CORPORATE AND PROFESSIONAL UPDATE APRIL 4, 2016

CORPORATE AND PROFESSIONAL UPDATE APRIL 4, 2016

DIRECT TAX:

- Income Tax : Security deposit collected from its members refundable – whether receipts does not partake the character of income? – Held No- (Gulmohar Greens Golf and Country Club Ltd. Versus DCIT, Circle-2 (1) (1) , Ahmedabad – 2016 (3) TMI 1065 – ITAT AHMEDABAD).

- Income Tax: Exemption u/s 54B – assessee has purchased agricultural land in the name of his wife and the payment was made by the assessee from his own source through banking channel – assessee is entitled for the benefit of deduction u/s 54B- (Jai Prakash S/o. Sh. Girdhari Lal Versus ITO Ward-1 (3) , Meerut – 2016 (3) TMI 1061 – ITAT DELHI)

INDIRECT TAX:

- Service Tax : ST counted from date of receipt of export proceeds and not from date of export Cenvat Credit : Export of services is complete only after receipt of consideration towards same; hence, service exporters may claim refund of utilized Cenvat credit within time-allowed under section 11B, viz., 1 year from date of receipt of consideration [2016] 67com 313 (Bangalore – CESTAT)

Infosys Technologies Ltd. v. Commissioner of Service Tax.

- Service Tax : Benefit of SSI Exemption – Appellant s name of the company itself is M/s. Elac Marketing Pvt. Ltd. The company name itself has the word Elac which is part of the company s name and the appellants cleared the goods indicating their company name Elac followed with Excel . Therefore it cannot be construed that they have affixed brand name of other person- (M/s. Elac Marketing Pvt. Ltd. And Shri K.S. Ganesh, Director Versus Commissioner of Central Excise, CESTAT CHENNAI.

- Service Tax : Interest on refund – respondent-assessee is not entitled to interest on delayed refund because the department has sanctioned the refund within a period of three months from the date of receipt of the application for refund as per the requirement in law- (Commissioner of Central Excise, Pune-III Versus Suresh Enterprises – 2016 (3) TMI 1045 – CESTAT MUMBAI)

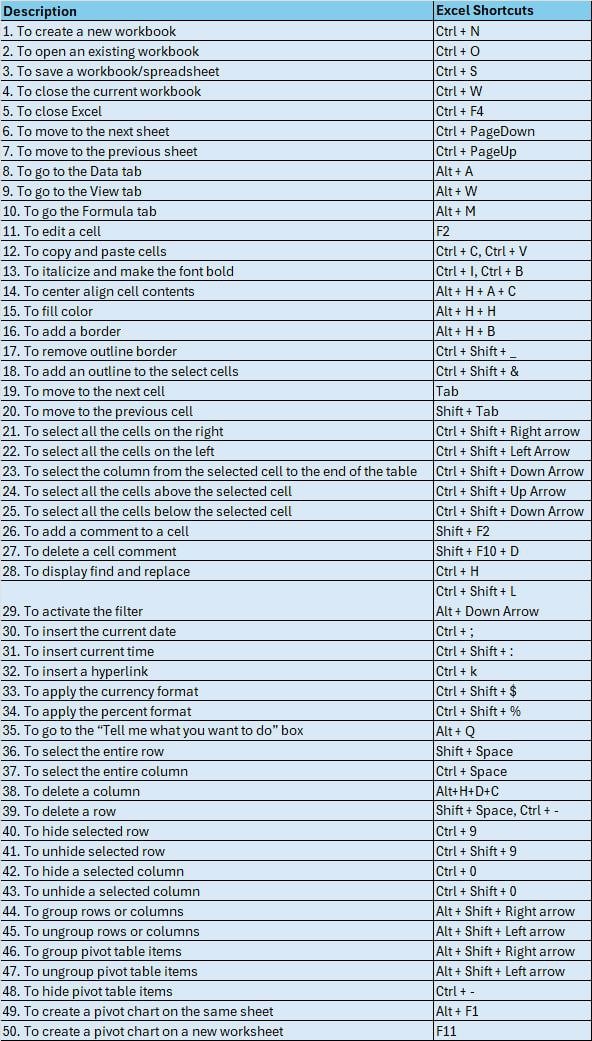

50 Excel Shortcut Keys You Should Know

Key Dates:

- Payment of TDS u/s 194IA deducted on purchase of property/TCS collected in March: 07/04/2016

- Submission of Forms received in March to IT Commissioner: 07/04/2016- Form No. 27C(TCS)

“Hard words cannot touch any soft heart but soft words can touch any hard heart, so speak in a soft way, world will be yours. Words win world.”

We look forward for your valuable comments. www.caindelhiindia.com

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.