What is the Difference between AIS and Form 26AS?

Table of Contents

What is the difference between AIS and Form 26AS?

Form 26AS is similar to a tax passbook in that it contains information about TDS and TCS deposited against the taxpayer’s PAN during the fiscal year.

Furthermore, in the altered version of Form 26AS, information relating to specified transactions like mutual fund unit purchases, foreign remittances, and so on will be reflected only if the transaction exceeds the specified limit or tax has been deducted.

- For example, if tax is deducted on the interest earned on a fixed deposit, it will be reflected on Form 26AS.

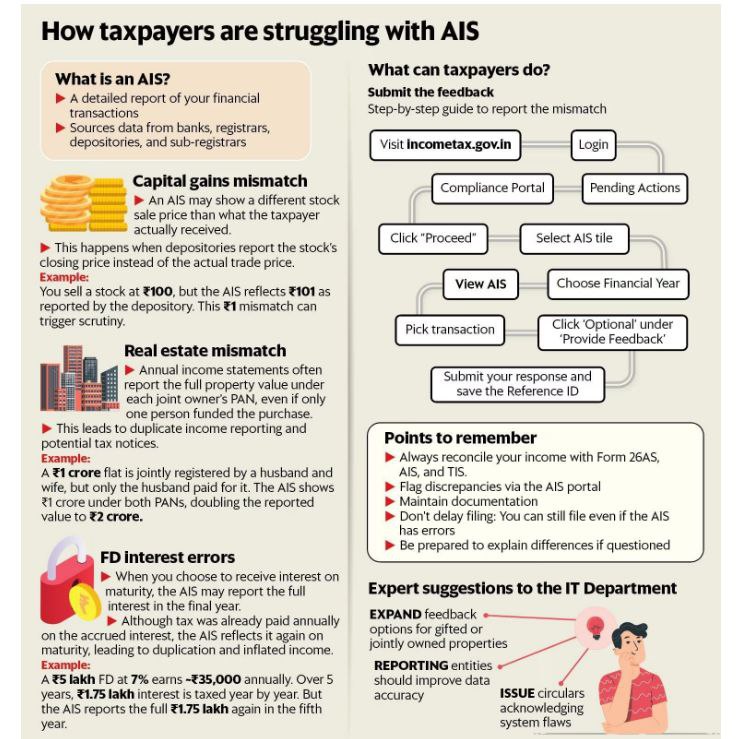

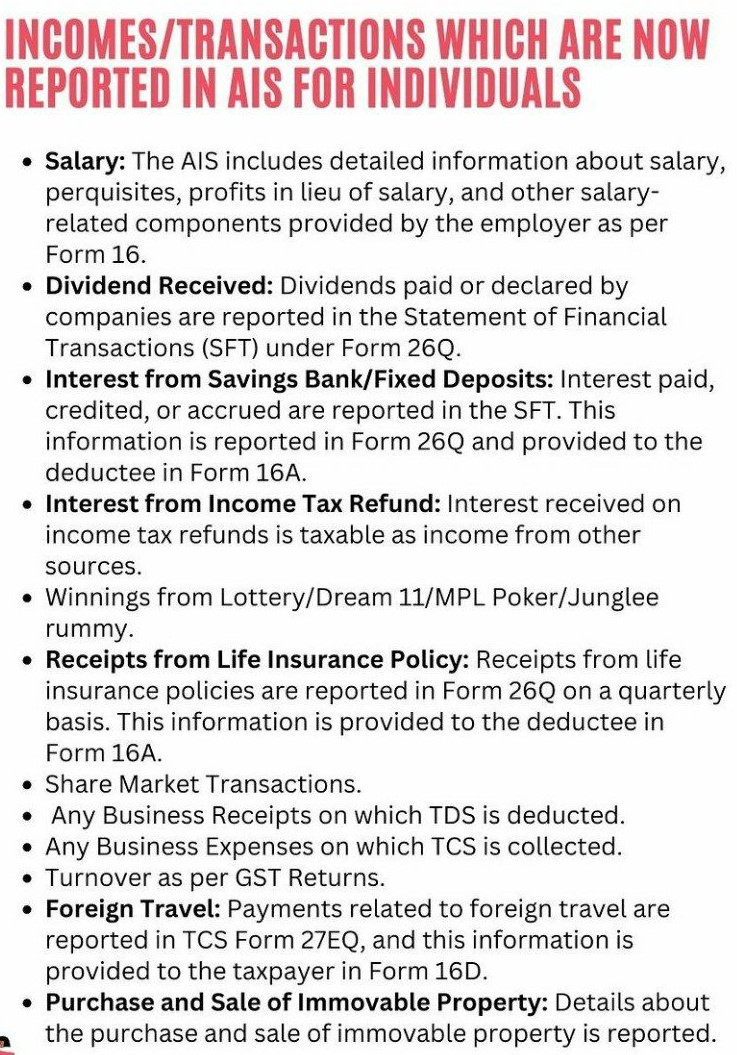

AIS is a more comprehensive system. In the case of AIS, the transactions will be reflected regardless of whether or not tax has been deducted. As a result, even if no tax is deducted from the interest received on a fixed deposit, it will still be shown in the AIS.

- The statement will include TDS, TCS, the sale and purchase of equity shares, mutual funds, dividends, interest income, and other items.

- There is no set limit for the number of transactions that can be included in the AIS. Thus, even a Rs 2,000 investment in a mutual fund SIP will be reflected in your AIS. Basically, AIS reflects all of your large and small specified financial transactions that have been reported to the income tax department by various financial entities.

- Such reporting is required of these entities by law. AIS displays all of your financial transactions that the income tax department is specified.

- Both AIS & TIS are expected to benefit taxpayers by providing details of all transactions and assisting them in being prepared in advance for essential discussions with tax officers. Importantly, the move will provide more transparency and detail about the assessees’ financial situation. On the other hand, they give the tax authorities with a comprehensive data set in one location.If properly implemented, this initiative will create a taxpayer-friendly environment and uphold the I-T department’s pledge to treat taxpayers as “honest” as stated in the taxpayers’ charter. This will also provide the government the power in its efforts to provide a seamless, painless, and faceless tax administration.

Key Differences: Form 26AS vs. AIS

| Particulars | Form 26AS | AIS (Annual Information Statement) |

| Purpose | Tax credit & TDS verification | Comprehensive income & transaction view |

| Data Sources | Deductors, banks | Deductors, banks, SFT filers, GST returns |

| Format | PDF, HTML | PDF, JSON |

| Feedback Mechanism | Not available | Available through AIS portal |

How can AIS assist taxpayers?

- With the assistance of Annual Information System, you can cross-check all financial transactions that you conduct and report to the income tax department. This will assist you in double-checking and reporting all of the required information on your income tax return.

- For example, a dividend received in fiscal year 2020-21 is taxable in your hands. As a result, even if the amount is as low as Rs 50, you must report it in your ITR and pay tax on it. If you ignore to report this Rs 50, the AIS will help you remember.

- This will assist them in removing any duplicate or incorrect information. The resulting data in TIS will be spontaneously updated in real-time if the taxpayer sends a response on AIS after rigorous scrutiny, and that information will be used for pre-filing of tax returns. As a result, taxpayers have been encouraged to double-check all related information and provide detailed and accurate information in their I-T filings.

- If a taxpayer has previously submitted an I-T return but some details were left out, the return may be updated to include the correct information.

Information covered in Income Tax AIS

Its very important to wait for fully updated Annual Information Statement (AIS), Taxpayer Information Summary(TIS) and 26AS before filing Income Tax Return .

Tax Dept Releases E-Flyer: Say No to Understand Cash Transaction & its Limits for FY 2023-24

Income Tax E-Flyer on Maintenance of Books of Accounts

Popular Article :More read for related blogs are:

- Provision-of-capital-gains-charts

- Govt needed to introduce changes in NSP Budget 2021

- All about the Income taxation on capital gain

- Tax Audit

- Implication of cash transaction under income tax Act

- How to file Revised Return of Income Tax E-Filing: Income Tax Department

- Prevent popular errors while filing an income tax return

- Needed to file Income Tax return of Bitcoin profit earned

India Financial Consultancy corporation Pvt Ltd is a Service Platform dedicated to provide all kinds of services under one roof i.e. with the aim of “MAKING BUSINESS EASY “at affordable prices. We will offer support and guidance at every stage to ensure that the business is compliant with the regulations and is continually growing. The services offered by us are attached for your reference, We will be happy serving you all the time. To know more kindly contact us on: +91 9555-555-480 or singh@caindelhiindia.com

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.