable income from business :

| Particulars | Amount (in Rs) | |

| Gross receipts | 15,00,000 | |

| (-) | Profession-related expenses | |

| Internet and mobile | 25,000 | |

| Salary | 3,00,000 | |

| Rent | 1,50,000 | |

| Lunch expenses | 24,000 | |

| Travel expenses | 1,50,000 | |

| Net Income | 8,51,000 |

This income will be added to Reena’s other taxable income, resulting in an aggregate sum on which she is required to pay taxes at the rates applicable to her income bracket.

- Tax Returns.

ITR 3 is the form that applies to you as a professional. Unless you are subject to an audit under the Income-tax Act, you must file your return on or before July 31 of the Assessment Year.

- Tax Audit Applicability

If your gross revenue from your profession exceeds Rs 25 lakhs in any given fiscal year, you must conduct a tax audit. Failure to have your books audited can result in a penalty of up to 0.5 percent of your gross revenue, or Rs 1.5 lakhs, whichever is less.

Choosing whether or not to use Section 44ADA.

A person can choose to participate in or opt out of Section 44ADA at any time. In contrast to Section 44AD for Business, a professional can opt in and out at any time without the 5-year limit. This is explained in the table below:

| Particulars | Presumptive Taxation under Section 44ADA for Professionals |

| AY 2017-18 | Opts for Presumptive Taxation |

| AY 2018-19 | Does not opt for Presumptive Taxation |

| AY 2019-20 | Can again opt for Presumptive Taxation. No Restriction |

A professional would only have to audit his books if he had less than 50 per cent of his income. If you opt out of section 44ADA, then you are not required to audit your accounts

- Taxation by Presumption.

A professional with a gross revenue of up to Rs 50 lakhs can choose the presumptive tax scheme, in which he can immediately offer 50% of his gross revenue as taxable income and pay taxes on such income at his slab rates. If he chooses this scheme, he will no longer be able to deduct any of his professional expenses.

Furthermore, anyone who chooses this scheme is not required to keep books of accounts. While he is also required to file his return by July 31 of the assessment year, he must do so in ITR 4.

Moreover, he will be subject to a tax audit if his income is less than the income calculated on a presumptive basis and his income exceeds the basic exemption limit.

Here is a simple example to help you understand when this scheme is appropriate:

| Particulars | Tax liability with Presumptive taxation | Tax liability without Presumptive taxation |

| Income | Rs. 30,00,000 | Rs. 30,00,000 |

| Expenses | Rs. 15,00,000 (50% of income is eligible for deduction) | Rs. 3,00,000 |

| Taxable income | Rs. 15,00,000 | Rs. 27,00,000 |

| Tax liability | Rs. 2,62,500 (excluding cess) | Rs. 6,22,500 (excluding cess) |

As an example:

Rahul is a practicing doctor with an annual salary of Rs 30 lakhs in the financial year 2017-18. Rahu’s actual expenses for running his practice total Rs 3,00,000.

Rahu’s tax liability for FY 2017-18 is as follows: It is clear that if Rahul uses presumptive taxation, he will be able to save Rs. 3,60,000 from his tax outgo.

- Income of Freelancers

Freelancers who work in any of the specified or unspecified professions are subject to the same rules as any other full-time specified or unspecified professional, including rules for calculating taxable income and tax liability, maintaining books of accounts, presumptive tax, return filing, and so on.

Section III: Other Selected Businesses – Presumptive Income Tax under Section 44AE

- Who is eligible to use Section 44AE’s presumptive taxation scheme?

The provisions of Section 44AE apply to everyone (i.e., an individual, HUF, firm, company, etc. ). Section 44AE’s presumptive taxation scheme can be used by anyone who is in the business of transporting, hiring, or leasing goods carriages and does not own more than ten goods vehicles at any time during the year.

- Individuals or businesses who are not covered by section 44AE.

Section 44AE’s presumptive taxation scheme cannot be used by anyone who is in the business of plying, hiring, or leasing goods carriages and owns more than ten goods vehicles at any time during the year.

- Calculation of taxable business income under section 44AE’s presumptive taxation scheme.

If a person chooses the presumptive taxation scheme of section 44AE, income will be calculated on an estimated basis.

- In the case of a heavy goods vehicle, income will be computed at the rate of Rs. 1,000 per tonne of gross vehicle weight for each month or part of a month that the taxpayer owns the heavy goods vehicle.

- In the case of vehicles other than heavy goods vehicles, income will be computed at a rate of 7,500 for each month or part of a month that the taxpayer owns the goods carriage. A portion of the month would be treated as a full month.

- Advance tax payment under Section 44AE

There is no payment of advance tax concession in the case of a person who adopts the presumptive taxation scheme of section 44AE, and thus he will be required to pay advance tax even though he accepts the presumptive taxation scheme of section 44AE.

Relevant Terms

The Indian income tax law is hundreds of pages long. There is no reason for you to waste time trying to figure out how to navigate it. Here’s a quick dictionary to help you understand some basic tax terms that will come in handy when it comes time to file your tax returns002E

Book of Account:

Books of accounts are a record of your company’s income, expenses, assets, and liabilities. These financial records are critical for understanding your company’s performance. In some cases, these may be required by law.

Deductions

Gross total income is the sum of income from all five categories. Deductions can be claimed from this gross total income. Because they reduce your gross total income, these deductions reduce your total tax bill. Investments such as PPF and NSC, as well as certain expenses such as life insurance premiums, education loan interest, and medical insurance, are allowable deductions from your gross total income.

Depreciation:

Usually the benefit of this asset is expected to last more than one year when a capital asset is purchased and these assets will be capitalised rather than charged for expenses when purchased. A small part of its costs is charged each year and may be reduced from your income. The cost is known as depreciation, which is charged each year.

Tax Deduction at Source (TDS)

Before making payment, the person responsible for payment must deduct the tax. Instead of waiting for you (the recipient) to make a tax payment yourself, the tax department wants payers to deduct tax in advance and deposit it. The net amount is given to the income recipient (after deduction of tax at source). The gross amount is added to the recipient’s income. TDS is subtracted from the final tax due because it is tax that has already been deposited on the recipient’s behalf. TDS guarantees that the government receives a consistent stream of revenue.

Advance Tax.

Income tax should be paid in advance rather than in one lump sum at the end of the year. It’s sometimes referred to as “pay as you go” tax. These payments must be made in instalments according to the income tax department’s due dates.

Form 26.

Your PAN’s tax information is contained in Form 26AS. It displays how much tax the government has received against your PAN.

It contains TDS, tax deposited by you directly, rebates you have received etc. Your Form 26AS can be seen and downloaded.

Tax Audit:

A tax audit is a Chartered Accountant’s examination of your financial records.

- You are a professional with gross receipts in excess of Rs.50 lakhs, and your books must be audited.

- A company owner with an annual income of more than Rs.1 crores

- Your total income has been declared to be below the percentage prescribed for presumptive taxation, however, exceeds the basic exemption limit of Rs. 250,000.

Signature Digital:

Both CAs signature and yours must be included during the filing of the audit report. You’ll need a digital signature for this. The validity of a digital signature certificate is one or two years.

For freelancers, a defective return notice under section 139(9)

When you use the ITR-3 Form to file an income tax return and check the box for “Are you liable to maintain accounts under section 44AA,” but fail to submit full details in the P&L and Balance Sheet sections, your return will be considered invalid under Section 139. (9).

Expenses that are deductible and those that are not.

- Renting a private or shared office space.

- Meal and travel expenditures relevant to the job.

- Costs of advertising, promotion, and publishing.

- Asset depreciation, such as laptops and PCs. Depreciation rates can be found on the IRS website.

- Fees paid to private platforms like Software Company to file tax returns.

- Expenses incurred as a result of professional travel.

- Conveyance costs.

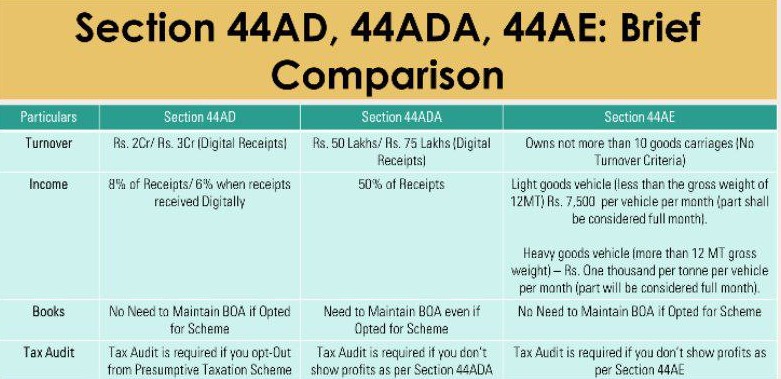

Section 44AD, 44ADA, 44AE For Business And Professions Provide a Comparative structure of each of these sections.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.