Brief about the NBFC Compliances and Returns

Table of Contents

Brief about NBFC Compliances and Returns

One of the well-known financial institutions which known as NBFC, NBFC are involved in the business of lending money, acquisition of equities, stocks etc issued by any authorities or government. Although NBFCs are not banks, they carry out lending operations on a level with banks.

In a similar manner, Non-Banking Financial Companies must adhere to a specific set of compliances and file returns on a regular basis, just like banks are required to do. Any NBFC’s efficient operation depends on adherence to NBFC Compliances, and failure in going along with have serious repercussions, such as financial penalties or even the cancellation of the Certificate of Registration.

According to the Master Direction- NBFC Returns (Reserve Bank) Directions, 2016, the Non-Banking Financial Companies (NBFCs) are required to submit a number of returns to the Reserve Bank of India regarding their acceptance of deposits, compliance with prudential standards, ALM, etc.

The master instructions lay the groundwork for safe and RBI-compliant NBFC operational procedures. Due to their comprehensiveness and complexity, NBFC Compliances and Returns must be thoroughly reviewed in order to avoid penalties.

Key requirements in complying with NBFC Compliances

RBI has switched from the COSMOS platform to the XBRL system for the current online supervisory return filing process. Therefore, in order to file returns on the brand-new XBRL platform, Non-Banking Financial Companies must possess the following:

- Obtain the user ID and Password from RBI.

- Install the XBRL RBI file.

- Regularly update your profile on the XBRL portal.

Normal Timeline for Balance Sheet and Auditing & ROC compliance for NBFC are mention here under on time to time are mentioned here under :

Kind of NBFCs- NBFC Compliance & Returns:

In order to focus on particular specific sectors or classes, NBFCs have been categorised as a result of their expansion and growth. All of these NBFCs are required to maintain strict adherence to the rules established by the regulatory authority. Each NBFC category has been covered below.

Non-Banking Financial Companies can be categorised –

- Basis of their activities.

- Based on liabilities.

Non-Banking Financial Companies categorised based on their activity-

- Investment and Credit Company–

It is a RBI registered company/business that primarily engages in asset financing through offering credit. After the RBI decided to combine Three NBFCs, namely Asset Business, Loan Company, and Investment Company into one, the category of investment and Credit Company is created.

- Mortgage Guarantee Company–

A MFC is an Non-Banking Financial Companies, whose net owned fund of the MFC is at least INR 100 crore & whose mortgage guarantee business generates at least 90% of the Micro Finance Company’s (MFC) business turnover or 90% of the Micro Finance Company’s gross income.

- Infrastructure Finance Company–

Infrastructure Finance Company means a non‐banking banking finance company, which utilizes at least 75 percent of its total assets in infrastructure loans. The CRAR (Capital to Risk Weighted Assets Ratio) is 15 percent and the minimum Net Funds owned by company, is 300 Cr.

- Non-Operative Financial Holding Company (NOFHC)-

Any promoter or group of sponsors may establish a new bank through NOFHC. This particular sort of NBFC holds banks and other financial companies that are under the control of the RBI or other financial sector regulators to the extent permitted by the relevant regulatory recommendation.

- Micro Finance Company–

These company are carryout Business Tasks Precisely like banks do. Small enterprises that are underserved or underqualified for loans are given loans by them.

- NBFC factors

This kind of NBFC is involved in the factoring business. Theses NBFC company are referred to as NBFC factors, and at least 50% of the factor’s assets must be financial.

- Infrastructure debt fund NBFC

This kind of NBFC specialises in the simplification of long-term debt. Only the infrastructure-financing Business industries is able to provide funding for it.

- NBFC Account Aggregator

A non-banking financial firm (NBFC) that has a licence from the Reserve Bank and engages in offering services such the retrieval or collecting of financial data relevant to the financial assets of its clients is known as an account aggregator.

- NBFC P2P

Using a digital platform, the NBFC P2P lending network connects lenders and borrowers. NBFC P2P has reduced the burdensome loan processing process and, to a certain extent, made it easier.

- HFCs

Housing finance company” are NBFCs whose main line of business is to finance the acquisition or building or construction of homes

NBFCs based on their Liabilities-

- Non-Deposit Taking Non-Banking Financial Companies.

- Deposit taking Non-Banking Financial Companies

Non-deposit taking NBFCs are further classified into-

- Systematically important Non-Banking Financial Companies;

- Others

| S.No | Form | Type of NBFC | Description | Due Date |

| 1

|

DNBS-04B Return Structural Liquidity & Interest Rate Sensitivity |

NBFCs-D and NBFCs-NDSI |

To capture-

(i) To record details of discrepancy found in the predicted cash flows inward and outward after maturing the assets & liabilities at the end of the Fiscal year for NBFC-NDSI;

(ii) Details of the risk in interest rate. |

Must be submitted within 10 day after the months end. |

| 2

|

CIC Reporting | All NBFCs | NBFC is require to reveal its loan among the all four CICs. | Done within 10 days or on the 10th day of the next month. |

| 3. | NESL | ALL NBFCs |

NBFCs are required to give reporting about it Business debt to NESL. |

Submitted within 7 days of the next months. |

Different NBFC Compliances and Returns (Annual, Monthly and Quarterly)

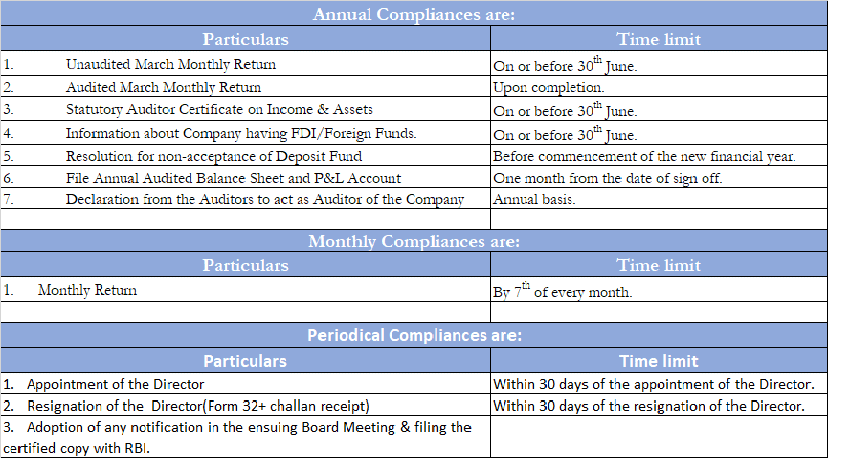

MONTHLY COMPLIANCES

QUARTERLY COMPLIANCES

| S.No | Form | Type of NBFC | Description | Due Date |

|

1

|

DNBS-01 Return | NBFCs-D and NBFCs-NDSI | This return consists of the financial details, including Assets, Liabilities, profit and loss account and details of the sensitive sectors. | 15th April;

15th July; 15th October; 15th January; |

|

2

|

DNBS-03 Return | NBFC undergo assets exceeding 100 crores and falls in the categories of NBFCs-NDSI, NBFCs-D and Non-NDSI NBFCs. | The return reflects adherence to prudential standards, including Capital Adequacy, Asset Classification, Provisioning, NOF, and others for NBFC-Deposit Taking and NBFC-NDSI. | 15th April

15th July 15th October 15th January |

|

3

|

DNBS-04A Return Short Term Dynamic Liquidity (STDL) | NBFC undergo assets exceeding 100 crores and falls in the categories of NBFCs-NDSI, NBFCs-D and Non-NDSI NBFCs

|

To record differences of predicted future cash withdrawals and inflows that don’t line up with the business projections | 15th April

15th July 15th October 15th January |

|

4 |

DNBS-06 | RNBCs | The return includes information on the assets, liabilities, and components of those, as well as compliance with several prudential standards for RNBCs.

|

15th April

15th July 15th October 15th January |

|

5 |

DNBS-07 | ARCs | To record financial metrics and various operational information for ARCs, such as assets (NPA) bought, acquisition cost, their recovery status, etc. | 15th April

15th July 15th October 15th January |

|

6 |

DNBS08-CRILC Main Return | NBFCs-D and NBFCs-NDSI and

NBFC-Factors |

must record credit information on total exposure of more than $5 billion to a single borrower.

|

21th April

21th July 21th October 21th January |

| 7 | DNBS-11 | NBFC-CICs | The return includes the financial information’s for CIC-ND-Sis of some components like liabilities, Assets, P&L Account, Exposures to sensitive sectors etc. | 15th April

15th July 15th October 15th January |

| 8 | DNBS-12 | NBFC-CICs | The return documents adherence or compliance to prudential standard for CIC-ND-Sis such as capital adequacy, Assets categorisations, provisioning and NOF. | 15th April

15th July 15th October 15th January |

| 9 | DNBS-13 | All NBFCs |

To verify information’s of the foreign institutions investors, it is mandatory because every NBFCs are having foreign investment. |

15th April

15th July 15th October 15th January |

| 10 | DNBS-14 | NBFC P2Ps | This return covers the financial information regarding assets and liabilities including compliance with different prudential standards for peer to peer lending platform (NBFC-P2P)

|

15th April

15th July 15th October 15th January |

ANNUAL COMPLIANCES

| S.No

|

Form | Type of NBFC | Description | Due Date |

|

1

|

DNBS-02 Return | Non-NDSI NBFCs | The return includes financial information for non-deposit taking non-NDSI NBFCs, including components of assets and liabilities and compliance with various regulatory standards. | Dated on or before 30th may (either on the basis of one of two i.e. Audited or Provisional) if return filled on the basis of provisional after that we have to we have to file Audited in next 30 days. |

|

2

|

DNBS-010 | All NBFCs and ARCs | This return is to verify the continuity of regular compliance for every NBFC. | The bounding of date for the finalization of the balance sheet is 15 days but not more than 31st October. |

ADDITIONAL COMPLIANCES

| S.No

|

Form | Type of NBFC | Description | Due Date |

|

1

|

DNBS-05 Return | Rejected NBFC’s | To include information’s regarding NBFCs in which public deposits accepted and to whom Certificate of Recognition rejected | This form is applicable when Certificate of Recognition is rejected by RBI |

|

2

|

DNBS09-CRILC SMA Details | NBFCs-D and NBFCs-NDSI and

NBFC-Factors |

All the NBFCs-D, NBFCs-NDSI with factors; overall exposure > 5 crore to an individual creditor reported in SMA-2 in the return filling date.

|

Accounts classified or de- classified upon SMA-2

|

|

3

|

CKYCR | REs | All the working Institutions (along with NBFCs) will have to do KYC at the timer of disbursement of loans and opening account relationship. | The timeline is 10 days after the date of account relationships. |

|

4 |

CERSAI | All Financials Institutions | At the time of disbursement of the secured loans. | Immediately as possible for appending 1st charge on secured loans |

|

5 |

FIU-IND | All regulated Entities | Separate and report specific transactions for Financial Intelligence Unit –India (FIU-IND) agency comes under Rule 3 of PMLA 2005 | .

In 7 days after satisfying about the suspicious transaction & the deadline is 15 days of the next month |

RBI Master Direction: Prudential Regulations

Although, after having the RBI compliances of the NBFC mentioned above, still there are few important regulations that must be followed by the non- banking institutions.

- Leverage Ratio of the all the NBFC (Excluding NBFC-MFIs & NBFC-IFCs) have to keep their ratio of leverage below 7 at any point of time.

- For Investment Accounting are according to the criteria followed by the company for different categories of investments (current, short & long term), NBFC’s board of the directors are required to publish and frame the investment policy of the institution and apply it.

- Policy for Demanding Loans should be published by the board of directors of all the eligible NBFC and have to frame that policy that would be followed by the institutions.

NBFC’s assets classifications are as follows:

- Standard Assets;

- Sub-standard Assets;

- Doubtful Assets; and

- Loss Assets.

- Furnishing Standard Assets, every NBFC are having some provisions regarding standard assets at 1/4% of the dues.

- All the relevant NBFC’s will be aiming for verifying the assets size of the institutions limit 500 crores.

- Balance Sheet Disclosure, Each NBFC will have a separate disclosure provision for questionable/bad debts and investment depreciation.

- Loans secured by a company’s shares are forbidden: No NBFC that qualifies may lend to or borrow money against its own shares.

The management of an NBFC must be well aware of these compliances and keep up with any changes to them. The most crucial compliances for NBFCs operating in India are some of these. If an NBFC doesn’t follow the RBI checklist, they’ll be hit with stiff fines and penalties. Since our company offers NBFC advising, compliance, and consultation services, you can trust them. We employ qualified professionals with extensive knowledge in NBFC services.

F&Q’s on Non-Banking Financial Company (NBFC)

What is means of NBFCs?

Non-Banking Financial Companies is RBI approved one of the most well-known financial organisations in India , NBFCs are involved in the lending and advancing of money as well as the purchasing of marketable assets such as stocks, bonds, and shares issued by local or national governments or other authorities.

What significance/use do NBFC Compliances services?

Once established of Non-Banking Financial Companies is completed, NBFCs are required to periodically abide by the regulatory authority’s numerous compliance requirements. these compliances must be met promptly to avoid paying fines,

What is DNBS-01 return?

Financial information, including components of liabilities & assets, profit & loss A/c, exposure to sensitive sectors, etc., are captured in the DNBS-01 return.

What is DNBS-05 return?

DNBS-05 return includes information/ details about Non-Banking Financial Companies that accepted public deposits but had their CoR was disallowed/ rejected.

What is DNBS-03 Return?

The DNBS-03 Return reflects adherence to a No of prudential standards, including Capital Adequacy, Asset Classification, Provisioning, and NOF. For NBFC-Deposit taking and NBFC-NDSI,

What is DNBS-06?

The DNBS-06 Return includes financials information/ details about the company’s finances, including the components of its assets and liabilities and its adherence to certain prudential norms and standards for RNBCs.

To give you our introduction, we are a full-service compliance management company providing cost effective compliance services at very reasonable professional charges; following is the list of indicative professional services, IFCCL specialise following services & other compliances on requisition.

- ESOP Guidance and policy drafting

- Shareholder’s Agreement

- Conversion of Private to Public Company

- Shifting of Registered office

- FCGPR, FCTRS

- Merger and Acquisition of Companies

- Incorporation of NBFC Company

- Management Change in NBFC Company

- Removal of Director Disqualification

- Conversion of Public to Private Company

- Revival of Companies through NCLT

For any further query, mail us at singh@caindelhiindia.com or call us at +91-9555-555-480

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.