A Guide to the Different Types of Legal Entities with Directors and Shareholders

Table of Contents

A Guide to the Different Types of Legal Entities with Directors and Shareholders

When you start a company registration in Delhi, you may have technical or non-technical partners, or you may be a single founder. Delhi is a startup hub and India’s investment capital.

- Private limited company

- LLP (limited liability Partnership)

- One Person Company.

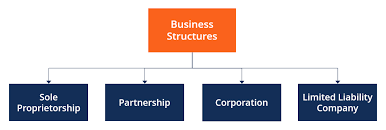

Types of Company registration

- One Person Company Registration

- Private Limited Company Registration

- Public Limited Company

- Limited liability Partnership

One Person Company Registration:

If you are a single person who wants to remain a sole proprietor but want the benefit of limited liability, choose a one-person company. Note that your turnover must exceed $2 Crore to qualify as a one-person company.

- Select One person limited if you only require a single shareholder.

- A one-person company registration can only have one shareholder, but there can be more than one director without shareholding.

- The government has removed the requirement for a minimum paid-up capital for all companies (you can register a company with as little as Rs 100/- as capital).

- Shareholders elect the board of directors, who run the company.

- The most significant advantage of forming a one-person company is that its liability is limited to the amount of paid-up share capital invested.

- The most significant advantage of forming a one-person company is that its liability is limited to the amount of paid-up share capital invested.

- This works similarly to a private limited company but with far fewer legal compliances.

- Appointment of the nominee is required to continue the business in the event of the director’s demise.

- A one-person business cannot have a turnover of more than Rs 2 crores (OPC).

- If OPC’s turnover surpasses a certain threshold, it must be changed to a private limited company with at least two directors and shareholders within 180 days.

Registration of a private limited company:

- A private limited company can be established with two directors who are also shareholders.

- The government has removed the requirement for all corporations to have a minimum paid-up capital (you can register a company with as little as Rs 100/- as capital).

- Shareholders appoint the board of directors, who then run the business.

- The most significant advantage of forming a private limited company is that its liability is limited to the amount of paid-up share capital invested.

- Startups that intend to raise funds or capital from investors must register as a private limited company.

Registration of Public Company:

- Select “Public limited” if you need more shareholders and free transferability of shares.

- A Public limited company can be required to register with a minimum of three directors and 7 shareholders.

- The government has removed the requirement for all firms to have a minimum paid-up capital (you can register a business with as little as Rs 100/- as capital).

- Shareholders elect the board of directors, who then run the company.

- The most significant benefit of founding a public limited company is that its liability is restricted to the amount of paid-up share capital invested (LLP).

Limited liability partnership (LLP):

- An LLP can be formed with two partners who are also shareholders.

- The government has eliminated the requirement for all firms to have a minimum capital (a company can be registered with as little as Rs 100/- in capital).

- The LLP’s partners will run the business.

- The biggest advantage of forming an LLP is that its liability is limited to the amount of capital invested.

- No partner is liable for any misdeed or misconduct, or for any decision made solely by that partner.

- An LLP has lower compliance requirements than a private limited company.

A limited liability partnership (LLP) is a new corporate structure that is simply a larger version of a partnership firm. LLP, like a corporation, exists independently of its partners. An LLP should have at least 2 designated partners. Anyone who is a citizen of India and runs a legal business can register as an LLP. No partner is liable for another partner’s independent misconduct. If the liability arises as a result of the misbehaviour of a partner, the culpability is limitless. Every year, a statement of accounts shall be filed on behalf of LLP.

Procedure for forming a business:

- In Delhi, a private limited company can be formed with two directors who are also shareholders.

- The government has removed the requirement for all corporations to have a minimum paid-up capital (you can register a company with as little as Rs 100/- as capital).

- Shareholders elect the board of directors, who then manage the business.

- The most significant benefit of founding a private limited company is that its liability is restricted to the amount invested in paid-up share capital.

- For startups that want to raise funds or capital from investors, forming a private limited company is required.

- Required documents for the Formation of a Private Limited Company.

- PAN CARD: A copy of each director’s pan card.

- Address Proof: Any of the documents listed below:

- Passport Copy of All directors,

- Voter Identity Card

- Driving License

- Aadhaar Card

Residential Confirmation: The residential proof must include the name of the Director, as required by Rule 16(2) of the Company Incorporation Rules 2014.

It is important to note that the residence proof must be no more than two months old. The following documents are only accepted as proof of residency; any one of them is required:

- Bank Statement

- Electricity Bill

- Telephone Bill

- Mobile Bill

Steps Involved in Forming a Company:

Forming a private limited company in Delhi necessitates the assistance of a CA/CS/Lawyer due to the legal procedures involved. It is a complicated process, but don’t worries, our team of specialists will handle it for you.

Step 1: Fill out RUN (Reserve Unique Name Form) and submit it (Name Availability).

Step 2: Obtain the DSC as well as the SPICE INC-32 forms (E Form used for Company Registration).

Step 3: In SPICE INC – 33 and AOA, draught the MOA. Registration of a business in SPICE format.

Step 4: Complete the PAN and TAN applications, as well as the SPICE INC -32 form (E Form used for Company Registration).

Step 5: Following the completion of the above-mentioned company registration process, RoC.

Step 6: Issues of Certificate of Incorporation.

Step 7: In Delhi, apply for GST Registration, ESI PF Registration, and Company Registration. The application for the incorporation of a company under rule 38 must be accompanied by e-form AGILE (lNC 35), which includes an application for registration of the following numbers, namely.

HOW MUCH DOES COMPANY REGISTRATION IN DELHI COST?

The cost of registering a company in Delhi would be around Rs 10,000, which would include the company name, DSC, DIN, and all other approvals.

ARE YOU LOOKING FOR THE BEST COMPANY REGISTRATION ADVISORS IN DELHI?

IFCCL is the top business registration consultants in Delhi. Contact IFCCL for help with company registration.

AFTER COMPANY REGISTRATION PROCESS

Can you start your business now that you’ve registered your company?

Yes!! is the quick answer.

What further forms of registration do you require?

IFCCL can help you make your venture a success by guiding you through the simple company registration process on:

- Mobile 9555555480

- Landline : 011 43520194

- email: info@caindelhiindia.com

PROCESS AFTER COMPANY REGISTRATION

What other Registration you need to have

- Register for GST

- IE Code Registration ( Import Export Code Registration)

- Registration under Shop and establishment act

- Register for Professional Tax

- PF , ESI , and much more

IFCCL assists you in writing of your startup a success through the hassle-free Company registration process.

All the best to all the entrepreneurs who are forming a company in Delhi for their business and corporate success.

In order to form a company in Delhi, you must do so online. IFCCL, your experts, is here to assist you. Contact IFCCL support service at info@caindelhiindia.com or call 9555555480 and 011 43520194 for any assistance on company registration near me in Delhi and Private Limited company registration in Delhi. We will guide you through the procedure.

Please contact us for assistance in forming a private limited business in Delhi.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.