All about Income tax return (ITR) filing via ITR-U Form

Table of Contents

Income tax return (ITR) filing via ITR-U

What is means of Income tax return (ITR) filing via ITR-U?

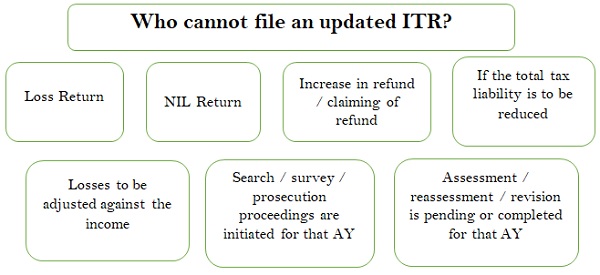

- In addition to provide an updated return, the CBDT has announced a new Rule 12AC and Form ITR-U that must be filed for every year late Income tax return filing. With the new updated return idea introduced by the Finance Act of 2022, Income tax taxpayer now have up to 24 months to submit their income tax returns.

- A new section, u/s 139(8), was added to allow individuals to file updated returns of income, with the exception of searches and seizures and other predetermined situations.

- Time limit of 24 months from the end of the relevant AY is specified for filing an updated return, and it is effective as of 01-04-2022. A person may submit an amended return for AY 2020–21 and AY 2021–22 in FY 2022–23.

- Income tax return filing for AY 2022-23: The last date for income tax return (ITR) filing for FY 2021-22 or for AY 2022-23 is 31st July 2022 and for filing

- ITR-U will also be available for filing updated returns for FY 19-20 & FY 20-21

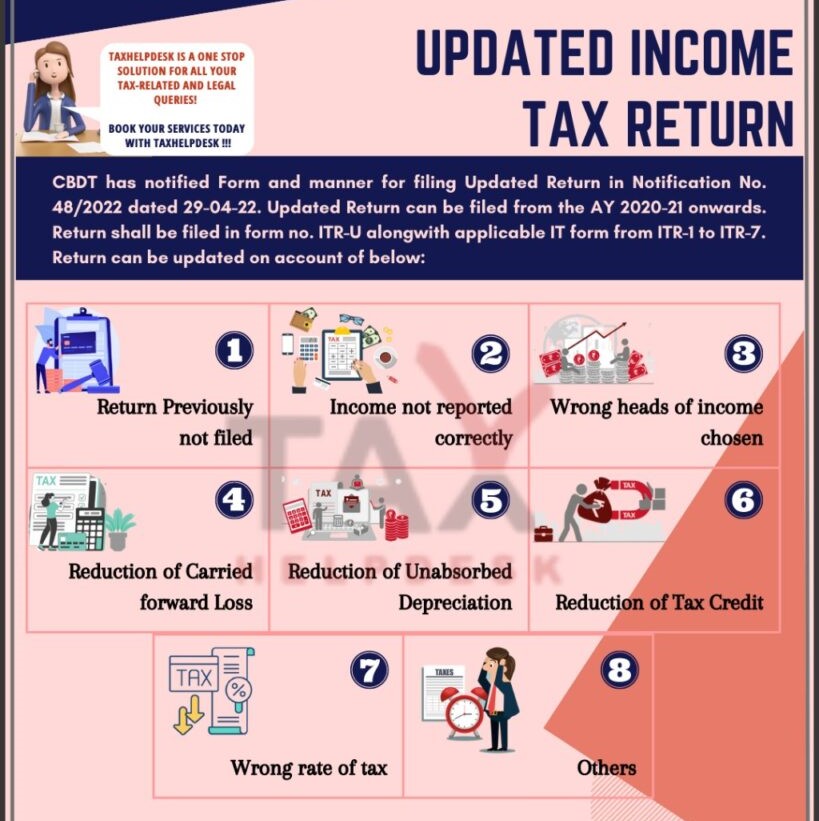

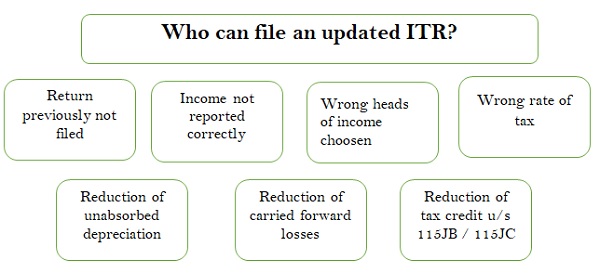

What are case in Which ITR-U Can be Filed ?

- Wrong Heads of Income Choosn

- Reduction of unabsorbed Depreciation

- Return Previously not filed.

- Reduction of Carried forward losses

- Income not reported correctly

- Reduction of Tax Credit u/s 115JB/115JC

- Wrong rate of tax

Note: Taxpayers will be allowed to file only 1 such correction (updated return) per AY.

What are the case in which ITR-U Form Cannot be filed?

- Income tax return is reducing the income tax liability from the return filed earlier

- Updated return is a return of the loss

- Return result increases the income tax refund

- Any proceedings for Assessment / Reassessment/Revision/Recomputation is Pending or Completed for Said A.Y.

- Income tax Act will not allow to file the updated return if there is no additional tax outgo

- Search/Survey/Prosecution are Initiated for said A.Y.

Additional Tax:

- The Income tax Act requires that the taxpayer has to pay an additional 25% interest on the tax due if the updated Income tax return is filed within 12 months from the end of relevant AY.

- While interest will go up to 50% if it is filed after 12 months but before 24 months from the end of relevant AY.

- Taxpayers looking to file the same for FY 19-20 will need to pay the due tax and interest along with an additional 50% amount of such tax and interest.

- For those looking to file for FY 20-21, the additional amount will be 25% of the due tax and interest.

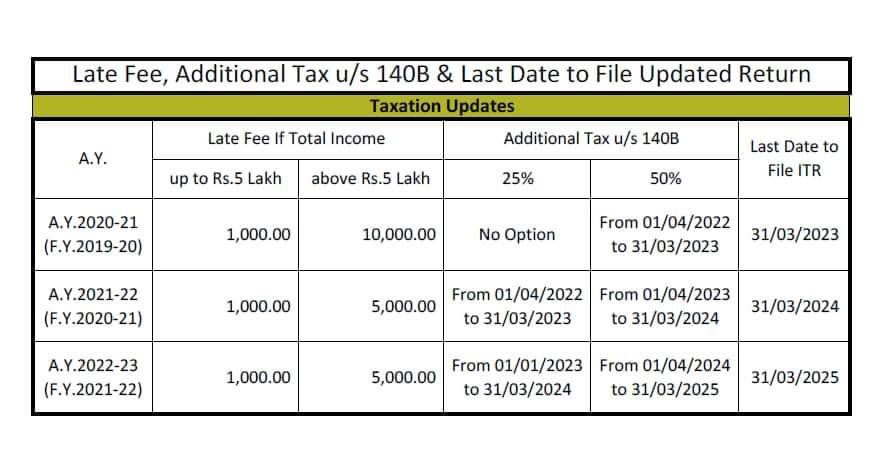

Update about The Late Fee, Additional Tax u/s 140B & last date to File updated Return

Also Read : Tax Audit

Implication of cash transaction under income tax Act

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.