Now on pay GST @ 18% on rent -Practical aspects

Table of Contents

Now on pay GST @ 18% on rent (Impact & Practical aspects)

Any person who makes supply of goods over INR 40,00,000/- & a supply of service over INR 20,00,000/- will be liable for compulsory required to be take the GST registration.

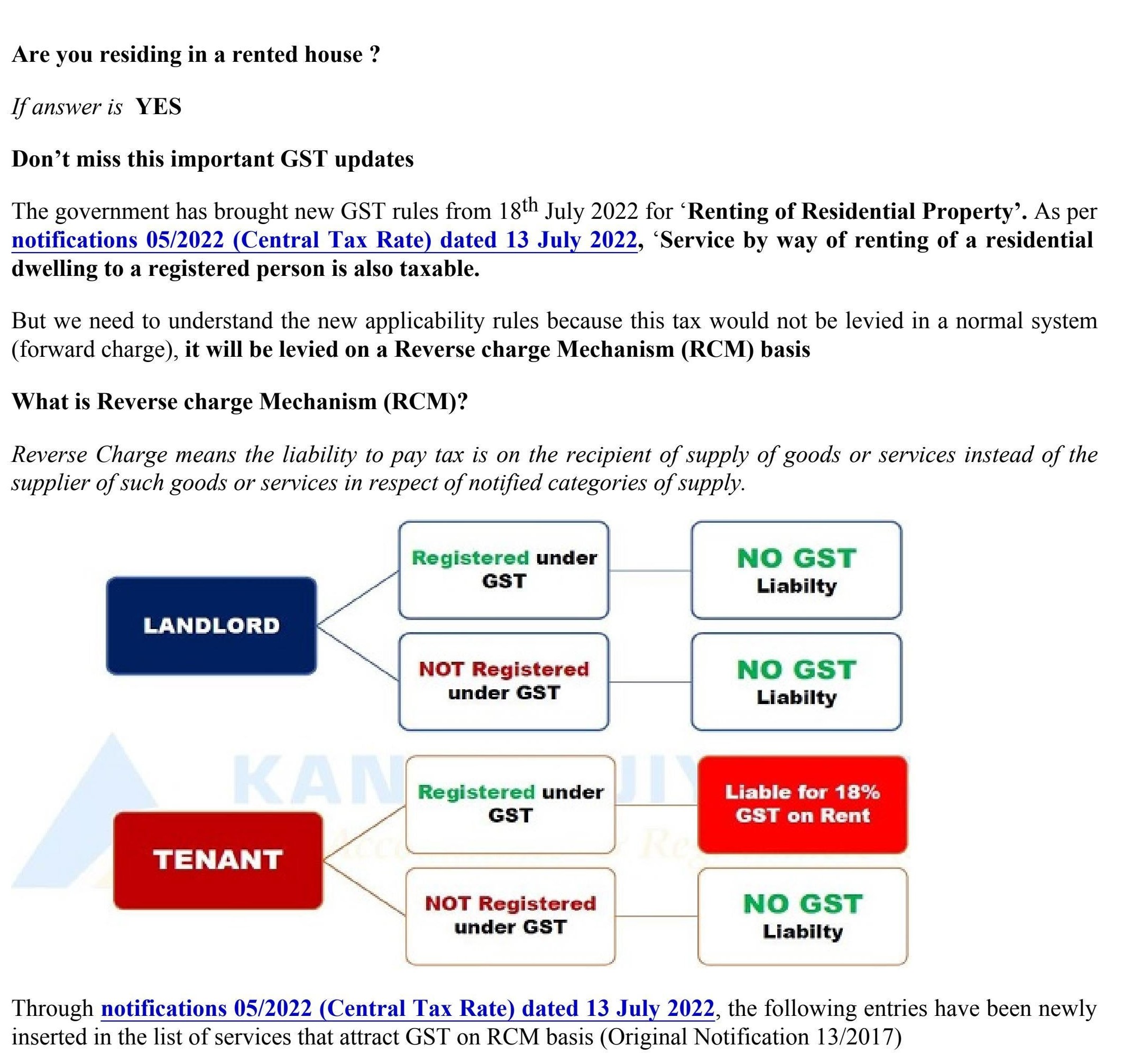

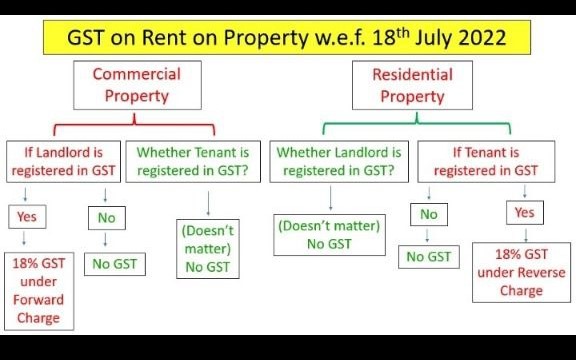

New GST rules are all set to unsettle rentals, too. The Finance Ministry’s has been introduced 18% GST on residential rentals income across the india, it has been commence from July 18 2022. As per the New GST notification, a residential house rented to a GST registered person under the GST will attract a GST @ 18%. Further, the lessee required to pay the GST, keeping the lessor out of legal liability.

Is the Landlord can be take GST registered in a other Different State

- Yes, a landlord may also register in an another state. The Landlord need not be registered in the same state as where the Property is situated.

- The mere fact that a landlord has an immovable property that is being rented out in another state does not imply that he is providing services from that location and is therefore exempt from the requirement to register for GST in that state.

- He can choose to register for GST from a different state or inside the same state.

- IGST will be charged if the landlord is registered in a state other than the one where the property is located. If he is in the same state, then CGST and SGST would apply.

Final outcome of this changes is that an person or individual, who is GST registered, & has income from rented a residential house property for the personal use persons & not as a business expenditure, will also required to tax under GST. This needed govt intervention.

This decision, in our viewpoint, will seriously impact how homebuyers feel. RERA Committee and the Builders Association, stated that the Reverse Charge Mechanism is applicable to all residential units with registered GST numbers (with a turnover of Rs 20 lakh). Small unit holders won’t experience any changes. As according him, this is a setback for the promotion of rental housing as a business from a real estate perspective.

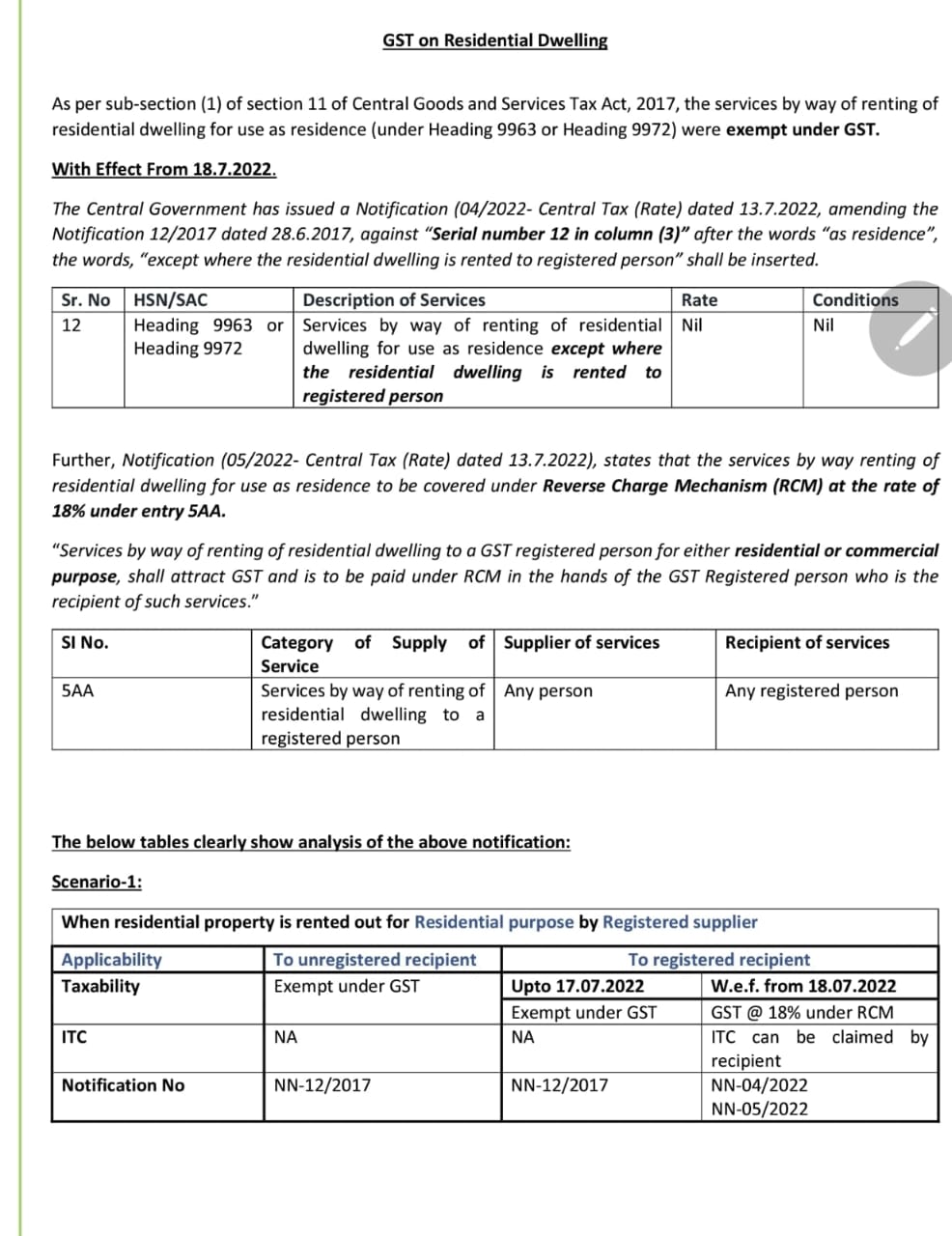

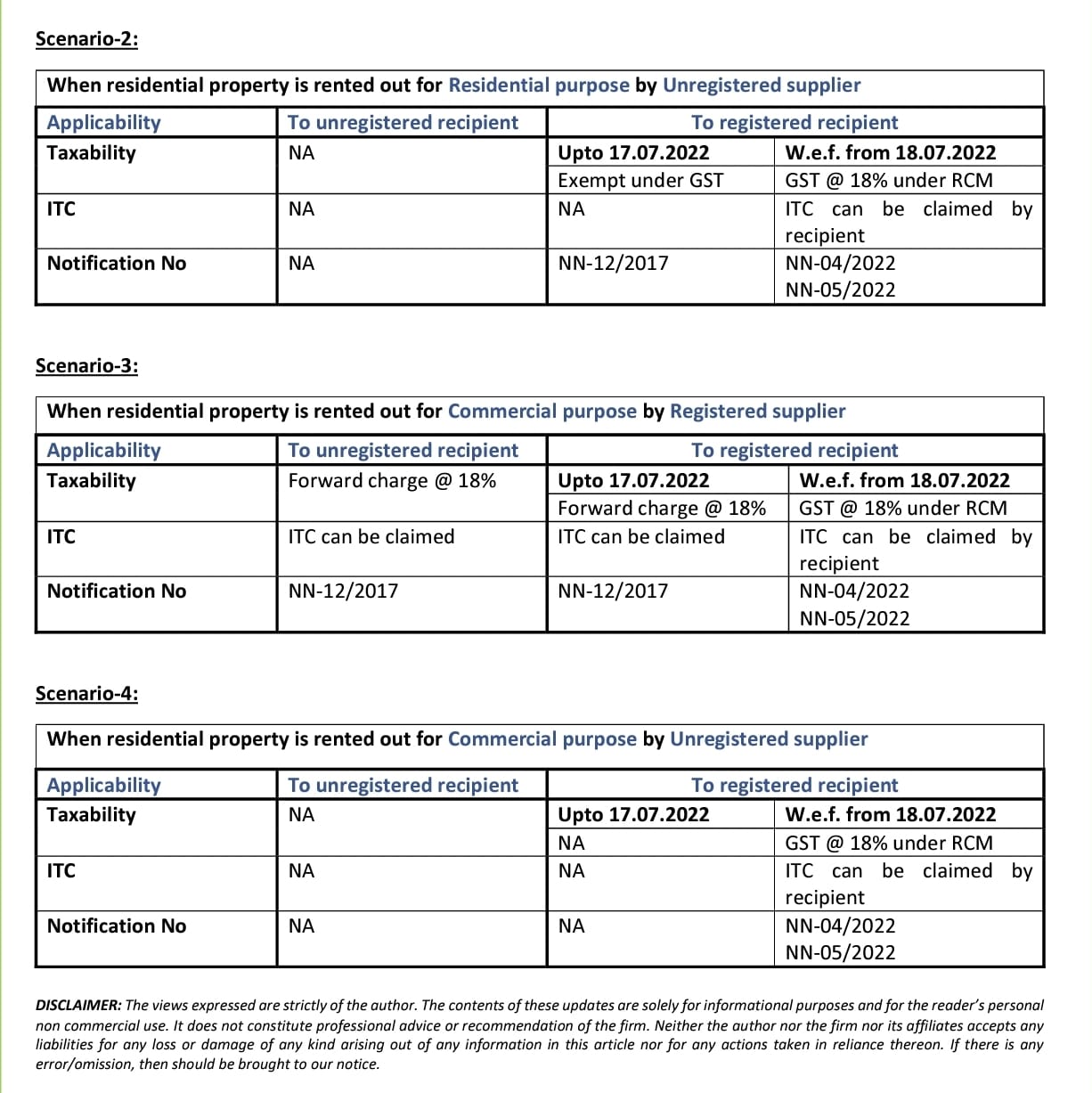

Below are Gist of Implication on GST of Residential Property rental

Residential dwellings Renting for residential use

| Tenant | Landlord | Good and services Tax | Input tax Credit |

| Registered Under GST | Registered Under GST | Good and services Tax under reverse charge mechanism | Input tax Credit can be claimed if the property is taken on rent for the furtherance of business |

| Unregistered | Registered Under GST | No Good and services Tax applicable | N.A. |

| Unregistered | Unregistered | No Good and services Tax applicable | N.A. |

| Registered Under GST | Unregistered | Good and services Tax under reverse charge mechanism | Input tax Credit can be claimed if the property is taken on rent for the furtherance of business |

Relevant Important Note :

- Tax Deducted at Sourceis different from Goods and Services Tax. In many cases, the tenant will needed to deduct Tax Deducted at Source on Rent under the income tax act.

- The landlord would be required to file Goods and Services Returns & deposit the GST collected with the Govt of India or GST Dept. based on the Goods and Services Tax compliance return filing deadline.

- The tenant who is making the payment of Goods and Services tax to the landlord can claim the benefit of ITC.

Unregistered individual is renting his commercial property to Registered company. So is that tenant should pay RCM in GST ?

Ans : NO

GST में Commercial property पर लगेगा RCM | 54 GST Council Meeting amendment

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.